Digestive Remedies Market in India and China

From DolceraWiki

Contents

- 1 Market Overview

- 2 Trends in Digestive remedies industry

- 3 Digestive remedies category size and growth

- 4 Top digestive remedies companies and brands

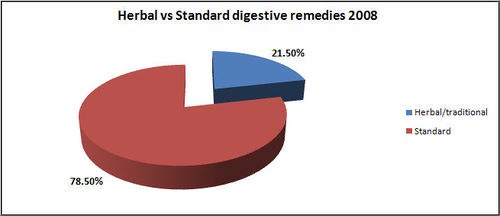

- 5 Herbal vs Standard digestive remedies

- 6 Prevalence of Digestive Diseases in India and China

- 7 Probiotics

- 8 Product Dashboard

- 9 Prospects of digestive remedies industry

Market Overview

India

- Digestive remedies in India saw current value growth of 7% in 2008, to reach Rs 8.5 billion

- Factors such as irregular eating habits, unhygienic food and stressful lifestyles have driven growth

- Digestive enzymes displayed the fastest growth, of 13% in current value terms, to reach Rs 1.7 billion

- GlaxoSmithKline Consumer Healthcare Ltd launched Eno Digesure in the first quarter of 2008

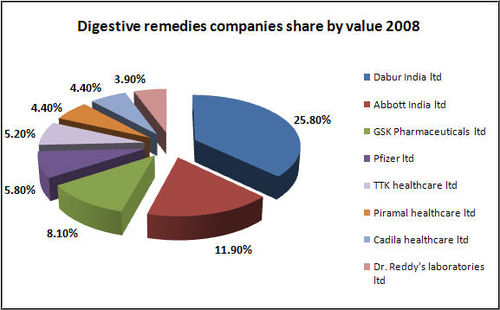

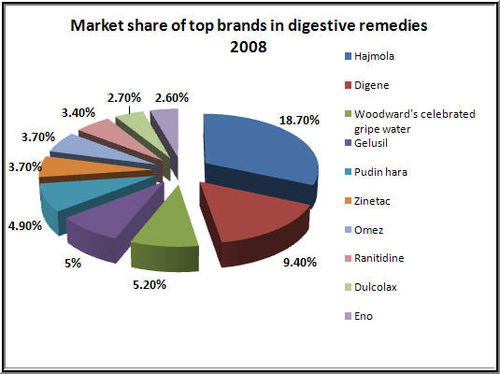

- Dabur India Ltd leads sales of digestive remedies, with a 26% value share, thanks largely to its Hajmola brand

- Sales of digestive remedies are predicted to grow by 17% in constant value terms over the forecast period[1]

China

- Current value sales grow by 8% from 2007 to reach RMB3.8 billion in 2008

- Stressful and hectic lifestyles result in higher incidence of digestive problems

- Proton pump inhibitors see most dynamic current value growth of 14% in 2008

- Jilin Xiuzheng Pharmaceutical Co Ltd leads sales with 17% share of value sales in 2008

- Constant value CACR of 7% expected during forecast period[2]

Trends in Digestive remedies industry

India

- Growth in digestive remedies in 2008 was led by urban consumers. Due to a growing economy and more hectic lifestyles, urban consumers increasingly skipped meals and ate out in sometimes unhygienic fast food outlets.

- Increasing stress led to constipation, diarrhoea and acidity, especially among young working adults. As a result, demand for digestive remedies was buoyant. In addition to this, lack of intake of nutrients in the form of fruits or dietary supplements further pushed growth.

- Heightened marketing activities by Dabur India Ltd for Hajmola drove digestive enzymes growth. Changes in positioning ensured that consumers perceived Hajmola as a must-have after every meal.

- For child-specific indigestion and heartburn remedies consumers started moving towards anti-spasmodic remedies.

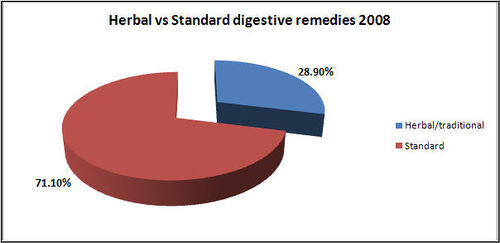

- The value share of herbal/traditional products rose marginally in 2008, having declined in previous years. Dabur India Ltd continued to be the leading player in this area, with brands such as Hajmola and Pudin Hara.

