LCD Technology

Contents

Introduction to Display Technology

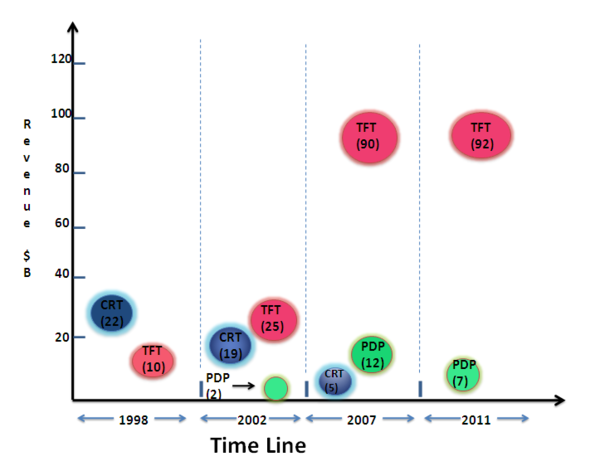

Display technology plays a critical role in how information is conveyed. Since its commercialization in 1922 up until the late 20th century, Cathode Ray Tube (CRT) has dominated the display industry. However, new trends such as the desire for mobile electronics have increased demand for displays that rival and surpass CRTs in areas such as picture quality, size, and power consumption. One such technology that has replaced the CRTs is Liquid Crystal Display (LCD) due to their lightweight, low operating power, and compact design. LCDs allowed devices such as digital watches, cell phones, laptops, and any small screened electronics to be possible. Although LCDs were initially created for handheld and portable devices, they have expanded into areas previously monopolized by CRTs such as computer monitors and televisions. Other contenders for leadership in display technology are Organic light emitting diode(OLED) and Plasma Display.

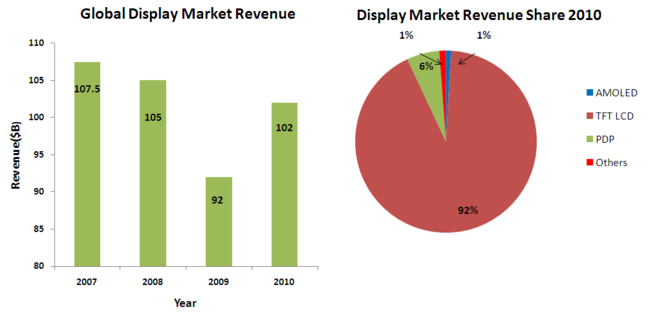

Comparison of LCD, OLED and Plasma Technologies

LCD Technology

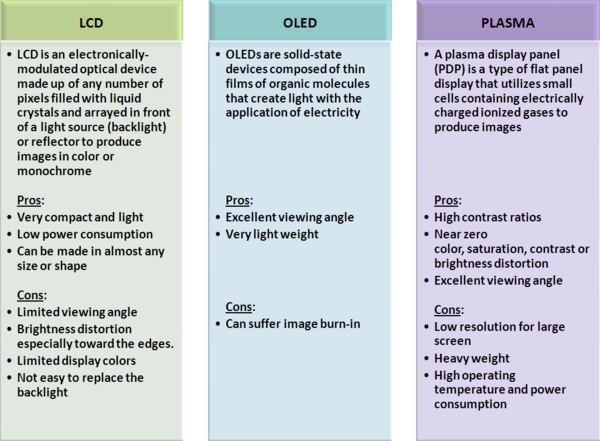

LCD is an electronically-modulated optical device made up of any number of pixels filled with liquid crystals and arrayed in front of a light source (backlight) or reflector to produce images in color or monochrome.

There are 2 types of LCD displays (based on the circuits that are responsible for activating pixels).

An active matrix liquid crystal display (AMLCD) is a type of flat panel display, currently the overwhelming choice of notebook computer manufacturers, due to low weight, very good image quality, wide color gamut and response time. The most common example of an active matrix display contains, besides the polarizing sheets and cells of liquid crystal, a matrix of Thin film transistor(TFT) to make a TFT-LCD. These devices store the electrical state of each pixel on the display while all the other pixels are being updated. This method provides a much brighter, sharper display than a passive matrix of the same size. An important specification for these displays is their viewing-angle.

Twisted nematicdisplays contain liquid crystal elements which twist and untwist at varying degrees to allow light to pass through. A Super-twisted nematic(STN)display is a type of monochrome passive matrix LCD.STN displays provide more contrast than TN displays by twisting the molecules from 180 to 270 degrees. Film compensated Super-twisted nematic (FSTN) is a passive matrix LCD technology that uses a film compensating layer between the STN display and rear polarizer for added sharpness and contrast. It was used in laptops.

