Suzlon Energy

Contents

Company Overview

Suzlon Energy (Suzlon) is engaged in the manufacture and sale of wind turbine generators (WTGs) and components. It provides various wind energy solutions including wind resource mapping, site identification and development, installation, operation, and maintenance services. The company has operations across Americas, Asia, Australia, and Europe. It is headquartered in Pune, India and employs about 16,000 people.

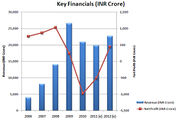

The company recorded revenues of INR206, 196.6 million ($4,330.1 million) during the financial year ended March 2010 (FY2010), a decrease of 20.9% compared to FY2009. The operating profit of the company was INR6, 125 million ($128.6 million) during FY2010, a decrease of 77% compared to FY2009. The net loss was INR9, 825.6 million ($206.3 million) in FY2010, compared to a net profit of INR2, 364.8 million ($49.6 million) in FY2009.

Key Facts

| Head Office | One Earth , Opp. Magarpatta City Hadapsar Pune 411 028 India |

| Phone | 91 20 4012 2000 |

| Fax | 91 20 4012 2100 |

| Web Address | http://www.suzlon.com |

| Employees | 16000 |

| Turnover (US $M) | 4330 |

| Financial Year End | March |

Key Financials

Source: IMS Capital Report

Business Overview

Suzlon's wind energy business traces its roots back to the incorporation of Suzlon Energy Limited in 1995 by the venture of Mr. Tulsi R. Tanti. The company along with its subsidiaries engages in designing, developing and manufacturing of wind turbine generators and related components such as rotor blades, control panels, nacelle cover, tubular towers, generators and gearboxes. Further, the company also provides consultancy, design, manufacturing, installation, operation and maintenance services as well as is involved in wind resource mapping, identification of suitable sites and technical planning of wind power projects. The company principally operates in India, China, The Americas, Europe, New Zealand, South Korea, South Africa and Australia.

The company has forged ahead with an ethos of innovation in everything that it does. This has led to pioneering approaches and offerings such as a fully vertically-integrated value chain, leveraging local expertise and global experience, an 'end-to-end solutions' model and highly customized products – all contributing to make Suzlon the highest-growth, highest-margin wind turbine maker in a highly competitive environment. Suzlon's design, manufacture, operations and maintenance services have been certified as ISO 9001:2000 by Det Norske Veritas. It has a strong presence in the BSE as well as a part of S&P CNX Nifty Index (NSE) that shows investors’ satisfaction towards the company and the stability of its stock in the financial market.

Product & Services

Product Portfolio

- Wind Turbine Generator, Low to Medium capacity (350 kW – 2.1 MW)

- Wind Turbine Generator, Medium to High capacity (1.5 MW – 5 MW)

- Wind Turbine Generator Gearbox (500 kW – 6 MW; 160 – 3,500 kNm)