- Due to the belief that standard/allopathic products have greater efficacy than their herbal/traditional counterparts, consumers generally prefer taking standard/allopathic products when it comes to treating severe bouts of acidity and other digestive ailments to get instant relief. However, consumers who take digestive remedies on a regular basis often prefer herbal/traditional products, due to their being less susceptible to side effects.

- Within indigestion remedies, the fastest growing type is digestive enzymes. Due to their positioning as a easy to take and without a medicinal taste, consumers are more comfortable using digestive enzymes on an everyday basis, unlike antacids which are positioned primarily as medicines. Hajmola’s tangy taste has endeared this brand to consumers from all age groups.

- Digestive ailments have risen, as consumers are rarely having a balanced diet, with regular intake of cereals, fruits or other dietary supplements. This trend has positively affected sales of antacids, digestive enzymes, laxatives and diarrhoeal remedies.

- UTC sales remained high in digestive remedies in 2008. Laxatives, diarrhoeal remedies, H2 blockers, motion sickness remedies and child specific products are where most UTC sales are seen. Brands such as Dulcolax, Cremaffin, Depandal and Stemetil enjoy long-standing brand loyalty, due to which they have virtually become household names and are freely sold without prescriptions.[3]

China

- With rapid urbanisation and increasingly stressful lives, people developed increasingly irregular daily schedules. This trend was especially notable amongst the younger generation who increasingly live apart from their families.

- These consumers often have irregular meal times, which can cause digestive problems. For office workers, meanwhile, the time available for lunch is limited, with some being too busy to take lunch.

- Growth in digestive remedies in 2008 is slightly lower than in 2007. Many consumers became more health-conscious and adopted healthier diets, which led to a slowdown in growth for mature digestive remedies such as diarrhoeal remedies and laxatives. However, consumers’ growing confidence in selfmedicating with digestive remedies maintained good growth in 2008.

- Proton pump inhibitors saw the highest current value growth in 2008 over the previous year. These products are used for the prevention and treatment of acid-digestion conditions, such as ulcers and gastrooesophageal reflux disease (GERD).

- According to trade sources, GERD affects almost 7% of the population in China at some point. From a survey based on 7,000 GERD patients at the beginning of 2008, meanwhile, 70% of patients are aged 26-55-years-old. As proton pump inhibitors are more effective than traditional medicines and can relieve symptoms and heal the oesophageal lining for most who suffer from GERD, they became increasingly popular.

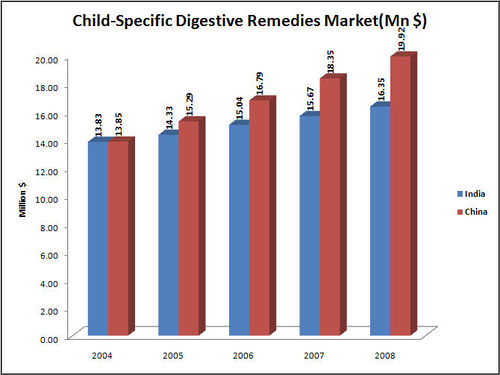

- Child-specific digestive remedies continued to see good growth in 2008. These products are influenced by very different factors than adult digestive remedies. Sales of adult digestive remedies are related mostly to consumers’ diets, stress levels and illness. Meanwhile, children’s digestive remedies saw sales boosted by parents purchasing decisions, with more parents opting for child-specific products for their children. These products offer fewer side-effects and are milder, with growing awareness of child-specific products resulting in them gaining popularity.

- Consumers also remain cautious about self-medication for children and prefer to take their children to a hospital for diagnosis in order to ensure their safety.

- Herbal/traditional products accounted for 22% of total value sales in digestive remedies in 2008, while standard products continue to dominate. Local consumers generally believe that herbal remedies are safe and good for long-term use, causing few side effects. This offers herbal/traditional products an advantage for some digestive diseases, which may need long-term care.

- For short-term digestive disorders and for rapid relief most prefer standard products as they believe standard products offer a more rapid effect.

