Key Findings:

- The first level of segmentation in Life Insurance industry is on the basis of Age and Gender. Then they are further segmented on the basis of their health class and thereafter on the basis of their smoking habits.

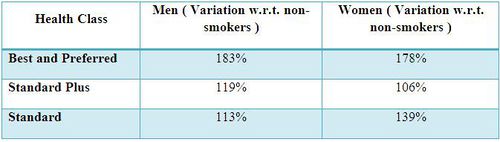

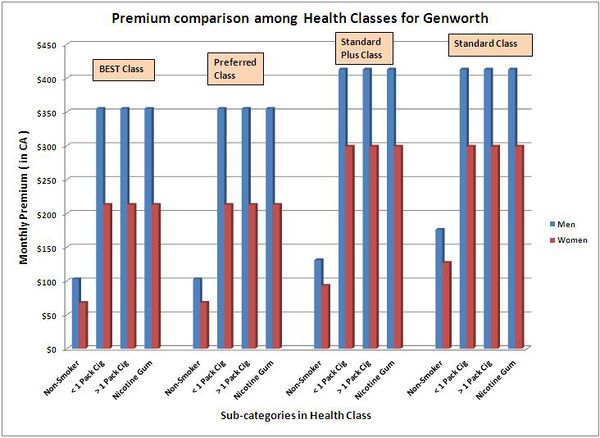

- It is noteworthy that although the companies charge less premium for women than men, the increase in premium as the health class shifts is higher for women than men. This is an indication that the companies maintain a policy of high risk averseness for women as their health class goes down.

- Companies consider Best and Preferred class customers in the same segment as the premium charged is same for both of these classes.

Objective

- To perform sensitivity analysis and qualitatively determine the variation in monthly premium charged by the life insurance companies.

- To understand Life Insurance companies behavior towards the consumers of different gender and belonging to different health groups.

Methodology

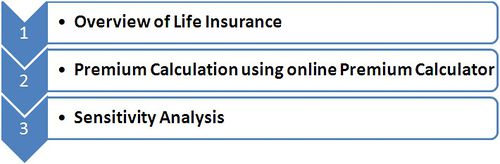

We have divided our analysis broadly into 3 parts:

Overview of Life Insurance

We first studied the basics of Life Insurance through secondary resources like related websites on the internet, journals etc. as to what is life insurance, why people should go for it, various types of life insurance and hoe segmentation is done in Life Insurance industry. We covered the Term Life Insurance in detailed because people more than 60 years of age, which was our focus area in this study, generally opt for this insurance.

Premium Calculation using online Premium Calculator

We determined the premium charged by the following life insurance companies using online premium calculator:

- Transamerica Life Insurance company

- American General Life company (AIG)

- Prudential Financial (Pruco life insurance company)

- Genworth Financial (Genworth life insurance company)

- (ING) Reliastar Life Insurance company

We considered cases for both men and women.

- For Men height and weight are taken as 5’8’’ and 176 lbs respectively while for Women height and weight are taken as 5’4’’ and 162 lbs respectively.

- Date of Birth is taken as march 3, 1949 (more than 60 yrs), coverage amount as $250,000, guaranteed term as 15 years and state as California both for male and female.

- Premiums were calculated considering different health conditions for Blood Pressure, Cholesterol, Cardiac problem or Cancer in the family, Medical advice or treatment for major illness etc.

Source: http://intelliquote.com

Sensitivity Analysis

Finally we analyze the companies response to different health conditions on the basis of the variation in premium amount. From this we also determined the key health parameters which have major impact on the premium that the companies are charging the individuals.

Assumptions

- Height and Weight for men and women is taken as the median height and weight prevailing in USA.

- Coverage Amount is based on the median annual household income of USA taken as $50,000 and Term duration is assumed as 15 years.

Overview of Life Insurance

Introduction

- Life Insurance is a contract between the policy owner and the insurer, where the insurer agrees to pay a sum of money upon the occurrence of the insured individual's or individuals' death or other event, such as terminal illness or critical illness.

- In return, the policy owner agrees to pay a stipulated amount called a premium at regular intervals or in lump sums.

- To be a life policy the insured event must be based upon the lives of the people named in the policy.

- Life policies are legal contracts and the terms of the contract describe the limitations of the insured events. Specific exclusions are often written into the contract to limit the liability of the insurer; for example claims relating to suicide, fraud, war, riot and civil commotion.

