Cardiac Pacemakers

This report contains a detailed description about cardiac pacemakers, its working, market potential, growth drivers and an in depth competitor analysis.Government policies and reimbursement have also been covered comprehensively.The report contains a detailed company profile of Cardiac Science Corporation and also throws light on the recent trends and developments related to cardiac pacemakers.

Contents

Introduction

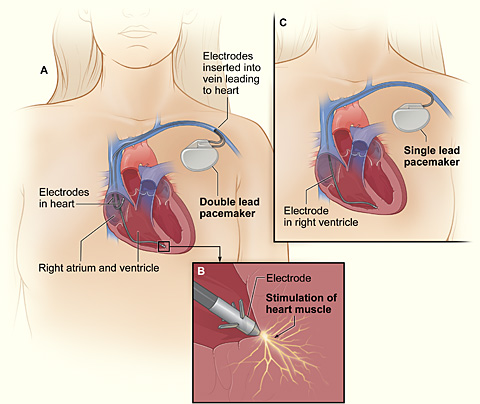

A pacemaker (or artificial pacemaker, so as not to be confused with the heart's natural pacemaker) is a medical device that uses electrical impulses, delivered by electrodes contacting the heart muscles, to regulate the beating of the heart. The primary purpose of a pacemaker is to maintain an adequate heart rate, either because the heart's native pacemaker is not fast enough, or there is a block in the heart's electrical conduction system. Modern pacemakers are externally programmable and allow the cardiologist to select the optimum pacing modes for individual patients. Some combine a pacemaker and defibrillator in a single implantable device. Others have multiple electrodes stimulating differing positions within the heart to improve synchronisation of the lower chambers of the heart.

Functioning

Process

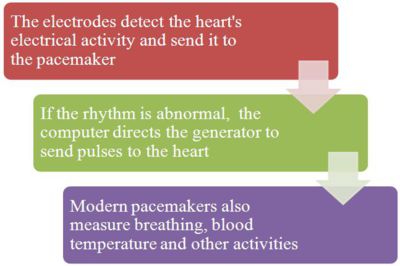

A pacemaker system consists of a battery, a computerized generator, and wires with sensors called electrodes on one end. The battery powers the generator, and both are surrounded by a thin metal box. The wires connect the generator to the heart.

Market Research

Global Market Estimate and Forecast

The evolution of cardiac devices has opened new vistas in the health care industry. Growth rate exhibited by the cardiac devices industry, even during the recession years, confirms the positive growth prospects going ahead.The cardiovascular (CV) device industry is highly competitive and has reached maturity resulting in single digit growth rates of prominent devices such as pacemakers, defibrillators, and drug eluting stents (DES).

- The North American segment accounts for nearly 40% of the global value while Europe claims less than 30% of the market.

Growth Drivers

- Innovations in niche sectors such as atrial fibrillation (AF) and ventricular assist devices (VADs).

- Companies are establishing manufacturing facilities outside the US to enhance cost containment and product distribution.

- Asia-Pacific is the fastest growing region with a CAGR of 13.3% driving a market value of US$1.3B by 2015.

- Aging global population which is subsequently leading to rise in the incidence of cardiovascular diseases.In 2007, 1 in 9 death certificates (277 193 deaths) in the United States mentioned heart failure.

- General decline in the prices of pacemakers treatments and procedures from $150,000 to $100,000.

- Untapped markets of Asia-Pacific and Latin America offer huge potential.

Challenges

- Pricing pressures due to industry regulations

- The cost for Pace Maker treatment in US is around $100,00 whereas its around $10,000 in India.The CV device industry is highly regulated around the world with stringent guidelines defined by regulatory bodies. The medical device approvals by governing bodies such as the FDA in the US have become very meticulous and CV device manufacturers are launching products outside the US such as Europe and Canada. Since the prices are strictly regulated outside the US, manufacturers will be forced to launch their roducts in the US for a similar price. In the long run, the pricing pressures would continue to prevail and limit the profitability margins for CV device manufacturers.

