Rx to OTC Switch-Market Analysis

Contents

Introduction

Over-the-counter (OTC) drugs are medicines that may be sold directly to a consumer without a prescription from a healthcare professional, and are commonly used to treat symptoms of common illnesses that may not require the direct supervision of a physician.

- For a medicine to be granted OTC status, it must have a wide safety margin and be effective, and must bear understandable labeling to ensure proper use

- More than 700 OTC products on the market today use ingredients or dosages, that were available only by prescription, less than 30 years ago

- Rx to OTC switch refers to the transfer of proven prescription drugs (Rx) to non-prescription, over-the-counter (OTC) status. Rx to OTC switch is a data-driven, scientifically rigorous, and highly regulated process that allows consumers to have OTC access to a growing range of medicines

There are two ways in which drugs are commonly switched as approved by FDA in US :

- The OTC Drug Review

- Began in 1972

- Ongoing assessment of the safety and effectiveness of all nonprescription drugs

- Panels of non-government experts review active ingredients in marketed OTC drug products to determine whether they can be classified as safe and effective

- About 40 former prescription-only drug ingredients have been switched by this process

- New drug application (NDA) process

- Manufacturers submit data to the FDA showing the drug is appropriate for self-administration.

- The submission includes studies showing that the product's labeling can be read, understood, and followed by the consumer without the guidance of a health care provider

- Some drugs are approved initially as OTC drugs, but most are first approved for prescription use and later switched to OTC

Market Overview

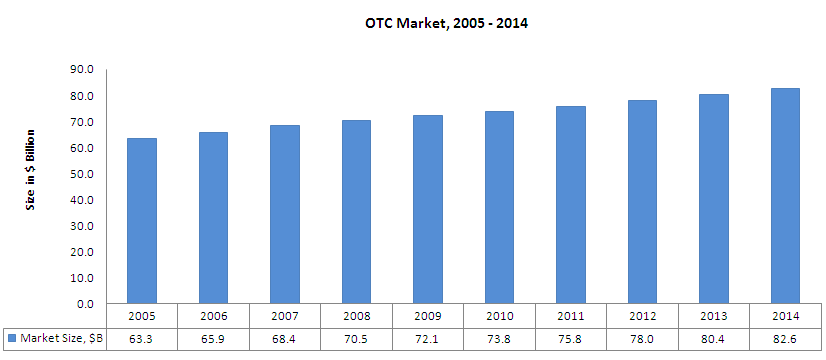

OTC Market

| Time Period | CAGR |

| 2005-2009 | 3.3% |

| 2009-2014 | 2.7% |

| 2005-2014 | 3.0% |

Rx vs. OTC Market

Total Pharmaceutical Market by Country, 2009 ($B)

| Country | Rx Market | OTC Market | Total Pharma Market | OTC as % of Total Pharma Market |

