Difference between revisions of "Project scope"

From DolceraWiki

(→Assignee wise IP activity) |

(→Assignee wise IP activity) |

||

| Line 92: | Line 92: | ||

* Assignees having single patent record are depicted in [[table]] | * Assignees having single patent record are depicted in [[table]] | ||

| − | [[Image:Assignee1.png|thumb|center| | + | [[Image:Assignee1.png|thumb|center|600 px|Assignee wise IP activity]] |

=Distribution of patents - Based on insurance type= | =Distribution of patents - Based on insurance type= | ||

Revision as of 01:03, 7 October 2006

Contents

- 1 Search Strategy

- 2 IP Activity Over Years

- 3 Assignees Involved – First cut

- 4 Other Assignees

- 5 Note

- 6 Deliverable

- 7 Insurance - Background

- 8 Market data - Insurance sector

- 9 Assignee wise IP activity

- 10 Distribution of patents - Based on insurance type

- 11 Distribution of patents - Based on activity

- 12 Overall Trend - Based on insurance sector and respective activities

Search Strategy

Search date: 14 Sept, 2006

Database: Micropatent (PatSearch Fulltext)

Search Strings, Hits & Scope:

- Search I

- Query: (Life) AND (Insurance OR Reinsurance OR Polic* OR Annuit*) - 532 hits

- Search scope – Title, Abstract & Claims, Date - 2000 till date

- Databases: US, EP, WO, JP, DE, GB and FR (common for all)

- Search II

- Query: (computer) and (Insurance OR Reinsurance) and (Polic* OR Annuit*) – 511 hits

- Search scope – Title, Abstract & Claims, Date 1991 till date

- Search III

- Query: (Insurance OR Reinsurance OR polic* or Annuit*) limited by assignee (Insurance OR Bank) – 345 hits

- Search scope – Title, Abstract & Claims, Date – 1991 till date – 345 hits

- Total # of records - Search I + Search II + Search III = 1239 (excluding duplicates and family members but includes off-target)

Note: All search hits exclude family members and duplicate patent records

IP Activity Over Years

The total count here is not equal to 1239, 8 patents (priority date prior to 1990) have already been dropped during 1st filtering process.

Priority date: The initial date of filing of a patent application, normally in the applicant's domestic patent office. This date is used to help determine the novelty of an invention.

Assignees Involved – First cut

- Assignee names available for only 687 out of 1239 patents

- 459 patents are having inventor name

- In 93 patent records assignee name is not available

- Dolcera will incorporate missing assignee names during the process wherever possible from known sources

Other Assignees

- There are other insurance companies also involved apart from key players which will be indicated in final report

- Technology companies apart from GE, IBM

- Accenture

- Nippon Electric

- Ntt DoCoMo

- Xerox Corp etc…..

- Banks involved are

- Bank Of America

- Bank Of Montreal

- Bank Of New York

- Chase Manhattan Bank

- First USA Bank

- JP Morgan Chase Bank

- UFJ Bank etc…….

- Above and other Insurance, Banking and Technology assignees will be incorporated in final report

Note

- # of patents (1239) will be reduced after filtering off-target patents, so the numbers presented here will vary in final report

- Patents will be considered for analysis starting date from 1990

- Report completion will take 3-4 weeks

Deliverable

- Content

- IP landscape

- Competitor landscape

- Market landscape

- Technology landscape

- Various dimensions under which patents have been filed

- Core insurance firms patents on their internal processes

- Technology companies and their activity in Insurance domain

- Geographic distribution

- Other standard Dolcera indicators (Dash board, Mind maps etc..)

- Report format

- Power point

- Wiki

Insurance - Background

- Definition of Insurance :

- Insurance is defined as the equitable transfer of the risk of a potential loss, from one entity to another, in exchange for a premium and duty of care.

Market data - Insurance sector

- Insurance and risk management is an immense global industry. In America alone, the insurance business employs about 2.5 million people

- Life and health insurance in the United States will be about a $725 billion in gross revenues business in 2006, compared to only about $500 billion in 2002

- U.S. life insurance firms hold about $3.8 trillion in assets

- Personal lines comprise another vast sector of insurance. For example, private passenger automobile insurance will be about a $172 billion annual premium market in the U.S. for 2006

- Homeowners insurance is about a $50 billion market

- Property and Casualty insurance premiums will total about $450 billion in the U.S. for 2006

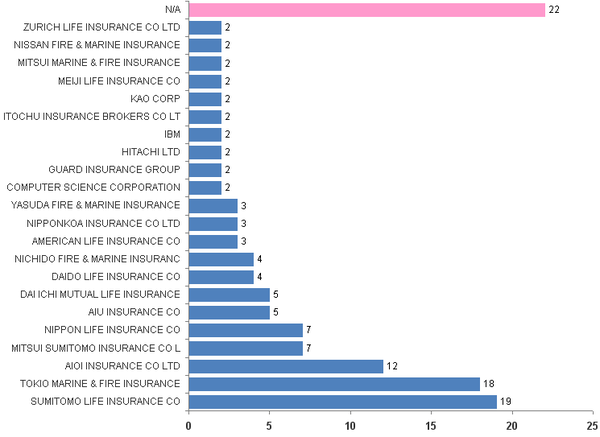

Assignee wise IP activity

- Graph depicts assignee and number of patents to their credit based on their patent filing activity

