Overview

Surface Energy

- Surface energy is a measure of how well an adhesive wets out over the surface of the material to which it is applied.

- The most common method of determining the surface energy is to measure the contact angle of a water droplet on the substrate surface.

- The contact angle between the solid and the fluid is the angle measured within the fluid, between the solid surface and the tangent plane to the liquid surface at the point of intersection.

- A contact angle of greater than 90° indicates that the fluid (which is ink or adhesive in this case) has not wet the surface. Conversely an angle of less than 90° means that the fluid has wet the surface - if the angle approaches zero then the surface is completely wetted by the fluid.

- The surface energy or the wetability of a particular substrate is measured in dynes/cm. Source

Low Surface Energy Substrates

- Low energy plastics, such as polypropylene (PP), polyethylene (PE) and Teflon (PTFE) are essentially "non- stick" plastics.

- Their molecular structure inhibits the adhesion and printing processes - this molecular structure is basically inert or inactive – these polymers are said to have a low surface energy.

- Materials with low surface energy (LSE) do not allow adhesives to wet out, while materials with high surface energy (HSE) provide excellent wet-out, providing the best adhesion.

- Rubber-based adhesives usually provide better adhesion to LSE surfaces.

- Some substrates require special treatment such as corona treating, primers, top coating, etc., in order to achieve better adhesion.

- On some LSE substrates, adhesion levels improve the longer adhesive is applied. Source

Adhesion

- Adhesion is the molecular force of attraction between unlike materials.

- Adhesion and cohesion, attractive forces between material bodies. A distinction is usually made between an adhesive force, which acts to hold two separate bodies together (or to stick one body to another) and a cohesive force, which acts to hold together the like or unlike atoms, ions, or molecules of a single body.

- For example water molecules stick to each other. This is caused by hydrogen bonds that form between the slightly positive and negative ends of neighboring molecules.

- Water is found in drops; perfect spheres. It’s hard to imagine water behaving any other way due to cohesion and water molecules stick to other surfaces due to adhesion.Source

Pressure Sensitive Adhesive(PSA)

- Pressure sensitive adhesives are adhesives that adhere to a variety of substrates when applied with pressure.

- The primary mode of bonding for a pressure sensitive adhesive is not chemical or mechanical but polar attraction to the substrate surface.

- Applied pressure is necessary in order to achieve sufficient wet-out onto the substrate surface to provide adequate adhesion. Source

Market Information

- According to a report from the Business Communications Company, the 2001 US market for specialty adhesives was about $5.7 billion, and is forecast to grow at 4.3% per year, with medical and dental applications being the fastest-growing sector at 5.9% per year. Source

- Frost and Sullivan report the size of the European PSA market (medical and non-medical) to be $620 million in 2000, forecast to grow to $796 million in 2007. Source

- The world value of the overall adhesives market is estimated at US $22 billion.

- Total Market Expected to Grow at a CAGR of 9 Percent: The U.S. PSA markets for labels and narrow-web graphics is expected to growth with a CAGR of 9 percent during the years 2006–2012. The total U.S. PSA markets for labels and narrow-web graphics unit shipments are expected to continue to growth at a CAGR of 6.6 percent due to high end-user growth. The UV technology is a new technology that have started to receive wide acceptance in the industry and that segment of the industry is a fragmented and developing segment with growth rates in double digits. While the solvent-based PSAs are expected to show decreasing growth percents, the water-based and solvent-based segments are expected to growth in the lines of the total industry. Source

- According to World Adhesives File 2000-2005, the leading handful of adhesives suppliers, including pressure sensitive companies, already controlled almost half the global market in 1999. Henkel leads the way with an estimated 12% global market share, which will probably increase to around 14% with the purchase of Dexter’s adhesives interests. Pressure sensitive suppliers 3M and Avery Dennison are ranked second and third, with 9% and 7% shares respectively, followed jointly by National Starch and H.B. Fuller — both at 6%. The newly enlarged Atofina and Rohm and Haas follow closely behind.” Source

- Growth of the world market averages about 2-3% per year.

- Packaging adhesives make up the majority of the market.

- The electronic and medical adhesives market is currently experiencing the most rapid growth.

- Market leaders by country are as follows:

- United States - approximately 2.6 tonnes annually

- China

- Japan

- Germany

- UK

- Market leaders by company(which account for one-third of the market share) are:

- Henkel

- 3M

- Avery Denison

- HB Fuller

- National Starch

- Atofina

Intellectual Property

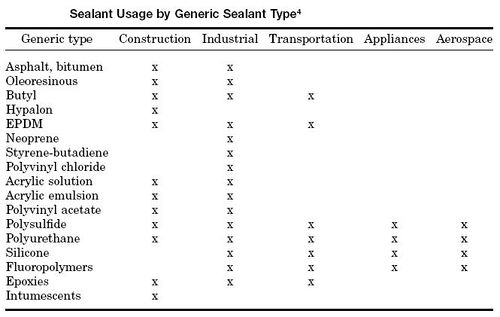

Patent Search Table

| ||||

| Query.No. | Searched Sections | Years Searched | Query | Hits |

| 1 | Claims, Title or Abstract | 1836 – Date | (rubber OR acryl* OR silicone OR oil*1 OR resin*1 OR ethylen* OR isoprene OR terpene OR copolymer* OR vinyl* OR siloxane* ((acid OR anhydride) ADJ1 (acrylic OR crotonic OR (vinyl ADJ1 acetic) OR fumaric OR maleic OR malonic OR succinic OR itaconic OR citraconic)) OR polymer* OR styrene OR ester*) SAME (((pressure ADJ1 sensitive) NEAR2 (adhesive* OR glue OR paste OR (binding ADJ1 agent) OR (epoxy ADJ1 resin*) OR film) OR PSA OR PSAs) OR (adhesion* WITH (peel OR tensile OR shear) OR stick*) OR (radical* ADJ1 (initiator* OR maker*))) | 76006 |