- Most established herbal product in digestive remedies was Jiangzhong Pharmaceutical Co’s Jiangzhong in indigestion and heartburn remedies.

- IBS treatments are not available OTC. However, consumers can obtain these products via prescriptions or even under-the-counter (UTC) in some small pharmacies/drugstores. The UTC sales of IBS are however very small, as consumers prefer to seek medical advice for this long-term disorder from professionals.[4]

Competitive landscape

India

- Dabur India Ltd led sales of digestive remedies in India in 2008. The company increased its value share to 26%, making it the fastest growing company in digestive remedies. Sales of Halmola were good while the sales of Pudin Hara were static due to an exceptionally short summer. The second placed manufacturer in 2008 was Abbott India Ltd, with its leading antacid brand, Digene.

- Sales of Cadila Healthcare Ltd, the marketer of best-selling laxative Dulcolax, have come under increasing pressure from the brand Duphalac, from Solvay Pharma Ltd. Consumers have shown a preference for lactulose-based brands, such as Duphalac, as they tend to be gentler on the stomach than bisacodyl-based brands, such as Dulcolax.

- Changing consumer preferences also led to sales of GlaxoSmithKline Pharmaceuticals Ltd and RPG Life Sciences Ltd in diarrhoeal remedies coming under pressure from Rx drugs, such as Cifran CT, from Ranbaxy Laboratories Ltd. Unlike brands such as Depandal, Lomotil and Lomofen, which simply provide relief from diarrhoea, drugs such as Cifran CT not only address diarrhoea in a patient, but also provide a more holistic benefit by working on the intestines and digestive system in general.

- Torrent Pharmaceuticals Ltd launched Fibotab in late 2007. The brand uses calcium polycarbophil as its API, and thus not only controls diarrhoea, but also treats constipation, thus making it a truly multipurpose drug. The brand has been positioned as better alternative to Isabgol.

- Novartis India ltd launched a new product Benefiber in 2008. A wheat dextrin-based laxative, the brand’s largest selling point is that it does not thicken and can be mixed with any beverage.

- Digestive remedies remained quite fragmented in 2008. Besides Dabur India Ltd and Abbott India Ltd, no other company managed to achieve a value share of more than 10%. Companies such as Pfizer Ltd, GlaxoSmithKline Pharmaceuticals Ltd and TTK Pharma Ltd lag behind with shares of around 4% to 5% each.

- Eno Digesure was launched by GlaxoSmithKline Consumer Healthcare Ltd in December 2007.[5]

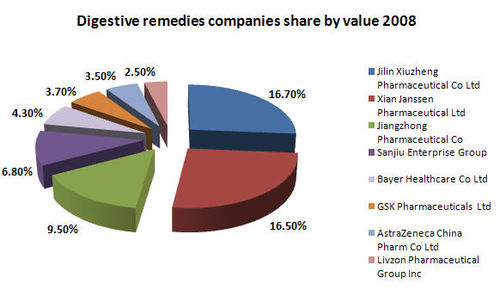

China

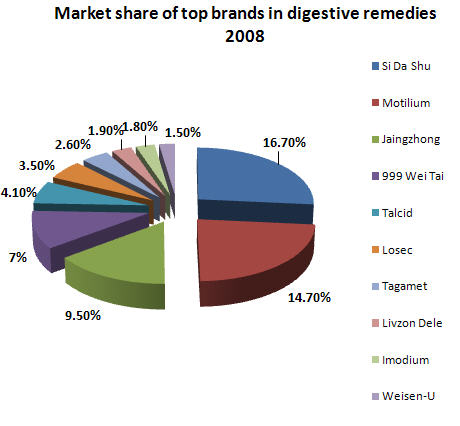

- Jilin Xiuzheng Pharmaceutical Co Ltd led digestive remedies with 17% value share in 2008. The company’s Si Da Shu brand is widely popular due to its clear product position and its differentiation of gastric diseases, offering variants for “stomach-ache”, “fullness” and “acid digestion”.