Source: http://en.wikipedia.org/wiki/Life_insurance

Why should people go for Life Insurance Policy

- To make sure their family will be well taken care of if they die.

- To minimize tax burden and to ensure whatever they have earned goes to their heirs as it is a tax free way to transfer their wealth.

- The value for the policyholder is derived, not from an actual claim event, rather it is the value derived from the 'peace of mind' experienced by the policyholder, due to the negating of adverse financial consequences caused by the death of the Life Assured.

- Some insurance policies like Universal life insurance, whole life insurance and some term life insurance can be settled for cash value, the value that can be borrowed against or cashed in when the owner needs money.

- To cover post death expenses like funeral, medical bills and to settle debts.

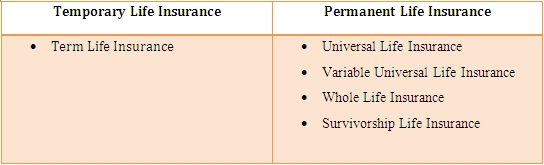

Types of Life Insurance

Broadly Life Insurance is divided into Temporary Life Insurance and Permanent Life Insurance. These can be further sub classified. Various life insurance policies prevailing in United States are:

Depending on the requirements of the individuals companies are giving them an option whereby they can convert their temporary insurance policy to permanent insurance policy.

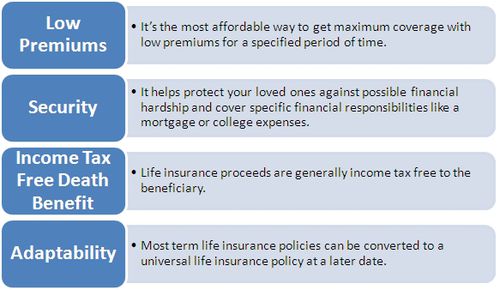

Term Life Insurance

Term life insurance provides death benefit coverage with a guaranteed level premium for a specific period of time - usually 10, 15, 20 or 30 years depending upon which product you choose.

Term life insurance can help one’s family pay for necessary expenses if he/she dies unexpectedly. The death benefit can help the family maintain their lifestyle, cover children’s college tuition and pay off a mortgage.

Benefits of term life insurance:

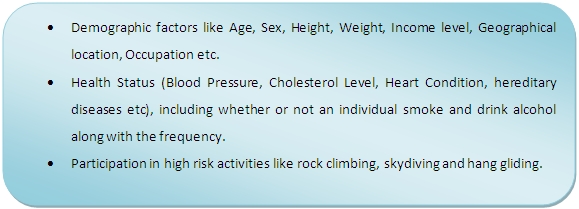

Segmentation in Life Insurance

Segmentation in Life Insurance industry is done on the basis of:

Companies call these segments as rating classes. Different companies give different weights to different diseases and they have their own health check list while developing these rating classes. All people in a rating class do not have the same life span but, they have a fairly predictable life expectancy. This give companies a basis to determine premiums.

Sensitivity Analysis

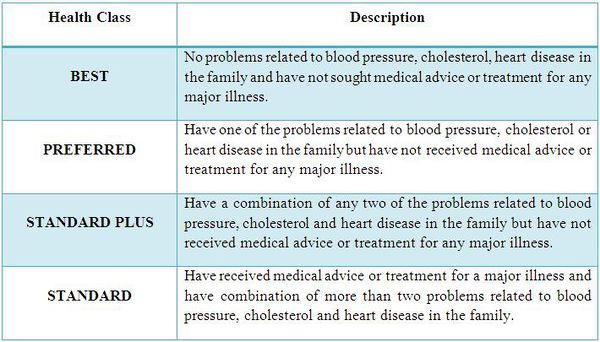

For the purpose of comparison, following Health Class classification has been defined:

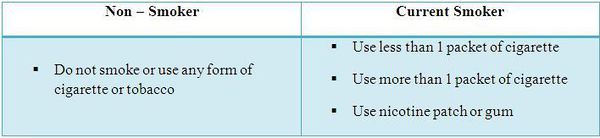

Each of these Health Class stated above have been further categorized on the basis of smoking habits of an individual as follows:

