Innovative personal finance products demo prep

From DolceraWiki

Contents

[hide]- [+]1 India: Overview

- [+]2 Loans

- [+]3 Insurance

- [+]4 Credit

India: Overview

Overall economy

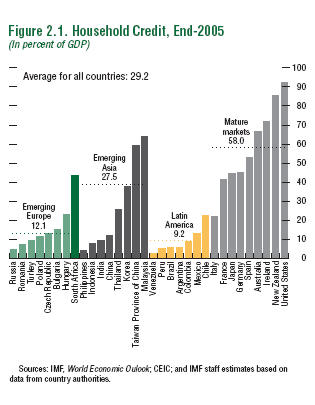

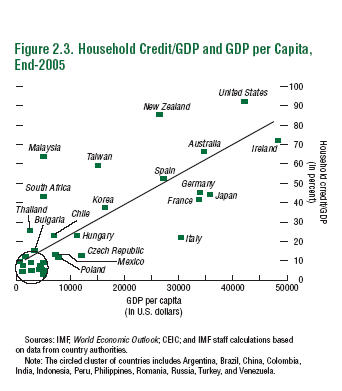

Household credit

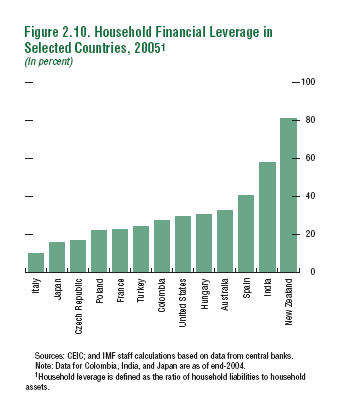

Household leverage

- This indicates a bias towards assets based leverage than leverage on incomes in India.

- Rising incomes in India thus indicates towards tremendous opportunities for loans based on 'income potential' on either side (a) asset creation side and (b) Liablity creation side. Also, fuelling of (a) will in parallel give rise to (b).

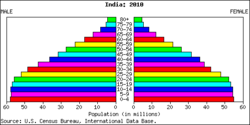

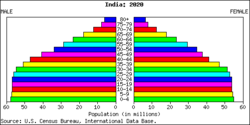

Demographic dividend

- India's population is extremely young

- 50% of the population is under the age of 25, while 2/3rd is under the age of 35

- Over the next several decades, India's young population will strengthen the workforce

Education

- Literacy levels are extremely low in India

- Education is in high demand

- Public education system is broken and private education is extremely expensive

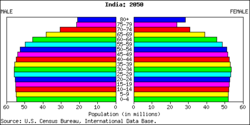

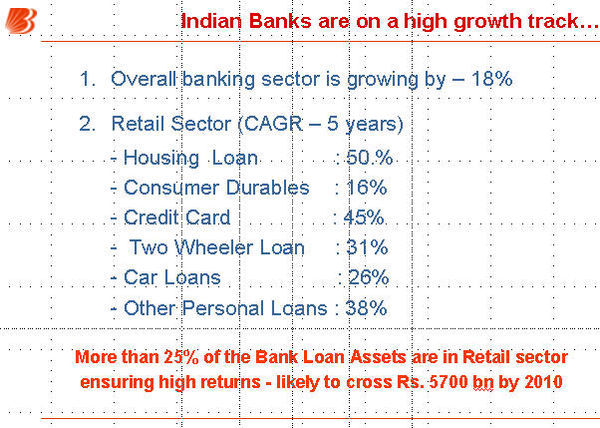

Personal income

- In some areas of knowledge services, salaries in India are coming close to American salaries in Purchase-Power Parity (PPP) terms

- The top end of over 700,000 people out of India's population of over one billion is estimated to have individual liquid wealth of about $1,00,000 (Rs 44,13,000) which is likely to go up to $1.1 million by 2009. This represents a cumulative liquid wealth of $203 billion, estimated to go up to $322 billion by 2009. These are the findings of a recent study done by market research firm Synovate.

