Difference between revisions of "Boston Scientific - Company Profile"

(→Company<nowiki>’</nowiki>s focus on R&D) |

(→Key Insights) |

||

| Line 513: | Line 513: | ||

====Key Insights==== | ====Key Insights==== | ||

| − | * Boston Scientific continues to focus on strategic initiatives to drive growth and profitability. | + | * Boston Scientific continues to focus on strategic initiatives to drive growth and profitability. Till now USA has been the major geographical market for this company but Japan is emerging post 2008 |

| − | * Recent acquisitions made by the company along with promising new technologies are expected to boost the company | + | * Recent acquisitions made by the company along with promising new technologies are expected to boost the company's pipeline |

| − | * | + | * Boston Scientifics' core businesses are witnessing significant pricing pressure and market decline. Due to which the revenues have gone down by 4.70% for the fiscal year 2010.Moreover, the economic uncertainty is impacting its procedure volume. |

| − | + | * The dependence on Cardiovascular segment is very high and cannot be ignored. As its witnessing several challenges including pricing pressure, intense competition and slower market growth leading to a decline ranging between 3-8% annually | |

| − | * | + | |

| − | * The | + | * There are a few segments like urology/ women's health, neurovascular & Neuromodulation which have shown higher growth percentage that reaches up to 14% but the contribution of these segments is very low despite higher growth rate. Though this higher growth rate can be a signal of growth potential for future concentration of efforts |

| − | + | ||

| − | * Coronary | + | * Company needs to realign their business portfolio to improve leverage and accelerate profitable revenue growth. The Company's diversification in Neuromodulation has been considered as a good decision by industry professionals |

| − | + | ||

| − | * | + | * Co. Faces certain industry risks such as failure of approval from FDA, approved devices being pulled from market due to safety reasons along with eroding market share and expiring patents. The recent example of pull back is the iCross Coronary Imaging Catheters |

| − | * | + | |

| − | + | * It's been noted that their long standing approach to growth is by strategic acquisitions of , investments in or alliances with other businesses or companies but the co. may not always be successful in generating growth this way | |

| + | |||

| + | * BSX needs to control costs, grow foreign market revenue and has to continue to get timely regulatory approvals. Expansion of global sales and marketing focus is important along with Increasing its presence in markets such as China, India and Brazil and expanding the number of product registrations outside the U.S. | ||

| + | |||

* With respect to these declining figures new strategies need to be worked on, to either increase the contribution from this segment or diversify in to other segments | * With respect to these declining figures new strategies need to be worked on, to either increase the contribution from this segment or diversify in to other segments | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

===Contact=== | ===Contact=== | ||

Latest revision as of 03:01, 9 September 2011

Contents

Boston Scientific

Company Overview

Key Facts

Boston Scientific (founded in 1979) is a worldwide developer, manufacturer and marketer of medical devices with approximately 25,000 employees and revenue of $7.8 billion in 2010. For more than 30 years, Boston Scientific has advanced the practice of less-invasive medicine by providing a broad and deep portfolio of innovative products, technologies and services across a wide range of medical specialties. The company’s products help physicians and other medical professionals improve their patients’ quality of life by providing alternatives to surgery.

| Type | Public Company |

| Company Size | 10,001+ employees |

| Website | http://www.bostonscientific.com |

| Industry | Medical Devices |

| Founded | 1979 |

Primary business divisions

- Cardiology, Rhythm and Vascular

- Endoscopy

- Urology and Women’s Health

- Neuromodulation

Key products

1) Taxus, Liberté, and Express coronary stents

2) Cognis cardiac resynchronization therapy defibrillator

3) Confient, Teligen, and Vitality implantable cardioverter defibrillators

4) Explorer and Inquiry diagnostic cardiology catheters

5) iLab ultrasound imaging system; Atlantis SR Pro ultrasound imaging catheter

6) Polyflex, Ultraflex and Wallflex esophageal, duodenal, and colonic stents

7) Sterling balloon dilation catheters

8) VersaPulse PowerSuite holmium urology laser systems

Significant subsidiaries

1) Advanced Stent Technologies Inc.

2) Boston Scientific Neuromodulation Corp.

3) Cardiac Pacemakers Inc.

4) Catheter Innovations Inc.

5) Corvita Corp.

6) EndoVascular Technologies Inc.

7) Enteric Medical Technologies Inc.

8) Guidant Corp.

9) Intermedics Inc.

