Overview of valuation

IP valuation is a complex procedure taking into account economic, technology-related as well as juridical factors. The heterogeneity of the factors concerned and the specific purposes addressed in every valuation do not allow adopting one generally-accepted standardized IP valuation model, but there are a variety of different models and tools comprising different approaches. The main approaches are:

- Cost based method - This method is based on the analysis of costs necessary to replace the IP concerned, as well as on costs that have been invested for the development, application, maintenance and commercialization

- Income based method - The value derived by this method is based on the expected income attributable to the asset during its remaining economic life. The fair value of asset can be expressed as the present value of the future stream of the economic benefits that are derived from the ownership of the property.

- Market based method - This method assesses the market value by reference to comparable market transactions. The method basically consists of assessing prices and/or profits achieved by third parties in comparable market transactions, such as mergers and acquisitions, sales or the grant of licenses etc.

Why Income method ?

We have used the Discounted Cash Flow (income based method) due to following reasons:

- It is a fundamental valuation method

- The value is based on the ability of the asset to generate future positive cash flows

- When appropriately discounted, this method gives the net present value of all the future cash flows

- Future business and market dynamics are considered while calculating future cash flows

- Easy to interpret and understand

Objective

- To estimate the market for an IP

- To estimate revenue generated from a particular IP

- To identify the main players

- To identify the importance of the product to the market

- To identify the importance of the patent to the product market

Methodology

The generic methodology for IP revenue estimation is given below

- To forecast the market of VoIP and segregate the markets based on the categories listed below

- Wireless Dual Mode VoIP phones

- Cellular and Wi-Fi

- Landline & VoIP

- 3G Wireless Router

- Wi-Fi VoIP

- Wireless VoIP

- Receiver Circuitry

- VoIP All Phones

- VoIP Wireless Phones

- Adaptive Rate/Redundancy

- Echo Cancellation

- VoIP Phone w/prioritization

- Hybrid VoIP network (Wired & Wireless)

- Determine the complete VoIP market

- Determine the market for each category listed above

- Identify the top players in each category

- Identify the importance of the product to the market based on the revenue, market share and acceptability

- Analyzing the importance of IP to the product market

- Determine the revenues for that particular IP

Analysis for 10/801,472 application number

The application number 10/801,472 comes under the category of Dual mode cellular/Wi-Fi. The analysis for this application number is illustrated below.

Dual mode mobile market

In order to assess the dual mode mobile market, the following steps were performed

- Total mobile handset market is estimated using various market research reports

- Wi-Fi handsets as a percentage of the total handsets is estimated

- Dual mode mobile units is then estimated as a percentage of the total wi-fi handsets

For this calculation, we have assumed

- Dual mode mobiles are Wi-Fi/cellular mobile phones

- 2012 mobile handsets data based on the average growth rate from 2009 to 2011

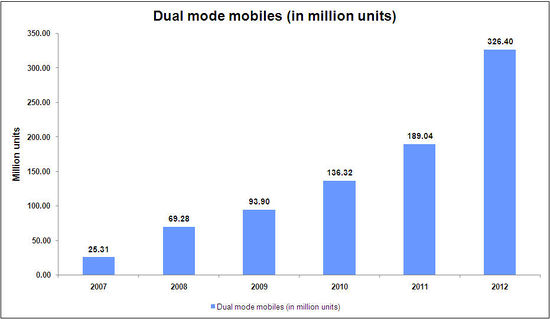

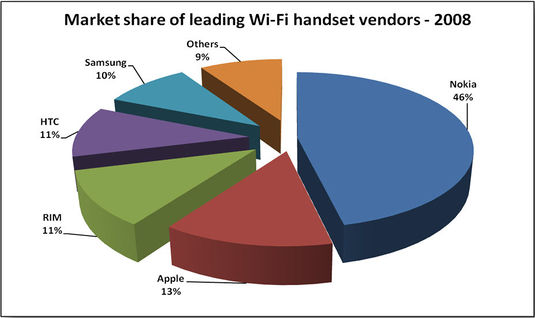

The growth of dual mode mobile handset units and the market share of leading Wi-Fi handset vendors is shown below:

- The following table displays the estimated dual mode mobile market till 2024

| Year | Total mobile units (billion) | Total Wi-Fi units (million) | Dual mode mobile units (million) |

| 2007 | 1.15 | 35.65 | 25.31 |

| 2008 | 1.19 | 97.58 | 69.28 |

| 2009 | 1.15 | 132.25 | 93.90 |

| 2010 | 1.20 | 192.00 | 136.32 |

| 2011 | 1.25 | 266.25 | 189.04 |

| 2012 | 1.78 | 459.73 | 326.40 |

| 2013 | 2.06 | 555.93 | 400.27 |

| 2014 | 2.37 | 663.00 | 483.99 |

| 2015 | 2.71 | 786.24 | 581.82 |

| 2016 | 3.09 | 927.23 | 695.42 |

| 2017 | 3.49 | 1082.69 | 822.85 |

| 2018 | 3.95 | 1262.91 | 972.44 |

| 2019 | 4.42 | 1458.66 | 1137.75 |

| 2020 | 4.95 | 1658.45 | 1310.18 |

| 2021 | 5.50 | 1868.35 | 1485.34 |

| 2022 | 6.04 | 2085.41 | 1668.33 |

| 2023 | 6.59 | 2306.04 | 1844.84 |

| 2024 | 7.12 | 2490.53 | 1992.42 |

Source: Gartner, Techcrunchies, Abiresearch

Importance of dual mode mobile phones

- Mobile voice-over-IP applications will reach 278 million users, generating $32.2 billion in annual revenues by 2013, a third of that going to reluctant cellular operators

- "The participants include a broad spectrum of mobile VoIP industry participants, including start-ups, online VoIP providers, mobile virtual network operators (MVNOs), and mobile virtual network enablers (MVNEs)—and the mobile operators themselves; all of whom are leveraging, or will leverage, very different opportunities associated with mobile VoIP," says Frank Dickson, analyst with Arizona-based research firm In-Stat

- "Sooner or later, mobile operators will be forced to deploy their own VoIP services, since next-generation networks, such as Long Term Evolution and WiMAX are all-IP and don’t support circuit voice," explained John Blau, a German-based research associate with Unstrung Insider

- By 2019, half of all mobile calls will be over all-IP networks, according to reports published earlier this year

Source: Wi-Fi Planet, VOIP Monitor

Importance of IP to the product market

Application Number - 10/801,472 (US20050008002)

Focus of the patent

Multi-mode communication device and method of its operation

Device specification

- Device capable of working on two communication network interfaces i.e. cellular & WLAN or Wi-Fi

- Device having transceivers for communication with respective communication networks & processor for routing the calls to any one of the communication networks based on the mode of communication and cost of use of communication network

- Transceiver of the device which communicates via WLAN network, communicates at app. 2.4 gigahertz using spread spectrum technique i.e. frequency hopping spread spectrum technique

- One of the transceivers is disposed on a user removable circuit card which is compliant with a Personal Computer Memory Card Interface Association (PCMCIA)

Method of communication

- Detecting an action (one of voice, a key press, and handwritten) by a user

- Determining a type of call (voice call, a data call, and a voice and data call) based upon the user action

- Selecting (based on evaluating a cost of use of a communication network) at least one wireless communication interface from the plurality of wireless communication interfaces based upon the type of call (voice call, a data call, and a voice and data call)

- Establishing call communication via the at least one wireless communication interface; and exchanging information (representative of voice or others) via the at least one wireless communication interface

Valuation for 10/801,472 application number

Steps of valuation

- Discounted cash flow method of valuation has been used

- Estimating total number of dual mode handsets

- Determine the revenue generated by multiplying the unit cost of processor and total number of dual mode handsets

