Executive Summary

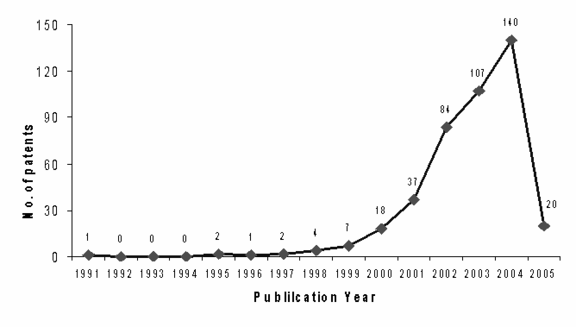

IP activity in the area of RFID-based supply chain applications seems to have started in 1991, and peaked in 2004. Most of the action in the integration of electronic identification system (RFID) with software system in supply chain applications has taken place in the last ten years or so.

Around 423 patents have been published in the span of 4.2 years from 2000 till February 2005. The major market in RFID-based supply chain applications appears to be the United States.

Technology area focus by key players

- Digital Data Processing

- Communication Techniques

- Computing, calculating, counting

- Recognition of data; Presentation of data

- Signaling Or Calling Systems

Some of the key players identified are

- United Parcel Service

- G.E.

- Silverbrook

- Micron Technology

- NCR Corporation

- SAP AG

- Savi tech.

Various software applications cited in patents

- Business applications

- UPS Supply Chain Solutions

- Anti-collision software

- Program for correlating the environmental condition data with the location data.

- Software applications (Web application" TagDetect")

- Software applications supporting a client-server system or n-tiered computer system.

- MW (Micro-warehouse) enterprise application

- XML middleware such as Biz Talk software

- ERP system, web ordering system

- BeefLink Software

- Source code, object code, or scripting code.

Key application areas identified

- Food and pharma industry

- Semiconductors and High-value electronic items

- Asset and materials management system

- Commercial enterprise

- Beef industry

- Airport and shipyard

Key RFID Tracking applications

- Assets

- Equipment

- Materials

- Orders

- Personnel

- Processes

- Products

- Production

- Quality

- Resources

RFID - Market Potential

- The global forecast RFID hardware, middleware, and IT market was worth $640 million in 2005. In 2006, this number will grow to more than $713 million, and is projected to reach more than $1.0 billion by 2011 at an average annual growth rate (AAGR) of 8.0%

- The RFID market is anticipated to continue to grow rapidly in these and many other market sectors and industries including the food and drug industry, propelled by United States FDA mandates. The technical issues that have made standardization more challenging are heading toward resolution with the emergence of the second-generation of UHF RFID.

- Retail RFID is estimated currently at just under 27% of the overall RFID market, and supply chain management (SCM) applications, when considered as separate from warehouse and distribution and transportation, represents just over 15% of the overall RFID market. These distributions will undoubtedly change rapidly, and should be reconsidered at regular time intervals as the RFID technology and established and emerging markets mature.

(Source - BCC Research)

Introduction to RFID technology in supply chain

The supply chain is a complex multi-stage process which involves everything from the procurement of raw materials used to develop products, and their delivery to customers via warehouses and distribution centers. Supply chains exist in service, manufacturing and retail organizations.

Although, the complexity of the chain may vary greatly from industry to industry and firm to firm. Supply chain management can be seen as the supervision of information and finances of these materials, as they move through the different processes, by coordinating and integrating the flows within and among the different companies involved.

The efficiency of the supply chain has a direct impact on the profitability of a company. It is no surprise therefore to find that many large corporate companies have made it a key part of their strategy, and invested heavily in software systems (ERP, WMS...) and IT infrastructure designed to control inventory, track products and manage associated finance.

RFID will bring a new dimension to supply chain management by providing a more efficient way of being able to identify and track items at the various stages throughout the supply chain. It will allow product data to be captured automatically, and therefore be more quickly available for use by other processes such as ASN, stock management and real time billing.

Search approach and project scope

The first task was to find the relevant U.S. granted patents, and EP granted patents or published patent applications. This was done for all patents published in years 1975 to 2005. This range of years is more than sufficient; but almost all of the action has taken place in the last ten years or even considerably lesser time in some categories.