10) Interventional Technologies LLC

11) Precision Vascular Systems Inc

Key Financials

| Financials of Boston Scientific in 2010 (in $M) | |

| Revenue (Fiscal Year) | 7,806 |

| Revenue Growth (1 yr) | (-4.70%) |

| Gross Profit | 5,207 |

| EBITDA | 1,859 |

| Trading Statistics (in $M) | |

| Market Capitalization | 10,758.57 |

| Shares Outstanding | 1,528.21 |

| Ratios | |

| Current Ratio | 1.75 |

| P/E Ratio | 18.9 |

| Debt to Equity Ratio | 43.31 |

Segment contribution

| Segment Contribution to the revenue (in $M) | ||

| Segment | Growth | Sales (2010) |

| Cardiovascular | (-5%) | 811 |

| Interventional Cardiology | (-8%) | 635 |

| Peripheral Interventions | 7% | 176 |

| Coronary stent system | (-7.9%) | 409 |

| Cardiac Rhythm Management | 4% | 559 |

| Defibrillators | 6.9% | 417 |

| Pacemakers | (-4%) | 142 |

| Electrophysiology | (-3%) | 37 |

| Endoscopy | (-3%) | 287 |

| Urology/Women’s health | 10% | 120 |

| Neuromodulation | 14% | 77 |

Boston Scientific derives maximum contribution from Cardiovascular, which recorded a 5% year-over-year decline in sales to $811 million. While sales from Interventional Cardiology declined 8% to $635 million, Peripheral Interventions increased 7% to $176 million. Global sales of coronary stent system (within Interventional Cardiology) at $409 million declined 7.9% driven by lower sales of both drug-eluting stents (DES, 6.9% to $379 million) and bare-metal stents (18.9% to $30 million). It is encouraging to note that the company maintained its leadership position in the global DES market with 36% share and 46% in the US market.

The next biggest contributor to Boston Scientific’s top line, Cardiac Rhythm Management, recorded a 4% increase in sales to $559 million. A 6.9% rise in defibrillators sales to $417 million coupled with a 4% decline in sales of pacemakers to $142 million contributed to the overall increase.

Hence, the overall revenue of Boston Scientific declined by 4.7%. (Seekingalpha.com)

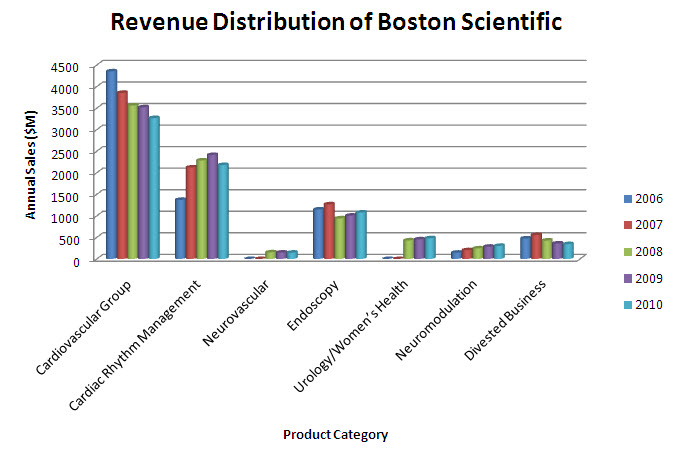

Revenue Distribution of Boston Scientific

By Product Category

The graph clearly shows the declining cardiovascular market, which constitutes the major part of Boston Scientific’s revenue. It gives a strong signal to the company to diversify its business into other business units and not be very dependent on one market.

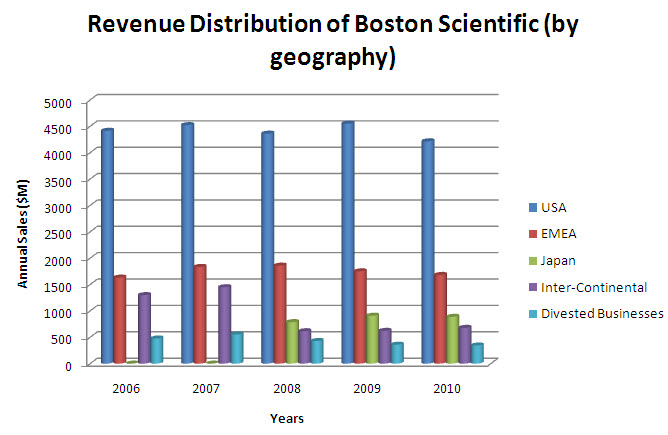

By Geography

*EMEA – Europe, Middle East and Africa

The graph clearly shows that U.S. contributes to more than 50% of the company’s revenues. It shows an opportunity for the company to expand in other markets. They have started selling their products in Japan, which has already started contributing majorly to the revenues.