- Estimate the average royalty rate

- Estimate the revenue generated

- Determine the discount rate and realistic growth rates

- Estimating future cash flows based on discount and growth rates

- Estimating the cost of obtaining a patent

- Calculating the maintenance fees of patents from USPTO and EPO

- Estimating the licensing and administrative costs

- Calculating the NPV (net present value) by discounting the future cash flows to the present

The working sheet

| Cost of processor per unit ($) | 0.025 | ||||||||||||||

| No. of dual mode mobile units | 136,320,000 | ||||||||||||||

| Expected revenue ($) | 3,408,000 | ||||||||||||||

| Average royalty rate | 7% | ||||||||||||||

| Expected revenue from royalty ($) | 238,560 | ||||||||||||||

| Discount rate | 10% | ||||||||||||||

| Time frame (2010-2024) | Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 | Year 8 | Year 9 | Year 10 | Year 11 | Year 12 | Year 13 | Year 14 |

| Cost incurred | |||||||||||||||

| Licensing and administrative cost ($) | 288,000 | ||||||||||||||

| Cost of obtaining US patent ($) | 12,565 | ||||||||||||||

| Cost of obtaining foreign patent ($) | 120,000 | ||||||||||||||

| Net cost ($) | 420,565 | ||||||||||||||

| Growth rate | 39% | 73% | 23% | 21% | 20% | 20% | 18% | 18% | 17% | 15% | 13% | 12% | 11% | 8% | |

| Revenue stream ($) | 331,598 | 573,665 | 705,608 | 853,786 | 1,024,543 | 1,229,452 | 1,450,753 | 1,711,889 | 2,002,910 | 2,303,346 | 2,602,781 | 2,915,115 | 3,235,778 | 3,494,640 | |

| Annual maintenance cost ($) | 0 | 49 | 174 | 736 | 493 | 702 | 994 | 2564 | 1588 | 1829 | 2236 | 4830 | 3198 | 3646 | |

| Cash flow ($) | -420,565 | 331,598 | 573,617 | 705,435 | 853,050 | 1,024,050 | 1,228,750 | 1,449,759 | 1,709,324 | 2,001,322 | 2,301,517 | 2,600,545 | 2,910,284 | 3,232,579 | 3,490,994 |

| Discount factor | 1.0000 | 0.9091 | 0.8264 | 0.7513 | 0.6830 | 0.6209 | 0.5645 | 0.5132 | 0.4665 | 0.4241 | 0.3855 | 0.3505 | 0.3186 | 0.2897 | 0.2633 |

| Present value of cash flow ($) | -420,565 | 301,453 | 474,063 | 530,003 | 582,644 | 635,855 | 693,597 | 743,956 | 797,412 | 848,756 | 887,334 | 911,475 | 927,306 | 936,363 | 919,288 |

| Net present value of cash flow ($) | 9,768,942 |

- The value for wireless dual mode VoIP phones = $9,768,942

Click here to view the excel sheet

Assumptions

Following assumptions were made for the IP valuation

- The patent for this application is granted in year 2010

- Since patent is not yet granted, the licensing and administration cost have been considered

- Discount rate is taken as 10% which is approximately 6% higher than the 10-year treasury bond rate in USA

- Average unit cost of TI OMAP35X processor is taken as the unit cost of processor for the valuation exercise

- Royalty rate for semiconductor and telecom industry ranges between 5% to 10%. Hence, an average rate of 7% has been considered

- Initial growth rate values are based on market research reports

- The number of dual mode handsets have been calculated as a percentage of Wi-Fi phones and assumed to be 80% of total Wi-Fi phones by 2024

- Wi-Fi phones as a percentage of total mobiles is assumed to be 35% by 2024

- Growth in total mobile phones market is assumed to decrease gradually as it will grow from larger volume in future

- The cost of the processor is assumed to be constant over the forecasted period

- Patent is applied for in USA and major European countries

- Maintenance fees include the fees in US and the European countries

Source: Royaltysource, Oceantomo, Bloomberg, Business of patents, European Patent Office, Netcom, Texas Instruments