Difference between revisions of "Deodorants Market Analysis: Acquisition of Sanex by Colgate"

Amika.sethi (Talk | contribs) |

(No difference)

|

Revision as of 05:37, 28 July 2011

Contents

- 1 Introduction

- 2 Market overview

- 3 Consumer Behavior

- 4 Brand Valuation

- 5 Brand Positioning

- 6 Company Profile in Personal Care Market

- 7 SWOT of Colgate

- 8 LinkedIn Data Mining

- 9 Recommendations

- 10 References

Introduction

Acquisition of Sanex by Colgate

- Colgate-Palmolive Co. (CL) has acquired Unilever’s Sanex personal-care unit for about $940 million, to expand in deodorant and body wash overseas.

- Colgate has also sold its Colombian laundry detergent business to Unilever for $215 million.

- Sanex, which Unilever had to sell to fulfill the Legal obligations of EU Antitrust Laws, generated sales of about $260 million in 2009.

- The acquisition is Colgate’s first since 2006 as Chief Executive Officer Ian Cook aims to expand into more profitable products.

- Colgate, which generates more than 80 percent of sales outside North America, will gain a foothold in key parts of the personal-care market in Western Europe as a result of the transaction

Asset Disposal by Unilever

- Unilever, which bought Sanex as part of its 1.2 billion euro ($1.7 billion) acquisition of Sara Lee Corp. (SLE)’s international toiletries unit, was forced to dispose of the brand by the European Union, which raised concerns about competition issues in Europe.

- Combining Sanex with the company’s Dove and Rexona brands would "likely have led to price increases" in seven countries including the U.K. and Spain, according to the European Commission.

- Sanex also drew interest from Procter & Gamble Co and Henkel AG, people briefed on the discussions said this month. Unilever didn’t want to sell the business, because Sanex was the brand it wanted most, according to the people.

- Colgate will pay all cash for the shares and net assets and expects to close the acquisition by the end of the second quarter.

- Colgate is planning to expand its portfolio of brands that can help Colgate increase its competitive strength.

Colgate needs research support in taking the decision.

Market overview

Introduction to the market

- The world market for deodorants registered growth during the years 2008 and 2009, albeit at a slower rate than in previous years.

- With the recovery from the financial crisis in 2010, the market is projected to post healthy growth in the coming years driven by manufacturers increased focus on delivering technologically advanced products in various novel product formats.

- In addition, rising demand for gender-specific products is expected to enhance market prospects.

- Further, growing population, increasing awareness and rise in disposable incomes among consumers in developing regions including Asia-Pacific and Latin America would contribute to enhanced deodorant sales.

- Deodorants is a matured market in developed regions such as the US and Europe. In these markets, delivery of innovative products and an improved product mix play a vital role for manufacturers to increase their revenues.

- Producers are more or less compelled to offer innovative products that deliver quick, effective protection against odor and wetness.

- Deodorant producers have sought to generate sales growth by relying on product introductions on a continuous basis as well as product line extensions.

Europe Market

- Europe represents the largest regional market for deodorants worldwide.

- Europe along with the US collectively account for a major share of the global deodorants sales.

- Demand for deodorants in Europe as well as the US reported a moderate drop during 2009 because of economic slowdown that forced consumers to cut down spending on certain avoidable products such as deodorants.

- Deodorant Market can be further segmented into aerosol sprays, non-aerosol sprays, and squeeze-bottle sprays. Aerosol Sprays constitute the largest as well as fastest growing product segment of deodorants in the world.

- Stick & Solid Deodorants category represents the second major deodorants product segment.

- The personal care category is witnessing a strong growth trend as a result of the increasing focus of men towards grooming, hygiene and appearance. Male oriented products are growing briskly, surpassing the hitherto women dominated cosmetics and personal care market.

- With regard to fragrances, men choose deodorants over the luxurious perfumes which are preferred by females. This has provided a definite impetus to the overall sales of deodorants.

