Ureteral Stent - Market Analysis

Contents

Introduction

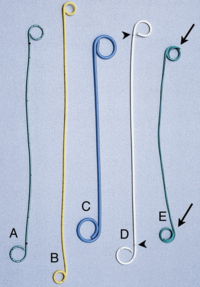

A ureteral stent, sometimes as well called ureteric stent, is a thin tube inserted into the ureter to prevent or treat obstruction of the urine flow from the kidney. The length of the stents used in adult patients varies between 24 to 30 cm. Additionally, stents come in differing diameters or gauges, to fit different size ureters. The stent is usually inserted with the aid of a cystoscope. One or both ends of the stent may be coiled to prevent it from moving out of place, this is called a JJ stent, double J stent or pig-tail stent.

Prevalence and Incidence

Urinary incontinence (any involuntary leakage of urine) is a significant health problem in the United States and worldwide. It has a considerable social and economic impact on individuals and society. When discussing the epidemiology and impact of incontinence, it is important to distinguish between prevalence and incidence.

Prevalence is the probability of having a disease or condition, in this case incontinence, within a defined population at a defined point in time. For example, prevalence would be the number of 60-year-old women in the United States in the year 2001 experiencing the symptom of incontinence.

Incidence, on the other hand, is the probability of developing a disease or condition during a defined period of time. Thus, the percentage of continent women in 2001 that will develop incontinence over the next year would define the incidence of incontinence over a 1-year period.

Incontinence in Women

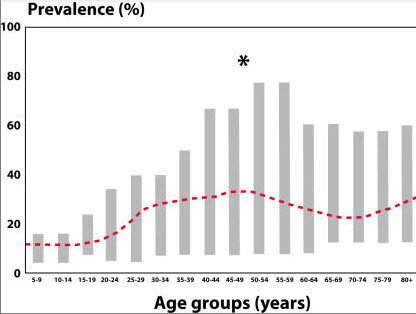

A 1995 review on the prevalence of incontinence in the general population summarized 11 studies conducted with a mixed population of females of various ages and a variety of causes of incontinence. Figure 1 shows that the prevalence is relatively low early in life, has a peak around the time of menopause, and then rises steadily between the ages of 60 and 80 years. The prevalence of 10% in 15–19-year-olds and 18% in 20–24-year-olds seems a bit high when one considers the number of young women who actually seek treatment for incontinence. This may be a result of including a large number of young women with "insignificant" or non-bothersome incontinence in the survey. (National Institutes of Health )

Prevalence of incontinence in general population of females reported in 13 different studies. Young adult, 20% to 30%; Middle age, 30% to 40%; Elderly, 30% to 50%. Reprinted from Sandvik, with permission.

Many studies have looked at the relative prevalence of stress, urge, and mixed incontinence in specific populations. The overall prevalence of stress incontinence and mixed incontinence (stress and urge incontinence) is quite high, whereas the overall percentage of urge incontinence is lower. When looking at such data, it is important to consider that although a majority of patients have the symptom of stress incontinence, urge incontinence (including lesser degrees of urge incontinence), tends to be considerably more bothersome than similar degrees of stress incontinence.

Incontinence in Men

The prevalence of incontinence in men of all ages is certainly lower than that for women. Large studies have indicated that there is a 3% to 11% overall prevalence rate of incontinence in the male population with urge incontinence being the prominent symptom reported in 40% to 80% of patients. Next, mixed incontinence is the most prevalent at 10% to 30%, whereas isolated stress incontinence accounts for less than 10% of incontinence in male patients. Stress incontinence in men is rare unless the patient has undergone some type of prostate surgery or has suffered neurological injury or trauma. Incontinence in men increases with age and appears to rise more steadily than it does in women. That is, there are no spikes in prevalence similar to those that occur for women around menopause. However, the estimates for severe incontinence in men in their 70’s and 80’s is still only about half of that in women. A major consideration in the incontinent male patient, especially with urge incontinence, is the potential contribution of bladder outlet obstruction to bladder over activity. Many men suffering from bladder over activity will also have bladder outlet obstruction. Such a situation can affect therapeutic options for patients.