| United States | 214 | 18 | 232 | 7.8 |

| Japan | 56 | 11 | 67 | 16.4 |

| Germany | 35 | 5 | 40 | 12.5 |

| France | 32 | 4 | 36 | 11.1 |

| China | 16 | 5 | 21 | 23.1 |

| United Kingdom | 17 | 3 | 20 | 15.0 |

| Russia | 13 | 3 | 16 | 18.8 |

| Brazil | 10 | 2 | 12 | 16.7 |

| Mexico | 9 | 2 | 11 | 18.1 |

| India | 6 | 3 | 9 | 33.3 |

Source: Kalorama Information

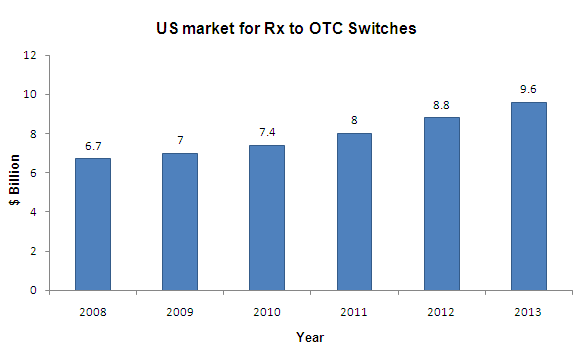

Rx to OTC Switches

- CAGR for 2008-2013 is 9.4%

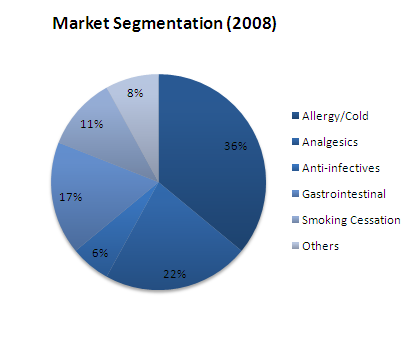

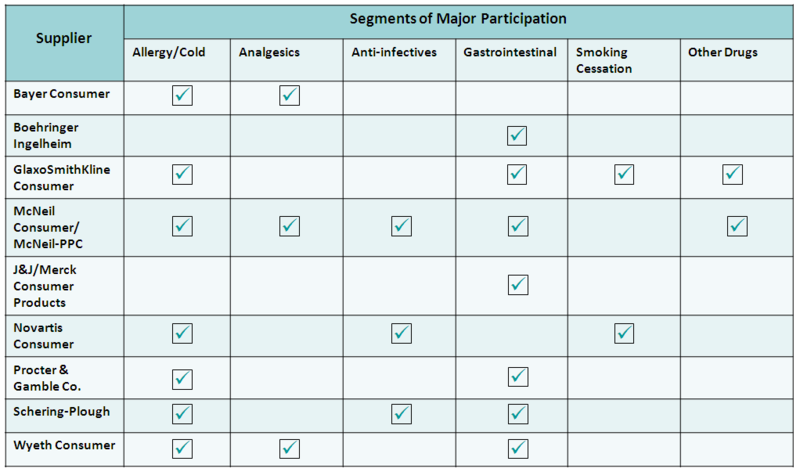

Major OTC Players

Sales Data for selected Rx to OTC Switches, USA

| S.No | Switched Drug | Manufacturer/Marketer | Drug Category | Switch Year | First 12-Month Sales (in $M) |

| 1 | Alli | Glaxo SmithKline Consumer Healthcare | Weight Loss Aid | 2007 | 80 |

| 2 | MiraLax | Schering-Plough Healthcare | Gastrointestinal | 2006 | 40 |

| 3 | Prilosec OTC | Procter & Gamble | Gastrointestinal | 2003 | 130 |

| 4 | Claritin | Schering-Plough Healthcare | Allergy | 2002 | 380 |

| 5 | Nicoderm CQ | Glaxo SmithKline Consumer Healthcare | Smoking Cessation | 1996 | 160 |

| 6 | Nicorette | Glaxo SmithKline Consumer Healthcare | Smoking Cessation | 1996 | 195 |

| 7 | Rogaine | McNeil Consumer Healthcare | Hair Loss | 1996 | 180 |

| 8 | Pepcid AC | Johnson & Johnson- Merck Consumer Pharmaceuticals Co. | Gastrointestinal | 1995 | 200 |

| 9 | Zantac 75 | Boehringer Ingelheim Consumer Healthcare Products | Gastrointestinal | 1995 | 140 |

| 10 | Aleve | Bayer Consumer Care | Analgesic | 1994 | 110 |

Source:Company Websites, Press Releases and Journals

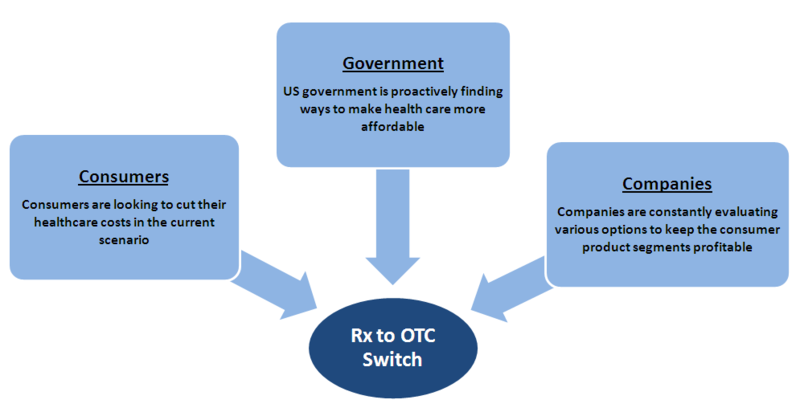

Factors Affecting Rx to OTC Switch

Trends in Rx to OTC Switches

Rx-to-OTC Switches Since 2000

| S.No | Ingredient | Product Category | Date of OTC Approval | Product Examples | Company |

| 1 | ibuprofen (NDA) | migraine | 25/02/2000 | Motrin Migraine Pain | McNeil Consumer Healthcare |

| 2 | docosanol (NDA) | cold sore/fever blister | 25/07/2000 | Abreva Cream | Avanir Pharmaceuticals |

| 3 | famotidine, calcium carbonate, | heartburn, | 17/10/2000 | Pepcid Complete | J&J/Merck |

| magnesium hydroxide (NDA) | acid indigestion | ||||

| 4 | butenafine hydrochloride (NDA) | athlete's foot, jock itch, ringworm | 7/12/2001 | Lotrimin Ultra | Schering-Plough |