- Another major trend in the deodorants market includes the shift towards more natural products. The increase in awareness about the benefits of natural products, led to a rise in demand for deodorants using herbs and botanicals. Botanical ingredients such as cucumber, aloe vera, lemongrass, and green tea are increasingly being used in deodorants to lure health-conscious individuals.

Market Size

Total Market Size

Key Insights

- Western Europe market is saturated with a value as high as 5000 m USD

- Eastern Europe market has lots of scope and is expected to grow, as more countries move towards Free Market Economy

Product wise Market Size

Western Europe

Eastern Europe

Key Insights

- Deodorants roll on and sprays are preferred more in western Europe while in Eastern Europe stick ons are expected to have a have a huge market

- Product Offerings for Colgate in Eastern and Western Europe should contain spray format and should have stick ons and roll ons in their offerings in these countries, respectively

- People in Eastern Europe are more Price Conscious due to communist regimes / mixed economies and hence, share of sticks in Eastern market is more as compared to Western Europe

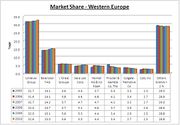

Western Europe

Market Share of Various Companies between 2005-10 in Western Europe

Market Share of Various Companies in 2010 - Western Europe

Eastern Europe

Market Share of Various Companies between 2005-10 in Eastern Europe

Market Share of Various Companies in 2010 - Eastern Europe

Key Insights

- Western Europe has two major players – Unilever and Beiersdorf, while the rest of the industry is moving towards consolidation which is a sign of saturated market, which can only be revived by continues product innovations

- Eastern Europe has three major players but no market leader, hence the shares are evenly distributed and the industry is fragmented into a lot of small players, while the scope of growth remains high

Western Europe

Sales Value

Sales Value Past Trends

Sales Value Future Trends

Value Growth

Value Growth Past Trends

Value Growth Future Trends

Per Capita Spending

Per Capita Spending Past Trends

Per Capita Spending Future Trends

Key Insights

- France, Germany, Italy and UK are the biggest markets for Deodorants and are saturated to a good extent.

- in next five years Spain and Netherlands are expected to grow and thus marketing expenditure by Colgate can be targeted accordingly

- in Switzerland, France, Germany, Denmark and Belgium are the countries where the Premium brand Sanex can be targeted as Per capita spend in these countries is very high

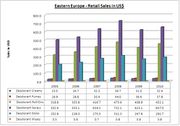

Eastern Europe

Sales Value

Past Trends in Sales Value

Future Trends in Sales Value

Value Growth

Per Capita Spending

Past Trends in Per Capita Spending

Future Trends in Per Capita Spending

Key Insights

- Market in Poland and Russia is expected to grow in next five years while market will saturate in other countries

- Spend per capita is high in countries – Czech, Poland and Slovak republic, while in coming next five years, the per capita spend by Poland is expected to grow, while other countries might become price sensitive to the product

Western Europe

Brand-wise share of Deodorants in Western Europe during 2010

Trends in Brand-wise Share between 2005-10 - Western Europe

Key Insights

- There is no clear leader in the Western European Deodorant Market, Nivea is the market leader but it is closely followed by other brands

- In such a scenario, much of the growth will depend upon Marketing and Advertising capabilities of the organizations along with the ability to differentiate offerings

- Unilever by far has the largest market share due to its ability to differentiate its offerings

- Sanex which is a Premium Priced Deodorant has a considerable market share of 4% due to high disposable incomes of people in this region

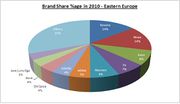

Eastern Europe

Brand-wise share of Deodorants in Eastern Europe during 2010

Trends in Brand-wise Share between 2005-10 - Eastern Europe

Key Insights

- East European Market has tremendous potential for growth

- Rexona and Nivea have the maximum Market share, having a significant lead of 6% over its nearest rival

