OTC vs. Prescription Drugs

Summary

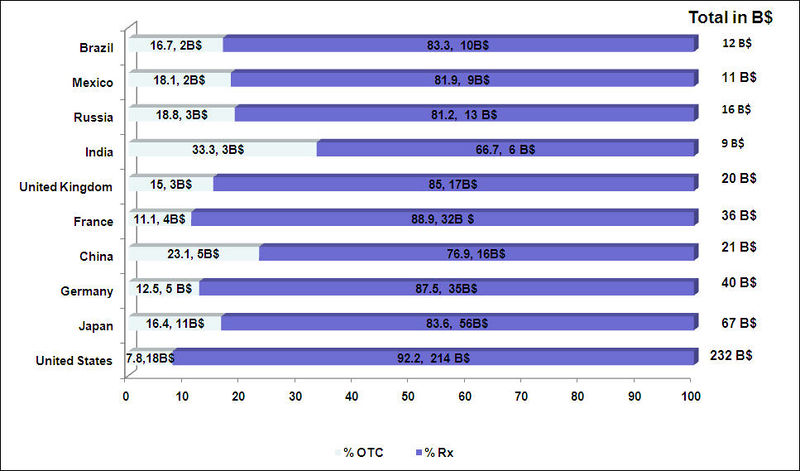

- OTC drugs have a greater market share than prescription drugs in the rest of the world as compared to the US

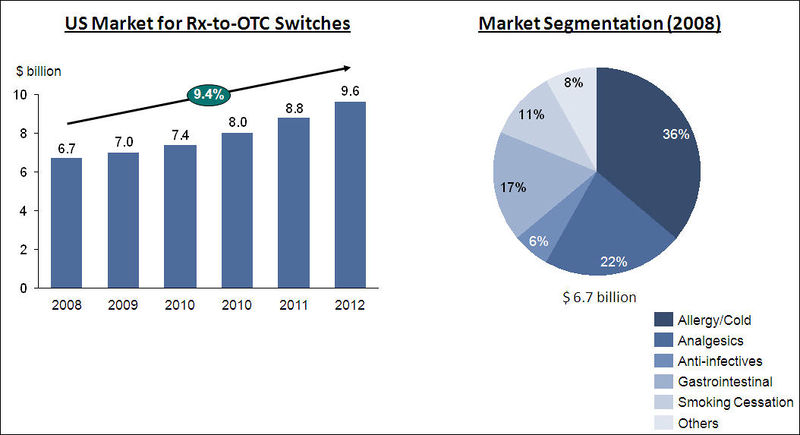

- Consumers and government pressure on pricing will continue to help accelerate the Rx-to-OTC transition in the US

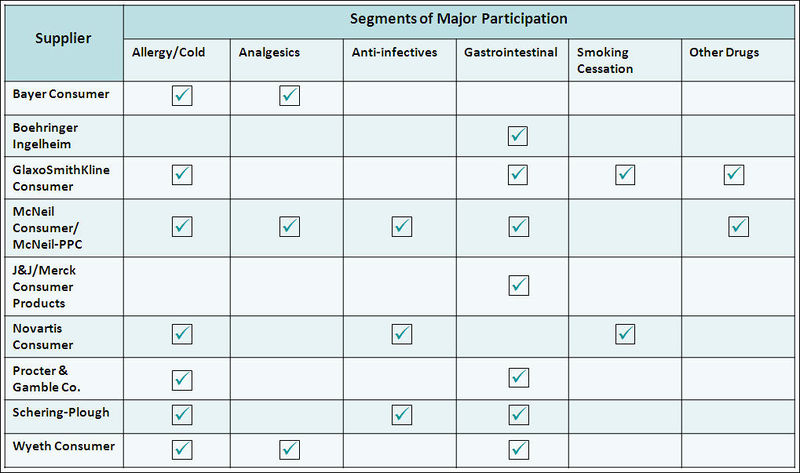

- The Rx-to-OTC transition will probably be limited to the traditional markets such as allergy/cold, analgesics, anti-infectives, gastrointestinal, and smoking cessation for now