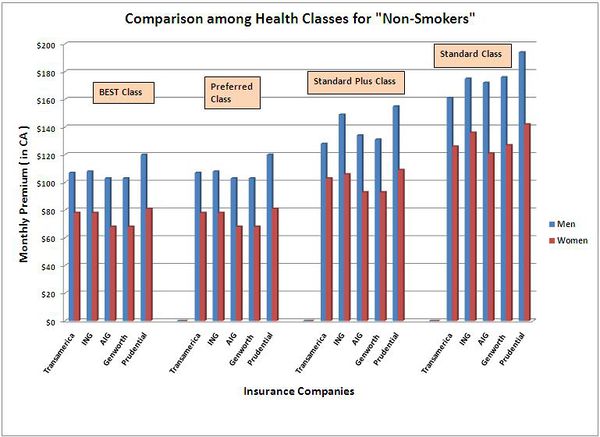

Premium charged by different insurance companies for “Non-Smokers” in different health classes

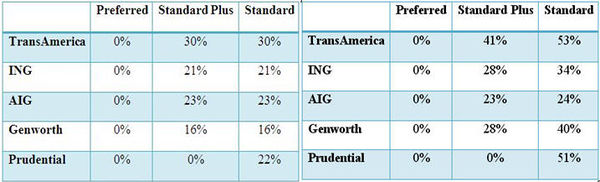

- AIG and Genworth charges the least premium for Best and Preferred health class for both men ($168) and women ($68); while Prudential charges the maximum pemium ( $120 and $81 for men and women respectively).

- In the Standard Plus health class, Transamerica charges the least premium ( $128 ) for men while AIG and Genworth charges least for women ( $93 ). Prudential charges the maximum premium in this class also; 21% higher for men and 17% higher for women, respectively.

- Similarly, in the Standard health class, while Transamerica charges least for men ($161) AIG charges least for women ($121). Prudential charges the maximum in this category too with $194 for men ( + 20% ) and $142 for women ( + 17% ).

- The variation in premium charged among men and women is from 24% to 51%.

- It is worth noticing that while premium charges for AIG increases by 67% from Best to Standard class, the increase for Prudential is only 62%.

- This indicates that AIG is more sensitive to health class than Prudential among Non-Smokers. However, Prudential may be termed as more risk-averse than the other insurance companies as the premium charged is maximum in all health classes.

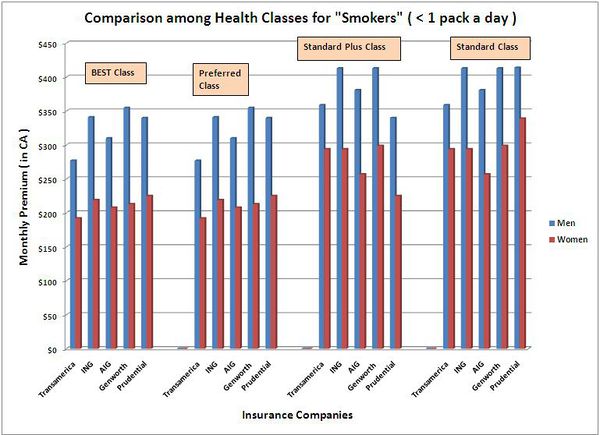

Premium charged by different insurance companies for “Smokers – having less than 1 pack a day” in different health classes

- Transamerica charges the least premium in all health classes except for Standard Plus health class in which Prudential charges least for men and in Standard health class in which AIG charges least for women.

- For men, as the health class shifts from Best to Standard, the variation in premiums for companies become less. The percentage variation between the minimum and maximum premium in Best health class is 28% while it is only 15% in Standard health class.

- However, the same for women is 17% in Best health class and 32% in Standard health class.

- Transamerica, the least premium charger increases its premium by 30% from Best to Standard health class while the highest premium charger Genworth has a increase of only 16% for the same. This may indicate that the risk appetite for Genworth is less.

- The maximum difference between the premium charged for men is 49% while for women is as high as 77%. This indicates that as the health category of women goes down the proportionate increase in premium is more than in case of men. So we can say insurance companies are more sensitive to the changes in health condition of women.

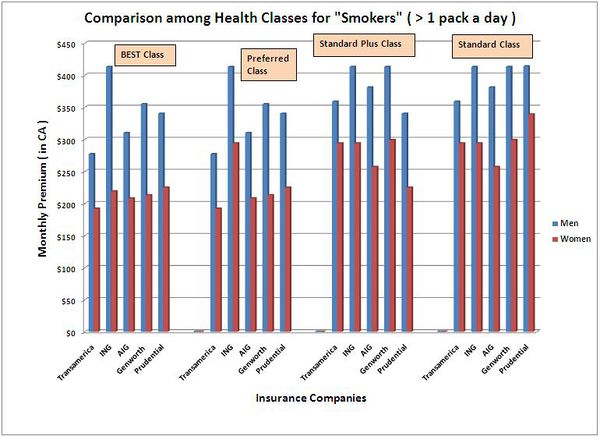

Premium charged by different insurance companies for “Smokers – more than 1 pack a day” in different health classes

- Transamerica charges the least premium in all health classes except for Standard Plus health class in which Prudential charges the least and in Standard health class in which AIG charges the least for women.