| 5 | ibuprofen, pseudoephedrine HCl, | analgesic/decongestant | 18/04/2002 | Children’s Advil Cold | Wyeth |

| suspension for pediatric use (NDA) | |||||

| 6 | guaifenesin extended-release tablet (NDA) | expectorant | 12/7/2002 | Mucinex | Adams Respiratory Therapeutics |

| 7 | nicotine polacrilex troche/lozenge (NDA) | smoking cessation | 31/10/2002 | Commit | GlaxoSmithKline |

| 8 | loratadine (NDA) | antihistamine | 27/11/2002 | Claritin Tablets, Claritin RediTabs, Claritin Syrup | Schering-Plough |

| 9 | loratadine, pseudoephededrine sulfate (NDA) | antihistamine/ | 27/11/2002 | Claritin-D 12 Hour Extended Release Tablets, | Schering-Plough |

| decongestant | |||||

| 10 | omeprazole magnesium | acid reducer to treat frequent heartburn | 20/06/2003 | Prilosec OTC | Procter & Gamble |

| 11 | loratadine (NDA) | hives relief | 15/11/2003 | Claritin hives relief | Schering-Plough |

| diphenhydramine citrate & ibuprofen (NDA); diphenhydramine HCl & ibuprofen potassium (NDA) | analgesic sleep-aid | 21/12/2005 | Advil PM | Wyeth | |

| 12 | ecamsule (combined with avobenzone and octocrylene (NDA) | sunscreen | 21/07/2006 | Anthelios SX | L’Oreal |

| 13 | levonorgestrel (NDA) | contraceptive | 24/08/2006 | Plan B | Duramed |

| polyethylene glycol 3350 (NDA) | laxative | 6/10/2006 | MiraLAX | Schering-Plough | |

| 14 | ketotifen (NDA) | antihistamine eye drops | 19/10/2006 | Zaditor | Novartis |

| 15 | orlistat (NDA) | weight loss aid | 7/2/2007 | alli | GlaxoSmithKline |

| cetirizine HCl & pseudoephedrine HCl (NDA) | antihistamine/ | 9/11/2007 | Zyrtec-D | McNeil | |

| 16 | decongestant | ||||

| 17 | cetirizine HCl (NDA) | antihistamine, hives relief | 16/11/2007 | Zyrtec | McNeil |

| lansoprazole (NDA) | acid reducer to treat | 18/05/2009 | Prevacid 24 HR | Novartis | |

| 18 | frequent heartburn | ||||

| 19 | levonorgestrel (NDA) | contraceptive | 10/7/2009 | Plan B One Step | Duramed |

| omeprazole and sodium | acid reducer to treat | 1/12/2009 | Zegerid OTC | Schering-Plough | |

| 20 | bicarbonate (NDA) | frequent heartburn |

- Blue highlighted drugs are patent-protected

- Purple highlighted drugs are under FDA exclusivity period

Rx to OTC Switches before patent expiry

| S.No | Product Examples | Company | Date of OTC Approval | Patent Expiry | FDA Exclusivity | Patent Number |

| 1 | Abreva Cream | Avanir Pharmaceuticals | 25/07/2000 | 28/04/2014 | -- | 4874794 |

| 2 | Pepcid Complete | J&J/Merck | 17/10/2000 | 15/10/2000 | -- | 4283408 |

| 3 | Mucinex | Adams Respiratory Therapeutics | 12/7/2002 | 28/04/2020 | -- | 6372252 |

| 4 | Commit | GlaxoSmithKline | 31/10/2002 | 21/08/2010 | -- | 5110605 |

| 5 | Prilosec OTC | Procter & Gamble | 20/06/2003 | 15/11/2019 | -- | 5690960, 5753265, 5817338, 5900424, 6403616, 6428810 |

| 6 | Claritin hives relief | Schering-Plough | 15/11/2003 | 19/06/2002 | -- | 4282233 |

| 7 | Anthelios SX | L’Oreal | 21/07/2006 | 24/12/2013 | -- | 5587150 |

| 8 | Plan B | Duramed | 24/08/2006 | -- | 24/08/2009 | -- |

| 9 | MiraLAX | Schering-Plough | 6/10/2006 | -- | 6/10/2009 | -- |

| 10 | alli | GlaxoSmithKline | 7/2/2007 | 6/1/2018 | 7/2/2010 | 6004996 |

| 11 | Zyrtec-D | McNeil | 9/11/2007 | 10/6/2022 | -- | 6469009, 6489329, 7014867, 7226614 |

| 12 | Zyrtec | McNeil | 16/11/2007 | 2/7/2018 | -- | 6455533 |

| 13 | Prevacid 24 HR | Novartis | 18/05/2009 | -- | 18/05/2012 | -- |

| 14 | Plan B One Step | Duramed | 10/7/2009 | -- | 10/7/2012 | -- |

| 15 | Zegerid OTC | Schering-Plough | 1/12/2009 | 15/07/2016 | -- | 6489346, 6645988, 6699885, 7399772 |