Habitual patterns

Before analyzing the habitual and behavioral patterns that lead to implantation of a ureteral stent we must understand what all medical conditions require a stent.

There are a variety of reasons why a stent has been placed. For patients with stone surgery, the stent allows passage of residual fragments without blocking the ureter.

Patients who have had ureteroscopy (a look up the ureter) have a stent placed to allow the ureter to remain open while the normal postoperative swelling of the ureter resolves.

Patients who have had any form of surgery on the ureter have a stent placed to allow healing of the ureter in the proper open fashion.

The following prominent medical problems that may lead to a ureteral stent have been analyzed -

Kidney stone

Role of dietary animal protein

Other factors(Alcohol, vitamin supplements, temperature, space travel etc)

Source Source

Urinary Tract Infection (UTI) and Diabetes

Urinary Tract Infection, (UTI) is a common ailment and can affect people of all ages, sex, and from all cultures. However, there are certain groups of people that are more prone to UTI than others. Women, for example, for reasons yet to be firmly established, carry a greater risk of UTI. Diabetic patients too fall under this category. Going further, pregnant women with diabetes are probably amongst the most vulnerable to UTI.

UTI and diabetes complete article

Habitual patterns causing or worsening diabetes include

Other causes

Other prominent reasons like prostrate cancers and tumours, narrowing of the ureter, scarring of the ureter wall etc do not directly relate to any behavioral or habitual patterns.

Though genes and hereditary increase the probability of these.

Prevalence rate of Urinary Incontinence in USA for the year 2009 & 2010

Uretral stents are used to ensure the patency of a ureter, which may be compromised, for example, by a kidney stone. This method is sometimes used as a temporary measure, to prevent damage to a blocked kidney, until a procedure to remove the stone can be performed. Following are the statistics from the national institute of diabetes and digestive and kidney diseases showing the prevalence and incidence rate of urinary incontinence which might result from any of these primary diseases: (Source)

• Diabetes

• Hypertension

• Glomerulonephritis

• Cystic kidney

• Urologic disease

• All other

Market Analysis

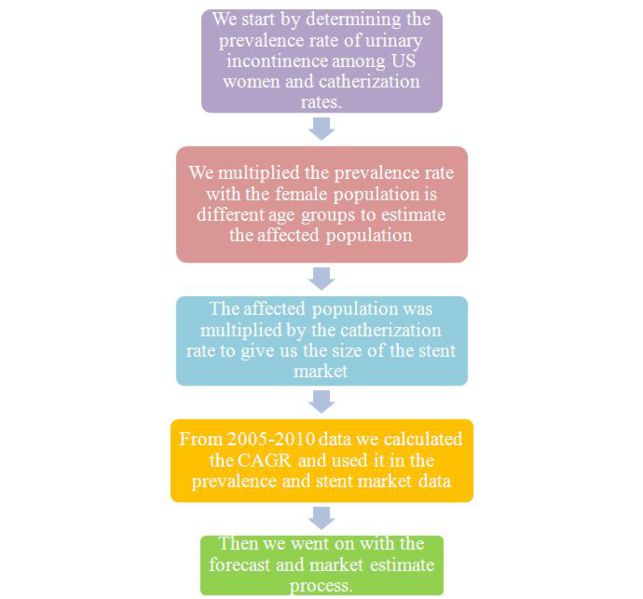

Methodology

Market Analysis for Ureteral Stent

Market for ureteral stent can be analyzed by estimating market for each of Ureteral Stent’s fundamental use. Following tree-diagram shows the fundamental uses of Ureteral Stent.

Other uses of Ureteral Stent include Post-surgical swelling/infection of uterus, Active kidney infection etc.