Business Overview

Product Portfolio

| Product Portfolio of Boston Scientific | ||||

| Cardiovascular Group | Cardiac Rhythm Management | Endoscopy | Urology and Women’s Health | Neuromodulation |

| Drug-Eluting Stents | Remote Patient Management | Biliary Devices | Stone Management | Spinal Cord Stimulation |

| Coronary Balloons | Pacemakers | Cholangioscopy | Benign Prostatic Hyperplasia | |

| Coronary Atherectomy | Implantable Cardioverter Defibrillators | Biliary Stents | Pelvic Floor Reconstruction | |

| Embolic Protection | Cardiac Resynchronization | Gastrointestinal Stents | Abnormal Uterine Bleeding | |

| Inflation Devices | Therapy Defibrillators | Tissue Acquisition | ||

| Peripheral Balloons | Cardiac Resynchronization | Gastrointestinal Bleeding | ||

| Interventional Oncology | Therapy Pacemakers | Balloon Dilatation | ||

| Guide Wires | Electrophysiology | Pulmonary Devices | ||

| Diagnostic Catheters | Ablation Catheters | Airway Stents | ||

| Guide Catheters | Intracardiac Echocardiography | Bronchial Thermoplasty | ||

| Intravascular Ultrasound | Diagnostic Catheters | |||

| Vascular Access/Chronic Total Occlusion | ||||

| Peripheral Stents | ||||

Geographical Presence

The Corporate headquarters of Boston Scientific is in Natick, Massachusetts. The company is present in the following locations in Europe/Middle East/Africa, America and Asia Pacific/Japan.