- Purple highlighted drugs are under FDA exclusivity period

Trend Analysis

- 11 out of 22 recent drugs (50%) which switched from Rx to OTC were patent protected

- 4 out of 22 recent drugs (18.2%) which switched from Rx to OTC were under FDA exclusivity period

- 13 out of 22 recent drugs (59%) were switched from Rx to OTC before their patent or FDA exclusivity expiry. 2 drugs switched after the expiry of patents

- 6 out of these 13 drugs made a switch more than 10 years before expiry

- 5 out of these 13 drugs made a switch between 3 to 10 years before expiry

Potential Drugs for Rx-to-OTC Switch

| S.No | Drug | Patent Expiry Date | Expected Switch Year | US Patent Numbers |

| 1 | Allegra | 14/3/2017 | 2012 | 5578610, 6037353, 6187791, 6399632, 7138524 |

| 2 | Clarinex | 1/12/2018 | >2013 | 6514520, 7211582, 7214683, 7214684 |

| 3 | Crestor | 17/6/2022 | >2014 | 6858618, 6316460, 7030152, RE37314 |

| 4 | Lescol | 12/6/2012 | >2014 | 5356896, 5354772, |

| 5 | Lipitor | 8/1/2017 | >2014 | 5969156, 4681893, 5273995, 5686104, 5969156, 6126971, RE40667 |

| 6 | Pravachol | 22/10/2014 | >2014 | 5622985 |

| 7 | TriCor | 21/2/2023 | >2014 | 7276249, 5145684, 6277405, 6375986 , 6652881, 7037529, 7041319, 7320802 |

| 8 | Vytorin | 25/4/2017 | >2014 | RE37721, 5846966, |

| 9 | Zetia | 25/7/2022 | >2014 | 7030106, 5846966, 7612058, RE37721 |

| 10 | AcipHex | 8/5/2013 | 2013 | 5045552 |

| 11 | Nexium | 25/11/2018 | >2014 | 7411070, 5690960, 5714504, 5877192, 5900424, 6147103, 6166213, 6191148, 6369085, 6428810, 6875872 |

| 12 | Protonix | 30/3/2025 | 2010 | 7553498, 4758579, 7544370, 7550153 |

| 13 | Zofran | 7/12/2026 | >2014 | 7544370, 4758579, 7550153, 7553498 |

| 14 | Propecia | 5/11/2013 | 2011 | 5571817, 5547957, 5886184 |

| 15 | Imitrex | 10/3/2014 | >2010 | 5554639, 5307953, 5705520 |

| 16 | Actonel | 10/12/2018 | >2014 | 6165513, 5583122, 6096342 |

| 17 | Boniva | 2/9/2014 | >2014 | 5662918, 4927814 |

| 18 | Fosamax | 17/1/2019 | >2014 | 6225294, 5462932, 5994329, 6015801 |

| 19 | Evista | 10/3/2017 | >2014 | 6894064, 6797719, 6458811, 5393763, 5457117, 5478847, 5811120, 5972383, 6906086, RE38968, RE39049, RE39050 |

| 20 | Detrol | 11/5/2020 | >2014 | 5382600, 6630162, 6770295, 6911217 |

| 21 | Ditropan | 22/11/2015 | >2014 | 5674895, 5840754, 1 5912268, 6262115, 6919092 |

| 22 | Cialis | 26/4/2020 | >2014 | 7182958, 5859006, 6140329, 6821975, 6943166 |

| 23 | Levitra | 31/10/2018 | >2014 | 6362178, 7696206 |

| 24 | Viagra | 22/10/2019 | >2014 | 6469012, 5250534 |

US Market Survey - Physicians Preferences and Insights

Objectives of Survey

- To find Physician preferences for OTC drugs in comparison to prescription drugs

- To find insights on OTC drugs market and usage

- To understand the effectiveness of different sources of marketing

Research Methodology

The research instrument used was a questionnaire survey administered to collect empirical data. The physician responses were kept confidential to encourage openness and disclosure. The respondents rated the questions on Yes or No, ticked the relevant choices from the options available and ranked the options on a numerical scale. All the responses were coded using a binary system logic and analysis was done to derive insights there after.