Ideas

Loans

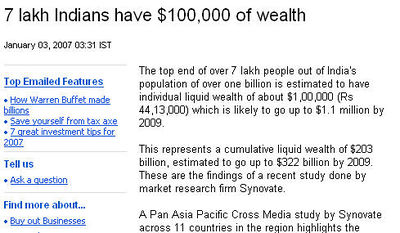

Trends

A consumption boom

- According to study by Bank of Baroda, India is riding a CAGR growth in excess of 35% for the last 5 years in 'retail loans' category

- Despite this, the penetration of credit products as a % of GDP is still very low

- Reasons could be (a) credit aversion (b) no distinction between good and bad paymasters (c) propensity to save is high due to insecure healthcare and social security concerns.

Expensive weddings

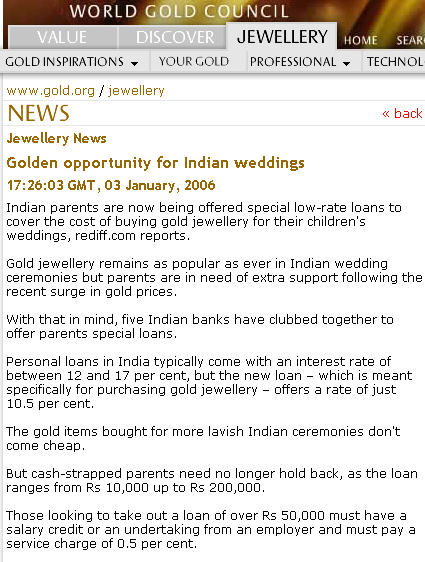

Gold lifestyle

- Jewellers in India give lose guarantees that upon return of the jewellery, value of the metal in jewellery adjusted for workmanship costs will be redeemed. This acts as a big incentive for people to invest in jewellery as principal amount is secure. However, there is no formal guarantee mechanism to ensure the contract.

- This can be an opportunity for banks to step in, whereupon the banks can underwrite the value of the jewellery and assure full value upon jewellery redemption. Banks can extend loans to people to buy jewellery, whereby interest is charged differently for the value of the metal (lower interest rate) and higher for the loan against workmanship.

Microfinance

- 1.4 million microfinance groups in India

- Over 20 million members for microfinance groups

- According to one estimate, 30 million non-agricultural enterprises and 50 million landless households in India collectively need approximately $30 billion credit annually

- Microfinance is growing in South India, which contrasts with the stagnation in Eastern, Central and North Eastern India

- Downside: Microfinance involves very high transaction costs given the small amounts of money involved for each loan, which necessitates high transaction costs

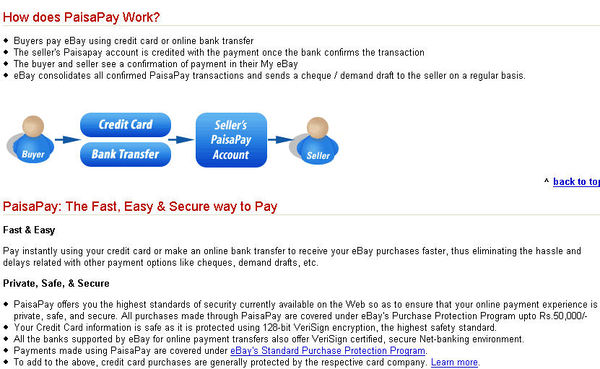

Peer-to-peer banking

- Paisa pay from ebay has empowered C2C payments

- A similar concept can be used for C2C cash payments.

- Here, a customer can pay cash to a approved vendor who is associated with a mobile telephone network. This vendor, in turn, for a fee, can credit the payment account of the 3rd party. The 3rd party, can then collect cash from the telephone company or ask the telephone company to credit his/her bank account.

Kitty parties

- Kitties are being organized as chit funds

- People pay EMI's of small amounts, in a group, and then wait for purchase of a consumer product when their chance comes

Islamic banking

Ideas

Microsavings instruments

- Tie up with telephone firms to create microsaving pre-paid cards

- In such cards, 10% of the amount paid will get credited to the payees account as a saving

- Compounding of such savings after several years can yield high returns

Education loans

- Provide loans for primary and high school education, besides college education

Wedding loans

- Provide cheap loans by tying up with wedding organizers, caterers etc. The loans get cheaper due to bulk discounts on prices offered by them.

Streamlining microfinance

Loans based on gold

- Already covered under trends

Insurance

Trends

Aspirational society

- Picture: How many homes have a...