LCD Industry Overview

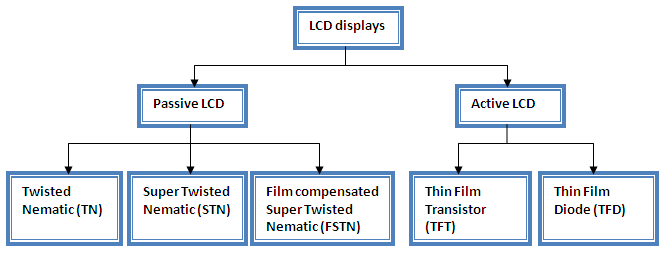

Global Market Size of Display Industry

- The revenue in 2008-09 and 2009-10 is decreasing, mainly due to recession.

- CAGR has been -1.74% due to the slump in 2008 to 2009.

- However, the market has been recovering at a steady pace, especially in 2010, with the revenue up by 10.86% from the previous year(2009).

- Pie chart depicts the revenue share of major technologies in the display market in 2010, which clearly indicates that TFT LCD is the leading technology and has maximum market share(92%) of the global display market.

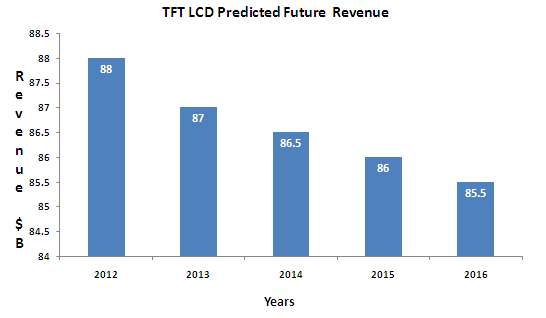

Predicted future revenue of TFT LCD Market

After growing rapidly throughout the 2000s, industry revenues declined in both 2008 and 2009. While the immediate cause of this decline was the global recession, the display industry has also entered a mature phase. With notebook PCs and desktop monitors completely penetrated by TFT-LCDs, much of the growth in recent years has come from the TV market. Despite the recession, flat-panel-TV shipments grew on the order of 30% per year in 2008 and 2009. However, this growth is leading to high penetration rates, even in formerly emerging markets, such as China, and will push the flat-panel share of the TV market past 90% in 2011. This high penetration, combined with increasing pressure on prices, will lead to slower revenue growth, particularly for TFT-LCDs.

- The display market is dominated by TFT LCD but the growth of TFT LCD revenue would slow down in the years to come(2012-2016)

- But TFT LCD still would constitute more than 80% of the whole display market

- Future Technologies like AMOLED and 3D have a brighter chance to grow and yield revenues in the future

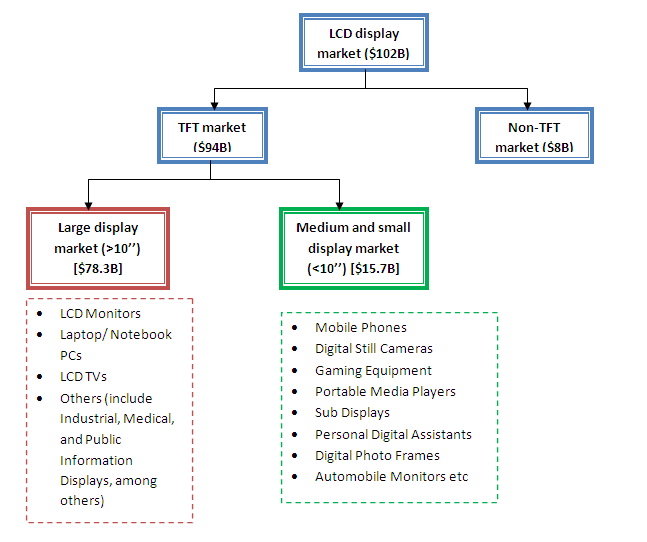

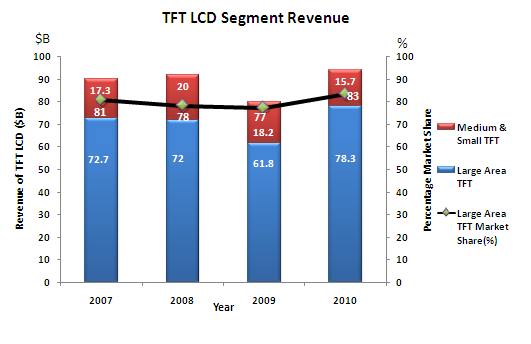

Market segmentation

The TFT LCD display market is divided into 2 segments :

- Large Area TFT - comprises of products that have a display size of more than 10 inches. The major applications for these displays are Television, Desktop Monitor and Notebook PC. Public displays comprises of only 2% share of the large area but is a growing sector.

- Small & Medium TFT- comprises of products that have a display size of less than 10 inches The major applications for these displays are mobile phones and automotive displays. Digital cameras and Digital photo frames are also promising sectors in the future.

TFT LCD Segment revenue

- Large area TFT comprises the majority (more than 75%) of the market share and has contributed the maximum share in terms of revenue consistently.

- The revenue of overall TFT LCD market had gone down in the years 2008 and 2009 due to recession. Also, the share of Large area in these 2 years have gone down, as the demand for these high priced products had gone down.

- However the market for small & medium area had gone up in 2008, mainly driven by mobile phone sales. But that too saw a slump in the year 2009 and even in 2010.