Sample Size and Screening Criteria

| Gender | Sample Size |

| Male | 18 |

| Female | 2 |

| Total Physicians | 20 |

| Screening Criteria | |

| Primary Medical Specialty | General Physician/Family Practice |

| No. of years in practice | 10 |

| No. of patients consulting per month | 150 |

Survey Results

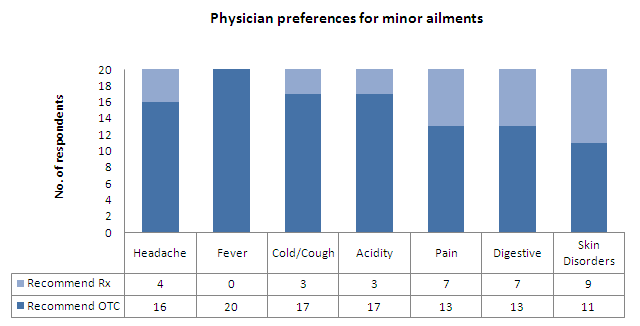

- All the respondents would recommend an OTC drug for fever

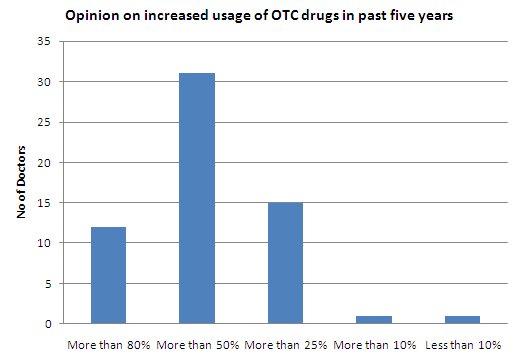

- About 95% of the doctors feel that the usage of OTC drugs has increased in the past five years

- About 85% of them would do so for other minor ailments like cold/cough and acidity

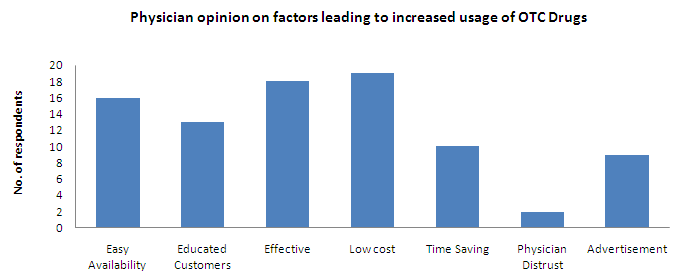

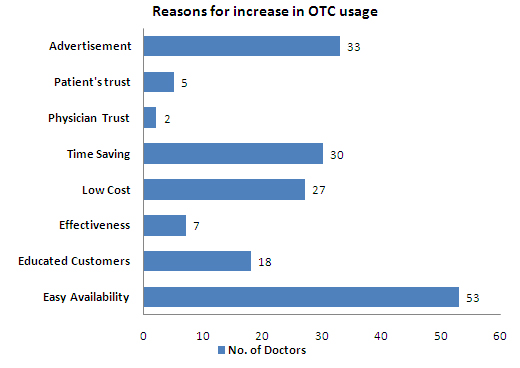

- Low cost, effective and easy availability are selected as the major factors that resulted in increased usage of OTC drugs

- All the respondents feel it is important to prescribe a drug that minimizes patients' out-of-pocket costs, while choosing between equally effective and safe medications

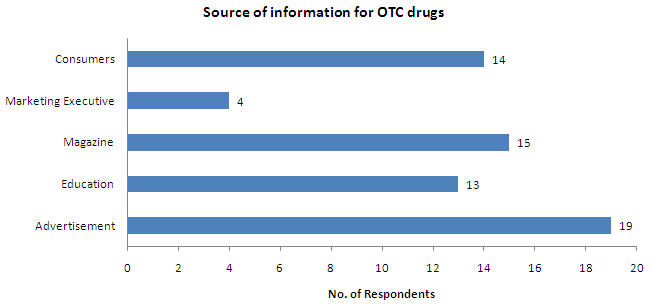

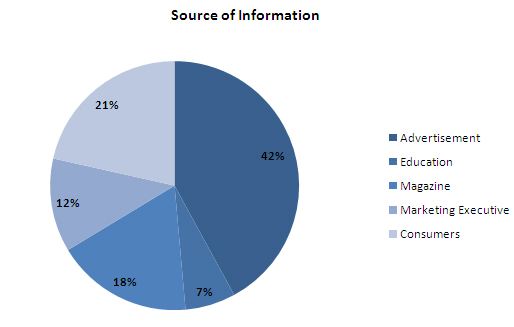

- Advertisement is the major source of information on OTC drugs for most of the respondents

- Only 30% of respondents replied in positive when asked about permitting marketing executives to market OTC products through them