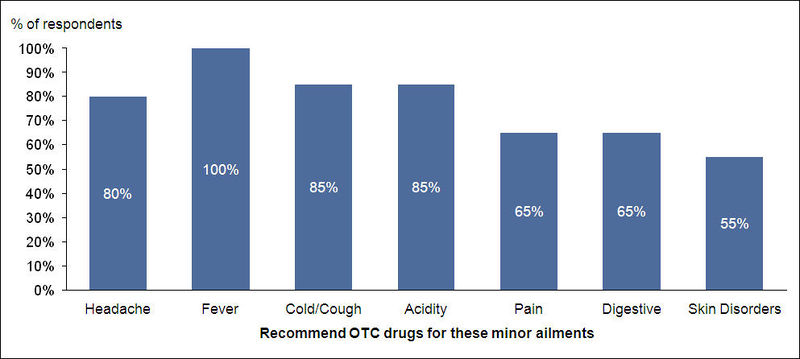

- There is widespread support for OTC usage among physicians for fever, cold/cough and minor ailments of that nature; beyond that, the physicians do have some reservations

Contents

OTC and Prescription Drugs

Introduction

For a medicine to be granted OTC status, it must have a wide safety margin and be effective, and must bear understandable labeling to ensure proper use. More than 700 OTC products on the market today use ingredients or dosages available only by prescription less than 30 years ago. Rx-to-OTC switch refers to the transfer of proven prescription drugs (Rx) to non-prescription, over-the-counter (OTC) status. Rx-to-OTC switch is a data-driven, scientifically rigorous, and highly regulated process that allows consumers to have OTC access to a growing range of medicines

OTC Players

OTC Market

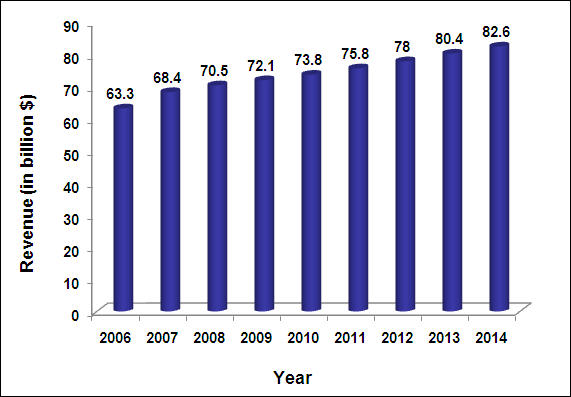

The compound annual growth rate (CAGR) of OTC market from 2005-2009 was 3.3%. The CAGR from 2009-2014 is expected to be 2.7%.

OTC vs. Rx Market

Rx-to-OTC Switch

There are two ways in which drugs are commonly switched as approved by FDA in US:

- The OTC Drug Review

- Began in 1972

- Ongoing assessment of the safety and effectiveness of all nonprescription drugs

- Panels of non-government experts review active ingredients in marketed OTC drug products to determine whether they can be classified as safe and effective

- About 40 former prescription-only drug ingredients have been switched by this process

- New drug application (NDA) process

- Manufacturers submit data to the FDA showing the drug is appropriate for self-administration.

- The submission includes studies showing that the product's labeling can be read, understood, and followed by the consumer without the guidance of a health care provider

- Some drugs are approved initially as OTC drugs, but most are first approved for prescription use and later switched to OTC

Market Overview

Sales Data for Selected Rx-to-OTC Switches, USA

| S.No | Switched Drug | Manufacturer/Marketer | Drug Category | Switch Year | First 12-Month Sales (in millions) |

| 1 | Aleve | Bayer Consumer Care | Analgesic | 1994 | $110 |

| 2 | Alli | GlaxoSmithKline Consumer Healthcare | Weight Loss Aid | 2007 | $80 |

| 3 | Claritin | Schering-Plough Healthcare | Allergy | 2002 | $380 |

| 4 | MiraLax | Schering-Plough Healthcare | Gastrointestinal | 2006 | $40 |

| 5 | Nicoderm CQ | GlaxoSmithKline Consumer Healthcare | Smoking Cessation | 1996 | $160 |