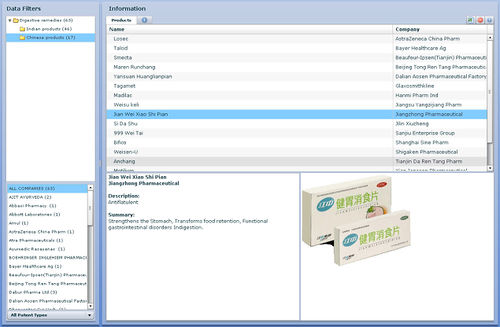

- Established local player Jiangzhong Pharmaceutical Co offers well-known herbal brand Jiangzhong Jian Wei Xiao Shi Pian in antiflatulents. In 2008, the company saw the biggest increase in value share in digestive remedies over the previous yea. Jian Wei Xiao Shi Pian is a generic traditional herbal remedy used to cure indigestion by easing stomach upsets and bloating.

- Domestic companies strived to gain share towards the end of the review period, benefiting from low prices and a wide distribution network.

- All of the leading domestic companies achieved GMP standards accreditation by the end of the review period, with product quality thus significantly improving.[6]

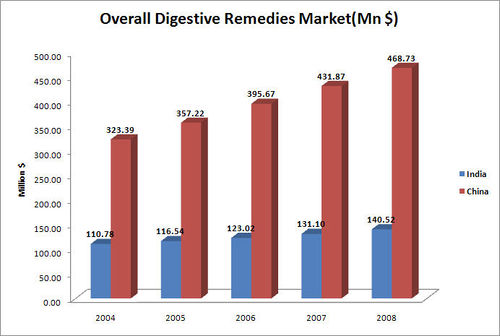

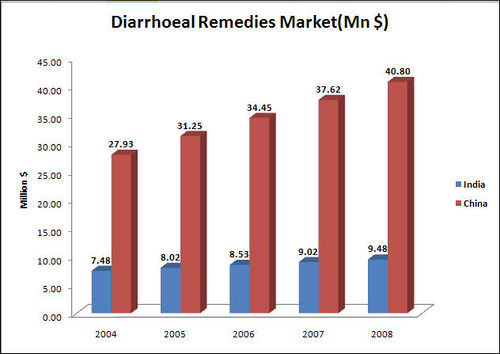

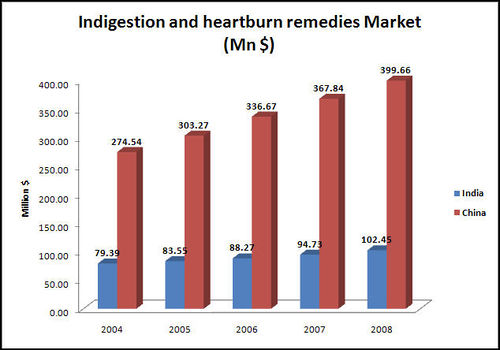

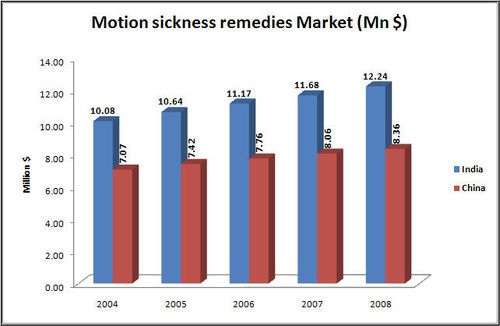

Digestive remedies category size and growth

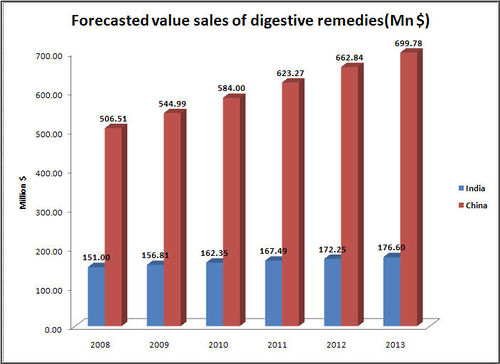

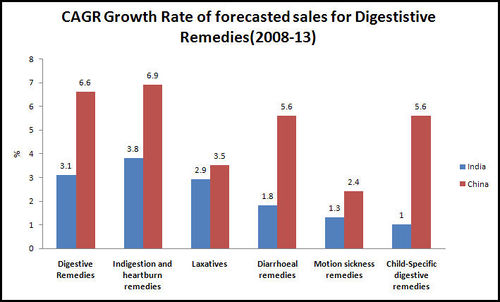

- The Chinese market is more then double of the Indian market and is expected to grow at a CAGR of 6.6%.