- Sanex is currently not present in East European Market, since the disposable income of these people is quite low. However, sice the trend is changing there is an opportunity for the brand

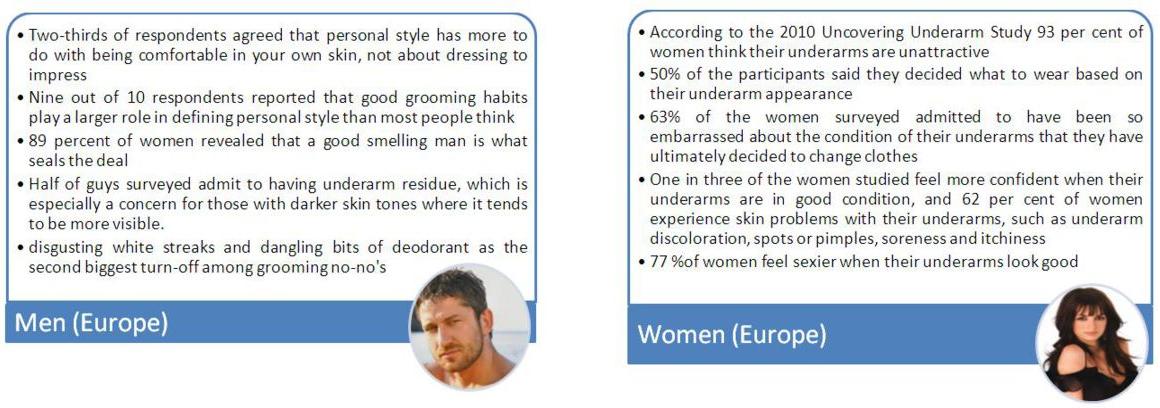

Consumer Behavior

Consumer Behaviour Trends in Europe

Trends in Men and Women

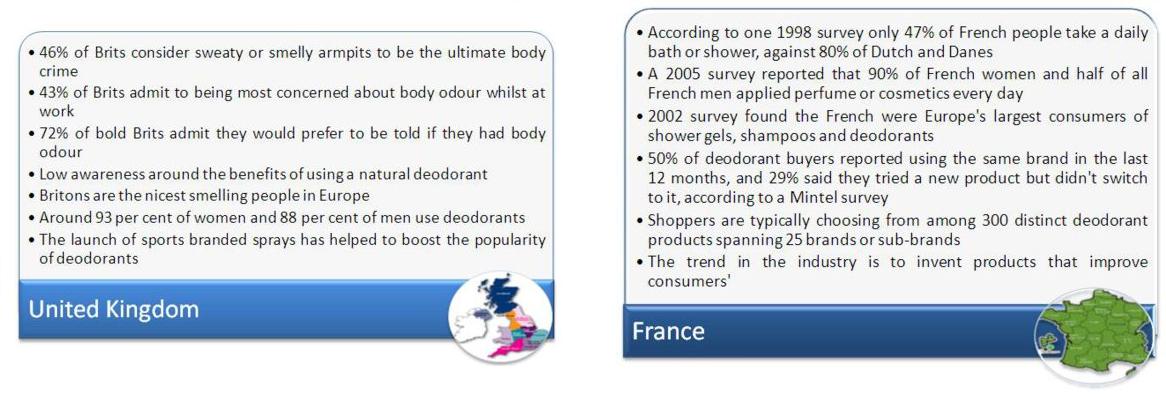

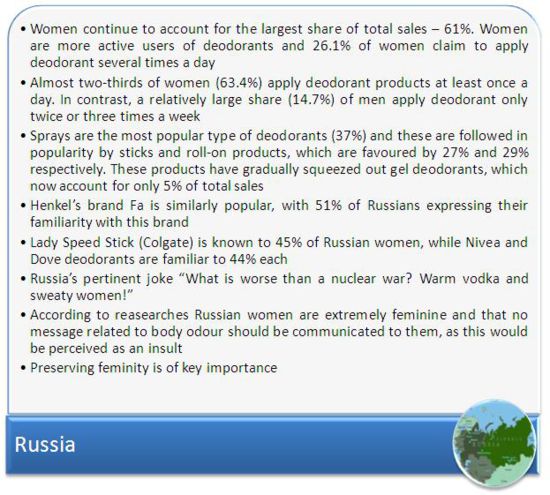

Geography Wise Consumer Behaviour Trends

Western Europe - United Kingdom and France

Eastern Europe - Russia

Brand Valuation

Price Premium Technique

Prime premium approach is based on the extra price (or profit) which a branded product may command over an unbranded or generic equivalent.

Volume X Price premium = Brand Value

| Brand | Price in GBP |

| Local | 0.73 |

| SANEX | 1.49 |

| Total Deodorant Sales in Europe in USD | 5,033.90M |

| Total Spray Deodorant Sales in Europe in USD | 2,885.30M |

| % of Spray Sales / Total Sales | 57.31 |

| Sales of Sanex Sprays in USD | 109,641,400 |

| Current Exchage Rate of 1 USD w.r.t GBP (as on 09/06/2011) | 0.61 |

| Current Exchage Rate of 1 GBP w.r.t USD (as on 09/06/2011) | 1.64 |

| Sales of Sanex Sprays in GBP | 66.88M |

| Volume of Sales in Units = (Sales Value in GBP / Price of 1 Spray Bottle) | 44.89M |

| Brand Value = (Price Premium * Volume of Sales) in GBP | 34.11M |

| Brand Value in USD | 55.92M |

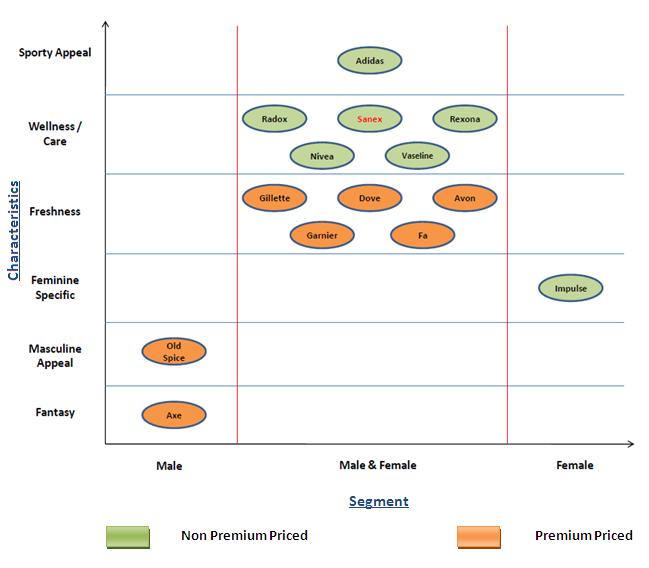

Brand Positioning

Key Insights

- The Position Map segments Deodorants on Three Parameters: Distinguishing Characteristics, Men/Women and Price Premium

- The Premiumness of Deodorants was calculated by considering the Median Retail Value of the top 14 Deodorant Brands of Western Europe as per the definition of a premium product by Business Dictionary is: "Practice in which a product is sold at a price higher that of competing brands to give it snob appeals through an aura of ’exclusivity’"

- Most Deodorant Brands in Europe have different versions for Men and Women, by differentiating the products this way they have been able to capture a larger market share

Company Profile in Personal Care Market

Unilever

Strategic Evaluation

Unilever Group

| Name | Unilever Group |

| Headquarter | Netherlands,England & Wales |

| Regionalinvolvement | WE, EE, LA, AP, MEA, AUS, NA |

| Leading categoryinvolvement | Deodorants,bath and shower, skin care |

| World beauty& personal care market share (2009) | 6.8% |

| Value growth (2008-2009) | 7.6% |

Key Strategies and Operations

1. Invest in Basic Products - Unilever is a global leader in categories which are generally described as commodities -examples include deodorants, bath and shower, shampoos and conditioners. Moving on, as the economic situation improves, these categories continue to have benefits as they have a much wider appeal for consumers in emerging markets.