| 6 | Nicorette | GlaxoSmithKline Consumer Healthcare | Smoking Cessation | 1996 | $195 |

| 7 | Pepcid AC | Johnson & Johnson - Merck Consumer Pharmaceuticals Co. | Gastrointestinal | 1995 | $200 |

| 8 | Prilosec OTC | Procter & Gamble | Gastrointestinal | 2003 | $130 |

| 9 | Rogaine | McNeil Consumer Healthcare | Hair Loss | 1996 | $180 |

| 10 | Zantac 75 | Boehringer Ingelheim Consumer Healthcare Products | Gastrointestinal | 1995 | $140 |

Factors Affecting Rx-to-OTC Switch

Consumers: In the current scenario, consumers are looking to cut their health care costs

Government: US government is proactively finding ways to make health care more affordable

Companies: Companies are constantly evaluating various options to keep the consumer product segments profitable

Trends in Rx-to-OTC Switch

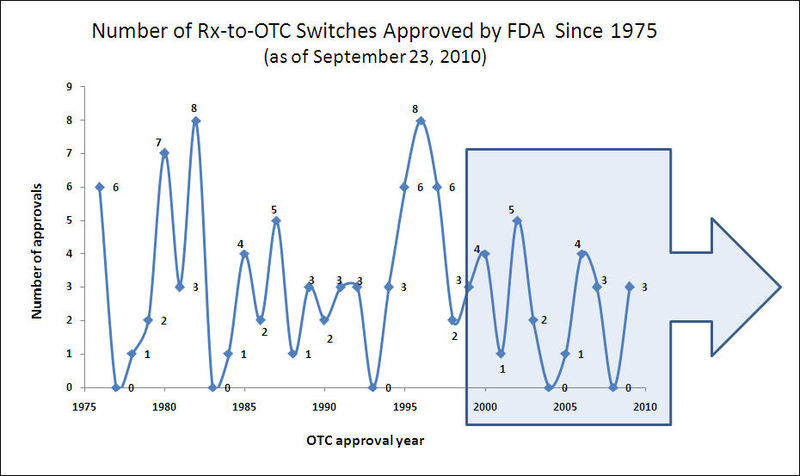

New OTC Switch Approvals

Rx-to-OTC Switches Since 2000

| S.NO. | INGREDIENT | PRODUCT CATEGORY | DATE OF OTC APPROVAL | PRODUCT EXAMPLES | COMPANY |

| 1 | ibuprofen (NDA)** | migraine | 25/02/2000 | Motrin Migraine Pain | McNeil Consumer Healthcare |

| 2 | docosanol (NDA)* | cold sore/fever blister | 25/07/2000 | Abreva Cream | Avanir Pharmaceuticals |

| 3 | famotidine, calcium carbonate, | heartburn, | 17/10/2000 | Pepcid Complete | J&J/Merck |

| magnesium hydroxide (NDA)* | acid indigestion | ||||

| 4 | butenafine hydrochloride (NDA) | athlete’s foot, jock itch, ringworm | 7/12/2001 | Lotrimin Ultra | Schering-Plough |

| 5 | ibuprofen, pseudoephedrine HCl, | analgesic/decongestant | 18/04/2002 | Children’s Advil Cold | Wyeth |

| suspension for pediatric use (NDA)* | |||||

| 6 | guaifenesin extended-release tablet (NDA) | expectorant | 12/7/2002 | Mucinex | Adams Respiratory Therapeutics |

| 7 | nicotine polacrilex troche/lozenge (NDA)* | smoking cessation | 31/10/2002 | Commit | GlaxoSmithKline |

| 8 | loratadine (NDA) | antihistamine | 27/11/2002 | Claritin Tablets, Claritin RediTabs, Claritin Syrup | Schering-Plough |

| 9 | loratadine, pseudoephededrine sulfate (NDA) | antihistamine/ | 27/11/2002 | Claritin-D 12 Hour Extended Release Tablets, | Schering-Plough |

