Rationale

- Financial markets are a part of the changing business paradigms, across the globe - G. N. Bajpai

- Today, globalization of competencies, thinking and perspectives has been the part of Strategic Action Plan of all the major players in the financial markets, globally - G. N. Bajpai

- "The focus over the last year has been around proving the value of IT as a key contributor to business success," - David Holtzman

- Real-time documents provide faster time to market with a personal touch - Penn National Insurance

Search Strategy

Search date: 14 Sept, 2006

Database: Micropatent (PatSearch Fulltext)

Search Strings, Hits & Scope:

- Search I

- Query: (Life) AND (Insurance OR Reinsurance OR Polic* OR Annuit*) - 532 hits

- Search scope – Title, Abstract & Claims, Date - 2000 till date

- Databases: US, EP, WO, JP, DE, GB and FR (common for all)

- Search II

- Query: (computer) and (Insurance OR Reinsurance) and (Polic* OR Annuit*) – 511 hits

- Search scope – Title, Abstract & Claims, Date 1991 till date

- Search III

- Query: (Insurance OR Reinsurance OR polic* or Annuit*) limited by assignee (Insurance OR Bank) – 345 hits

- Search scope – Title, Abstract & Claims, Date – 1991 till date – 345 hits

- Total # of records - Search I + Search II + Search III = 1239 (excluding duplicates and family members but includes off-target)

Note: All search hits exclude family members and duplicate patent records

Market data - Insurance sector

- Insurance and risk management is an immense global industry. In America alone, the insurance business employs about 2.5 million people

- Life and health insurance in the United States will be about a $725 billion in gross revenues business in 2006, compared to only about $500 billion in 2002

- U.S. life insurance firms hold about $3.8 trillion in assets

- Personal lines comprise another vast sector of insurance. For example, private passenger automobile insurance will be about a $172 billion annual premium market in the U.S. for 2006

- Homeowners insurance is about a $50 billion market

- Property and Casualty insurance premiums will total about $450 billion in the U.S. for 2006

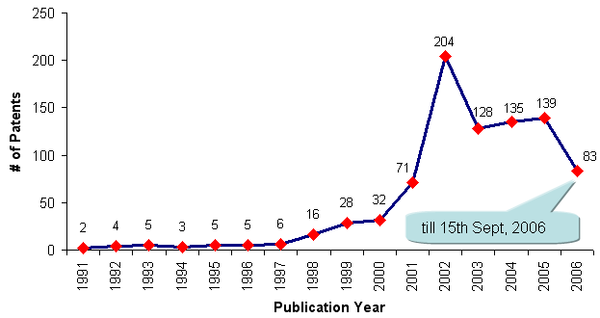

Year wise IP activity

- Graph depicts IP activity based on publication year

- Trend indicates high IP activity during 2002 followed by sudden fall during 2003, since then recovering gradually

Assignee wise IP activity

- Graph depicts assignee and number of patents to their credit

- Assignees having single or double patent record depicted in table

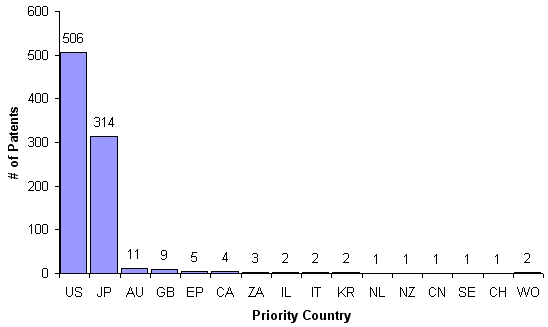

Country wise IP activity

- Graph indicates IP activity based on priority country

- Maximum number of patent records filed in United States (506) followed by Japan (314) and Australia (9)

- Country code

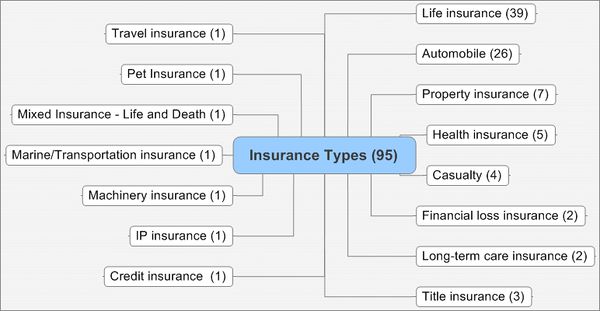

Distribution of patents - Based on insurance type

- 95 patents have been analyzed and categorized based on type of insurance

- For definitions follow the link

- Number in () indicates # of patents

- Trend - Top insurance filing sectors

- Maximum number of patents file under life insurance category (39) followed by

- Automobile insurance (26) and

- Property insurance (7)

Distribution of patents - Based on activity

- Above 95 patents further analyzed for more granularity to project various patterns involved

- Trend based on various activities under insurance:

- Maximum patent filed on insurance information management system (23) followed by

- Insurance payment process (21) and on

- Insurance selling system and various selling parameters (15)

Overall Trend - Based on insurance sector and respective activities

Automobile Insurance

- Customize insurance policy and customized insurance premium for different cars and people

- Keeping uninsured from driving

Casualty insurance

- Automatic accident reporting system of an insured person

Health insurance

- Pharmacy benefits calculator – selects a cost effective insurance plan form the group of plans

General Insurance

- Capability modeling – Computerized, customized and flexible insurance accepting, declining and design system

- Contract management –

- Converting current insurance contract to newly launch insurance terms

- System for decreasing insurance – Computer program calculates point based on the transaction data

- Reducing insurance policy issuing time by automating assessment processing - Application contents are automatically assessed after checking predefined conditions on applicant terminal

- Real-time insurance coverage verification system

- Online policy and insurance portfolio analysis for greater value and low risk – Analyzing data of present and proposed insurance policies and provides user comparative output for different policies

- Automated insurance processing – processes (mainly verifies) current status of insurance policies

- Risk assessment system – evaluates history of natural/man made disasters in a particular geographical area and sets insurance premium

- Insurance selling system – online auction for life settlement and vertical transactions

- Straight through processing – Insurance policy issuance and management system

Life Insurance

- Annuity – Automated benefit scheme administration apparatus

- Package – Selling other services (funeral plan) along with life insurance

- Retirement – Computer based retirement planning and income arrangement system

Property insurance

- GPS Mobile insurance system – Monitoring current location and condition