Difference between revisions of "Olympus Corporation- Company Profile"

(→Key Facts) |

(→Key Financials) |

||

| Line 59: | Line 59: | ||

|- | |- | ||

|align = "center" rowspan = "2"|'''Revenue''' | |align = "center" rowspan = "2"|'''Revenue''' | ||

| − | |2011: | + | |2011: ¥ 847.10 B / $ 10.58 B |

|- | |- | ||

| − | |2010: ¥ 883. | + | |2010: ¥ 883.08 B / $ 11.03 B |

|- | |- | ||

|align = "center" bgcolor = "#DBE5F1"|Revenue Change | |align = "center" bgcolor = "#DBE5F1"|Revenue Change | ||

| Line 67: | Line 67: | ||

|- | |- | ||

|align = "center" rowspan = "2"|'''Operating Income''' | |align = "center" rowspan = "2"|'''Operating Income''' | ||

| − | |2011: | + | |2011: ¥ 35.4 B / $ 442 M |

|- | |- | ||

| − | |2010: | + | |2010: ¥ 60.1 B / $ 751 M |

|- | |- | ||

|align = "center" bgcolor = "#DBE5F1"|Operating Income Change | |align = "center" bgcolor = "#DBE5F1"|Operating Income Change | ||

| Line 75: | Line 75: | ||

|- | |- | ||

|align = "center" rowspan = "2"|'''Net Profit''' | |align = "center" rowspan = "2"|'''Net Profit''' | ||

| − | |2011: | + | |2011: ¥ 7.38 B / $ 92.25 M |

|- | |- | ||

| − | |2010: | + | |2010: ¥ 47.76 B / $ 597 M |

|- | |- | ||

|align = "center" bgcolor = "#DBE5F1"|Net Profit Change | |align = "center" bgcolor = "#DBE5F1"|Net Profit Change | ||

| Line 83: | Line 83: | ||

|- | |- | ||

|align = "center" rowspan = "2"|'''R&D Expenses''' | |align = "center" rowspan = "2"|'''R&D Expenses''' | ||

| − | |2011: | + | |2011: ¥ 67.28 B / $ 841 M |

|- | |- | ||

| − | |2010: | + | |2010: ¥ 61.85 B / $ 773 M |

|- | |- | ||

|} | |} | ||

Revision as of 01:29, 20 September 2011

Contents

Company overview

OLYMPUS CORPORATION, a Japan-based manufacturer, mainly manufactures and sells medical products, life and industrial products, imaging products, information communication products and other products. The Company operates in five business segments.

- Medical Systems: Manufacture and sale of medical endoscopes, surgical endoscopes, endoscope disposal equipment and ultrasonic endoscopes

- Life and Industrial: Provides biological microscopes, industrial microscopes, endoscopes for industrial use and non-destructive testing equipment

- Imaging: Manufacture and sale of digital cameras and voice recorders

- Information Communication: Sale of mobile terminals, such as cellular phones

- Others: Development of biomaterials and systems, industrial endoscopes, nondestructive inspection equipment, printers, mobile solutions and mobile contents services, the development and sale of package software, the sale of semiconductor-related equipment and electronic machines, as well as the development of systems

In August 2009, the Company disposed its analytical equipment business to its wholly owned subsidiary, which has been engaged in the manufacturing and sale of clinical laboratory examination equipment. In addition, the Company has sold the subsidiary to Beckman Coulter, Inc. on August 1, 2009. As a result, the Company holds no stake in the subsidiary.

As of March 31, 2011, the Company has 188 subsidiaries and 11 associated companies.

Key Facts

| Established | 1919 |

| Headquarters | Tokyo, Japan |

| Type | Public Company |

| Website | www.olympus-global.com |

| Regional involvement | Worldwide |

| Business lines | Manufacture and Sales of precision machinery and instruments |

| Employees | 34,391 Medical System Business: 15,000 Approx. |

| Group Companies | Approx. 180 Subsidiaries |

| Chairman & CEO | Tsuyoshi Kikukawa |

| President & COO | Michael C. Woodford |

| Consolidated Net Sales (2011) | 847.1 Billion YEN |

Key Financials

| Olympus Corporation | |

| Financial Year End | March, 31st |

| Revenue | 2011: ¥ 847.10 B / $ 10.58 B |

| 2010: ¥ 883.08 B / $ 11.03 B | |

| Revenue Change | -4.07% |

| Operating Income | 2011: ¥ 35.4 B / $ 442 M |

| 2010: ¥ 60.1 B / $ 751 M | |

| Operating Income Change | -41.10% |

| Net Profit | 2011: ¥ 7.38 B / $ 92.25 M |

| 2010: ¥ 47.76 B / $ 597 M | |

| Net Profit Change | -84.45% |

| R&D Expenses | 2011: ¥ 67.28 B / $ 841 M |

| 2010: ¥ 61.85 B / $ 773 M |

Revenue Distribution

Source: SEC fillings

Patents Held by Business group

| Business Segment | Medical Systems | Life science & Industrial Systems | Imaging Systems | R&D/Innovation | Total |