- Assignees having single patent record are depicted in table

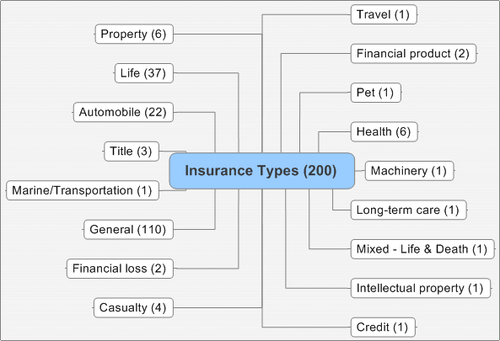

Distribution of patents - Based on insurance type

- 200 patents have been analyzed and categorized based on type of insurance

- For definitions follow the link

- Number in () indicates # of patents

- Trend - Top insurance filing sectors

- Maximum number of patents file under general insurance category (110) followed by

- Life insurnace (37) and

- Automobile insurance (22)

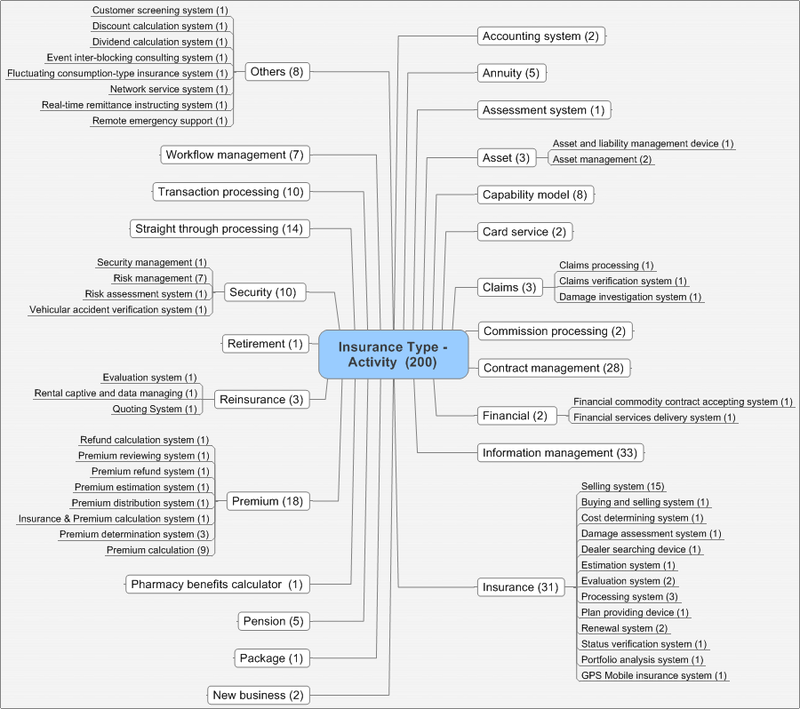

Distribution of patents - Based on activity

- Above 200 patents further analyzed for more granularity to project various patterns involved

- Trend based on various activities under insurance:

- Maximum patent filed on insurance information management system (33) followed by

- Insurance contract management system (28) and

- on various parameters of insurance premium (18)

Overall Trend - Based on insurance sector and respective activities

Automobile Insurance

- Customize insurance policy and customized insurance premium for different cars and people

- Keeping uninsured from driving

Casualty insurance

- Automatic accident reporting system of an insured person

Health insurance

- Pharmacy benefits calculator – selects a cost effective insurance plan form the group of plans

General Insurance

- Capability modeling – Computerized, customized and flexible insurance accepting, declining and design system

- Contract management –

- Converting current insurance contract to newly launch insurance terms

- System for decreasing insurance – Computer program calculates point based on the transaction data

- Reducing insurance policy issuing time by automating assessment processing - Application contents are automatically assessed after checking predefined conditions on applicant terminal

- Real-time insurance coverage verification system

- Online policy and insurance portfolio analysis for greater value and low risk – Analyzing data of present and proposed insurance policies and provides user comparative output for different policies

- Automated insurance processing – processes (mainly verifies) current status of insurance policies

- Risk assessment system – evaluates history of natural/man made disasters in a particular geographical area and sets insurance premium

- Insurance selling system – online auction for life settlement and vertical transactions

- Straight through processing – Insurance policy issuance and management system

Life Insurance

- Annuity – Automated benefit scheme administration apparatus

- Package – Selling other services (funeral plan) along with life insurance

- Retirement – Computer based retirement planning and income arrangement system

Property insurance

- GPS Mobile insurance system – Monitoring current location and condition