2. Leverage Economies of Scale - Unilever has consolidated its operations in terms of manufacturing, procurement and other relevant activities and intends to take full advantage of this. It aims to invest in products that can work globally rather than just in a few countries.

3. Maintain Diversity - Unilever intends to focus on basic products that work globally, it still wants to maintain a diverse portfolio to accommodate different market conditions.

4. Increased Competition - While Unilever has performed well with its compact and focused approach to growth, it faces increased competition in the market. L’Oréal and Beiersdorf are identifying areas such as deodorants and body care, overlapping with Unilever. Moreover, Unilever faces competition from more competitively-priced private label.

Competitive Positioning

| Company name | 2005 | 2006 | 2007 | 2008 | 2009 | 2009 % share |

| Procter & Gamble | 1 | 1 | 1 | 1 | 1 | 11.7 |

| L’Oréal Groupe | 2 | 2 | 2 | 2 | 2 | 10.1 |

| Unilever Group | 3 | 3 | 3 | 3 | 3 | 6.8 |

| Colgate-Palmolive Co | 4 | 4 | 4 | 4 | 4 | 3.7 |

| Avon Products | 6 | 6 | 6 | 5 | 5 | 3.4 |

| Beiersdorf AG | 7 | 7 | 7 | 6 | 6 | 3.3 |

| Estée Lauder | 5 | 5 | 5 | 7 | 7 | 3.1 |

| Johnson & Johnson | 9 | 8 | 8 | 8 | 8 | 2.9 |

| Shiseido Co | 8 | 9 | 9 | 9 | 9 | 2.5 |

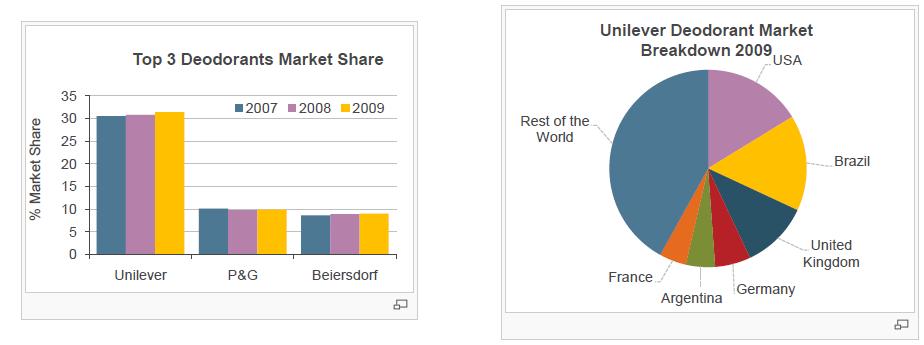

Market Assessment

- Unilever is by far the market leader in deodorants, with an over 31% global share in 2009. The company’s closest competitor is Procter & Gamble, with a 10% share.

- In the US, its largest deodorants market, Unilever launched four new deodorants each supported by substantial media advertising, marketing campaigns and promotions.

- Unilever has captured the deodorants market by offering interesting products, a slew of launches and products that appeal to a wider consumer group, supported by heavy investment in advertising and marketing.

- The markets to lead growth in absolute terms for deodorants are Brazil, Germany and India, all of which are led by Unilever, and the company is in a good position to benefit from the growth opportunities

- Unilever is the market leader and its position is unchallenged, but strategic moves by its competitors could put the company under strong threat.

- Deodorants is a strong category for Unilever and it should continue to spend on product development to beat the competition and keep its strong category leadership.

Category and Geographic Opportunity

- Deodorants is Colgate-Palmolive’s fourth largest category in beauty and personal care, but the company’s sales are predominantly derived from the US market, at nearly 30% of its global category sales. However, the US is projected to grow only marginally, by US$51 million, over 2009-2014 compared to US$548 million for Brazil, the highest in the world.