| Japan patents | 2941 | 1067 | 2021 | 1131 | 7160 |

| US patents | 1059 | 680 | 1534 | 974 | 4247 |

| China patents | 405 | 86 | 444 | 90 | 1025 |

| Other patents | 948 | 249 | 102 | 165 | 1464 |

| Total | 5353 | 2082 | 4101 | 2360 | 13896 |

In Medical systems business, the company owns 39% of the total number of patents held by the company, with Japanese patents being the highest contributor to that.

Business Overview

Business lines

The company operates under the following business lines:

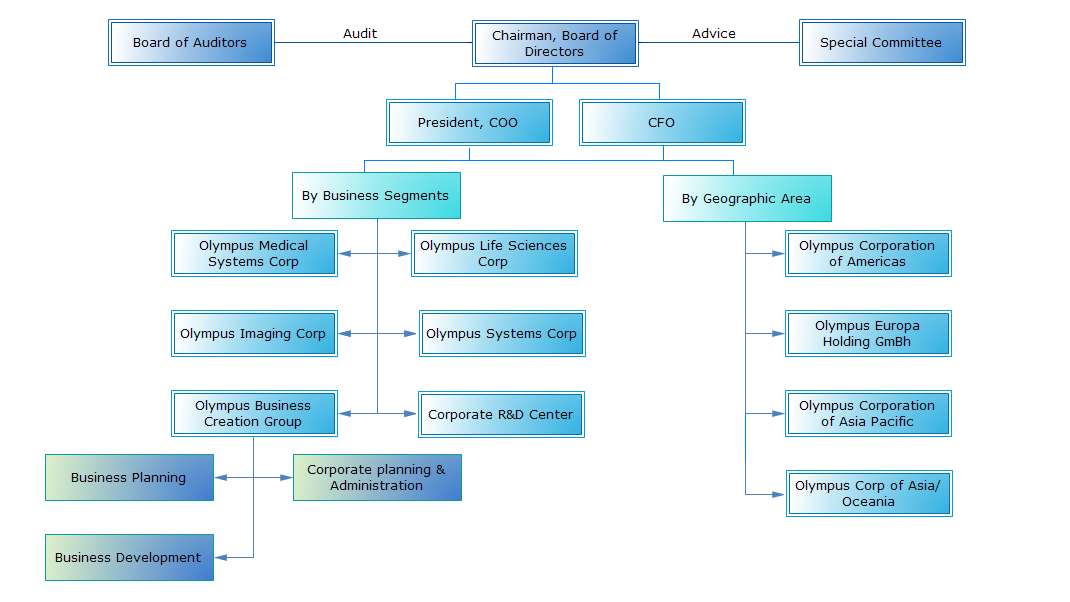

Organisation Structure

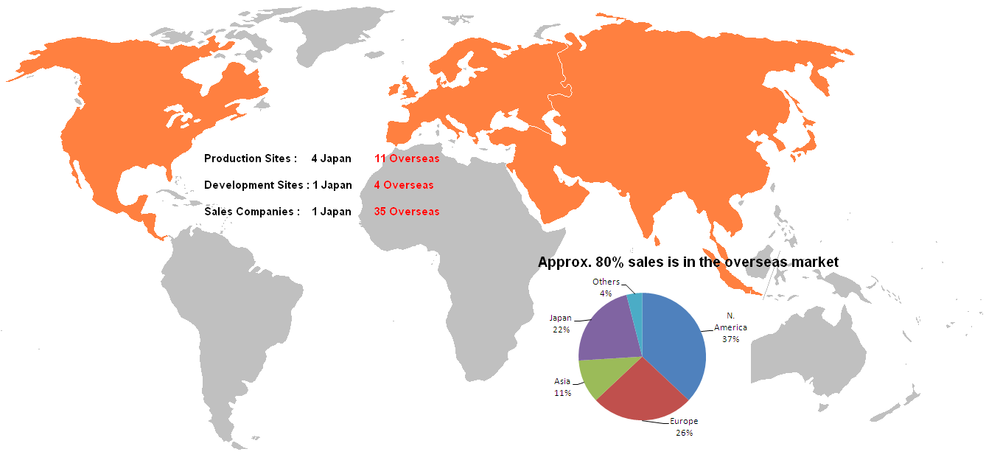

In April 2011, the company launched their regional headquarters for Asia and Oceania to coordinate regional strategy and facilitate business infrastructure development.

Medical Systems Business

The Medical Systems Business covers gastrointestinal endoscopes, surgical endoscopes, endotherapy devices, endoscopic ultrasound systems and medical information systems.