| decongestant | |||||

| 10 | omeprazole magnesium | acid reducer to treat frequent heartburn | 20/06/2003 | Prilosec OTC | Procter & Gamble |

| 11 | loratadine (NDA)** | hives relief | 15/11/2003 | Claritin hives relief | Schering-Plough |

| diphenhydramine citrate & ibuprofen (NDA)*; diphenhydramine HCl & ibuprofen potassium (NDA)* | analgesic sleep-aid | 21/12/2005 | Advil PM | Wyeth | |

| 12 | ecamsule (combined with avobenzone and octocrylene (NDA)* | sunscreen | 21/07/2006 | Anthelios SX | L’Oreal |

| 13 | levonorgestrel (NDA) | contraceptive | 24/08/2006 | Plan B | Duramed |

| polyethylene glycol 3350 (NDA) | laxative | 6/10/2006 | MiraLAX | Schering-Plough | |

| 14 | ketotifen (NDA) | antihistamine eye drops | 19/10/2006 | Zaditor | Novartis |

| 15 | orlistat (NDA) | weight loss aid | 7/2/2007 | alli | GlaxoSmithKline |

| cetirizine HCl & pseudoephedrine HCl (NDA) | antihistamine/ | 9/11/2007 | Zyrtec-D | McNeil | |

| 16 | decongestant | ||||

| 17 | cetirizine HCl (NDA) | antihistamine, hives relief | 16/11/2007 | Zyrtec | McNeil |

| lansoprazole (NDA) | acid reducer to treat | 18/05/2009 | Prevacid 24 HR | Novartis | |

| 18 | frequent heartburn | ||||

| 19 | levonorgestrel (NDA) | contraceptive | 10/7/2009 | Plan B One Step | Duramed |

| omeprazole and sodium | acid reducer to treat | 1/12/2009 | Zegerid OTC | Schering-Plough | |

| 20 | bicarbonate (NDA) | frequent heartburn |

Blue highlighted drugs are patent-protected

Purple highlighted drugs are under FDA exclusivity period

Rx-to-OTC Switches before patent expiry

| S.NO. | PRODUCT EXAMPLES | COMPANY | DATE OF OTC APPROVAL | PATENT EXPIRY | FDA EXCLUSIVITY | PATENT NUMBER |

| 1 | Abreva Cream | Avanir Pharmaceuticals | 25/07/2000 | 28/04/2014 | -- | 4,874,794 |

| 2 | Pepcid Complete | J&J/Merck | 17/10/2000 | 15/10/2000 | -- | 4,283,408 |

| 3 | Mucinex | Adams Respiratory Therapeutics | 12/7/2002 | 28/04/2020 | -- | 6,372,252 |

| 4 | Commit | GlaxoSmithKline | 31/10/2002 | 21/08/2010 | -- | 5,110,605 |

| 5 | Prilosec OTC | Procter & Gamble | 20/06/2003 | 15/11/2019 | -- | 5690960, 5753265, 5817338, 5900424, 6403616, 6428810 |

| 6 | Claritin hives relief | Schering-Plough | 15/11/2003 | 19/06/2002 | -- | 4,282,233 |

| 7 | Anthelios SX | L’Oreal | 21/07/2006 | 24/12/2013 | -- | 5,587,150 |

| 8 | Plan B | Duramed | 24/08/2006 | -- | 24/08/2009 | -- |

| 9 | MiraLAX | Schering-Plough | 6/10/2006 | -- | 6/10/2009 | -- |

| 10 | alli | GlaxoSmithKline | 7/2/2007 | 6/1/2018 | 7/2/2010 | 6004996 |

| 11 | Zyrtec-D | McNeil | 9/11/2007 | 10/6/2022 | -- | 6469009, 6489329, 7014867, 7226614 |

| 12 | Zyrtec | McNeil | 16/11/2007 | 2/7/2018 | -- | 6455533 |

| 13 | Prevacid 24 HR | Novartis | 18/05/2009 | -- | 18/05/2012 | -- |

| 14 | Plan B One Step | Duramed | 10/7/2009 | -- | 10/7/2012 | -- |

| 15 | Zegerid OTC | Schering-Plough | 1/12/2009 | 15/07/2016 | -- | 6489346, 6645988, 6699885, 7399772 |

