China

According to the third National Wind Energy Resources Census, China’s total exploitable capacity for both land-based and offshore wind energy is around 700-1,200 GW. Compared to the other leading global wind power markets, China’s wind resources are closest to that of the United States, and greatly exceed resources in India, Germany or Spain.

Market Developments in 2010

Due to varied wind resources across China and differing

technical and economic conditions, wind power development

to date has been focused on a few regions and provinces,

including: Inner Mongolia, the Northwest, the Northeast,

Hebei Province, the Southeast coast and offshore islands.

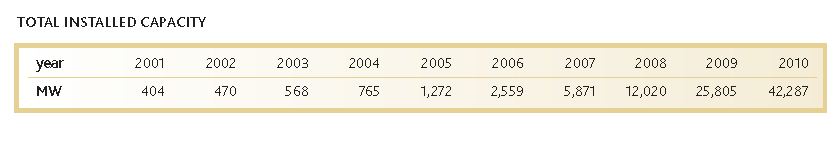

China’s wind market doubled every year between 2006 and

2009 in terms of total installed capacity, and it has been the

largest annual market since 2009. In 2010, China overtook the United States as the country with the most installed wind

energy capacity by adding 16,500 MW* over the course of

the year, a 64% increase on 2009 in terms of cumulative

capacity, reaching 42.3 GW in total.

According to Bloomberg New Energy Finance, the growth in

installed capacity was driven by a record level of investment

in wind power in China, which exceeded USD 20 billion in

2009. In the third quarter of 2010, China’s investment in new

wind power projects accounted for half of the global total.

In addition, the Chinese government report “Development

Planning of New Energy Industry” calculated that the

cumulative installed capacity of China’s wind power will

reach 200 GW by 2020 and generate 440 TWh of electricity

annually, creating more than RMB 250 billion (EUR 28 bn /

USD 38 bn) in revenue.

Chinese Wind Power Sector

2010 was also an important year for Chinese wind turbine

manufacturers, as four companies, including Sinovel,

Goldwind, UnitedPower and Dongfang Electric, are part of

the world's top ten largest wind turbine manufacturers, and

are beginning to expand into overseas markets.

Driven by global development trends, Chinese firms,

including Sinovel, Goldwind, XEMC, Shanghai Electric Group

and Mingyang, have entered the competition to manufacture

wind turbines of 5 MW or more.

China’s wind power generation market is mainly shared

among the ’Big Five’ power producers and several other

major state-owned enterprises. These firms account for more

than 80% of the total wind power market. The largest wind

power operators, Guodian (Longyuan Electric Group), Datang

and Huaneng expanded their capacity by 1-2 GW each during

the year, while Huadian, Guohua and China Guangdong

Nuclear Power are following close behind. Most of the local

state-owned non-energy enterprises, as well as foreignowned

and private enterprises have retreated from the

market. Access to finance is generally not a problem for wind

power projects.

The Renewable Energy Law and the Chinese Feed In Tariff

The breathtaking growth of the Chinese wind energy industry

has been driven primarily by national renewable energy

policies. The first Renewable Energy Law entered into force in

2006, and gave huge momentum to the development of

renewable energy. In 2007, the first implementation rules for

the law emerged, giving further impetus to wind energy

development. In addition, the “Medium and Long-term

Development Plan for Renewable Energy in China” from 2007

set out the government’s long term commitment and put

forward national renewable energy targets, policies and

measures for implementation, including a mandatory market

share of 1% of non-hydro renewable energy in the total

electricity mix by 2010 and 3% by 2020.

In 2009, the Renewable Energy Law was amended to

introduce a requirement for grid operators to purchase a

certain fixed amount of renewable energy. The amendment

also requires grid companies to absorb the full amount of

renewable power produced, also giving them the option of

applying for subsidies from a new “Renewable Energy Fund”

to cover the extra cost related to integrating renewable

power if necessary.

The breathtaking growth of the Chinese wind energy industry

has been driven primarily by national renewable energy

policies. The first Renewable Energy Law entered into force in

2006, and gave huge momentum to the development of

renewable energy. In 2007, the first implementation rules for

the law emerged, giving further impetus to wind energy

development. In addition, the “Medium and Long-term

Development Plan for Renewable Energy in China” from 2007

set out the government’s long term commitment and put

forward national renewable energy targets, policies and

measures for implementation, including a mandatory market

share of 1% of non-hydro renewable energy in the total

electricity mix by 2010 and 3% by 2020.

In 2009, the Renewable Energy Law was amended to

introduce a requirement for grid operators to purchase a

certain fixed amount of renewable energy. The amendment

also requires grid companies to absorb the full amount of

renewable power produced, also giving them the option of

applying for subsidies from a new “Renewable Energy Fund”

to cover the extra cost related to integrating renewable

power if necessary.

Grid Connection Problem

The rapid development of wind power in China has put

unprecedented strain on the country’s electricity grid

infrastructure. This has become the biggest problem for the

future development of wind power in the country, as some

projects have to wait for several months before being

connected to the national grid.

There are reports that a large share of China’s wind power

capacity is not grid connected, but this is based on a

fundamental misunderstanding, which has its source in the

methodology used for calculating installed capacity. The

Chinese Federation of Power Generation, which provides

China’s energy statistics, only counts wind farms as operational from the moment that the last turbine of a

project has become grid-connected. However, in reality, most

of the installed wind turbines of a project are connected to

the grid and generating power much earlier. This explains the

much reported “gap” between installation and grid

connection which is often reported from China. In other

markets, it is common practice to include all turbines that are

grid connected, whether or not they constitute a completed

wind farm.

Due to a lack of incentives, Chinese grid companies have

been reluctant to accept large amounts of wind power into

their systems. However, they have recently reached an

agreement to connect 80 GW of wind power by 2015 and

150 GW by 2020. According to figures by the State Grid, at

the end of 2010, 40 billion RMB (EUR 4.5 bn / USD 6.1 bn)

had been invested to facilitate wind power integration into

the national power grid.

Outlook 2011 & Beyond

Despite its rapid and seemingly unhampered expansion, the

Chinese wind power sector continues to face significant

challenges, including issues surrounding grid access and

integration, reliability of turbines and a coherent strategy for

developing China’s offshore wind resource. These issues will

be prominent during discussions around the twelfth Five-Year

Plan, which will be passed in March 2011. According to the

draft plan, this is expected to reflect the Chinese

government’s continuous and reinforced commitment to

wind power development, with national wind energy targets

of 90 GW for 2015 and 200 GW for 2020.