- Decline in capital expenditure of hospitals

- The impact of economic recession since 2008 had forced hospitals to decrease their capital expenditure by almost 6%. This decline has impacted the medical devices industry across all sectors in the CV device division. Some segments of the CV device industry such as ICD, pacemakers, heart valves and stents will remain insulated from the economic impact given their non-elective nature of associated procedures. other low budget, high-frequency CV accessories that hospitals purchases on a regular basis will be affected due to decline of capital expenditures.

Key Statistics

- On the basis of 2007 mortality rate data, more than 2200 Americans die of CVD each day, an average of 1 death every 39 seconds.

- Each year, 795,000 people experience a new or recurrent stroke. Approximately 610,000 of these are first attacks, and 185,000 are recurrent attacks.

Though the death rates from CVD have declined, yet the burden of the disease remains high.

Prevalence and Incidence

Prevalence

- An estimated 82,600,000 American adults ( 1 in 3) have 1 or more types of CVD.

- Of these, 40,400,000 are estimated to be above 60 years of age.

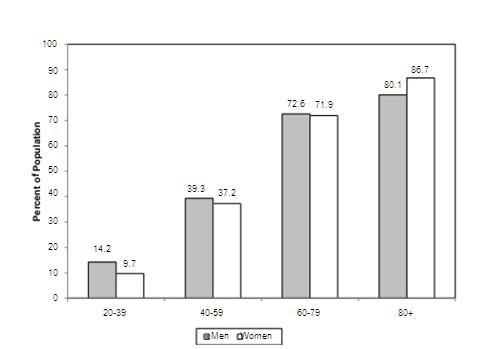

Prevalence rates according to age and gender

Source AHA-journal-report

Disease wise breakup of population

| Disease | Affected numbers (in millions) |

| High Blood Pressure | 76.4 |

| Coronary Heart Disease | 16.3 |

| Heart Fail | 5.7 |

| Stroke | 7.0 |

| Other problems | 1.3 |

Source AHA-journal-report

Incidence

- The average annual rates of first cardiovascular events rise from 3 per 1000 men at 35 to 44 years of age to 74 per 1000 men at 85 to 94 years of age.

- For women, comparable rates occur 10 years later in life. The gap narrows with advancing age.

As per American Heart Association,the 7 metrics of cardiovascular diseases identified are:

- Current Smoking

- Body Mass Index

- Physical Activity

- Healthy Diet Score

- Total Cholestrol

- Blood Pressure

- Fasting Plasma Glucose

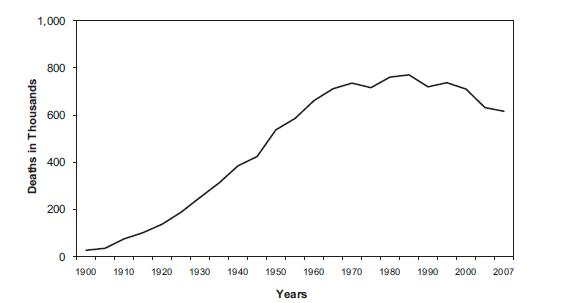

Mortality rates

The graph below depicts the number of deaths(in thousands) due to cardiac problems.

Source AHA-journal-report

The decline towards the end is due to advancement of medicine and science which has resulted in better healthcare facilities.

US Market Forecast

- Estimate includes Cardiac Rhythm Management Products(which includes Cardiac Defibrillators, Cardiac Pacemakers, Cardiac Resynchronization Therapy (Crt) Devices and Surgical Ablation)

External Factors

Government Programs

Government programs directly cover 27.8% of the population (83 million), including the elderly, disabled, children, veterans, and some of the poor, and federal law mandates public access to emergency services regardless of ability to pay. Public spending accounts for between 45% and 56.1% of U.S. health care spending.As per Per-capita spending on health care by the U.S. government,it is among the top ten highest spenders among United Nations member countries in 2004.

Government funded programs include:

- Medicare, generally covering citizens and long-term residents 65 years and older and the disabled.

- Medicaid, generally covering low income people in certain categories, including children, pregnant women, and the disabled. (Administered by the states.)