Blue highlighted drugs are patent-protected

Purple highlighted drugs are under FDA exclusivity period

Trend Analysis

- 11 out of 22 recent drugs (50%) which switched from Rx to OTC were patent protected

- 4 out of 22 recent drugs (18.2%) which switched from Rx to OTC were under FDA exclusivity period

- 13 out of 22 recent drugs (59%) were switched from Rx to OTC before their patent or FDA exclusivity expiry. Two drugs switched after the expiry of patents

- 6 out of these 13 drugs made a switch more than 10 years before expiry

- 5 out of these 13 drugs made a switch between 3 to 10 years before expiry

Potential Drugs for Rx-to-OTC Switch

| S.NO | DRUG | PATENT EXPIRY DATE | EXPECTED SWITCH YEAR | US PATENT NUMBERS |

| 1 | Allegra | 14/3/2017 | 2012 | 5578610, 6037353, 6187791, 6399632, 7138524 |

| 2 | Clarinex | 1/12/2018 | >2013 | 6514520, 7211582, 7214683, 7214684 |

| 3 | Crestor | 17/6/2022 | >2014 | 6858618, 6316460, 7030152, RE37314 |

| 4 | Lescol | 12/6/2012 | >2014 | 5356896, 5354772, |

| 5 | Lipitor | 8/1/2017 | >2014 | 5969156, 4681893, 5273995, 5686104, 5969156, 6126971, RE40667 |

| 6 | Pravachol | 22/10/2014 | >2014 | 5622985 |

| 7 | TriCor | 21/2/2023 | >2014 | 7276249, 5145684, 6277405, 6375986 , 6652881, 7037529, 7041319, 7320802 |

| 8 | Vytorin | 25/4/2017 | >2014 | RE37721, 5846966, |

| 9 | Zetia | 25/7/2022 | >2014 | 7030106, 5846966, 7612058, RE37721 |

| 10 | AcipHex | 8/5/2013 | 2013 | 5045552 |

| 11 | Nexium | 25/11/2018 | >2014 | 7411070, 5690960, 5714504, 5877192, 5900424, 6147103, 6166213, 6191148, 6369085, 6428810, 6875872 |

| 12 | Protonix | 30/3/2025 | 2010 | 7553498, 4758579, 7544370, 7550153 |

| 13 | Zofran | 7/12/2026 | >2014 | 7544370, 4758579, 7550153, 7553498 |

| 14 | Propecia | 5/11/2013 | 2011 | 5571817, 5547957, 5886184 |

| 15 | Imitrex | 10/3/2014 | >2010 | 5554639, 5307953, 5705520 |

| 16 | Actonel | 10/12/2018 | >2014 | 6165513, 5583122, 6096342 |

| 17 | Boniva | 2/9/2014 | >2014 | 5662918, 4927814 |

| 18 | Fosamax | 17/1/2019 | >2014 | 6225294, 5462932, 5994329, 6015801 |

| 19 | Evista | 10/3/2017 | >2014 | 6894064, 6797719, 6458811, 5393763, 5457117, 5478847, 5811120, 5972383, 6906086, RE38968, RE39049, RE39050 |

| 20 | Detrol | 11/5/2020 | >2014 | 5382600, 6630162, 6770295, 6911217 |

| 21 | Ditropan | 22/11/2015 | >2014 | 5674895, 5840754, 1 5912268, 6262115, 6919092 |

| 22 | Cialis | 26/4/2020 | >2014 | 7182958, 5859006, 6140329, 6821975, 6943166 |

| 23 | Levitra | 31/10/2018 | >2014 | 6362178, 7696206 |

| 24 | Viagra | 22/10/2019 | >2014 | 6469012, 5250534 |

Physician Preferences and Insights: US Market Survey

Rx vs. OTC Survey

Objectives of the survey

- General information on OTC market and usage

- Attitude of physicians towards OTC drugs as compared to Rx drugs

- Effectiveness of marketing campaigns

| Sample size of physicians | 20 |

| Primary medical specialty | General or Family Practice |

| Avg of visiting patients per month | 466 patients |

| Avg of years of experience | 20 years |

Physician panel provisioned by: World One.