- ING seem to be very risk averse in this category for men as the premium charges for all health classes is among the highest at $413 ( except for Standard Class in which Prudential charges a monthly premium of $414 ).

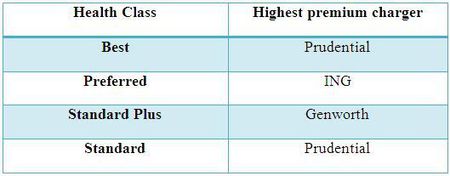

- For women the highest premium chargers vary as follows:

- In this category too, maximum difference between the premium charged for men is 49% while for women is as high as 77%.

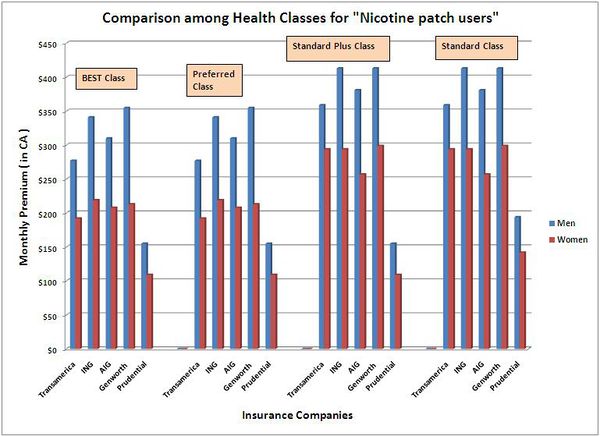

Premium charged by different insurance companies for “Nicotine patch users” in different health classes

- Prudential charges the least premium in all health classes. Genworth charges the maximum for men while ING charges the maximum for women in the Best and Preferred class while maximum premium charges for women in Standard Plus and Standard health class are same for three companies – Transamerica, ING and Genworth.

- In the Standard Plus health class, all insurance companies except Prudential appears risk averse as their premium is on average 153% more than Prudential’s for men ($155). For women, the average premium charged is as high as 162% more than Prudential’s ($109).

- This difference seems to converge a little as we inspect the premium charges in the Standard health class which is on an average only 101% and 102% for men and women, respectively.