Kidney Stones Market for Ureteral Stent

There are four main types of treatments available for curing kidney stones based on type of Kidney Stone, listed as follows

| Sr. No. | Treatment | Indications | Requirement of Ureteral Stent | % of cases in general |

| 1 | Lithotripsy | Radiolucent calculi, Renal stones <2 cm, Ureteral stones <1 cm | No | 49.07%* |

| 2 | Ureteroscopy | Ureteral stones | Yes | 15.48%* |

| 3 | Ureterorenoscopy | Renal stones <2 cm | Yes | 0.47%* |

| 4 | Percutaneous nephrolithotomy | Renal stones >2 cm, Proximal ureteral stones >1 cm | No | 34.98%* |

*Dolcera Estimate 2011

As seen in table ureteral stent is required for Ureteroscopy and Ureterorenoscopy which together constitute for around 16% of Kidney stone cases.

Total Number of Kidney Stone Cases in US in 2006: 166,000

Approximate Stents required in 2006 = 166,000*0.16=26560

Kidney Transplant Market for Ureteral Stent

Every kidney transplant operation required ureteral stent to be placed in Patient’s body for few days till newly placed kidney adapts to Patients’ body

Total No. of Kidney Transplants done in United States in 2007 are approx. 17,513

Total Market for Ureteral Stents in 2007 is 17,513

| Year | No. of Kidney Transplants |

| 2007 | 17,513 |

| 2006 | 18,056 |

| 2005 | 17,443 |

| 2000 | 14,611 |

| 1995 | 12,160 |

| 1990 | 10,029 |

| 1985 | 7,504 |

| 1980 | 3,785 |

Urinary Incontinence Market For Stents

Inpatient hospital stays:The estimated number of hospital admissions among adults ages 18 or older with urinary incontinence listed as a diagnosis:

(2000): 47,802 hospital stays (1,332 men; 46,470 women)

Prevalence rate in US (women)

| Prevalence of Urinary Incontinece in US (Women) | |

| Age (in years) | Population with Urinary Incontinence (in %) |

| 30-39 | 28 |

| 40-49 | 41 |

| 50-59 | 48 |

| 60-69 | 51 |

| 70-79 | 55 |

| ≥ 80 | 54 |

| Estimated cases for ureteral stents in US, 2010 | |||||

| Age groups | A) Female population (Million) | B) Prevalence rate in female (%) | C=A*B Affected population (Million) |

D) Catherization rate (%) | E=C*D Stent market based on catherization |

| 30-39 | 20.10 | 28 | 5.62 | 0.043 | 2420.42 |

| 40-49 | 21.99 | 41 | 9.01 | 0.123 | 11092.83 |

| 50-59 | 21.50 | 48 | 10.32 | 0.124 | 12800.37 |

| 60-69 | 15.32 | 51 | 7.81 | 0.160 | 12503.68 |

| 70-79 | 9.16 | 55 | 5.04 | 0.172 | 8674.44 |

| ≥ 80 | 7.15 | 54 | 3.86 | 0.044 | 1699.48 |

| Total | 95.25 | 41.69 | |||

- Catherization rate depicts the actual number of people going in for ureteral stents.

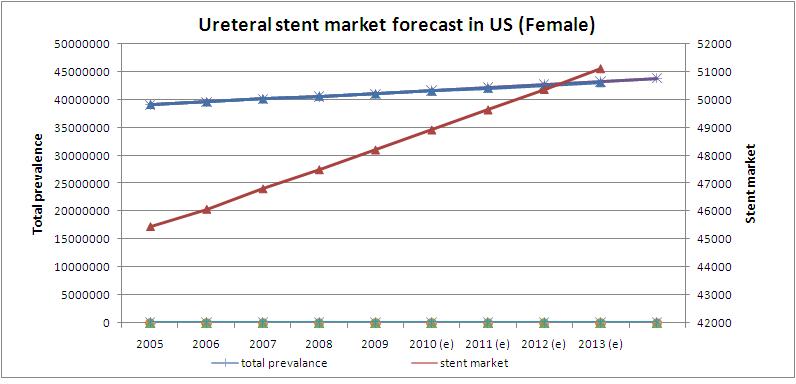

- Prevalence rate in US women is growing at a CAGR of 1.26%

Assuming that each admission in hospital required one ureteral stent, market from Urinary Incontinence is around 47,802 stents per year