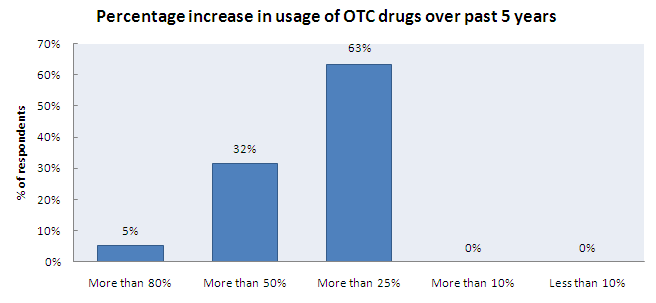

Increase in OTC Usage

- 95% of the respondents think that the usage of OTC drugs has increased in the past five years

- About 63% of them think that usage of OTC drugs has increased by more than 25% over the past 5 years

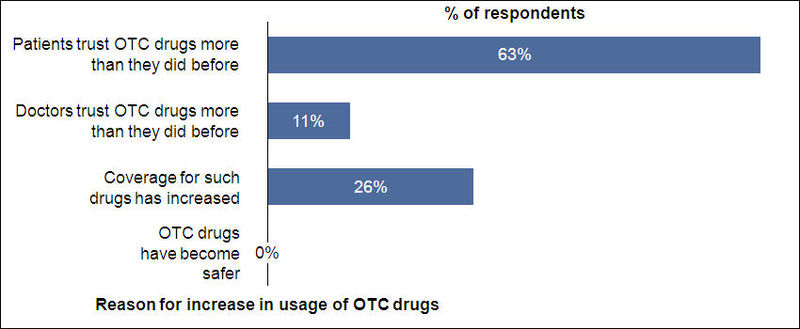

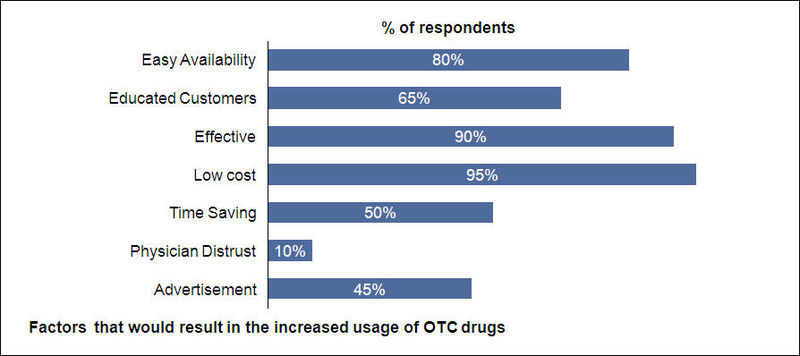

Reasons for Increased OTC Usage

- Majority of the respondents feel that patients are trusting OTC drugs more than they used to do before and this, along with increased coverage to OTC drugs, triggered the increased usage of OTC drugs over the past five years

About 50% of the respondents think that more OTC drugs should be included under Medicare/insurance coverage.

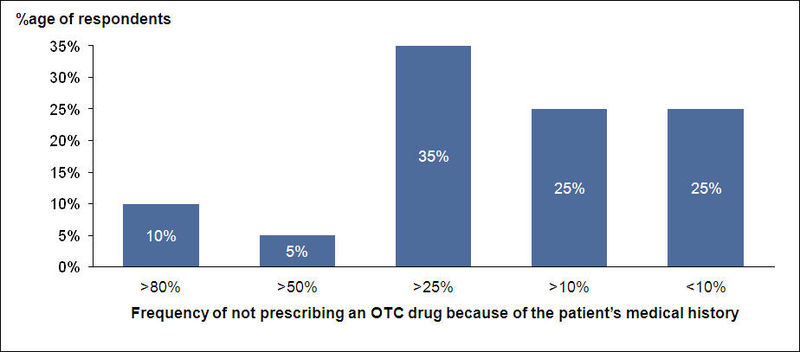

OTC Usage and Medical History

- Doctors generally check patient’s medical history for probable side effects and habits before prescribing OTC drugs

About 85% of the respondents think that the information on the labels of OTC drugs is sufficient.