| 2 | Claims, Title or Abstract | 1836 – Date | (((low ADJ surface ADJ energy) WITH (substrate*1 OR polymer OR compound* OR material OR film)) OR (surface ADJ1 tension) OR (surface ADJ1 rough*) OR viscosity OR (oily ADJ surface) OR (low ADJ1 energy ADJ1 surface*)) AND (polyolefin*1 OR polyethylene*1 OR polypropylene*1 OR (polyvinyl ADJ1 chloride ADJ1 film) OR (oil ADJ1 contaminated ADJ1 metal) OR polybutene OR polyisoprene*1 OR (polyvinylidene ADJ1 fluoride*) OR polytetrafluoroethylene*1 OR polyester*1 OR polyamide*1 OR polyacetal*1 OR polystyrene*1 OR polyurethane* OR polyurea OR silan* OR polycarbonate*) | 75602 |

| 3 | Claims, Title or Abstract | 1836 – Date | 1 AND 2 | 2272 |

- Total number of patents - 2272

- Total number of unique patent families - 1483

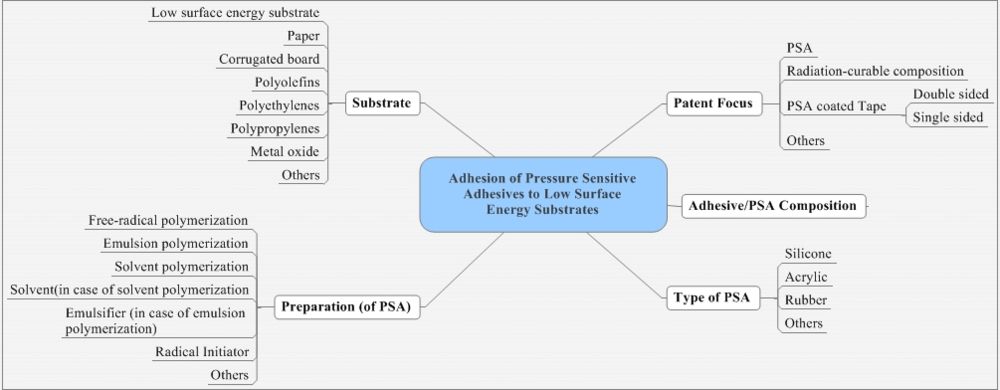

Taxonomy for analysis

Taxonomy for PSA composition

Composition components matrix

| Assignees | Rubber | Silicone | Polymers | Acrylic | Tackifying resin | Plasticizer oil | Carboxylic acids | Acid Esters | Priority Year | Patent numbers |

| 3M Innovative Properties Company | x | x | x | x | x | 2000 | US6630531 | |||

| x | x | x | x | 2000 | US6632872 | |||||

| x | x | 2000 | US6455634 | |||||||

| American Tape Company | x | x | 1997 | US5798175 | ||||||

| Ashland Oil, Inc. | x | x | x | 1991 | US5434213 | |||||

| Atlantic Richfield Company | x | x | x | x | 1984 | US4656213 | ||||

| x | x | x | x | 1996 | US5817426 | |||||

| x | x | x | 1996 | US5817426 | ||||||

| x | x | 1997 | US6461707 | |||||||

| Coloplast | x | x | x | 1980 | US6437038 | |||||

| Dow Corning Corporation | x | x | x | 1970 | US5916981 | |||||

| x | x | 1990 | US6337086 | |||||||

| x | 1990 | US6121368 | ||||||||

| x | x | 1994 | US5561203 | |||||||

| x | x | 1996 | US5861472 | |||||||

| Exxon Chemical Patents Inc. | x | x | 1993 | US5714254 | ||||||

| Fujikura Ltd. | 2000 | US6388556 | ||||||||

| General Electric Company | x | x | 2000 | US6387487 | ||||||

| H Fuller Licensing & Financing, Inc. | x | x | x | x | x | 1996 | US5741840 | |||

| H. B. Fuller Licensing & Financing, Inc. | x | x | x | 1997 | US5869562 | |||||

| Johnson & Johnson Products Inc. | x | x | x | x | 1981 | US4335026 | ||||

| Minnesota Mining and Manufacturing Company | x | x | x | 1993 | US5602221 | |||||

| x | x | x | 1993 | US5612136 | ||||||

| Nichiban Company Limited | x | 1997 | US6274235 | |||||||

| None | x | x | x | x | 1996 | US20030136510 | ||||

| PPG Industries, Inc. | x | x | x | x | 1996 | US5776548 | ||||

| Ralf Korpman Associates, Inc. | x | 1992 | US5760135 |