- Text:

No medical coverage

- Picture:

- Text:

Increasing savings rate

- Picture:

- Text:

Ideas

Insurance as a saving vehicle

- Picture:

- Text:

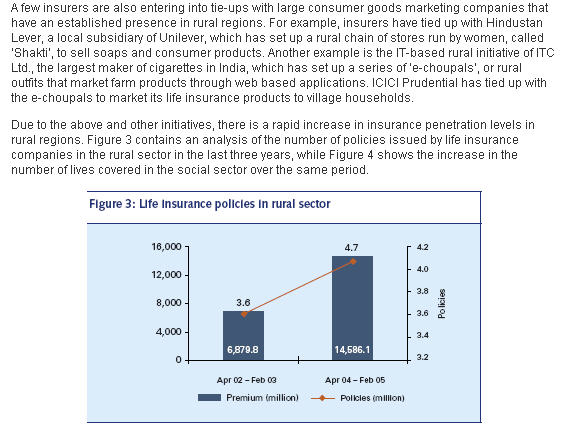

Rural Insurance - an opportunity or a risk?

- Seasonal premium collection system in line with harvest season, with no lapse of policy in case of seasonal fluctuations (affecting crops) can be organized

- Distribution of agents can be ramped up by tying up with Fertilizer dealers, Tractor dealers etc.

Credit

Trends

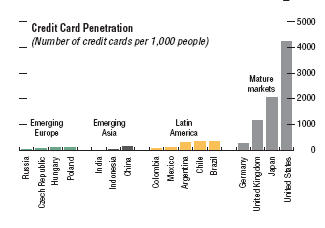

Credit card penetration

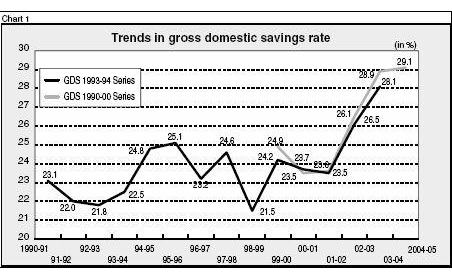

Increasing savings rate

- Savings as percentage of GDP was 29.1% in FY 2004 and 25.9% in FY 2005

- With a strong GDP growth, rising salaries, and low social security, savings rate are likely to rise even further

Increasing purchasing power

Rural demand for credit

- Lack of access to savings mechanisms and credit is one of the biggest challenges for villagers in India.

- According to a World Bank study, in Andhra Pradesh, 59% of rural households lack access to deposit accounts and 79% don’t have borrowing facility from the organised financial sector. Bankers too complain that though the rural potential is huge, they don’t have enough knowledge about the rural customer.

Remittances

COD (???)

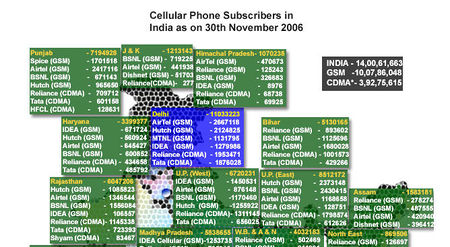

Mobile phones

- Mobile phone usage is exploding in India with subscriber numbers growing by several percentage points each month

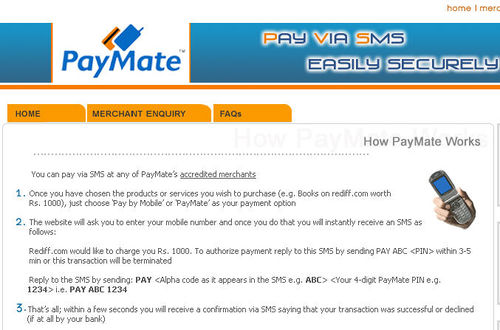

Payments through SMS

Ideas

Mobile ATM

- Innovative concepts, such as a mobile ATM machine are being tried out at the moment.

Credit cards linked to US accounts

- Credit cards for family members in India linked to credit rating of Non-Resident Indian family member (in the US or elsewhere)

COD for online shopping (???)

Retail store cards

Mobile phone credit cards

- Sony's Felica system combines mobile phones with credit card style payment capabilities

- With 140 million cell phones, but less than half as many credit cards, cell phones offer a great possibility for improving credit-card penetration in India