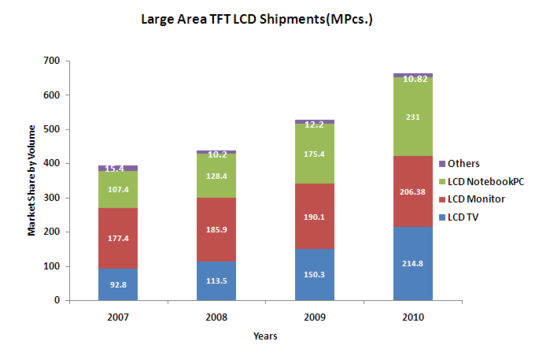

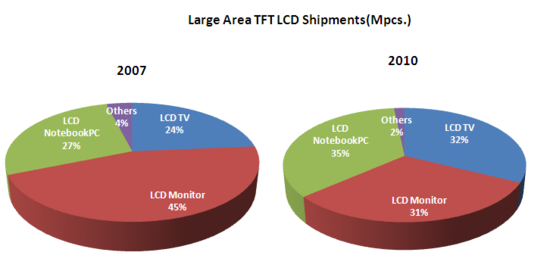

Large Area TFT market

Year on Year there was an increase in shipments for all the products of large area TFT LCD. In total the revenue grew by 25% in 2010 up from 20% in 2009. After recession and a laggard growth of 11.5% in 2008, the market has picked up and the revenue is growing.

- Market revenue overall is growing, but the most promising product and market that uses this technology is Television. With a growth of 42.9% in 2010 up from 32.4% in 2009, the market looks profitable.

- Notebook PC market also looks profitable, with a growth rate of 31.7%, but a decline from the previous year from 36.6%. The OLED technology is eating up the market share of the TFT LCD market share in this market.

Key Business Drivers

Technology

Here we observe that there is technology shift that is happening. Industry has moved from CRT to LCD now. The is shift has been gradual over the time. It can be observed that there is a gradual decrease in the basic CRT and increase in the new technologies.

- CRT is loosing on the technology and revenue front.

- LCD sales and revenue are increasing and so of the other technologies.

- Revenue of LCD is constantly increasing.

- There is new technological innovations.

- Technological innovations are driving the market and increasing demand for new additional features.

- Technology plays an important role in determining the market share for different technologies.

Research & Development

- Display Search forecasts that the plasma TV market will start shrinking in 2009 after hitting $24 billion in 2008, while it sees LCD TV demand reaching $75 billion in 2008 and $93 billion in 2010 - a trend that will likely make companies offering both LCD and plasma lines think twice about their strategy.

- Sharp has recently developed 64 inch ultra high resolution direct view LCD with “ 4k *2k” one kind of digital cinema system specification- making it world’s first.

- In future sharp seeks to concentrate on visual entertainment by developing LCD for it.

- Sharp Corp. in August started LCD production at its Kameyama No. 2 plant, the world's first to cut panels from eighth-generation glass substrates, which can yield eight 40-inch-class panels.

- With escalating demand for larger fabs of Gen 8, Gen 8.5, and Gen 10, the liquid crystal display (LCD) and organic light emitting diode (OLED) manufacturing equipment market has witnessed a growth spur. The market will continue its upward growth trajectory through 2011, with the majority of demand stemming.

- Demand plays a major role in the R&D improvement in the technology and makes company spend huge amounts.

- Under the belief that only technological development can secure the company's survival and progress, Dongwoo Fine- Chem has been investing aggressively in the field of R&D. The company has built its main R&D center in Poseung Industrial Park in Pyeongtaek with an investment of 10 billon won for improving the quality of such LCD materials as color resists and polarized films in addition to electronics materials such as CMP slurries and color resists of next generation. In addition, the company constructed a new R&D center next to its already existent one in Iksan. The company has invested 7 billion won for the construction of Iksan research center furnished with ultramodern equipment.

- Companies have developed transmissive and transflective sunlight-readable models.

- Makers in China are also increasing resolution and supporting 3D capability.

- Other R&D trends point to higher brightness, wider viewing angle and operating temperature range, lower power consumption and anti-glare.

- The world's largest LCD display manufacturer TPV Technology has signed an agreement with the Chengdu Hi-tech Zone to launch its R&D and production center in Chengdu, capital of Southwest China's Sichuan Province. The center of an investment of $90 million is expected to start operation in 2012 and will reach its full capacity in five years, with an annual output of some 6 billion yuan, said officials from the zone.

Demand

- The share of LCD TVs outsourced reached a record high of 34% in Q3'10, as Sony and LGE increased their outsourcing ratio to more than 50% and 20%, respectively.

- Among OEM shipments in Q3'10, excluding TV manufacturers, TPV ranked #1 with a 23% share, followed by Foxconn/Chimei Innolux at 15% and Vestel at 13%. Taiwanese OEMs (Compal, Wistron, and AmTran/Rakern) each have shares of about 8-9%.