- While,Indian market will continue to grow at 3.1% on CAGR basis.

- The Chinese diarrhoeal remedies market is more then triple of the Indian market and is expected to grow at a CAGR of 5.6%.

- While,Indian market will continue to grow at 1.8% on CAGR basis.

- The Chinese Indigestion and heartburn remedies market is expected to grow at a CAGR of 6.9%.

- While,Indian market will continue to grow at 3.8% on CAGR basis.

- The Chinese motion sickness remedies market is expected to grow at a CAGR of 2.4%.

- While,Indian market will continue to grow at 1.3% on CAGR basis.

- The Chinese child specific digestive remedies is expected to grow at a CAGR of 2.4%.

- While,Indian market will continue to grow at 1.3% on CAGR basis.

Forecasted Sales of Digestive Remedies

Top digestive remedies companies and brands

India

China

Herbal vs Standard digestive remedies

India

China

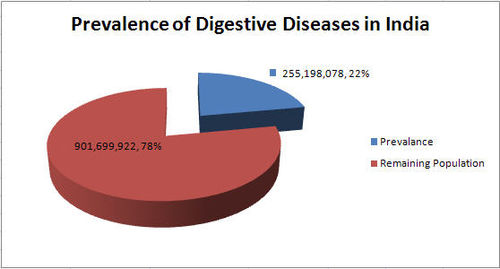

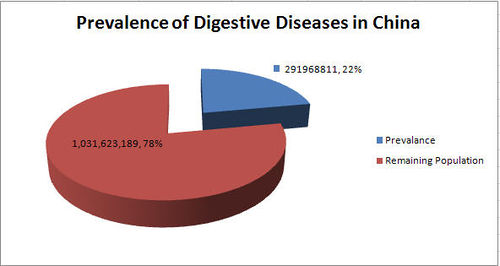

Prevalence of Digestive Diseases in India and China

India

China

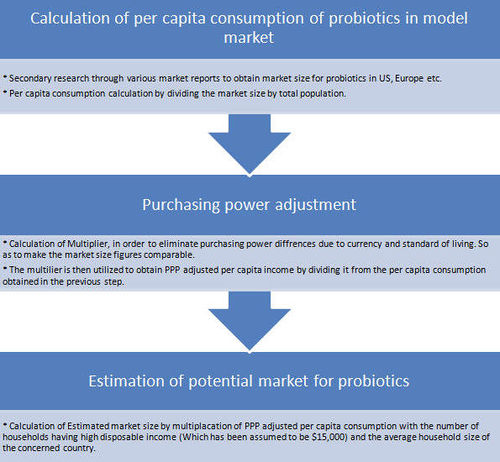

Probiotics

Probiotics Market in India and China

Methodology

Results

| Country | Compared Geography | Probiotic Market in Mn $ | Population 2008 in Thousands | Per Capita Probiotic Consumption (in $) | PPP Adjustment Factor | PPP Adjusted Consumption Per Capita in ($) | Households with high Disposable Income (in thousands) | Average number of people per household | Potential Market for Probiotics (in Mn $) |

| India | US | 1530 | 304060 | 5.03 | 2.73 | 1.84 | 4466.70 | 5 | 41.16 |

| Europe | 3550 | 306008 | 11.60 | 3.42 | 3.40 | 75.84 | |||

| United Kingdom & Ireland | 971.75 | 65100 | 14.93 | 4.21 | 3.54 | 79.17 | |||

| China | US | 1530 | 304060 | 5.03 | 1.83 | 2.75 | 23163.9 | 4 | 254.77 |

| Europe | 3550 | 306008 | 11.60 | 3.01 | 3.85 | 356.71 | |||

| United Kingdom & Ireland | 971.75 | 65100 | 14.93 | 2.82 | 5.29 | 490.50 |

- The households that are wealthy enough to consume such products on a regular basis are take as those having disposable income more then 15000$ per year.