- State Children's Health Insurance Program, which provides health insurance for low-income children who do not qualify for Medicaid. (Administered by the states, with matching state funds.)

- Various programs for federal employees, including TRICARE for military personnel (for use in civilian facilities)

- The Veterans Administration, which provides care to veterans, their families, and survivors through medical centers and clinics.

- National Institutes of Health treats patients who enroll in research for free.

- Government run community clinics

- Medical Corps of various branches of the military.

- Certain county and state hospitals

Reimbursement

Medicare covers cardiac pacemakers when provided by a hospital, skilled nursing facility, home health agency,comprehensive outpatient rehabilitation facility (CORP), or a rural health clinic.Most insurers provide coverage for device therapy, the insurance plan should be designed accordingly.It will, though, depend on age, medical condition or status, income or employer and where a person lives.

| Type of Pacemaker | Cost($) | Reimbursement($) |

| Single Chamber | 10,000 | 7748 |

| Dual Chamber | 11,000 | 8919 |

| Rate Responsive | 12,000 | 10,814(approx) |

Medicare will not fund patients for a MRI scan in case of a MRI-safe pacemaker

Source:MD Buyline Paper

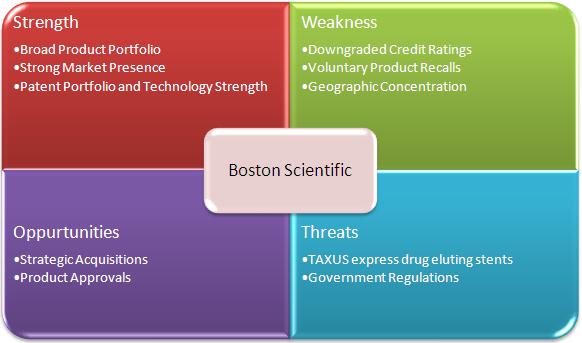

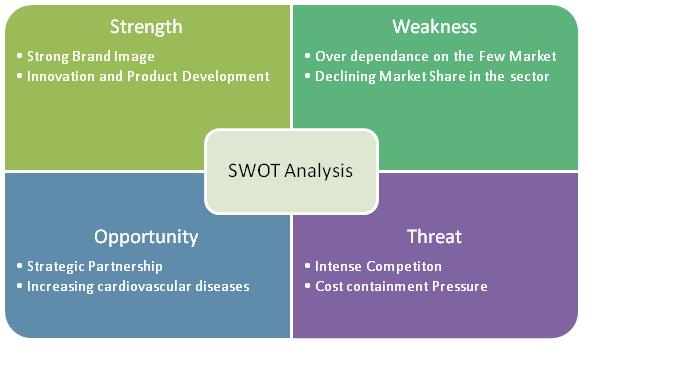

2.8 SWOT Analysis of Boston Scientific Corporation

2.9 Competitors

2.9.1 Five major competitors

- All figures in US$M

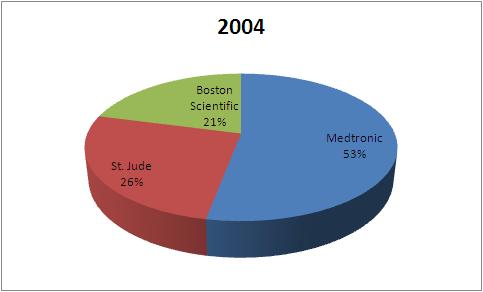

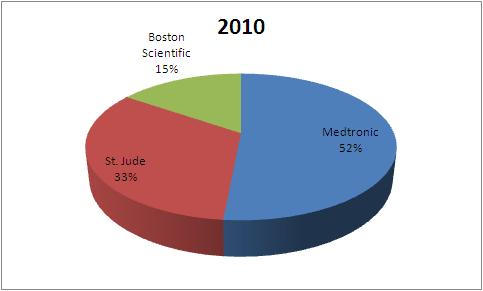

| Company | 2004 | 2007 | 2010 |

| Medtronic | 1823 | 1937 | 2115 |

| St. Jude | 898 | 1056 | 1356 |

| Boston Scientific | 720 | 578 | 635 |

| Total | 3441 | 3571 | 4106 |

Source Stjudereport

Source Stjudereport

This data tells that the market share of Boston Scientific has fallen in Pacemaker market from 2004 to 2010.