- In 2011, the top three panel makers, Samsung, LG Display, and Chimei Innolux, will be aggressive with their plan to ship more than 60 million units of LCD TV panels. In total, LCD TV panel makers plan to ship more than 270 million units in 2011.

- Sales targets for the top seven Chinese TV brands for 2011 total 60 million units.

Market Analysis

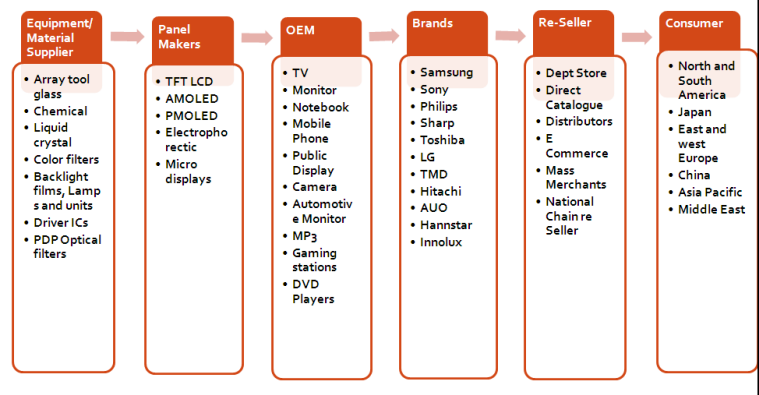

Value Chain Analysis

Players involved in the Value chain are

- Equipment/Material Suppliers: these are the industries which supply the basic material like ICs, Chemicals, and Liquid crystal etc. They help in putting the fundamental frame in place and start the process of manufacturing. They supply the basic and essentials parts required for the LCD.

- Panel Makers: Panel makers are the companies which make basic Skeleton for product. They design the panels according to the demand and requirement. They play a major role as to design the basic frame. They are the players who design the basic technology like LCD, AMOLED etc. these are the companies which do most of the R&D in the technology to improve and introduce innovations.

- OEM’s: OEM’s are the companies which do the work of assembling the parts and supplying it to different payers. They basically join everything and make it useful. They play an important role in the chain.

- Brands: Brands are the big organizations which have a value in the market. They add their brand name to the assembled piece and sometimes assemble the complete unit at their own location e.g. Samsung, Toshiba. Their brand value helps in determining the market value of the unit and sets a perception the consumers mind.

- Re-Seller: Re- sellers are various players who distribute and sell the product in the market. There can be different type like Retailer, DEPARTMENTAL STORES, and National Chain stores, Distributors etc they play an important role because they increase the reach of the organizations and make it easier for consumers. They help in building the consumer psyche as they help consumers in understanding the technology and product. They help in increasing the sales by providing the consumer feedback and POS data.

- Consumers: Consumers are the most important part as every product is designed keeping consumer in mind. All the margins of the players in chain depend in the consumers. If the product is not selling well margins go down and vice verse.

In the diagram above we can see that the most important factor which makes the equipment/material supplier crucial is “Technology”. It provide the base for the other players/different stages. Similarly Panel makers have the advantage of capacity. They give the frame and final touch to the work of previous player. The “profit” is added by OEM’s in the later stage which makes the product commercial. Brands helps with their captured market share. They make the product reachable to the market they captured. Reseller add “margin” in this and make the product physically available for the final consumption. And at last consumers pay the “price” for the product and completes the value chain cycle.

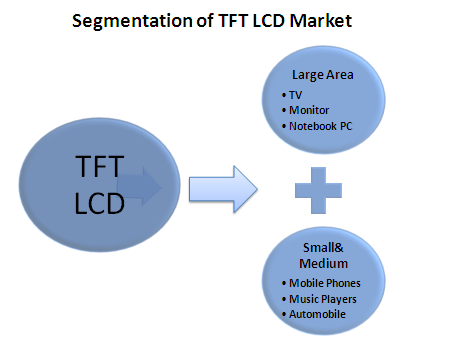

Market Segmentation

The TFT LCD market is divided into Large area i.e >10 inches of display size and Small&Medium area i.e. 1.5 inches to 10 inches of display size. The major applications under Large area are:

- Television

- Notebook PC

- Monitor

- Others include Industrial, Medical, and Public Information Displays

The major application under Small & Medium area display are:

- Mobile Phones

- Music Players

- Automobile

- Others include Digital Still Cameras,Personal Digital Assistants,Digital Photo Frames,Gaming Equipment

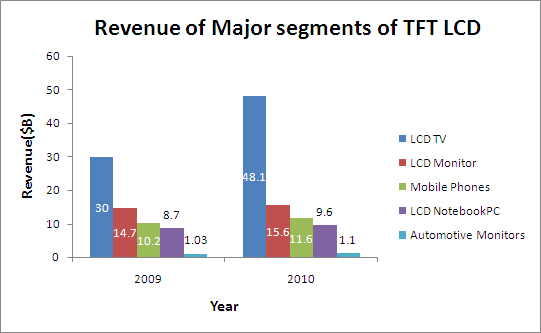

Analysis of Major segments

In terms of revenue, the top three segments in the TFT LCD market are:

- Television

- Desktop Monitor

- Mobile Phones

However, Television is the sector that is growing the maximum, with a 60.3% growth in revenue in 2010 over the previous year. Followed by Mobile phones, with a growth of 13.7% in revenue in 2010 over the previous year. Then it is followed by Notebook PC, Automotive monitors and Desktop Monitor with a growth rate of 10.3%, 6.7% and 6.1% respectively.