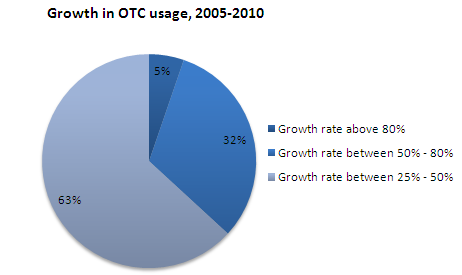

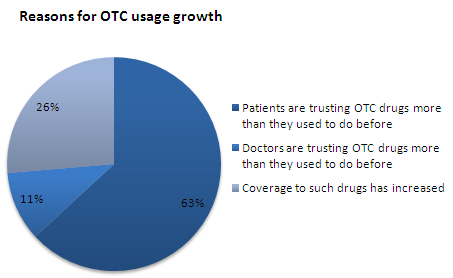

- About 63% of the respondents reported the growth rate of OTC usage during 2005-2010 between 25% - 50% and equal percentage of respondents stated that patients are trusting OTC drugs more than they used to do before as the prime reason for the growth

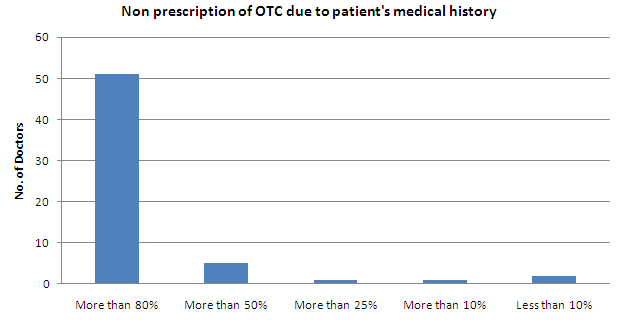

- Less than 50% of the patients are not prescribed OTC due to their medical history

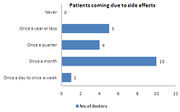

- The case of patients coming to the doctor due to side effects from OTC drugs happens once a month

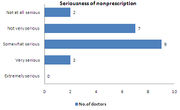

- About 90% of the respondents feel that non-prescription of drugs is not a serious problem

- 85% of the doctors feel that the information on the label of OTC drugs is sufficient for the patients, in order to take OTC medicines

- 50% of the doctors feel that more OTC drugs should be included under Medicare/insurance coverage

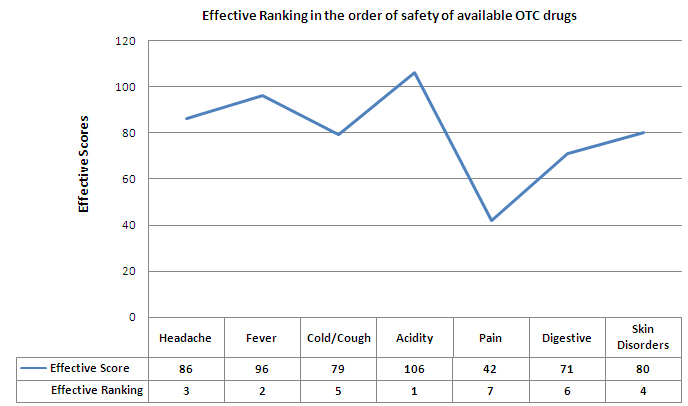

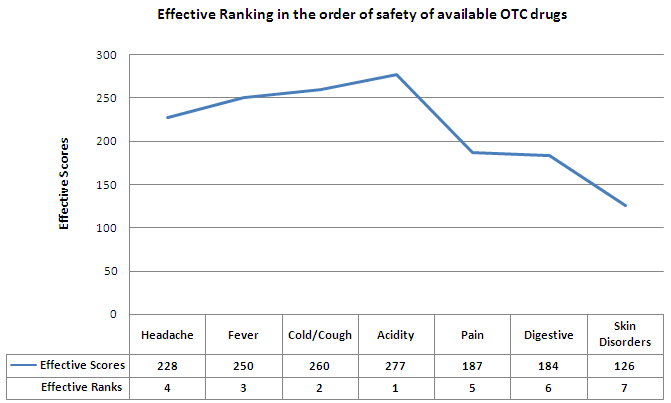

The effective ranking of the ailments in the order of safety of available OTC drugs is as follows:

To see the calculation of the effective scores and effective ranking, click on this link

Indian Market Survey - Physicians Preferences and Insights

Objectives of the Survey

The reason for carrying out this research is to determine the scope of potential switch of prescription drugs to over the counter drugs in the Indian pharma industry. The study is particularly focused at the scope of making statins, a drug for reducing cholesterol level, available over-the-counter. The study aims to understand how successful a switch would be, and if it is safe for such drugs to be made available without prescription. The study also aims at determining the marketing pattern of over the counter drugs, and how it can be improved in future.

