LG Electronics Acquisition Analysis

Contents

[hide]Acquisitions by LG Electronics and its subsidiaries

Given below are the LG Electronics’ five major subsidiaries along with its stake

| Subsidiary Name | Stake |

| LG Display | 37.90% |

| LG Innotek | 50.60% |

| Hi Plaza Inc. | 100.00% |

| Hi Business Logistics | 100.00% |

| System Air-Con Engg Application | 100.00% |

Following are some of the Transactions involving above subsidiaries

| Sr. No | Investor/Buyer | Target | Seller | Deal size (in $m) | Date | Comments | % Stock Purchased |

| 1 | LG Electronics Co. Ltd. | LS Mtron Air Conditioning Division | LS Mtron Ltd. | 139.50 | 10th March 2011 | The acquisition includes handover of Mtron’s Jeonju factory and research and development workers. The Air Conditioning Division generated revenue of KRW 220 billion in 2010. | |

| 2 | LG Display Co., Ltd. | Image & Materials, Inc | Daeduck Innopolis Patent Technology Commercialization Investment Fund, Innopolis Partners LLC | 32.52 | 4th March 2011 | ||

| 3 | LG Display Co., Ltd. | Gumi LGE TV factory and Gumi LGE learning center | NA | NA | 25th Feb 2011 | ||

| 4 | LG Display Co. Ltd. | New Optics Ltd. | New Optics Ltd. | 8.81 | Jul-08 | New Optics produces backlight units. | 36.70% |

Total No. of acquisitions data available from Jun-08 to till date is 13

Sources i) http://investing.businessweek.com

ii) LG Display SEC filings

Sample Acquisition Analysis

| Investor/Buyer | LG Display Co. Ltd. |

| Target | New Optics |

| Month of Acquisition | Jul-08 |

| Size of the deal | $8.81 m |

| Stake Acquired | 36.7 |

| Years in Business | 6 |

NEW OPTICS Ltd. was incorporated on August 1, 2005 to manufacture back-light parts for TFT-LCD.

Relevance to LG Display

LG Display manufactures LCD displays for electronic devices.

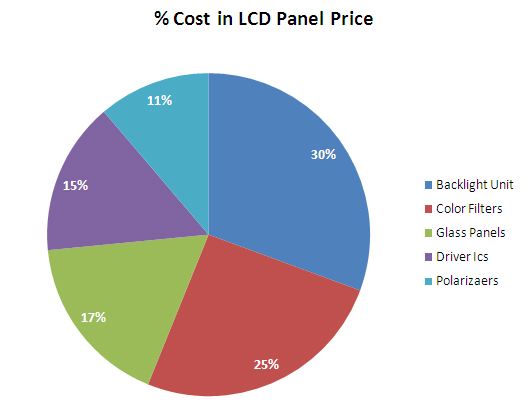

Backlight Units is a major key component for LCD display in terms of percentage cost in the total price (30%) as shown in pie chart below.

Reasons for Acquisition of Stake

Reason 1: Backward integration & Response to competition

- Acquisition indicates backward integration intentions of LG Display. No subsidiary of LG was in production of BLU (Back-light Unit) at the time of acquisition whereas competitors had subsidiaries with production capacity for BLU.

- Excerpts from LG Display SEC Filing 2009

"In order to reduce our component and raw material costs and our dependence on any one supplier, we generally develop compatible components and raw materials and purchase our components and raw materials from more than one source. However, we source the key components and raw materials from a limited group of suppliers in order to ensure timely supply and consistent quality."

"We maintain a strategic relationship with many of our key material suppliers, and from time to time, we make equity investments in our material suppliers as part of our efforts to secure a stable supply of key components and raw materials."

- Subsidiaries of other major TFT manufacturers for BLU unit

| Manufacturer | BLU Procurement |

| Samsung | Through subsidiary- Chilin Co |

| CMO | Self-sufficiancy upto 70% |

- As shown in the table, LGE's top competitors in TFT LCD market are having stable supply of BLU either through subsidiary or through self-sufficiency.

- New Optics plant's geographical location is suitable for LG Display manufacturing facility

Reason 2: Huge anticipated demand and shortage of supply

- LG Display anticipated huge demand in LCD market in terms of units sold consequently pressure from suppliers of raw materials i.e. backlight units.

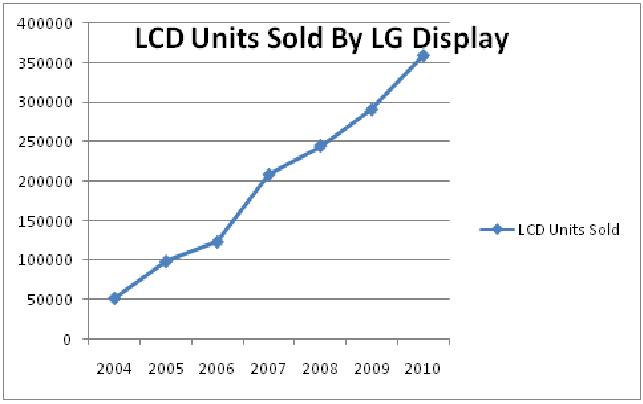

- Graph depicts the actual sales of LCD Panels by LG Display.