Total Market for Ureteral Stent

Following table displays approximate stent market per year

| Category | No. of Stents Required |

| Stent Market for Kidney Stones | 26560 |

| Stent Market for Kidney Transplant | 17513 |

| Stent Market for Urinary Incontinence | 47802 |

| Total | 91875 |

- Ureteral stent market is growing at a CAGR of 1.58%

Government Policy

Medicare carriers may issue local coverage decisions (LCDs) listing criteria that must be met prior to coverage.

Physicians are urged to review these policies [1], and are encouraged to contact their local carrier medical director or commercial insurers to determine if a procedure is covered.

The coding covers the following -

- Placement

- Removal

- Imaging

- Outpatient hospital

- Inpatient hospital

Click here for coding details and payment.

Ureteral stent market forecast in US (women)

Ureteral Stent Pricing

Boston Scientific and Cook INC

| Manufacturer | Stent | Price (in USD) |

| Boston Scientific | Percuflex Plus Ureteral Stent | 16.99-24.99 |

| Boston Scientific | Polaris Ureteral Stent | 24.99 |

| Boston Scientific | Polaris Ultra Ureteral Stent | 16.99-24.99 |

| Cook INC | Ureteral Stent Set | 19.99 |

| Cook INC | Resonance Metallic Ureteral Stent and Introducer | 179.99-224.99 |

Source

* Most of the products apart from speciality products of both the companies have the same name and price.

Their is just a slight modification in the stent which can be found out on the website given above according to the item number.

Paid report (medtechinsight and lifescienceintelligence) on pricing and ordering information.

Ureteral Stent Substitutes

Ureteral Stents are not very expensive so the primary reason to seek alternatives arise out of the disadvantages of using a ureteral stent.

About 50% of patients will have some type of side-effect associated with their stent. It is not possible to predict who will have stent-associated difficulties or when the stent symptoms will resolve. Some patients have stent symptoms for just a few days, while others find their symptoms persist throughout their entire stent duration.

Main article- Ureteral stent difficulties

It may be reasonable not to leave a ureteral stent if obstruction is likely to be transient. Your surgeon decides at the time of the procedure whether or not your circumstance warrants “stent free.” Occasionally, it may be possible to place a tube externally that drains the kidney. This tube is placed directly through the skin, through the kidney, and into the urinary space, called a nephrostomy tube. This is placed under ultrasound or fluoroscopic Xray guidance. As the tube remains outside the body, it is slightly more inconvenient, has higher infection rates, and can sometimes get pulled out by accident. The advantage of a nephrostomy tube is better drainage, ability to place contrast into the kidney to evaluate for obstruction or leakage, and removal that does not require a cystoscopic procedure.

Other alternative methods for treating or removing stones are

1) Extracorporeal shock wave lithotripsy

5) Allopurinol

Cost analysis of different treatments

| Treatment/Procedure | Cost (In USD) |

| Ureteral Stent implant | 1500-2500 |

| Laser lithotripsy | 5000-7000 |

| Urine Alkalization | Cost comparison (Drug based) |

| Allopurinol | Drug wise prices |

| Extracorporeal shock wave lithotripsy | Not available |

Source - medsolution

Trends in stent R&D

- Given that the first bare metal stent entered the market in 1994, the technology is far from mature.

- Whilst drug eluting stents will be improved through the use of what are described as more ‘cell friendly’ (i.e. more hydrophobic) coatings and adapted (by using CFD in stent design) to varying wall sheer conditions, the industry is already well down the road of developing bioresorbable coatings and even bioresorbable stents.