Television(TV)

In 2010, TV captured 51.2% share of the global TFT LCD revenue and hence is a major segment of the market.

LCD TV in the worldwide TV market has been well placed in the developed nations. However, there is an increase in the sales of LCD TV in the emerging countries as well.

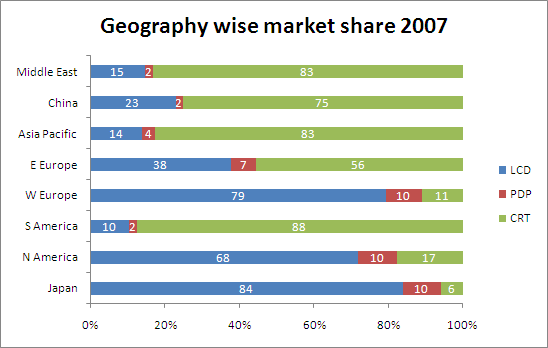

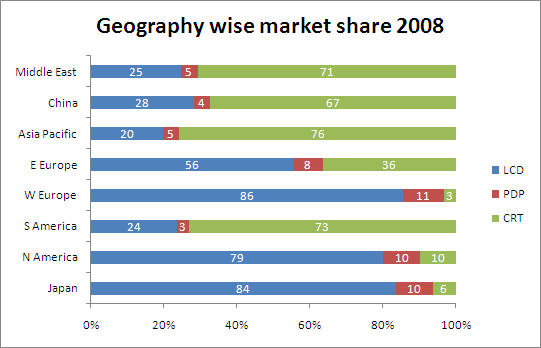

- East europe saw the maximum increase in the market share of LCD TV, from 38% in 2007 to 56% in 2008

- While South America saw an increase of 14 points from 10% to 24 % market share in 2008

- Similarly, with other emerging countries, there has been an increase in the market share of LCD TV

- There has been an increase in Plasma TV in all the countries, while CRT TV has seen a decrease in all the countries except Japan

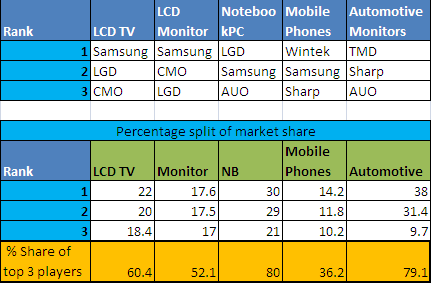

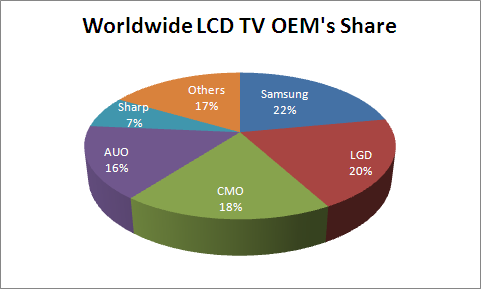

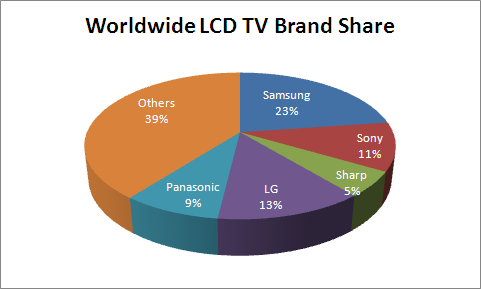

- Samsung has the maximum market share in both OEM and Brand TV, 22% and 23% respectively.

- Similarly, LG display(LGD) captures 20% market share of the TV OEM and 13% share of the market's brand share. In the TV market, backward integration has worked for both Samsung and LGD.

Desktop Monitor

In 2010, Desktop Monitor captured 16.6% share of the global TFT LCD revenue and hence is a major segment of the market.

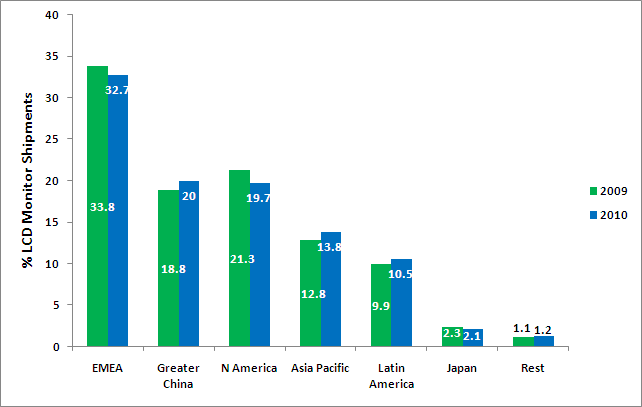

- Europe, Middle East, Africa(EMEA) saw the maximum share in the market in both years, 33.8 and 32.7 in 2009 and 2010 respectively

- There has been a decrease in the share of developed nations in the year 2010, over the year 2009. EMEA saw a decrease of 0.9 points, while North America saw a decrease of 1.6 points.