Source Stjudereport

Company wise products and brands

| Manufacturers | Products |

| BIOTRONIK Pacemaker | Cylos DR-T |

| CCC Pacemaker | |

| Sorin Group | Reply DR |

| Symphony DR 2550 | |

| Boston Scientific(Guidant Medical) | ALTURA pacemaker family |

| Medico Pacemakers | EASY |

| MILLENNIUM | |

| Medtronic Pacemekers | Adapta |

| EnRhythm | |

| St. Jude Medical Pacemakers | Affinity |

| Victory | |

| Shree Pacetronix Pacemakers | Ventralite |

| Pinnacle | |

| Vitatron Pacemakers | Vitatron T-series |

| Vitatron C-series |

For exhaustive list visit: Healthbase

2.9.2 Two Main Competitive Strategies

Medtronic

Medtronic found that the doctors in Inda and China saw some of the current state of art features as unecessary and too expensive.Instead, they wanted an affordable pace maker which was cheap and easy to implant.This led medtronic to develop a new pace maker, Champion aimed towards asian market segment.

For the five-year marketing plan of Medtronic,marketing mix activities include the following:

- Product strategy Offer a Champion brand heart pacemaker with features needed by Asian patients at an affordable price.

- Price strategy Manufacture Champion to control costs so that it can be priced below US$1,000—a fraction of the price of the state-of-the-art pacemakers offered in Western markets.

- Promotion strategy Feature demonstrations at cardiologist and medical conventions across Asia to introduce the Champion and highlight the device’s features and application.

- Place (distribution) strategy Search out, utilize, and train reputable medical distributors across Asia to call on cardiologists and medical clinics.

Source:Medtronic's market segmentation strategy

St. Jude

In 2004, St. Jude invited companies to be a part of the Thanks and Giving® campaign, an unprecedented union of celebrities, media retail and corporate partners that asked consumers to “Give thanks for the healthy kids in your life, and give to those who are not.

In 2008, St. Jude Children’s Research Hospital received the Cause Marketing Forum’s Golden Halo Award, the industry’s top award.

Source:St Jude Cause related marketing

2.10 Strategic Activities in Industry

| Activity | Objectives |

| OPTO circuits purchased 77% of Cardiac Science’s shares | * This transaction is expected to open many new global markets for Cardiac Science’s products and will greatly enhance Opto Circuits’ product offering and presence in the United States. * Cardiac science business will benefit greatly from Opto Circuits’ financial resources, operational capabilities and global scale. |

| St. Jude Medical Inc. (STJ) bought 19% of CardioMEMS through a $60 million equity investment last year and has an exclusive right to buy the rest for $375 million | * The deal could allow St. Jude access to CardioMEMS’ wireless sensing and communication technology, used to assess cardiac performance. * CardioMEMS’ monitoring system involves a sensor being placed in a patient’s pulmonary artery and transmitting real-time data for clinicians to analyze. * It can transmit from the patient’s home, reducing the burden on hospitals. * A trial presented earlier this year found the device reduced the rate of heart failure-related hospitalizations by 30% at six months and 38% after a year. St. Jude has benefited from selling mostly life-saving devices. |

| CEA-Leti and five partners( :Heart-Beat Scavenger (HBS) Consortium) are combining their expertise to develop a self-powered cardiac pacemaker eight times smaller than current models | The HBS Consortium project goals include: * Developing a self-powering pacemaker by harvesting the mechanical energy produced by the movements of the heart and eliminating the need for batteries that must be replaced every six to 10 years. * Reducing the size of a cardiac pacemaker by a factor of eight, from 8 cm3 to 1 cm3. This reduction will make it possible to attach the pacemaker directly to the epicardium, eliminating the need for intravenous introduction of cardiac probes. |

2.10.1. Product launches and development

- Boston Scientific heart devices gets FDA approval

- Endologix declares foremost clinical implant

2.11 Cardiac Science Corporation

2.11.1 Company Overview

Cardiac Science is a global medical device company and a subsidiary of Opto Circuits (India) Ltd. Company employ more than 550 people worldwide. Global capabilities include direct and indirect sales personnel and distribution in more than 100 countries and an extensive worldwide service network. Cardiac Science Corporation was formerly known as Quinton Cardiology Systems, Inc., and changed its name in September 2005. The company was founded in 1913 and has operations in California, Wisconsin, China, Central Europe, Denmark, France, and the United Kingdom.