The objectives for the survey are :

- To understand the effectiveness of OTC drug marketing campaigns in India

- To understand the source of information for the OTC drugs among doctors

- To explore the potential of switch from Rx to OTC drugs

- To gauge the current prescription pattern of statins in India

- To identify if statins can be switched to OTC

Research Methodology

The research instrument used was a questionnaire survey administered to collect empirical data. The physician responses were kept confidential to encourage openness and disclosure. The respondents rated the questions on Yes or No, ticked the relevant choices from the options available and ranked the options on a numerical scale. All the responses were coded using a binary system logic and analysis was done to derive insights there after.

Sample Size and Screening Criteria

Screening Criteria

| Screening Criteria | |

| Medical Specialty | General Physician, Consulting Physician, Gynaecologist, Dermatologist, Cardiologist, Pediatrician |

| No. of years in practice | 10 |

| No. of patients consulting per month | 150 |

Sample Size

| Gender | Sample Size |

| Male | 44 |

| Female | 16 |

| Total Physicians | 60 |

| Medical Specialty-wise Breakup | |

| General Physician | 17 |

| Consulting Physician | 9 |

| Gynecologist | 9 |

| Dermatologist | 4 |

| Cardiologist | 12 |

| Pediatrician | 6 |

| Geographywise Breakup | |

| Mumbai | 15 |

| Hyderabad | 15 |

| Delhi NCR | 14 |

| Bangalore | 16 |

Survey Results

- 97% of the Indian doctors feel that the usage of OTC drugs has increased in the past 5 years

- Indian doctors feel that the usage of OTC drugs has increased by more than 50% in the past 5 years

- Ease in the availability of OTC drugs, Advertisements and Saving time are the major reasons for increase in the usage of OTC drugs

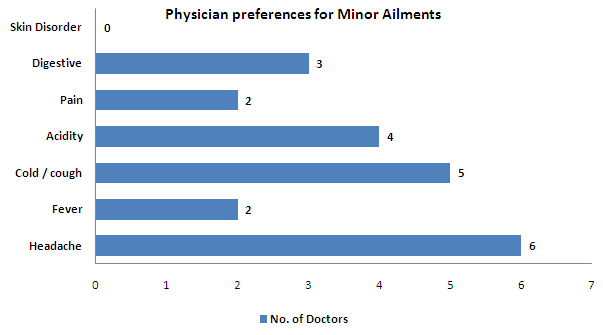

- Headache, Cold/Cough and acidity are the most common ailments for which physicians prefer giving an OTC drug

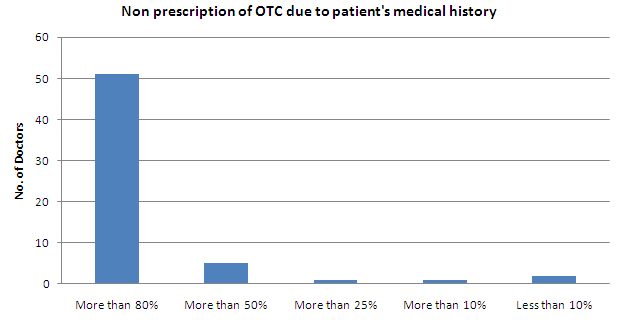

- More than 80% of the patients are not prescribed OTC drugs beacuse of their prior medical history

- Only 13% of the doctors feel that the information on the labels of OTC drugs is sufficient

- 98% of the doctors feel that drug-drug interactions might be a potential danger for OTC drugs

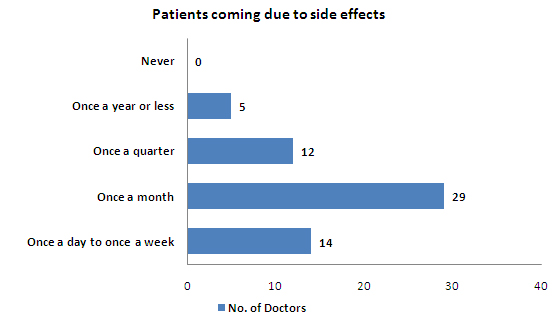

- 48% of the patients come once a month to doctor due to side effects caused by OTC drugs

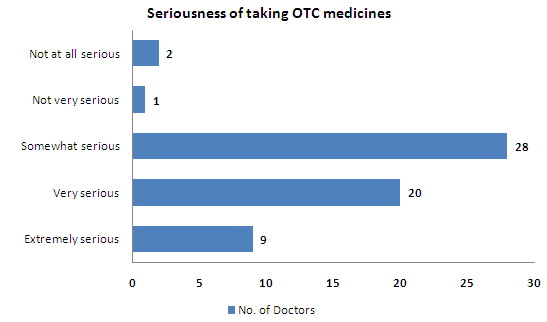

- 95% of the doctors feel that the problem of taking OTCs in India is serious

The effective ranking of the ailments in the order of safety of available OTC drugs is as follows:

To see the calculation of the effective scores and effective ranking, click on this link

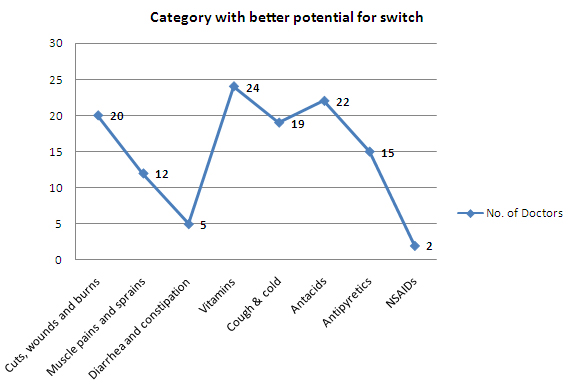

- 72% of the doctors see an opportunity for Rx-to-OTC switch in Indian pharma market

- Drugs relating to Vitamins, Antacids, Cuts, wounds and burns & Cold/Cough have a better potential to do well as an OTC drug

Effectiveness of marketing campaigns

- Advertisements are a major source of information for Indians on OTC drugs

- Only 23% of the doctors permit marketing executives to market OTC products through them

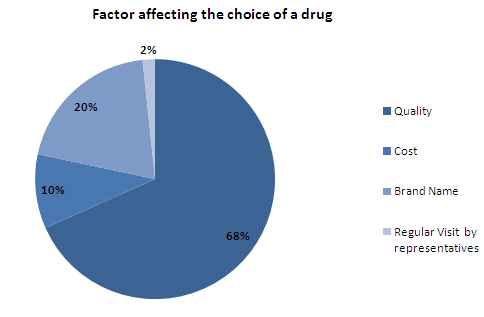

- Quality is the most important factor affecting the choice of a drug

Results on Statins

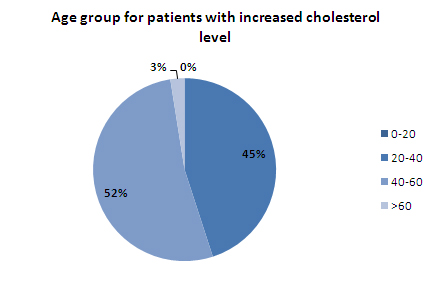

- More than 50% of the patients with high cholesteral level fall in the age group of 40-60 years

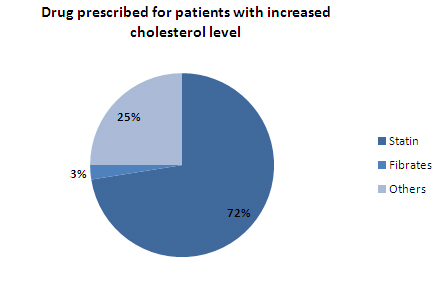

- 73% of the patients with high cholesteral level are prescribed Statin by doctors

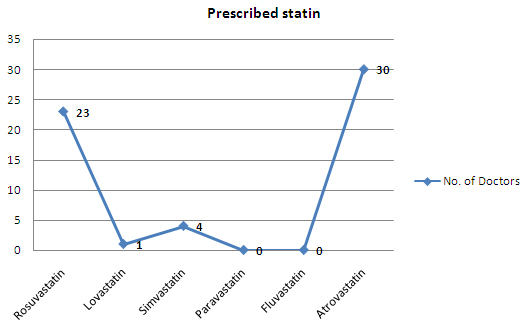

- Atrovastatin and Rosuvastatin are prescribed more than 90% of the times (whenever statins are prescribed) by doctors to patients with high cholesterol level

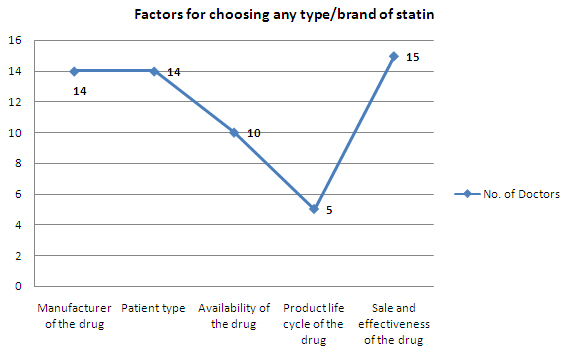

- Sale and effectiveness of the drug, Manufacturer of the drug and Patient type are the major factors for choosing any type/brand of statin

- Only 25% of the doctors feel that statins safe to be made available as OTC drugs for low- to-moderate risk group