Service Portfolio

- Wind Resource Mapping

- Identification & Procurement of Sites

- Execution of Project Work

- Erection & Commissioning of Wind Turbine Generators

- Construction of Power Evacuation Facilities

- Operation & Maintenance Services

Geographic Presence

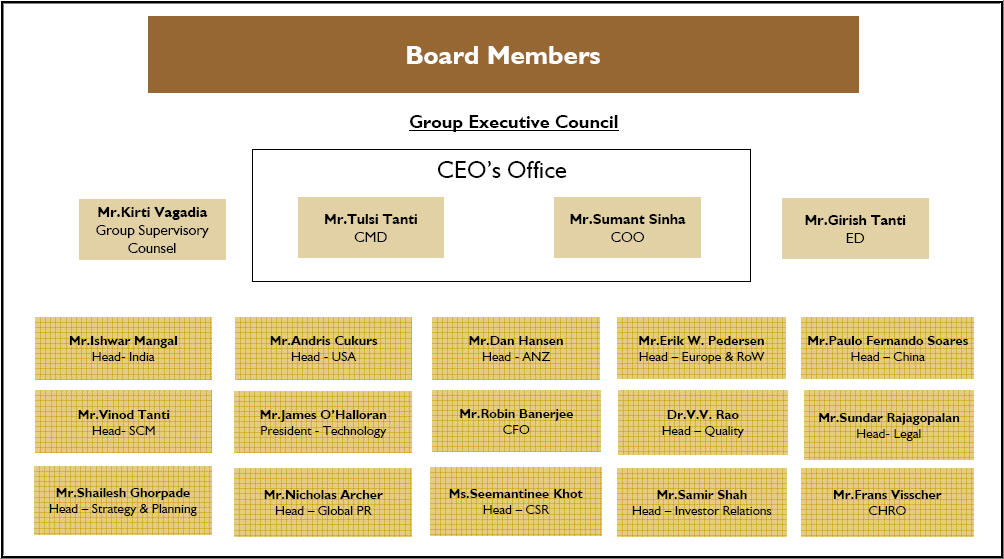

Organization Structure

Mergers & Acquisitions

| Acquisitions | Disinvestments | Subsidiary M&A |

| * SE Forge (Oct 2010) * RE Power Systems (Dec 2009) * RE Power Systems AG (Jun 2009) * RE Power Systems AG (Jun 2008) * RE Power Systems AG (Jun 2007) |

* RE Power Systems (Aug 2010) * Swibi AG (Jun 2010) * Hansen Transmissions (Apr 2009) * Denker & Wulf AG-Quitzow Wind (Mar 2009) * Hansen Transmissions (Jan 2009) * SE Forge (Oct 2008) |

* RE Power Systems AG acquired PROASEGO Wind Park (May 2010) * RE Power Systems Swiz acquired stake in Wind farm Corleto Perticara (Aug 2010) * AE-Rotor Techniek of the Netherlands acquired Eve Holding NV, a manufacturer of wind turbines (Mar 2006) |

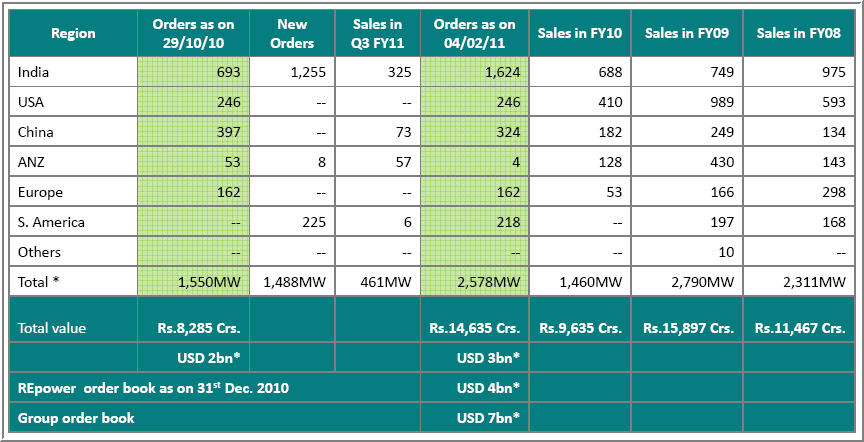

Order Book

(*Exchange rate: 1st February 2011: 1 EUR= 1.3742 USD, 1 USD= 45.7950 INR)

Source: Factiva News Articles, Analyst Reports

Client Base in Key Markets

| India | USA | China | Australia/NewZealand | Europe & South America |

| Tata Power Bajaj Auto Essel Mining MSPL ONGC |

John Deere Credit Edison Mission Group PPM Energy Horizon Wind Duke Energy |

Huaneng Shandong Guohua Datang Honiton Jingneng North Union Power |

Australia Gas & Light TrustPower Renewable Power Ventures Pacific Hydro |

SIIF Energies do Brasil Ltda (SIIF) Servtec Instalacoses NeoAnemos Srl Techneira S.A. Energi Kontoret Martifer Energy Systems Iniciativas Energetitas Eólia Renovables group Spanish Savings Bank Unicaja Ayen Enerji |

Source: BTM Consult

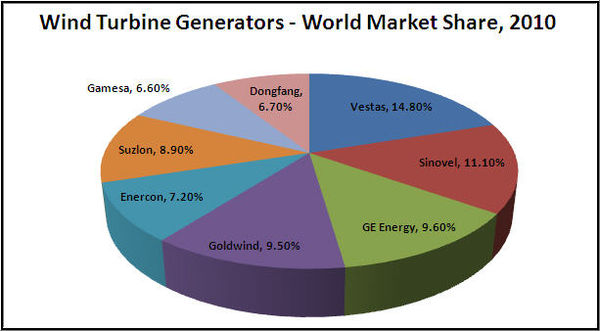

Market Overview

(*Suzlon 6.9% plus RE Power 2%)