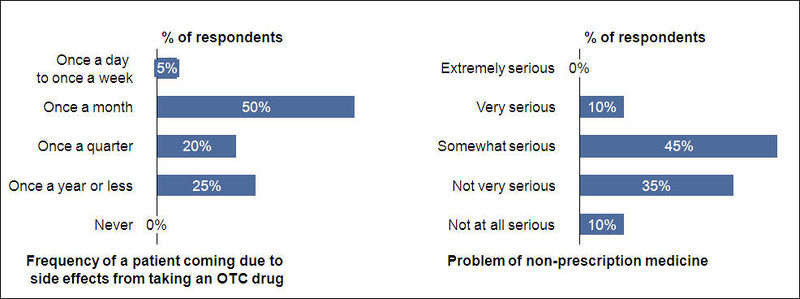

OTC side effects

- The average no. of patients visiting each respondent in a month is 466 and about one patient among them would visit due to side effect from taking an OTC drug

About 45% of respondents think that the problem of non-prescription medicine today is somewhat serious.

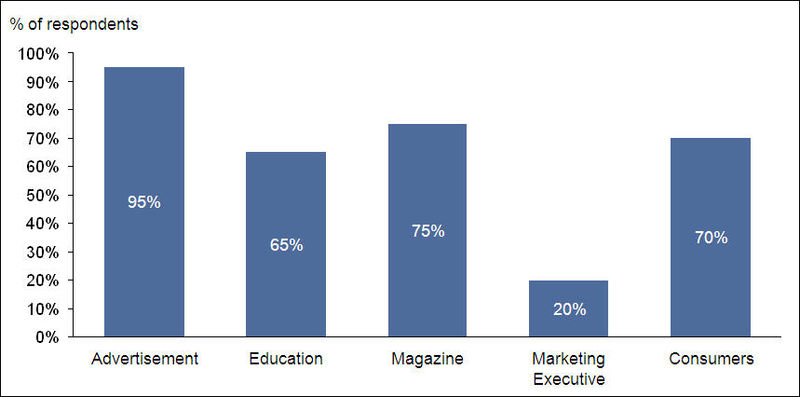

Effectiveness of Marketing Campaigns

- Advertisement is the major source of information on OTC drugs for most of the respondents

Only 30% of respondents replied in positive when asked about permitting marketing executives to market OTC products through them.

Physician attitude – OTC vs. Rx

- 100% of the respondents would recommend an OTC drug for fever and about 85% of them would do so for other minor ailments like cold/cough and acidity

- About 95% of the respondents suggested low cost would be a major factor that would result in the increased usage of OTC drugs

100% of the respondents feel it is important to prescribe a drug that minimizes patients' out-of-pocket costs, while choosing between equally effective and safe medications.

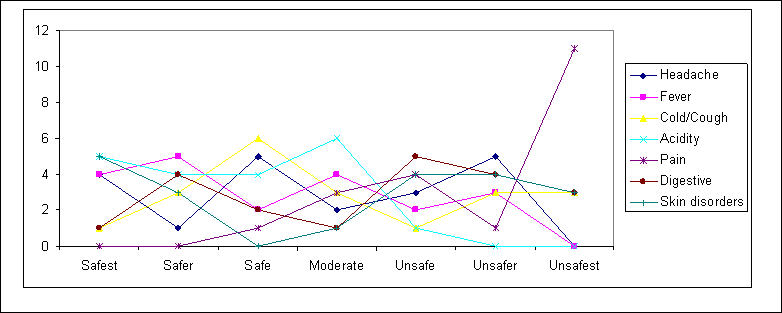

OTC Safety Perceptions

Physicians perceive OTC drugs to be:

- Very safe for fever, acidity, skin disorders

- Unsafe for pain

- Generally safe for headache, cold/cough and digestive disorders