Identified patents in RFID-base supply chain applications category using a patent search filter. Filter development and testing is usually the most difficult and time-consuming part of a patent analysis, and that was certainly not the case in this research.

Patent search filters are sometimes relatively simple, but more often complex. Combinations of patent invention art classifications and keywords in titles, abstracts and claims were targeted for search. Because I was working with a combination of US and EP documents, I used classifications based on the International Patent Classification (IPC) system.

Details on the approach of search is given in search strategy. Since the scope of project is limited to test, therefore only 30 patent records were selected for quantitative analysis and 15 for qualitative analysis.

Most of the indicators could not be project due to insufficient data.

Objective:

The aim of this project is to identify IP activity in the area of RFID-Based supply chain applications primarily focused on the application of software in warehouse, distribution, inventory control and also the related applications.

Data Interpretation:

Appropriate patent records were selected for analysis. The selection criteria was based on:

- Type of RFID tags (Active, Passive, Microwave or Chipless)

- Type of receiver (Mobile, Handheld, fixed)

- Tag system (Read-only/WORM (Write once read many times)/Read-Write tags)

- Type of reader (Interrogator)

- Type Sensor and RFID frequency

- Receiver link and software

- Applications by where the event takes place (Airport, shipyard, factory, warehouse etc.)

- Process involved (Shipping, receiving, inventory etc.)

- Type of software used (Middle ware, applications etc.)

Search strategy:

Date of search: xyz

Database used: USPTO, EPO and PatFam

Keywords used for searching are listed below:

| Device term | Action term | Application term | Other important terms |

| RFID | Data Track* | Supply chain | Software |

| Electronic identification | Data Captur* | Distribution | Program |

| Data Collect* | Warehouse | Computer | |

| Data Read* | Inventory |

The total number of patent records on RFID based supply chain applications sourced through search was 212, but only 30 records were selected for analysis. An additional broad search conducted (database: PatFem) to understand the actual IP activity (based on keywords and assignees) as depicted in below tables:

Search based on keywords and relevant hits:

| S. No | Key words | Search scope | No. of records available |

| 1 | RFID | 1975-2005 | 6147 |

| 2 | RFID AND WAREHOUSE | 1975-2005 | 444 |

| 3. | RFID and (SUPPLY CHAIN) | 1975-2005 | 212 |

| 4. | RFID and transportation | 1975-2005 | 573 |

| 5. | RFID and distribution | 1975-2005 | 1141 |

| 6. | RFID and SOFTWARE | 1975-2005 | 2301 |

Search based on assignees with relevant hits:

| S. No | Assignee | Search scope | No. of records available |

| 1 | 3M INNOVATIVE PROPERTIES COMPANY | 1975-2005 | 146 |

| 2 | SENSORMATIC ELECTRONICS CORPORATION | 1975-2005 | 66 |

| 3 | HEWLETT PACKARD DEVELOPMENT COMPANY | 1975-2005 | 63 |

| 4 | NOKIA | 1975-2005 | 58 |

| 5 | PHILIPS ELECTRONICS | 1975-2005 | 54 |

| 6 | SYMBOL TECHNOLOGIES INC | 1975-2005 | 49 |

| 7 | AVERY DENNISON CORPORATION | 1975-2005 | 24 |

| 8 | KIMBERLY CLARK | 1975-2005 | 19 |

| 9 | SILVERBROOK RESEARCH PTY LTD | 1975-2005 | 19 |

| 10 | UNITED PARCEL SERVICE OF AMERICA INC | 1975-2005 | 16 |

| 11 | IBM | 1975-2005 | 15 |

| 12 | SAP | 1975-2005 | 14 |

| 13 | SAMSYS TECHNOLOGIES | 1975-2005 | 11 |

| 14 | MEADWESTVACO CORPORATION | 1975-2005 | 8 |

| 15 | DE LA RUE INTERNATIONAL LIMITED | 1975-2005 | 8 |

| 16 | SAVI | 1975-2005 | 6 |

| 17 | MICROSOFT | 1975-2005 | 5 |

| 18 | WESTVACO CORPORATION | 1975-2005 | 5 |

| 19 | SENSITECH | 1975-2005 | 3 |

| 20 | UNITED SECURITY APPLIC ID INC | 1975-2005 | 3 |

| 21 | GAP INC | 1975-2005 | 2 |

| 22 | SEMBCORP | 1975-2005 | 1 |

| 23 | SHAW IP PTY LTD | 1975-2005 | 1 |

| 24 | EXAGO PTY LTD | 1975-2005 | 1 |

Patent analytics

IP landscape over years

IP landscape over years: Growth in RFID base supply chain applications

(Actual scenario based on 423 patent records)