Product Dashboard

- The product dashboard contains the names, effect and claims of various digestive remedies available in Indian and Chinese markets.Click here to view the dashboard.

Prospects of digestive remedies industry

India

- Increasingly busy lifestyles, irregular eating habits, lack of exercise and poor nutrition in meals will continue to be the main drivers of growth in sales of digestive remedies over the forecast period.

- Digestive problems such as constipation and acidity are likely to rise. In addition to this, lack of basic amenities, such as clean water and sanitary conditions in many rural and semi-urban parts of India, will give further impetus to growth, as these are the main causes of diarrhoea.

- The forecast period is expected to see growth a lot higher than that of the review period in constant value terms.

- Growth will be driven by increasing UTC consumption of proton pump inhibitors, antiflatulents, IBS treatments and H2 blockers. Consumers are expected to turn to advanced drugs like these in the hope of getting faster and long lasting relief from various digestive ailments.

- In the short term, growth in 2009 is expected to be marginally stronger than that in 2008, in spite of the economic downturn in India. Consumption of digestive remedies is expected to increase in line with a rise in population, which will naturally widen the consumer base.

- The review period saw many yoga centres being established in urban centres. Yoga is frequently touted as an effective way to control digestive ailments. If a “yoga revolution” does sweep across the country, growth in digestive remedies will again be negatively affected.

- Digestive enzymes are set to see the strongest growth over the forecast period, of 53% in constant value terms. Growth will be driven to a significant extent by Dabur India Ltd increasing penetration through aggressive marketing and promotional activities. Child-specific indigestion and heartburn remedies are expected to see the slowest growth between 2008 and 2013, of just 5% in constant value terms.

- Fibotab is expected to perform extremely well in the short term. The brand is expected to see success based on its multipurpose positioning as well as the fact that it does not need to be mixed with water, unlike Isabgol. On the other hand, Benefiber is not expected to do well, because of its high price and a lack of promotion by Novartis India Ltd.

- Companies might opt to position their products as meal supplements, instead of medicines, to take advantage of the growing trend to consume digestive remedies on a regular basis. Furthermore, companies will look to rural areas to drive further growth in sales, as urban areas are highly saturated when it comes to products such as antacids, diarrhoeal remedies and laxatives. Promotional activities are likely to include tying up with additional distributors, and conducting road shows and awareness programmes.[7]

China

- Digestive remedies are expected to post moderate growth in most product areas during the forecast period. The continued acceleration of consumer lifestyles is expected to lead to an increasing number of people skipping meals or having irregular meal times. This will be the main factor maintaining demand for digestive remedies during the forecast period.

- Healthy eating and the widening use of vitamins and dietary supplements might pose a threat to digestive remedies during the forecast period. Sales of functional food products with high fibre content are expected to increase during the forecast period, while food containing prebiotics and/or probiotics such as yoghurt is also expected to see growing sales. These products can aid digestion and may reduce the incidence of digestive disorders.

- Moreover, consumers are increasingly opting for natural food instead of medicine under prevailing health trends. As a result, sales of diarrhoeal remedies are likely to be adversely affected.

- The decreasing demand for motion sickness remedies was led by the advancement of local transportation infrastructure. Moreover, the unit price of motion sickness remedies is low, at around RMB0.1 per tablet in 2008, with low prices also constraining value sales.

- Sales of motion sickness remedies are likely to remain sluggish during the forecast period, despite an increasing number of frequent travellers. This is because growth in the number of travellers is expected to mostly come from students and young adults. Many people in these groups do not bother taking motion sickness remedies and are often more accustomed to the discomfort caused by vehicle motion.

- Proton pump inhibitors is expected to see the fastest constant value growth in digestive remedies over the forecast period. Robust sales growth for the leading brand, AstraZeneca China Pharm Co Ltd’s Losec Mups, are likely to attract local manufacturers and other international brands, with new players thus set to enter this product area.

- As in other product areas of OTC healthcare, the unit price of digestive remedies is expected to decline over the forecast period. This will occur as a result of government efforts to make digestive remedies more affordable.

- Advertising is expected to become more prominent for digestive remedies during the forecast period, with marketing activities becoming intense. Companies will spend more on advertising OTC digestive remedies, aiming to create a strong brand image in order to increase sales.[8]