- The two other leading markets to drive growth are Germany and India, where Colgate-Palmolive does not a significant presence.

- Deodorants is projected to post robust growth and a few companies in the industry are expanding their presence in this category with the launch of products with additional features or breakthrough technology. Both Beiersdorf and L’Oréal have launched deodorants within the natural/organic niche, but Beiersdorf has gone a step further stating that it has formulated a technology to control stress-induced sweat with its deodorants. Strong product launches combined with effective marketing campaigns can ease the competitive pressure for Colgate-Palmolive.

Colgate

Strategic Evaluation

Colgate Palmolive Co

| Name | Colgate Palmolive |

| Headquarters | New York, USA |

| Regional Involvement | Global |

| Category Involvement | Oral care, bathand shower, hair care, deodorants, men’s grooming, baby care |

| World Beauty and Personal Care value share (2009) | 3.7% |

| World Beauty and Personal Care value growth (2009) | 6.1% |

Key Strategies and Operations

1. International expansion - Colgate-Palmolive’s success in building a strong emerging market profile has helped its oral, personal and home care business weather the global financial storm, at least to date.

2. Product innovation based on scientific study - As part of its ’winning on the ground’ strategy, Colgate-Palmolive aims to combat the threat from private label at a time when consumers are trading down through a greater focus on product development close to consumer needs.

3. Strong marketing focus - Colgate-Palmolive’s strategy is to combine product development with strong marketing initiatives, across the globe.

4. Product offering at different pricing tiers - While the focus is on premium products, Colgate-Palmolive also aims to offer a range of products at a lower pricing tier –in case consumers are looking to trade down.

Competitive Positioning

| Company name | 2005 | 2006 | 2007 | 2008 | 2009 | 2009 % share |

| Procter & Gamble | 1 | 1 | 1 | 1 | 1 | 11.7 |

| L’Oréal Groupe | 2 | 2 | 2 | 2 | 2 | 10.1 |

| Unilever Group | 3 | 3 | 3 | 3 | 3 | 6.8 |

| Colgate-Palmolive Co | 4 | 4 | 4 | 4 | 4 | 3.7 |

| Avon Products | 6 | 6 | 6 | 5 | 5 | 3.4 |

| Beiersdorf AG | 7 | 7 | 7 | 6 | 6 | 3.3 |

| Estée Lauder | 5 | 5 | 5 | 7 | 7 | 3.1 |

| Johnson & Johnson | 9 | 8 | 8 | 8 | 8 | 2.9 |

| Shiseido Co | 8 | 9 | 9 | 9 | 9 | 2.5 |

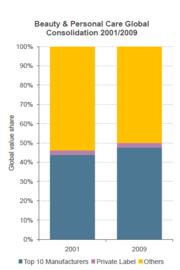

Global Consolidation

Market Assessment

- Colgate-Palmolive is too focused on oral care, which generates around 63% of its total revenue. While the company is the global leader in oral care, with nearly a quarter of value sales, oral care is also one of the most mature categories with its percentage growth projection below that of the industry average over 2009-2014.

- Its three other categories following oral care are bath and shower, hair care and deodorants, respectively. Colgate-Palmolive has a good presence in Brazil bath and shower, one of the markets to drive growth in this category, but has yet to penetrate China and India, two other strategic markets to drive absolute growth in bath and shower.

- Colgate-Palmolive will also benefit from expanding in deodorants, which has a robust growth projection. Competitive pressure is strong with not only Unilever controlling the market, but also players, such as Beiersdorf and L’Oréal, making the category their key priority.

Category and Geographic Opportunity

- Deodorants is Colgate-Palmolive’s fourth largest category in beauty and personal care, but the company’s sales are predominantly derived from the US market, at nearly 30% of its global category sales. However, the US is projected to grow only marginally, by US$51 million, over 2009-2014 compared to US$548 million for Brazil, the highest in the world.