| Europe/Middle East/Africa | America | Asia Pacific/Japan |

| Austria | Argentina | New Zealand |

| Belgium | Brazil | China |

| Czech Republic | Canada | Hong Kong |

| Denmark | Chile | India |

| Finland | Colombia | Korea |

| France | Costa Rica | Tokyo |

| Germany | Mexico | Fukuoka |

| Greece | Uruguay | Hiroshima |

| Hungary | Venezuela | Kanagawa |

| Ireland | West Indies | Ishikawa |

| Israel | Massachusetts | Saitama |

| Italy | California | Miyazaki |

| Lebanon | Florida | Aichi |

| Netherlands | Indiana | Osaka |

| Norway | Minnesota | Hokkaido |

| Poland | Utah | Miyagi |

| Portugal | Washington | Kanagawa |

| Spain | Malaysia | |

| South Africa | Philippines | |

| Sweden | Singapore | |

| Switzerland | Taiwan | |

| Turkey | Thailand | |

| United Kingdom |

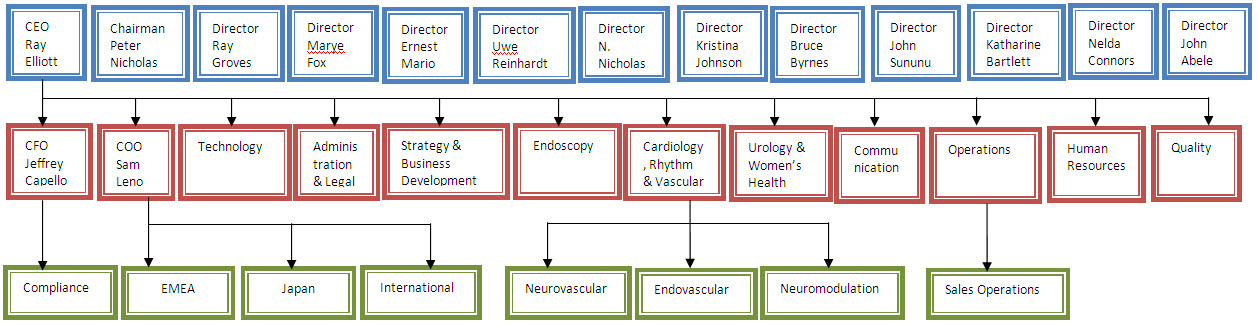

Organization Structure

Key Executives

- Chairman: Peter M. (Pete) Nicholas

- EVP and COO: Samuel R. (Sam) Leno

- EVP and CFO: Jeffrey D. (Jeff) Capello

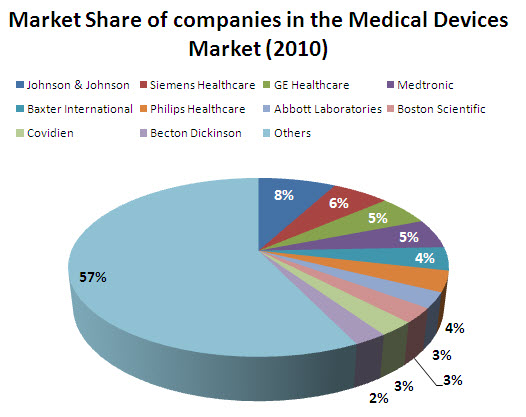

Market Overview

Top 10 companies in the medical devices industry

| Top 10 companies in the medical devices industry | Sales in 2010 ($B) |

| Johnson & Johnson | 23.60 |

| Siemens Healthcare | 17.40 |

| GE Healthcare | 16.00 |

| Medtronic | 15.82 |

| Baxter International | 12.60 |

| Philips Healthcare | 11.20 |

| Abbott Laboratories | 8.40 |

| Boston Scientific | 8.00 |

| Covidien | 7.81 |

| Becton Dickinson | 7.16 |

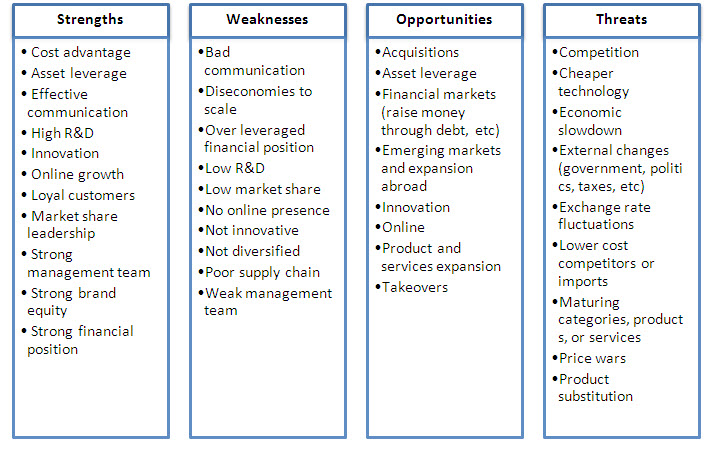

SWOT Analysis of Boston Scientific

Transactional Activities

| Mergers & Acquisitions done by Boston Scientific | |||

| <width="100%">|align = "right"| Acquired Company | <width="100%">| Date | <width="100%">| Value ($) M | <width="100%">| Reason for Acquisition |

| Atritech Inc | Jan-11 | 100 | * It strengthens the BS’s product offerings in the fast-growing areas of structural heart therapy * Also a trial fibrillation, which represent two of their Priority Growth Initiatives. (Alacrastore.com) |

| ReVascular Therapeutics Inc | Feb-11 | N/A | * These two novel technologies treat peripheral chronic total occlusions (CTOs). * BSX made the acquisitions because the devices cover areas with promise of high growth potential. (Yahoo Finance) |

| Intelect Medical Inc | Jan -11 | 78 | * It supports BSX long-term strategy of enhancing the product portfolio and gaining market share in the Neuromodulation space * It will help them to provide the most advanced deep brain stimulation technology solutions for neurologists, neurosurgeons and their patients. * The GUIDE DBS system would be a major advance in deep brain stimulation therapy, especially when used in conjunction with BSX’s Vercise DBS System. (Massdevice.com, Medicaldesign.com) |

| Sadra Medical Inc | Jan -11 | 193 | * Will Help BSX leverage on its clinical expertise and existing sales channels in the fast-growing area of structural heart therapy.( Reuters) |

| Asthmatx Inc | Oct-10 | 193.5 | * Named as Top Ten Medical Innovations for 2007" by the Cleveland Clinic Foundation. * The transaction is expected to provide meaningful revenue growth in the midterm (Asthmatx.com) |

| Labcoat Ltd . (Ireland) | Sep- 10 | N/A | * The Technology represents a major advance for drug-eluting stents and would help BSX maintain their strong position in this market (Bostonscientific) |

| Remon Medical Technologies Inc | Aug-07 | . 73 | * Provides BSX with innovative sensor and wireless communication technology that complements their Cardiac Rhythm Management product line. * Also to maintain the leadership position (Salesandmarketingnetwork.com) |

| EndoTex Interventional Systems Inc . | Jan-07 | 142 | * leadership in treating carotid artery disease (Reuters) |

| Guidant Corp | Apr-06 | 27000 | * To be a global leader in cardiovascular devices (Cbsnews) |

| TriVascular | Apr-05 | 110 | * To increase its share in the overall market for abdominal aortic aneurysms (AAA)device (Fdanews) |