Company Analysis

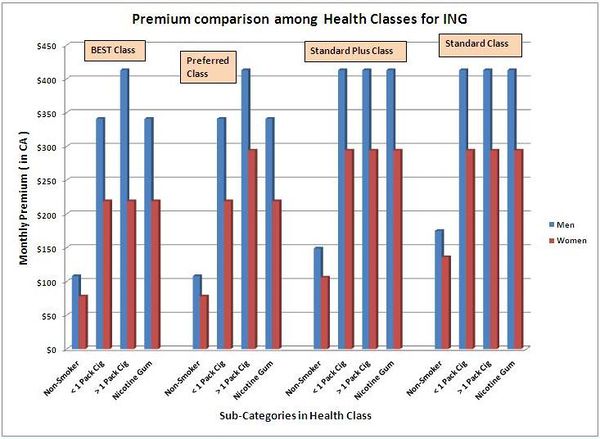

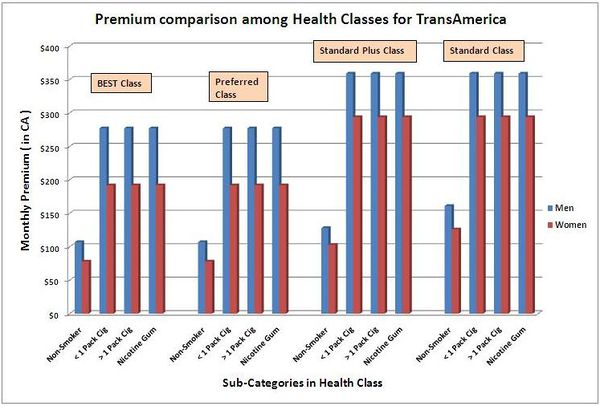

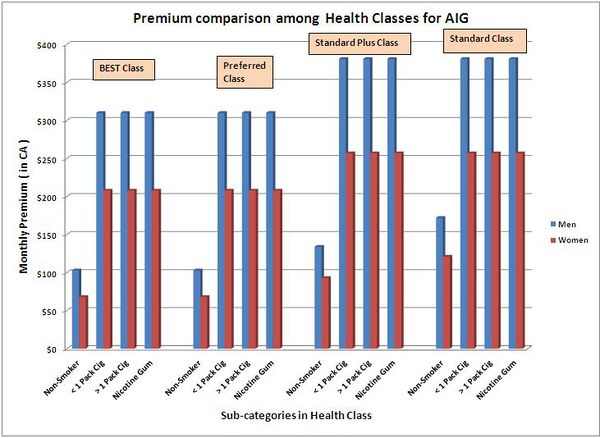

- The graphs presented below depict the premium charges of the respective insurance company for different health classes and sub-categories based on smoking habits.

- It is noteworthy that although the companies charges less premium for women than men, but the increase in premium as the health class shifts, is higher for women than men. This is an indicative that the companies maintain a policy of risk averseness for women as their health class goes down.

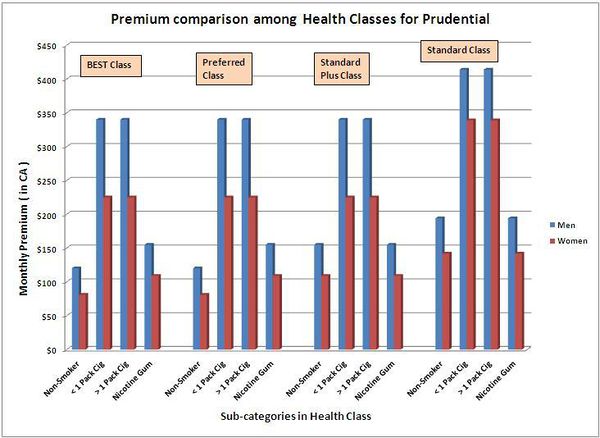

Pruco Life Insurance Co. (Prudential)

- Although Prudential charges higher premium for other categories, the charges are least for nicotine patch users.

- The premium charges for nicotine users are only 29% higher for men and 35% higher for women than the non-smokers in the Best and Preferred health class.

However, premium variation among smokers are as follows:

- For Standard Plus and Standard health class, the premium charges for Non-smokers and Nicotine patch users are same. This indicates that the company may be treating these two segments as one or at par with each other.

- From the graph we find that as the health class of the Non-smoker moves from Best/Preferred health class to Standard, the premium charged increases by 29% for men and 35% for women in Standard Plus and by 62% for men and 75% for women in Standard health class. This shows that the sensitivity of the company increases with the decrease in health condition and they are more sensitive to Standard health segment.

- One interesting thing to note is that the company charges the same premium for both men and women who smoke for the health classes – Best, Preferred and Standard Plus. However the premium increases by 22% (< 1 pack of cigarette) and 25% (> 1 pack of cigarette) for men while for women it increases by 51% and 30%.

- The highest rate differential is found in the Best and Preferred segments where the average rates between Non-smokers and Smokers (excluding nicotine patch users) differ by 181%.

Reliastar Life Insurance company (ING)

- The highest rate differential is found in the Best and Preferred segments where the average rates between Non-smokers and Smokers differ by as much as 209%.

Trnasamerica Life Insurance Co.

- The highest rate differential is found in the Standard Plus segment where the average rates between Non-smokers and Smokers differ by as much as 183%.

American General Life company (AIG)

The highest rate differential is found in the Best and Preferred segments where the average rates between Non-smokers and Smokers differ by as much as 203%.

Genworth Life Insurance company (Genworth Financial)

- The highest rate differential is found in the Best and Preferred segments where the average rates between Non-smokers and Smokers differ by as much as 229%.

- In AIG, monthly premium for men who smoke more than 1 pack of cigarettes a day remains constant at $413 in all health classes.

- In AIG, monthly premium for women who smoke more than 1 pack of cigarettes a day in Best health class is $219 which increases by 34% to $294 for all other health classes.

Constraints

- This study incorporates only five insurance companies because of the constraint of data availability.

- The study is limited only to the state of California; however, we observed that the premium charges in other states are similar to that of California.