- Such systems are already on limited trial in Europe with FDA trials aimed at 2012 and approval by 2015.

- There are still other areas under study including thinner struts which are important in terms of giving improved stent flexibility, a reduced cross-sectional profile within the vessel and potentially reduced restenosis (due to reduced vascular trauma).

- Silicon carbides, carbon coatings, titanium nitride/oxide and sputtered indium oxide have all been trialled as routes to reducing the incidence of restenosis and/or thrombosis.

- Click here for recent news and developments in Boston Scientific and Cook INC

Source Ceram-newsrelease

Reimbursements

| 2011 MEDICARE REIMBURSEMENT FOR URETERAL STENT PLACEMENT OR REMOVAL - PHYSICIAN AND OUTPATIENT FACILITY | ||||||

| Ambulatory Surgery Center | Outpatient Facility | Physician Services | ||||

| CPT Code |

Procedure Description | Facility Payment1 | APC | Facility Fee Schedule (National Medicare Avg)2 |

Fee When Services Are Provided in the Hospital or ASC (National Medicare Avg)3 | Fee When Services Are Provided in the Office (National Medicare Avg)4 |

| 50393 | Introduction of ureteral catheter or stent into ureter through renal pelvis for drainage and/or injection, percutaneous | $1,020.24 | 0162 | $1,813.74 | $224.92 | N/A* |

| 50605 | Ureterotomy for insertion of indwelling stent, all types | Procedure not permitted in outpatient setting | $982.60 | N/A* | ||

| 50947 | Laparoscopy, surgical; ureteroneocystostomy with cystoscopy and ureteral stent placement | $1,853.68 | 0131 | $3,295.39 | $1,424.97 | N/A* |

| 51045 | Cystotomy, with insertion of ureteral catheter or stent (separate procedure) | $288.27 | 0160 | $512.48 | $500.13 | N/A* |

| 52310 | Cystourethroscopy, with removal of foreign body, calculus, or ureteral stent from urethra or bladder (separate procedure); simple | $680.87 | 0161 | $1,210.41 | $157.65 | $253.80 |

| 52315 | Cystourethroscopy, with removal of foreign body, calculus, or ureteral stent from urethra or bladder (separate procedure); complicated | $1,020.24 | 0162 | $1,813.74 | $284.72 | $444.41 |

| 52332 | Cystourethroscopy, with insertion of indwelling ureteral stent (eg, Gibbons or double-J type) | $1,020.24 | 0162 | $1,813.74 | $151.87 | $501.15 |

| 74480 | Introduction of ureteral catheter or stent into ureter through renal pelvis for drainage and/or injection, percutaneous, radiological supervision and interpretation | Imaging is included in allowance for ureteral stent placement or removal | $27.18 | $112.80 | ||

| 76942 | Ultrasonic guidance for needle placement (eg, biopsy, aspiration, injection, localization device), imaging supervision and interpretation | Imaging is included in allowance for ureteral stent placement or removal | $33.64 | $198.08 | ||

| 77002 | Fluoroscopic guidance for needle placement (eg, biopsy, aspiration, injection, localization device) | Imaging is included in allowance for ureteral stent placement or removal | $27.52 | $75.77 | ||

| 77012 | Computed tomography guidance for needle placement (eg, biopsy, aspiration, injection, localization device), radiological supervision and interpretation |

Imaging is included in allowance for ureteral stent placement or removal | $57.08 | $163.77 | ||

| 1. 2011 Medicare Ambulatory Surgery Center Fee Schedule 2. 2011 Medicare Hospital Outpatient Prospective Payment System Fee Schedule 3. 2011 Medicare Physician Fee Schedule | ||||||

| N/A* Medicare has not developed a rate for the in-office setting as these procedures are typically performed in a hospital setting. Physicians should contact the Medicare contractor to determine if the service can be performed in-office. If the contractor determines the service or procedure may be performed in-office, the physician will receive Medicare’s physician fee schedule amount for procedures performed in the hospital/ASC. | ||||||

| CPT© 2010 American Medical Association. All rights reserved. CPT is a registered trademark of the American Medical Association. | ||||||

2 "Allowed Amount" is the amount Medicare determines to be the maximum allowance for any Medicare covered procedure. Actual payment will vary based on the maximum allowance less any applicable deductibles, co-insurance, etc.