Roadmap

Company’s focus on R&D

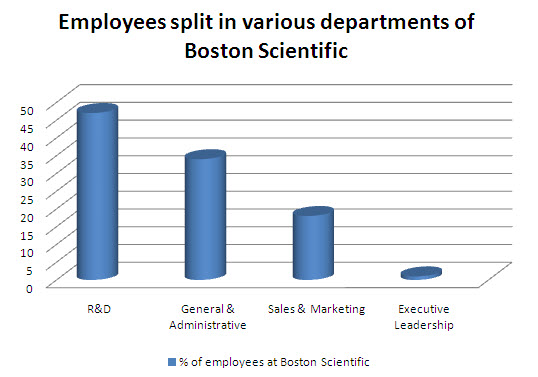

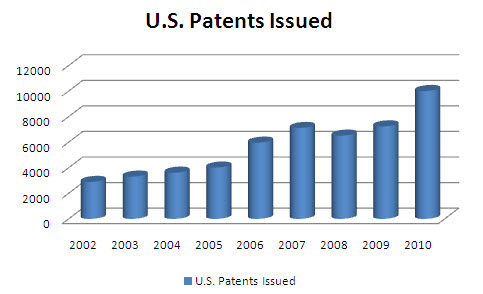

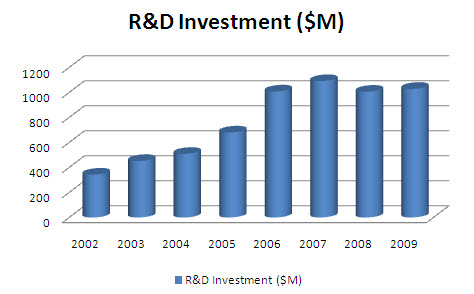

(Similar companies are based on the same industry and similar size for the year 2011)

- The first chart shows the number of employees in the R&D department in Boston Scientific is 9% higher than the industry standards (in 2011). The other chart shows that over the span of 8 years (2002-2009), the investment by Boston Scientific in R&D has increased by 200%. Also, by the end of 2009, 7240 US patents have been granted to Boston Scientific and 10,009 patents are pending. It shows that Boston Scientific is clearly focused on investing in new technology through R&D.

- In addition to the Company’s internal investments, Boston Scientific is committed to investing in external, or acquired, R&D through acquisitions and investments in new businesses.

- Boston Scientific in future is committed to developing less-invasive products and procedures, and through the acquisition of new technologies, to better enable physicians to treat their patients.

- The sales force of Boston Scientific is 3% lower than the industry standards. This shows that the company has an established customer base that are loyal to the company and Boston Scientific does not have to push is products in the market.

Key Insights

- Boston Scientific continues to focus on strategic initiatives to drive growth and profitability. Till now USA has been the major geographical market for this company but Japan is emerging post 2008

- Recent acquisitions made by the company along with promising new technologies are expected to boost the company's pipeline

- Boston Scientifics' core businesses are witnessing significant pricing pressure and market decline. Due to which the revenues have gone down by 4.70% for the fiscal year 2010.Moreover, the economic uncertainty is impacting its procedure volume.

- The dependence on Cardiovascular segment is very high and cannot be ignored. As its witnessing several challenges including pricing pressure, intense competition and slower market growth leading to a decline ranging between 3-8% annually

- There are a few segments like urology/ women's health, neurovascular & Neuromodulation which have shown higher growth percentage that reaches up to 14% but the contribution of these segments is very low despite higher growth rate. Though this higher growth rate can be a signal of growth potential for future concentration of efforts

- Company needs to realign their business portfolio to improve leverage and accelerate profitable revenue growth. The Company's diversification in Neuromodulation has been considered as a good decision by industry professionals

- Co. Faces certain industry risks such as failure of approval from FDA, approved devices being pulled from market due to safety reasons along with eroding market share and expiring patents. The recent example of pull back is the iCross Coronary Imaging Catheters

- It's been noted that their long standing approach to growth is by strategic acquisitions of , investments in or alliances with other businesses or companies but the co. may not always be successful in generating growth this way

- BSX needs to control costs, grow foreign market revenue and has to continue to get timely regulatory approvals. Expansion of global sales and marketing focus is important along with Increasing its presence in markets such as China, India and Brazil and expanding the number of product registrations outside the U.S.

- With respect to these declining figures new strategies need to be worked on, to either increase the contribution from this segment or diversify in to other segments

Contact

Boston Scientific Corporate Headquarters

One Boston Scientific Place

Natick, MA 01760-1537

Main Number: 1-508-650-8000