- However, developing nations saw an increase in the market share.

- Greater China, saw an increase of 1.2 points in 2010, while Asia Pacific saw a 1 point increase

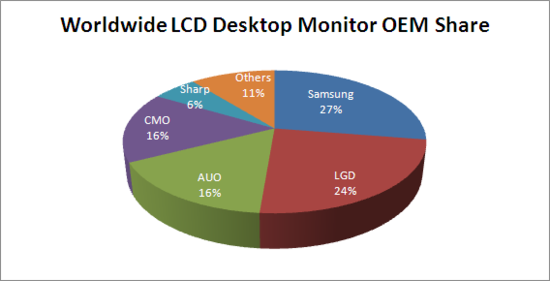

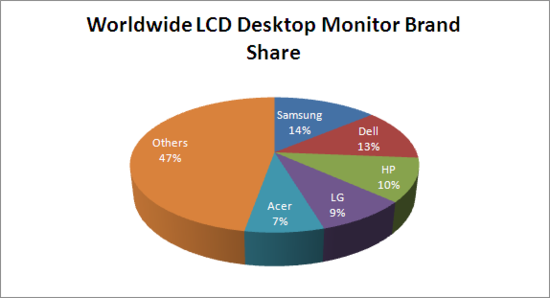

- Samsung and LG produce their own display panels, while other players in the market outsource it to display panel makers like AUO, CMO, etc.

- Samsung has the maximum market share in both OEM and Brand Desktop Monitor, 27% and 14% respectively.

- Even though LG display(LGD) captures 24% market share of the Desktop OEM but only 9% share of the market's brand share (behind Dell and HP), which shows it could not leverage the benefits of backward integration like Samsung in Desktop Monitor marketspectively.

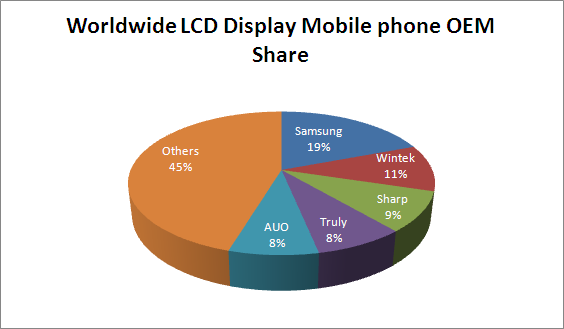

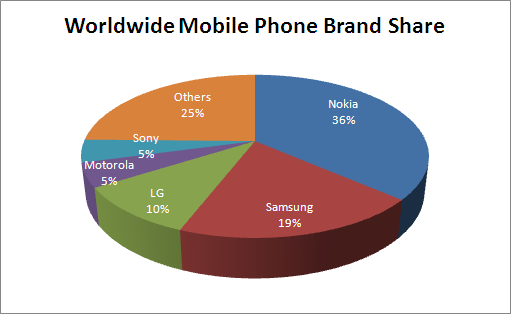

Mobile Phones

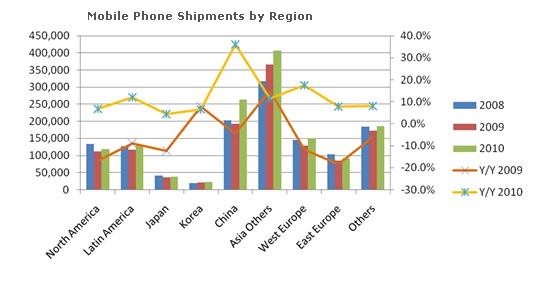

In 2010, Mobile Phones captured 12.3% share of the global TFT LCD revenue and hence is a major segment of the market.

- China has the maximum share in the market in all the three years.

- All the countries saw a decrease in shipments in 2009, except Asia others where there was an increase in shipments even after recession

- Mobile phone demand has picked up in 2010

- Nokia captures 36% of the mobile market, but Nokia doesn't produce its own mobile phone LCD panels but rather outsources it from other companies that produce the same.