Source:BTM Consult

- Market Share of Suzlon Wind Energy for 3 years from different sources (Excluding RE Power)

| Source | 2010 | 2009 | 2008 |

| BTM Consult | 6.9% | 6.4% | 7% |

| Make Consulting | 6% | 5.8% | 7% |

- India

Suzlon is the dominant provider in India, with a 50% market share in 2009. Enercon and Vestas have aggressively

targeted the Indian market over the past 3 years, in part driven by the slowdown in developed markets. Suzlon has maintained

its share. In India, many of Suzlon’s customers are small in size, and Suzlon provides the land as well as the infrastructure. This

land bank of premium sites is an important barrier to entry.

- Brazil

Suzlon is market leader in Brazil with a 50% share. Source:MAKE Consulting Report

- China

Chinese providers (Sinovel, Goldwind and DongFang Electric) are expected to continue to dominate the Chinese market. Suzlon

has launched a price competitive product to compete with local players. A small market share would have a material impact on

Suzlon due to the large size of the addressable market. Suzlon said in August 2010 that it hopes to generate up to 1/3 of its

revenues from China, although it subsequently appears to have reduced this emphasis. The presence of Chinese companies

outside China is minimal, held back by the perception that they produce low price, but low quality turbines.

Competitive Advantage

Integration is a key advantage for Suzlon, setting it apart from most of its competitors. This helps to maintain quality standards

and compatibility and is particularly important for gearboxes. Suzlon remains the dominant shareholder in Hansen and the two

companies have long term supply agreements in place. Hansen is also developing a customised gearbox for RePower. If Suzlon

sells its stake in Hansen, some of this advantage may be eroded.

Source:Analyst Reports

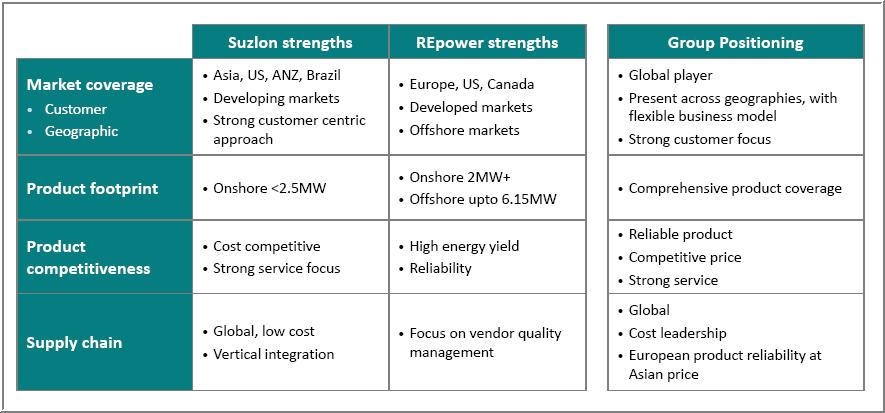

Strategic Position

Source:Analyst Reports

SWOT Analysis

| Strengths | Weaknesses |

| 1. Integrated business model 2. In house technology and design capabilities 3. Market leadership in India and global presence 4. Prudent acquisitions and alliances 5. Global production 6. Pricing power 7. Diversified product line |

1. Operational risk 2. Growth in assets diminishing growth in profits 3. Unsupportive stock prices 4. Unfavorable ratings 5. Improper working capital management 6. Weak strategic financial management |

| Opportunities | Threats |

| 1. Environmental awareness 2. Government initiatives 3. Untapped offshore market 4. Steady growth in demand 5. Vast coastlines of India and low cost |