2.11.2 Key Executives

| Name | Designation |

| David L. Marver | Chief Executive Officer and President |

| Michael K. Matysik | Chief Financial Officer |

| Robert W. Odell | Senior Vice President of Strategy Design & Operations |

| Todd T. Alberstone | Vice President and General Counsel |

| Barbara J. Thompson | Vice President of Human Resources |

2.11.3 Business Overview

Cardiac Science is a global leader in the development, manufacture, and marketing of diagnostic and therapeutic cardiology products and services. Company provides a full spectrum of cardiology products and services that help protect hearts and save lives, including:

• Devices designed to identify the early stages of heart disease — such as electrocardiographs,cardiac stress testing systems,diagnostic workstations and Holter monitors.

• Sophisticated systems for cardiac rehabilitation and cardiology data management

• Innovative and patented automated external defibrillators(AEDs) that provide assistance to victims of sudden cardiac arrest for both medical and public markets.

2.11.4 Brands of Cardiac Science Corporation

| Brand Name | Product & Services |

| Burdick | ECG Machines, Stress Testing, Holter System |

| HeartCentrix | Data Management & Connectivity |

| Powerheart | Defibrillators/AED Program |

| Quinton | Cardiac Rehab, ECG Machines, Stress Testing |

2.11.5 Products & Services

| Product | Services and Support |

| Defibrillator/AED (Automated External Defibrillator )Programs | Professional Services |

| ECG Machines | Technical Support |

| Stress Testing | Education and training |

| Diagnostic Workstation | Service Contracts |

| Holter Systems | Announcement & Upgrades |

| Cardiac Rehab | Product Registration |

| Data Management & Connectivity |

- The company serves hospitals, physicians, offices, schools and athletics, corporations, government agencies, communities, fire/EMS departments, and police/law enforcement departments, as well as military and hospitality industries.

- It sells its products directly to end customers and through third party distributors.

2.11.6 Strategic Activity

The Company was very active in Corporate Development during 2009, forging a host of new partnerships and alliances that will contribute to future growth and profitability.

- Pact with Patni and Syncroness to improve R&D productivity.

- Patni specializes in the design and engineering of Class II and III medical devices and is a global leader in providing high-quality, reliable, and cost effective Product Engineering and IT Services. One of the company strategies is to increase the volume and frequency of new product introductions, particularly in Cardiac Monitoring. Company have great brands and distribution channels and want to better leverage. This agreement, dramatically increases companies engineering capacity and allows internal team members to focus on changing market dynamics, new customer solutions, and new revenue opportunities.

- The creation of the Bardy Innovation Center in concert with Gust Bardy, MD to drive breakthroughs in Primary Care medicine.

- Partnerships with Omron and Cambridge Heart to bolster the Company's product portfolio.

- Development agreements with eClinicalWorks, Epic, Medent, and Sage to broaden the Company's interoperability with leading electronic medical record systems (EMRs).

2.11.7 SWOT Analysis

2.11.8 Market Overview

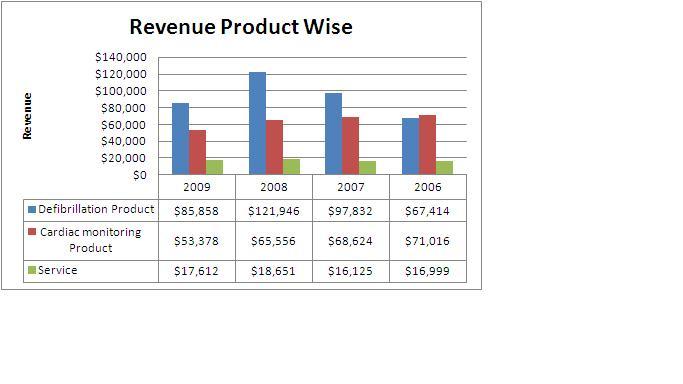

All figures in US$ (thousands)

2.12 Notes

- Defibrillation Products accounts for more than 55% of the total revenue from which it can be inferred, Cardiac Science Corporation is a main competitor of Boston scientific group if it plans to enter the market.