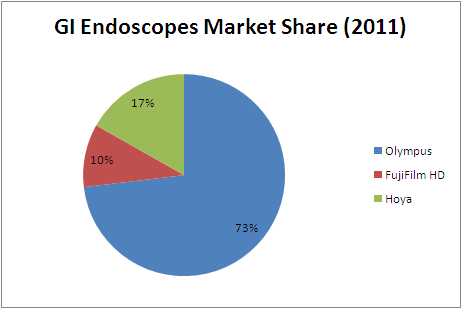

With an approximately 70% share, the Olympus group has secured a leading position in the global Gastrointestinal endoscopy market. Working to expand diagnostic coverage beyond the digestive system, the group is developing new equipment and new techniques ranging from diagnosis through treatment.

It's current research focus is on both minimally invasive treatment technology that reduces the burden on patients and product usability, for example, enhanced performance and functions to benefit doctors and technicians. The group's flagship products are equipped with a high-resolution endoscopic system and Narrow Band Imaging technology so that they can also support cancer diagnosis and treatment.

Medical systems business has the following business lines:

- Endoscopes

Endoscopic video imaging systems, medical information systems, fiberscope systems, broncho endoscope systems, endoscopic ultrasound systems; ultrasound fiberscopes; ultrasound probes; ultrasound centers; ultrasound-guided needle puncture systems; cleaning, disinfecting and sterilization systems; medical treatment peripherals; ancillary products - MIP includes surgical endoscopes and treatment equipments

- Endosurgery

Endoscopy products for gastroenterological surgery, thoracic surgery, urology, gynecology, orthopedic surgery, neurosurgery, cardiovascular surgery, anesthesiology and otolaryngology; treatment and surgical equipment; peripherals - Endotherapy

Endotherapy products

- Endosurgery

Revenue

Medical systems business is the biggest business segment of Olympus corporation:

- Net sales ratio : 40% approx.

- Contribution to total corporate operating income :109% approx.

- (before corporate allocation of expenses)

| Metrics ( in Billion Yen) | 2009 | 2010 | 2011 | |

| Medical Systems | Domestic | 76.2 | 75.1 | 79.4 |

| Overseas | 307.6 | 275.7 | 275.9 | |

| Total | 383.89 | 350.75 | 355.46 | |

| Endoscopes | Domestic | 44.6 | 40.9 | 43.8 |

| Overseas | 168.3 | 151 | 151.6 | |

| Total | 212.9 | 191.9 | 195.5 | |

| MIP | Domestic | 31.6 | 34.2 | 35.6 |

| Overseas | 139.3 | 124.6 | 124.3 | |

| Total | 170.9 | 158.8 | 159.9 |

Projections for FY 2012

Quarter 3

- In endoscopes, new shipments of some products (Lucera) have ground to a halt, but the company expects to see a rebound in 2nd Half. For the year as a whole it projects endoscope sales will be down 5% YoY.

- The company estimates 1st Half sales in the medical systems division at JPY165bn (-6% YoY), and OP at JPY27bn; it projects 2nd Half sales at JPY195bn (+8%) and OP at JPY43bn.

- In the medical systems division, new product launches are planned for both surgical endoscopes and energy devices (treatment tools).

- It projects sales of MIPs (surgical endoscopes, treatment equipment) at JPY180.5bn (+10% YoY). Sales in FY3/11 were flat YoY due mainly to the strength of the yen, but positive growth is expected this year.

- The company projects sales of gastrointestinal endoscopes at JPY164bn, -5% YoY, reflecting production setbacks in 1st Half.

- The earthquake’s impact has caused bottlenecks in purchasing of parts and materials for gastrointestinal endoscopes,leading to delays in product launches. In the latest telephone conference, the company offered no new information about timing. We believe there has been no real change from the company’s comments at the results briefing in May,and it remains to be seen whether the company will be able to launch its new products this fiscal year. The company’s FY3/12 earnings forecasts do not reflect any contribution from new products. Sales in the medical systems division got off to a slow start, falling short of projections in April-May.

Geographic Presence

Corporate Strategic Plan

- Expand the endoscopic business base ( Gastrointestinal )

- Gain a dominant market share and ensure profitability in the imaging field

- Early introduction and diffusion of next generation endoscope systems

- Establishment of a significant presence in emerging markets

- Diagnostic technology to promote early detection

- Endoscope technology to achieve definite diagnoses

- Imaging technology for achieving early detection :Narrow Band Imaging (NBI)

- Acquisition of approval of insurance reimbursement for medical effects from early cancer detection using NBI ( in Japan)

- Initiative for standardization of NBI observation as diagnosis

- Gain a dominant market share and ensure profitability in the imaging field

- Growth Drivers

- Expansion of EndoTherapy field

- Introduce Visera Elite, a new integrated endoscopy video system

- Secure a 30% share of the global operating room imaging market in 2015

- Expand the lineup of differentiated products focused on minimally invasive surgical techniques

- Achieve the top share (30%) of the existing global endoscopy market in 2015. Also, secure top share of the Japanese market and further strengthen the sales structure

- Expansion of Chinese and Asian market

- Introduce popularly prices models

- Expand the size of the market and share in such markets. Increase the number of endoscopists and improve their training.