1. Intense competition 2. Foreign exchange risk 3. Technology risk 4. Objections to wind power |

Recent Developments

| S.No | Date | Details | Source |

| 1 | 23rd April’11 | Suzlon has announced the signing of an order with Gujarat State Fertilizers & Chemicals (GSFC) to set up, operate and maintain wind energy projects totaling to 50.4 MW in Gujarat.The projects, utilising 24 units of Suzlon’s S88-2.1 MW wind turbine, will be set up in wind farms operated by Suzlon in the Rajkot and Surendranagar districts of Gujarat. This is GSFC’s fifth order with Suzlon and is scheduled for completion and commissioning by September 2011. | ProQuest |

| 2 | 9th April’11 | Recently, Suzlon Energy, India’s leader in wind energy launched a new range of large capacity wind turbine machines suitable for low wind speeds. It has also raised its stake in Repower Systems AG to 95.16% from earlier 91%. The company will initiate a ’squeeze out procedure’ of minority shareholders so that Repower becomes a wholly owned subsidiary. | ProQuest |

| 3 | 6th April’11 | Suzlon Energy, through its subsidiary, would have full control over the off-shore wind equipment specialist Repower, thus enabling access to the German player’s portfolio of products and more importantly technology. Added to it, the reasonably rich cash status of REpower and its minimal debt balance sheet could be more effectively utilised by Suzlon. This was not possible earlier, with Suzlon holding a less than 100 per cent stake. | Business Line |

| 4 | 5th,April ’11 | Massive, new natural-gas discoveries in the U.S. slashed the price of the fuel that wind competes most directly against. And the recession slowed demand for new power plants of any kind, leading more politicians to question renewables subsidies. Congress has declined so far to pass a renewable-energy requirement. Some major wind-turbine makers are cutting production at some factories. More than a year ago, Suzlon Energy Ltd., an Indian company that is one of the world’s biggest wind-turbine makers, began laying off workers at its plant in Pipestone, Minn., which makes blades for turbines; the plant now is operating at just one-third of its capacity, says Tulsi Tanti, the company’s chief executive. Given the lack of a nation-wide renewables mandate, he says, Suzlon also has postponed plans to build another U.S. factory, in Texas. | Factiva |

Key Insights

Support from Government of India

The Indian government has enacted legislation giving a tax break for investments in renewable energy twice in the last five years giving a significant boost to Suzlon as it has a 50% market share in India.

Rejection of Wind Turbine Blades

Suzlon has faced the problem of continuous rejection of wind turbine blades and it resulted in the following:

- Shares dropped 19% because of china issue

- Shares dropped 84% last year because of US issue

- Spends $100M to fix cracked-blade problem

Debt Problem

Suzlon currently has net debt of USD 2.05bn and faces a heavy debt repayment schedule beginning in FY2013.

- Monetized 35.22% stake in Hansen Transmissions

- Realized GBP 224 million through placement of 236 million depository interests at a price of 95 pence per depository interest

R&D and NPD Outlook

- Suzlon has doubled its R&D expenditure

- Introduced 2 new products

- Extensive research in setting up wind mills in forested area

Repeat Orders in India

- Gujarat State Petronet Ltd.

- Rajasthan State Miners & Minerals Ltd.

- Gujarat Alkalies and Chemicals Ltd.

- State Bank of India

- Gas Authority of India

Key Executives

| Name | Designation |

| Tulsi Tanti | Founder, Chairman, Managing Director, Chairman of Employees Stock Option Plan Committee, Chairman of Securities Issue Committee and Member of Investors Grievance Committee |

| Robin Banerjee | Chief Financial Officer |

| Andris Cukurs | Chief Executive Officer of USA |

| Dan Kofoed Hansen | Chief Executive Officer of Australia & New Zealand and Vice President of Sales & Marketing - Asia Pacific |

| Per Hornung Pedersen | Chief Executive Officer of Europe |

| Silas Zimu | Chief Executive Officer of South African Operations |

| Ashok D'Sa | President of India South Asia and Middle East |

| Arvind Mathew | President of Nacelle Manufacturing |

| Nilesh Vaishnav | President of Blades |

- Biography of CMD, Tulsi Tanti

- Tulsi Tanti is from Gujarat, India where he started his first venture which was in textiles but he found the prospects stunted due to infrastructural bottlenecks. The biggest of them all was the cost and unavailability of power, which formed a high proportion of operating expenses of textile industry. In 1990, he invested in two wind turbine and realized their huge potential. In 1995, he formed Suzlon and gradually quit textiles. This is how he set out on a new path.

- The $10 billion Suzlon Energy is his wind power based company that has expanded its operations into various parts of the globe. With this successful venture, Tanti is amongst the ten richest Indians and one of the most successful entrepreneurs in Asian region. With a net worth of $5.9 billion, he is the chairman and managing director of Suzlon energy. Tanti owns 70% of the company with his three siblings.