Objective

- To perform sensitivity analysis and qualitatively determine the variation in monthly premium charged by the life insurance companies.

- To understand Life Insurance companies behavior towards the consumers of different gender and belonging to different health groups.

Assumptions

- Height and Weight for men and women is taken as the median height and weight prevailing in USA.

- Coverage Amount is based on the median annual household income of USA taken as $50,000 and Term duration is assumed as 15 years.

Overview of Life Insurance

Introduction

- Life Insurance is a contract between the policy owner and the insurer, where the insurer agrees to pay a sum of money upon the occurrence of the insured individual's or individuals' death or other event, such as terminal illness or critical illness.

- In return, the policy owner agrees to pay a stipulated amount called a premium at regular intervals or in lump sums.

- To be a life policy the insured event must be based upon the lives of the people named in the policy.

- Life policies are legal contracts and the terms of the contract describe the limitations of the insured events. Specific exclusions are often written into the contract to limit the liability of the insurer; for example claims relating to suicide, fraud, war, riot and civil commotion.

Source: http://en.wikipedia.org/wiki/Life_insurance

Why to go for Life Insurance Policy

- To make sure their family will be well taken care of if they die.

- To minimize tax burden and to ensure whatever they have earned goes to their heirs as it is a tax free way to transfer their wealth.

- The value for the policyholder is derived, not from an actual claim event, rather it is the value derived from the 'peace of mind' experienced by the policyholder, due to the negating of adverse financial consequences caused by the death of the Life Assured.

- Some insurance policies like Universal life insurance, whole life insurance and some term life insurance can be settled for cash value, the value that can be borrowed against or cashed in when the owner needs money.

- To cover post death expenses like funeral, medical bills and to settle debts.

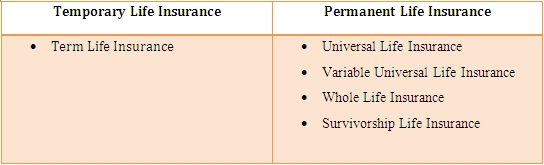

Types of Life Insurance

Broadly Life Insurance is divided into Temporary Life Insurance and Permanent Life Insurance. These can be further sub classified. Various life insurance policies prevailing in United States are:

Depending on the requirements of the individuals companies are giving them an option whereby they can convert their temporary insurance policy to permanent insurance policy.

Term Life Insurance

Term life insurance provides death benefit coverage with a guaranteed level premium for a specific period of time - usually 10, 15, 20 or 30 years depending upon which product you choose.

Term life insurance can help one’s family pay for necessary expenses if he/she dies unexpectedly. The death benefit can help the family maintain their lifestyle, cover children’s college tuition and pay off a mortgage.

Benefits of term life insurance:

Segmentation in Life Insurance

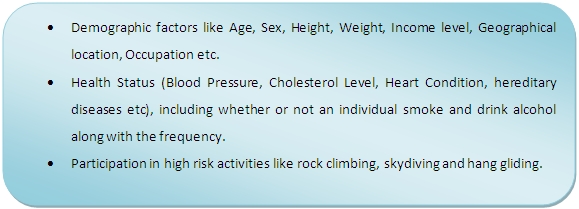

Segmentation in Life Insurance industry is done on the basis of:

Companies call these segments as rating classes. Different companies give different weights to different diseases and they have their own health check list while developing these rating classes. All people in a rating class do not have the same life span but, they have a fairly predictable life expectancy. This give companies a basis to determine premiums.