- Expansion of EndoTherapy field

Endoscopes Business

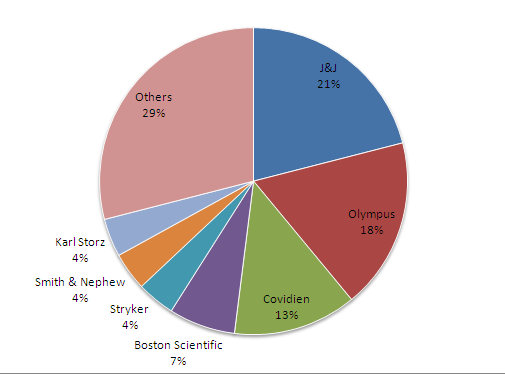

The worldwide endoscopy market (comprising laparoscopy, gastro-intestinal, visualisation, arthroscopy and urology

products, rigid and flexible scopes, implants, surgical and other instruments) was worth approximately US$21.3 billion in 2009. Olympus’ share of this market was estimated to be 18%($3.834B), behind market leader Johnson & Johnson with an

approximate 21% market share. In third place was Covidien (13%), followed by Boston Scientific (7%), Stryker (4%), Smith &

Nephew (4%) and Karl Storz (4%).

Product Portfolio

In the medical equipment market, growth in the inspection device field has been stagnant, although such therapeutic device fields as surgical and endotherapy devices have shown market growth and drawn attention for technological innovation.

- The Exera 2, the previous entry in the Exera series, used NBI technology to enable full-color endoscopy, allowing doctors to more easily recognize affected areas in their patients. This product thus addressed doctors’ needs in the area of visibility, and sales grew worldwide.

Recent Developments

Gastrointestinal Endoscopes Business

With an approximately 70% global market share for gastrointestinal endoscopes and an established position at the medical vanguard, Olympus maintains its passion for advancing technologies in response to doctors' needs

Diagnosis and Treatment using Gastrointestinal Endoscopy

Diagnosis

- Biopsy

- Cytodiagnosis

- Staining

Treatment

- Cancer (esophageal, stomach, colon, etc.)

- Varcies (esophageal)

- Foreign object retrieval ( esophagus, stomach)

- Hemostasis (stomach)

- Ployps (stomach, colon)

- Gallstones, bile duct stenosis (duodenum)

| Company ( in Billion Yen) | 2009 | 2010 | 2011 |

| Olympus | 212.89 | 191.94 | 195.45 |

| FujiFilm HD | 26.98 | 25.00 | 27.00 |

| Hoya | 48.87 | 47.00 | 45.00 |

Products Offered

Source: Company website

New Products

- Evis Lucera Colono-Videoscope: It helps in reducing the burden on patients and improving performance for both the inspection and treatment of colorectal cancer through the incorporation of two new functions, namely, high flexibility and highly responsive control at the insertion site, while adopting a thinner scope.

- Evis Lucera Gastrointestinal Videoscope: This slim gastrointestinal videoscope can be inserted through the nasal tract or the mouth to realise high quality images and is suited for the examination of lesions in the upper digestive tract, for example, in the stomach.

- Capsule Endoscopes:

They are non-invasive, endoscopic imaging by use of VIDEO CAPSULE ENDOSCOPES to perform examination of the gastrointestinal tract, especially the small bowel. After being introduced in 2007, they have become a revolution. High-resolution imaging, real-time viewing, ease of use and proprietary hard and software make EndoCapsule a comprehensive and powerful system - redefining capsule endoscopy.

One has to simply swallow the Endo capsule, a pill sized (11mm in external diameter and 26mm in length) capsule equipped with a tiny camera and lights, allows pictures to be taken of the entire small bowel. Endo capsule delivers high resolution images equivalent to those provided by endoscopes. EndoCapsule displays a clear and bright field of view for the fine observation of a variety of small bowel abnormalities.

The Real Time Viewer enables the physician to test the proper functionality before the procedure and to confirm the location of the capsule in the GI tract during the process. In addition it is now possible to check whether and when the capsule has left the stomach.

Product Details:- Supersensitive CCD

- Ultra compact lens

- Automatic Brightness Control adjusts illumination to maintain optimal imaging

- A wide depth of field provides superior observation

- 6 white LED lights always ensure a clear field of view

- Compact battery with energy efficient technology

The company is developing technologies to expand the application of capsule endoscopes to the stomach and large bowel.

Source: Company website, SEC fillings