- From 2004 to 2008, the CAGR is 20%, which should have prompted LG Display to secure supplies of Backlights for expected booming periods in future.

Shortages were reported in 2010 for backlight unit which show that acquisition of strategic stake was required for securing supplies

Key Component Shortages Limiting Growth of LED Backlight Units for LCD TVs

"SANTA CLARA, CALIF., July 19, 2010—The LED backlight unit has emerged as a key factor in the TFT LCD industry, and is expected to maintain its growth momentum for the next several years. According to the latest DisplaySearch Quarterly LED Backlight Report, LED backlight shipments will pass those of CCFL backlights in all large-area TFT LCD panels and achieve 80% penetration in Q4’12. ""

Reason 3: Keeping pace with the BLU technology

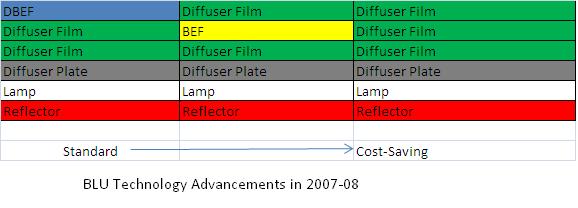

- LG Display wanted to extract maximum benefits arising due to technical advancements in 2007-08 time period

- During 2007-2008 BLU technology was undergoing lot of advancements to come up with newer cost saving ways of manufacturing.

- Some of the research going on then is as follows

i) Substitution of DBEF or BEF with diffuser films would reduce costs by more than 10%.

ii) By raising the CCFL luminescence efficiency 15%~20%, the backlight’s BEF can be replaced to reduce costs

- By acquiring stake in BLU manufacturing company LG Display would have obtained immediate benefits of outcomes of such research compared to waiting for overall prices to fall in case of arm’s length relationship with BLU manufacturers

Reason 4: Strong R&D of New Optics

- New Optics held a patent in area of Backlight Units at the time of acquisition. Apart from that it seems New Optics was expected to file for new patents. LG Display would have benefited immensely due to research activities particularly going in New Optics

Patents held by New Optics in 2010

| Sr.No. | Country Code | DocNo | Title | Filed | Inventor |

| 1 | KR | 20080103869 | FRAME FOR BACKLIGHT UNIT | 5/25/2007 | cheon in gi |

| 2 | KR | 100894257 | GLASS FIBER REINFORCED FLEXIBLE MOLD FOR BARRIER RIB MANUFACTURE OF PLASMA DISPLAY PANEL AND FABRICATION METHOD THEREOF | 10/12/2007 | park lee soon |

| 3 | KR | 20100076154 | HARD COATING AGENT FOR MODIFICATING THE SURFACE OF TRANSPARENT PLASTICS AND METHOD FOR PREPARING FOR THE SAME | 12/26/2008 | lee kyu chang |

| 4 | KR | 20100127198 | HARD COATING AGENT FOR MODIFICATING THE SURFACE OF TRANSPARENT PLASTICS AND METHOD FOR PREPARING FOR THE SAME | 11/19/2010 | han sang do |

| 5 | KR | 100995243 | MANUFACTURING METHOD AND THAT CYLINDRICAL MOLD OF NANO PATTERN FORMATION CYLINDRICAL MOLD | 9/15/2010 | kim yu sung |

| 6 | KR | 20110030124 | ILLUMINATION DEVICE USE LIGHT GUIDE PANEL | 9/17/2009 | cheon in gi |

| 7 | KR | 101026497 | THE VACUUM CHAMBER INSIDE WHERE THE HIGH PRECISION STAGE IS INSTALLED AND COOLING DEVICE | 9/15/2010 | sin myeong dong |

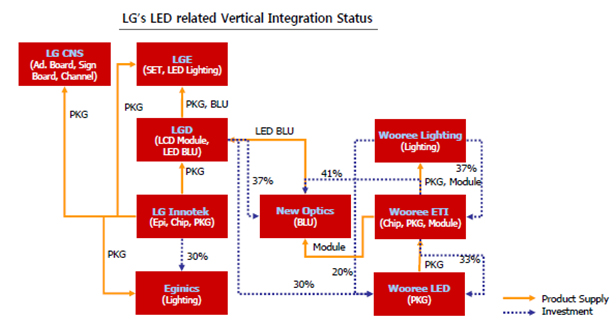

Reason 5: Good relationship with Wooree Group {Other major stakeholder(41%) in New Optics}

- LG Display enjoys good relationships with Wooree Group

Success Assessment:

- LG Group’s Subsidiary Structure after acquisition

- Acquisition can be termed as successful as New Optics have become LG’s biggest supplier in the world for raw materials (only BLU supply). Stake in the company assures LG Display of stable supply of key components.