3 The hospital outpatient payment rates are 2011 Medicare national averages. Source: November 2, 2010 Federal Register, CMS-1504-FC.

4 The ASC payments rates are 2011 Medicare national averages. ASC rates are from the 2011 Ambulatory Surgical Center Covered Procedures List – Addendum AA. Source: November 2, 2010 Federal Register, CMS-1504-FC.

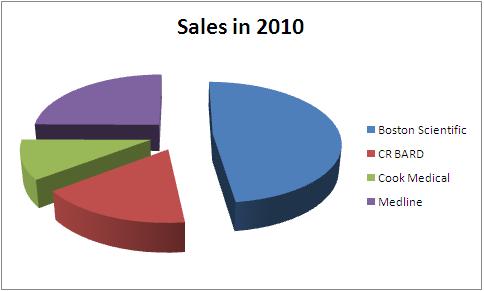

Competitor Analysis

Boston Scientific

Net sales in 2010 – USD 7.8 Billion

Share of Urology- 8.48 %

Net sales from Urology- USD 661 Million

Source BSsalesdata

CR BARD

Net sales in 2010 – USD 2.7 Billion

Share of Urology- 26%

Net sales from Urology- USD 702 Million

Source – CR BARD annual report

Cook Medical

Total Sales - USD 1.7 Billion

Medline

Total Sales in 2010 - 4.04 Billion USD

| Company | Total Sales in 2010 | Urological sales | Percentage share | Product portfolio |

| Boston Scientific | 7800 | 661 | 8.48 | Boston_portfolio |

| CR BARD | 2700 | 702 | 26.00 | BARD_portfolio |

| Cook Medical | 1700 | - | - | Cook_portfolio |

| Medline | 4040 | - | - | Medline_portfolio |

All figures in USD million

Research Work

Research at University of Minnesota about symptoms and pain associated with ureteral stent

Background and Purpose

- Ureteral stents are associated with significant pain and urinary symptoms.

- Manufacturers have altered stent designs and materials in an attempt to minimize this morbidity.

- This study evaluated the impact of these modifications.

Patients and Methods

- Stent manufacturers were asked to provide the 6F ureteral stent they believed would be associated with the least patient discomfort.

- Patients undergoing uncomplicated ureteroscopy were randomized to the Bard Inlay, Cook Endo-Sof, Microvasive Contour, Applied Medical Vertex, or Surgitek Classic Double-Pigtail stent.

- The Ureteric Stent Symptom Questionnaire (USSQ) was administered on days 1, 3, and 5, and the patients maintained a narcotic diary. The data were analyzed using ANOVA and nonparametric methods.

Results

- A total of 44 patients (73%) completed all USSQ questionnaires.

- Urinary symptom scores were significantly lower for the Inlay stent on day 3 than for the Vertex (P = 0.01), Contour (P = 0.05), Endo-Sof (P = 0.03), and Classic (P = 0.02) stents. No significant differences were noted in pain and general symptom scores or narcotic use.

Conclusion

- The Bard Inlay stent is associated with less-severe urinary symptoms than other ureteral stents.

- The USSQ is a sensitive tool to measure differences between stents.

The complete USSQ form is available at BUI and endourology.

Source University of Minnesota

Boston Scientific

Click here for the company profile

References

1- http://en.wikipedia.org/wiki/Demographics_of_the_United_States

2- http://www.wrongdiagnosis.com/c/catheter_infection/stats.htm?ktrack=kcplink

3- http://www.fda.gov/downloads/ScienceResearch/SpecialTopics/WomensHealthResearch/UCM247851.pdf