According to the search data IP activity in RFID base supply chain applications seems to have started during the year 1991. The graph shows terrific growth from 2000 onwards and high activity during 2004 with 140 patents records alone. Around 423 patents have been published in the span of 4.2 years from 2000 till date (Feb. 2005) indicating the potential in the field.

IP landscape by region

IP landscape by region: RFID base supply chain

(Based on selected 30 records)

The present graph and interpretation is based on selected 30 records. The graph reveals that the growth in RFID based supply chain applications patenting has been across all the regions. United States is more active than Europe, Japan and Australia.

Competitor landscape

Competitor landscape - Growth in RFID base supply chain

(Based on selected 30 records)

The present graph and interpretation is based on selected 30 records. The graph indicate SAP as leading and consistent player with 3 patent records. EXAGO seems to be the new entrant in 2005. It is interesting to note that the competitors in 2004 have not shown any activity in the beginning of 2005.

Technology trend

Technology Trend (Main IPC)

(Based on selected 30 records)

| IPC Code | Description |

| G01N | Measuring, Testing – Investigating or analyzing materials by determining their chemical or physical properties. |

| G06F | Computing, calculating, counting - Electric Digital Data Processing |

| G07B | Checking device - Ticket-issuing; Fare-Registering Apparatus; Franking apparatus |

| G06G | Computing, calculating, counting – Analogue computers |

| G06K | Recognition of data; Presentation of data; Record carriers; Handling record carriers |

| G08B | Signaling - Signaling Or Calling Systems; Order Telegraphs; Alarm Systems |

| H04Q | Electric Communication Technique – Selecting (Switches, relays etc.) |

Technology landscape (Main IPC) - Growth in RFID base supply chain

(Based on selected 30 records)

The present graph and interpretation is based on selected 30 records. It is evident from graph that G06F(Electric Digital Data Processing) Technology is widely used in RFID based supply chain applications showing continues progress through out. The progress indicates key technology area targeted by many players and having market potential. Followed by G08B (Signaling), H04Q (Electric Communication Technique ) and G06K (Recognition of data; Presentation of data; Record carriers; Handling record carriers).

Technology Trend (Sub-class)

(Based on select 30 records)

| IPC Code | Description |

| G01N033569 | Measuring, testing or investigating or analyzing material by determining their chemical or physical properties for microorganisms. |

| G06F00700 | Methods or arrangements for processing data by operating upon the order or content of the data handled. |

| G06F01760 | Administrative, commercial, managerial, supervisory or forecasting purposes -electronic cash registers other than digital data processing aspects |

| G06F01900 | Record carriers for use with machines and with at least a part designed to carry digital markings |

| G06G00114 | Hand manipulating computing device for arrangements G07B01502 |

| G06K00500 | apparatus for collecting fares, tolls or entrance fee at control point with provision of taking account of variable factors such as distance or time e.g. for passenger transport |

| G06K00710 | Recognition of Data; Presentation of Data; Record Carriers; Handling Record Carriers by electromagnetic radiation, e.g. optical sensing by corpuscular radiation |

| G08B00108 | Signaling Or Calling Systems; Order Telegraphs; Alarm Systems for signaling characterized solely by the form of transmission of signal using electronic transmission |

| G08B00522 | Visible calling system, e.g. personal calling systems remote indication of seat occupied using electric or electromagnetic transmission. |

| G08B01314 | Burglar, theft, or intruder alarm by lifting or attempted removal of hand – portable articles. |

| G08B02300 | Alarm responsive to unspecified or abnormal conditions |

| H04Q00100 | Electrical comm. Technique, details of selecting apparatus or arrangement. |

| H04Q00522 | Selecting arrangements where one or more subscriber stations are connected by the same line into the exchanges. The subordinate center not permitting interconnection of subscriber connected thereto. |

Technology landscape – Assignee wise

(Based on select 30 records)

According to the present data, most of the leading players have focused on building sound: Administration, commerce, management, supervision and forecasting (electronic cash registers other than digital data processing) aspects for RFID-base supply chain applications.