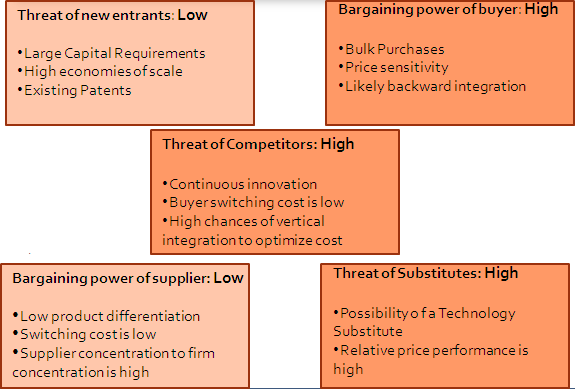

Porter's 5 Forces analysis

- Threat of new entrants: Low

- Capital Requirements are large for entrants to effectively compete especially due to large set up costs and R&D expenditure

- High economies of scale

- Many patents issued on the technology

- Reaction of Existing Competitors also acts as a barrier as key players like Samsung have been known to fight fiercely for market share by cutting prices and possess substantial resources

- Bargaining power of supplier: Low

- Many competitive suppliers exist

- Product Differentiation of raw materials is low

- Switching costs are low

- Forward Integration is unlikely as many of the purchasers like Samsung are more powerful and operate their own manufacturing factories. Any upward pressure on raw material prices is likely to be absorbed or passed on to customers

- Supplier concentration to firm concentration ratio is high

- Bargaining power of buyer: High

- B2B buyers are more powerful due to bulk purchases. For example Dell

- Backward integration is possible (for price optimization)

- Price Sensitivity is high due to a large number of similar products

- Threat of Substitutes: High

- Availability of various display technologies leads to pressure being put on lowering pricing and high R&D costs to continually differentiate products

- Buyer switching cost is low

- High relative price performance of substitutes

- Threat of Competitors: High

- Competitors are numerous and diverse

- Continuous Innovations for product differentiation

- Switching Costs are low, so rivalry is intensified

- High competitor strategy with respect to price, cost, marketing and sales

- High chances of vertical integration leading to lower costs

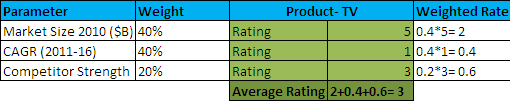

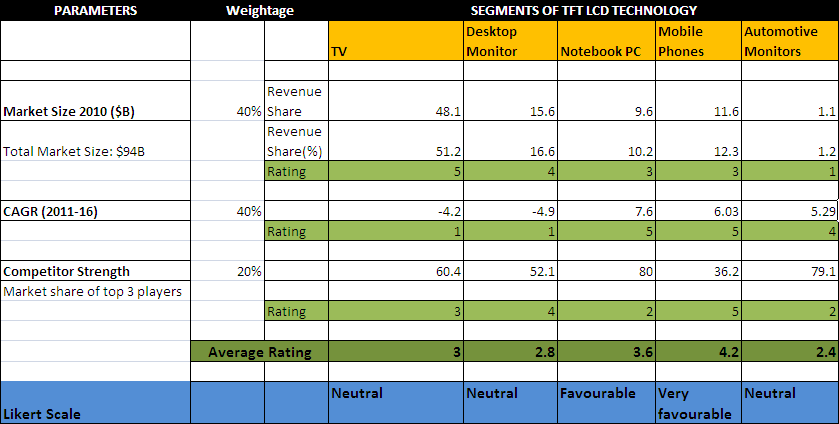

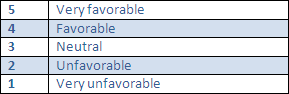

Model to measure market attractiveness

Market Attractiveness Model

Objective: This model can be used to study the attractiveness of a market and the various segments in the same. The model uses 3 parameters to measure the appeal of the market, namely:

- Market share:

Market size of each segment in the whole industry according to the revenue and the percentage share of each segment with respect to the whole industry. This is calculated for the current year in order to understand the current market size and share. - Compounded Annual Growth Rate (Forecasted for the next 6 years):

This year over year forecasted growth rate is taken as an indicator to show the future growth rate of each segment in the industry and hence its attractiveness in the future. - Competitors Strength:

This is the total market share captured by the top 3 players in each segment. This helps us in determining one of the entry barriers into the segment.

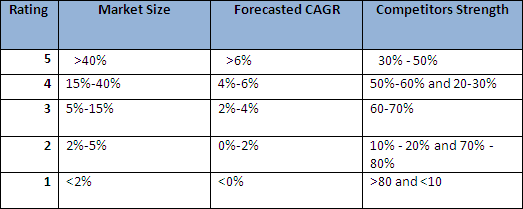

To analyze the model, Likert Scale Model has been used with the following ratings:

Each of the 3 parameters has been assigned the scale on different criteria’s (according to their nature), as given below:

For each parameter weights have been assigned as following:

- Market size: 40%

- CAGR: 40%

- Competitor Strength: 20%

Weights have been assigned in order to calculate the weighted average of the 3 parameters assigned to each segment, which would help us in determining one unit on the scale for each segment, which will help us in determining the attractiveness of each segment.

Market size and Forecasted CAGR have been assigned 40% weigh each as these are the two most important parameters which will help in determining whether a company should enter into that segment of the industry or not. Market size would give the revenue in the segment at present and also the percentage share each segment captures of the total Industry. CAGR would determine the growth rate of the revenue of each segment and hence would be profitable in the future or not.