- Revenue from defibrillation products declined by $36.1 million, or 30%, for 2009 compared to 2008.Approximately $27.8 million of this decrease was due to reduced AED shipments to Nihon Kohden, their exclusive Japanese distribution partner, due to their relationship with that partner beginning to wind down, their introduction of competing AED products in the Japanese market and overall weakened demand in Japan. The Company has signed an agreement with a new Japanese distributor for regaining the lost sales, but does not expect meaningful AED sales in Japan until the second half of 2011.

This shows that other than USA, Japan is a big potential market for cardiac pace makers. Also it shows dependence of Cardiac science corporation on few markets like USA and Japan.

2.13 Recent Developments

2.13.1 Engineered Biological Pacemakers

The National Institute on Aging’s Cellular Biophysics Section is seeking statements of capability or interest from parties interested in collaborative research to further develop, evaluate, or commercialize biological pacemakers.

Technology:

A common symptom of many heart diseases is an abnormal heart rhythm or arrhythmia. While effectively improving the lives of many patients, implantable pacemakers have significant limitations such as limited power sources, risk of infections, potential for interference from other devices, and absence of autonomic rate modulation.

The technology consists of biological pacemakers engineered to generate normal heart rhythm. The biological pacemakers include cardiac cells or cardiac-like cells derived from embryonic stem cells or mesenchymal stem cells. The biological pacemakers naturally integrate into the heart. Their generation of rhythmic electric impulses involves coupling factors, such as cAMP-dependent PKA and Ca2+-dependent CaMK II, which are regulatory proteins capable of modulating/enhancing interactions (i.e. coupling) of the sarcoplasmic reticulum-based, intracellular Ca2+ clock and the surface membrane voltage clock, thereby converting irregularly or rarely spontaneously active cells into pacemakers generating rhythmic excitations.

Applications:

This technology can be utilized in heart disease characterized by arrhythmia or situations requiring an implantable cardiac pacemaker.

Advantages:

In contrast to current implantable cardiac pacemaker technology, this technology is not externally powered, has a lower risk of infection, has decreased potential for interference from other devices, and has full autonomic rate modulation.

Development Status:

Early stage.

Patent Status:

U.S. Provisional Application No. 61/180,491 filed 22 May 2009

3. Patient Experiences

| Name of the Patient | Experience | Link | |

| Patrick R. | After the surgery, with his doctors approval Pat started playing tennis within weeks."I ended up playing competitive tennis." But, he struggled to walk up a hill—particularly a steep hill. It was also difficult to ride a bike,again especially uphill.He learned that his 1990s-era pacemaker did not yet have the technology to sense the subtle physical, muscular activity exerted when going up a hill. However, if he were to walk down a hill where his legs were pounding the pavement a little bit more, the pacemaker would be able to sense more measurable physical muscular activity. He went in for a new pace maker in 2002 with sensor technology.It would do a better job of adjusting his heart rate while going uphill or doing other activities by sensing the associated increase in his breathing. Two days after when patrick, tried climbing up the hill, he could do that without any difficulty. | http://www.bostonscientific.com/lifebeat-online/assets/pdfs/resources/CRM9R-1080-0609_PacemakerBrochure.pdf | |

| Sharon S. | In fact, I was astonished at how much better I felt in the hospital. I really didnt know how sick I was until after getting the pacemaker, when I felt well again."For a while the pacemaker felt heavy, but that feeling went away in a matter of days | http://www.bostonscientific.com/lifebeat-online/assets/pdfs/resources/CRM9R-1080-0609_PacemakerBrochure.pdf |