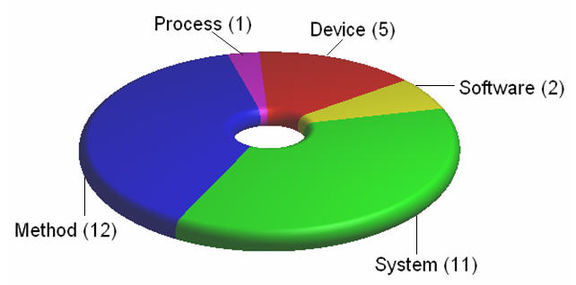

Qualitative Analysis

Classification of patents based on main claims

The following graph indicates various subjects that have been covered by various assignee in the area of RFID based supply chain applications. The various subjects are the result of SAO analysis. More granularity on subjects is presented in next slide in the form of clusters.

SAO analysis clustering

Problem Vs Solutions

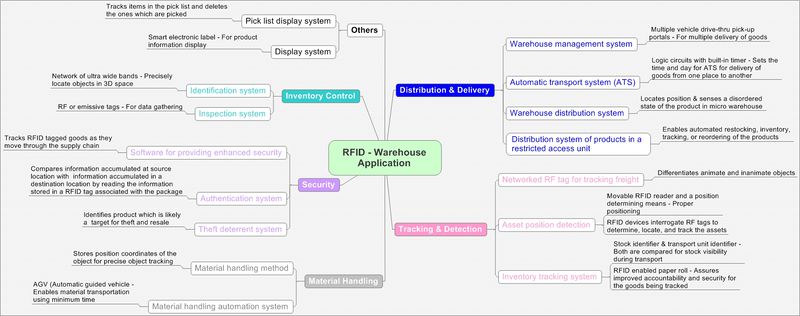

Main applications of RFID

Applications which appeared in analyzed patent records have been listed.

1. Logistics chain management system in Food and pharma industry

2. Global supply chain of semiconductors

3. Supply chain management of High-value electronic items & pharmaceuticals

4. Tracking system

5. Supply chain management

6. Inventory along a distribution chain

7. Asset and materials management system

8. Point-of-sale and point-of-delivery and/or distribution

9. Reusable transportation means

10. Materials handling

11. Commercial enterprise (personnel and asset retention system (PARS))

12. Tracking cargo through customs

13. Supply chain management in Beef industry

The product moves through the global supply chain which involves various stages (places and processes). Next slide indicate the details about the various stages involved in supply chain applications, software applications and hardware used.

Main applications of RFID along with various stages, S/W applications and H/W’s involved

Features cited in analyzed 15 patent records

1. The container can be reprogrammed to include updated logic, updated states, and/or updated expected event information. (US20040246130)

2. The system comprises a truck server and an optional in-truck data communications means, which comprise a digital cell phone or satellite link. (US20040201454)

3. A local computer communicates with the see-through display, information gathering devices, and orientation sensors, optical tracking system, and business applications over one or more networks. (US20040182925)

4. OmniTRACS.RTM., which is a two-way satellite communication system that allows trucks to be monitored and tracked and to allow data communication with dispatchers. (US20040174260)

5. The data report from the reporting software can alert the user as to when the detrimental event occurred and identify the custodian who caused the detrimental event. (US20040049428)

6. Web-based information system for a beef marketing alliance; value-based procurement, and supply chain management. (US20020158765)

7. The software contains a component for determining the best time for an animal to go to slaughter based on a target weight. (US20020158765)

SWOT analysis

| Strengths * Advanced technology * Easy to use * High memory capacity * Small size |

Weaknesses * Lack of industry and application standards * High cost per unit and high RFID system costs * Weak market understanding of the benefits of RFID technology |

| Opportunities * Could replace the bar code * End-user demand for RFID systems is increasing * Huge market potential in many businesses * Need for standardization |

Threats * Ethical threats concerning private life * Highly fragmented competitive environment |

Conclusion

It has been observed that selection of RFID tag depend up on the frequency desirable in supply chain application. Industrial attentions is on passive RFID technology. The integration of software technology with electronic identification system will definitely give new dimensions to the supply chain management.