Competitor strength is assigned 20% weight. We need to see how strongly or loosely is the segment held by the top 3 players of that particular segment. If it is tightly held then entry becomes difficult and similarly if loose, then there is huge unorganized sector or too many players in the market.

Market Attractiveness Model – LCD Technology

Working of the model Following is the method used to calculate the market attractiveness model:

- Major segments of the LCD display technology were found out on the basis of the revenue and the shipments of each. 5 top segments were found out: Television, Desktop Monitor, Notebook PC, Mobile Phones and Automotive monitor displays. Automotive monitors are used for in-console navigation, controls and rear-seat entertainment.

- Market sizes of each of the 5 segments on the basis of revenue were found out. Also the revenue share of the Total TFT LCD market was found out in order to calculate the share of each segment in the whole industry.

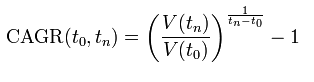

- Forecasted CAGR (2010-2016) was found out for each segment with the help of the formula :

- Market share of the top 3 players was added in order to calculate the strength of the competitors in each segment. This is used to calculate the strength of one of the entry barrier. The top 3 players in each segment is given as below:

- Ratings of the 3 parameters were given according to the scale given below for each segment:

- Average weight of each segment is calculated according to the individual rank of each segment and the weight assigned for each parameter. For example:

Transactional Activity

- In 2009, Innolux Display acquired Taiwan LCD maker TPO Displays Corp. Then, Innolux acquired another Taiwan LCD maker, Chi Mei Opto electronics Corp. And recently, Innolux Display announced the completion of its acquisition of Chi Mei Optoelectronics and TPO Displays.

The new entity is called Chimei Innolux Corp. Chimei Innolux is now a dominant player in the global TFT-LCD panel market. It sells from 1.5- to 50-inch. panels. By essentially gaining control of Chimei Innolux, Foxconn can now offer customers a one-stop shop of contract manufacturing services, including LCD production.

- Skyworth has invested in LG Display's LCD-module factory and established its own LCD-module assembly line.

- Hisense and Konka have set up LCD-module assembly lines with the help of CMO; TCL set up an LCD-module assembly line using know-how transmitted from Samsung.

- AUO and Changhong jointly invested in an LCD-module line.

- LG Display formed an alliance with AmTRAN to set up an LCD-module and LCD-TV-set assembly line and set up a joint venture with TPV for LCD-module lines.

- AUO and TPV are jointly establishing an LCD-module line in Eastern Europe.

- Samsung accquires LiquavistaBV in DEC'10.

- AU Optronics Signs Memorandum of Understanding to Acquire Toshiba Mobile Display

Subsidiary in Singapore, April 2010

- AUO and TCL to Establish a Joint Venture for TFT-LCD Module Plant on Apr'10.

- Toshiba and Sony combining LCD operations. The new entity would overtake Sharp as the largest maker of small

and mid-sized LCD panels, which are commonly found in smartphones and tablet computers.

- The new entity would overtake Sharp as the largest maker of small and mid-sized LCD panels, which are commonly found in smartphones and tablet computers.

- We acquired 49% stake and obtained management control in Cedova, a start-up venture for laser manufacturing.

Samsung Company Profile

Recommendations

- Though the market share of TFT LCD in the display market is predicted to reduce in the future, it would still capture more than 80% of the market. This presents ample of opportunity for existing players (currently producing semiconductor devices and want to enter LCD market) to use their technological excellence to milk the LCD market.

- AMOLED technology is predicted to substitute TFT LCD in applications like smart phones and tablets. Hence for a new player, who plans to invest in R&D and manufacturing to enter the LCD industry, investing in better technology is advisable.

- Entry and Exit barriers are both high for the industry. Hence, this industry is attractive only for big players who have the capacity to make huge investments to enter the industry.

- From the analysis, the most attractive segments to enter in the TFT LCD display panel are Mobile Phones and Notebook PC.

- The developed nations have an exhausted market and there is a lot of potential in the emerging countries for all the segments of TFT LCD

Small Players

It is not advised for small players to enter the LCD industry as it is already in the consolidation phase. Many players like Samsung, have undergone vertical integration to optimize their costs. The initial investment required to enter the LCD industry is very high. In such a scenario, for a small player, who manufactures displays or products, will find it difficult to compete with giants like Samsung, LG etc on prices.

Big Players

Players who have the expertise, capital and capacity to invest in LCD market can consider entering Mobile phones and Notebook PCs market. For them to succeed in the LCD market, they can either specialize in producing LCD displays with the latest and best technology available or consider vertical integration to optimize their cost.

Reference

- ElectronicsB2B

- iSuppli

- Frost

- Electronics

- Google Books

- Beyond VC

- Anderson

- Philps

- Electronics

- Electronics

- Berkely

- FTP

- FTP

- NBER

- Samsung

- DFU

- Sharp

- JRC

- MSN

- IAMOT

- Korea iTimes

- LED Magazine

- iSuppli

- CEO Consultant

- Research in China

- Research in China

- LCD

- Digital Lifestyle

- Screen Tek

- Market Report

- Display Search

- Display Bank