- The two other leading markets to drive growth are Germany and India, where Colgate-Palmolive does not a significant presence.

- Deodorants is projected to post robust growth and a few companies in the industry are expanding their presence in this category with the launch of products with additional features or breakthrough technology. Both Beiersdorf and L’Oréal have launched deodorants within the natural/organic niche, but Beiersdorf has gone a step further stating that it has formulated a technology to control stress-induced sweat with its deodorants. Strong product launches combined with effective marketing campaigns can ease the competitive pressure for Colgate-Palmolive.

Competitors

L'Oreal Inc

| Parameters | Details |

| Overview | * L’Oreal is world’s largest beauty products company, it creates makeup, perfume, and hair and skin care items * L’Oreal has a century of expertise in cosmetics with €19.5 billion consolidated sales in 2010 * L’Oreal 23 global brands across 130 countries * L’Oreal filed 612 patents filed in 2010 |

| Business Segments | * Consumer Products: High technology products at competitive price are distributed through mass-market retailing channels (Garnier, L’Oréal Paris, Maybelline NY, Softsheen-Carson) * Professional Products: Portfolio of brands that meet the requirements of hair salons (L’Oréal Professionnel, Kérastase, Redken, Matrix, Mizani, Shu Uemura Art of Hair, Keraskin Esthetics) * Active Cosmetics: Dermo-cosmetics products sold in pharmacies and specialist retailers and supported by advice from pharmacists and dermatologists (Vichy, La Roche-Posay, Innéov, Skinceuticals, Sanoflore) * The Body Shop: Naturally inspired and fairly traded products sold in over 2300 The Body Shop stores throughout the world |

| Geographic Presence | * The company currently has operations in over 130 countries across five continents |

| Brands | * L’Oréal Paris, Garnier, Maybelline New York, Softsheen, Carson, CCB Paris, L’Oreal Professionel, Kerastase, and Redke, etc. |

| Revenue | * €19.50 billion (2010) |

| Profit | * €2.240 billion (2010) |

| Recent Developments | * L’Oreal announces the reunification of the roles of Chairman of the Board of Directors and Chief Executive Officer of the Group. Jean-Paul Agon was appointed the Chairman and CEO Sir Lindsay Owen-Jones Honorary Chairman |

Beiersdorf AG

| Parameters | Details |

| Overview | * Beiersdorf Aktiengesellschaft engages in the development, manufacture, and marketing of consumer goods in Europe, the Americas, Africa, Asia, and Australia * It is based out of Hamburg, Germany |

| Business Segments | * Consumer Business segment: It offers skin and beauty care products * Tesa Business segment: It manufactures and sells self-adhesive systems and product solutions for industrial customers and consumers |

| Geographic Presence | * Company operates wholly owned subsidiaries in Germany, Austria, the Czech Republic, Switzerland, Poland, Russia, Hungary, Mexico, the United States, Canada, Brazil, Japan, Singapore, and the United Arab Emirates |

| Brands | * Nivea, Eucerin, La Parairie, Florena, Slek, SBT & Hansaplast, etc. |

| Revenue | * €6.194 billion (2010) |

| Profit | * €318 million (2010) |

| Recent Developments | * NIVEA brand recently completed "100 Years Skincare for Life". * Focus on Skin Care, closer to Markets’ strategy is designed to make the company even more competitive * Focus its resources in selective skin care markets * Global streamlining & harmonization of product portfolio by substantial investments in the company’s skin and body care brands * Beiersdorf appointed Peter Feld, formerly General Manager of Johnson & Johnson GmbH Germany, as the new Executive Board member |

Henkel AG & Co KGaA

| Parameters | Details |

| Overview | * Henkel was founded in 1876 * The Dax-30 company is headquartered in Düsseldorf, Germany, and ranked among the Fortune Global 500 * Henkel employs 48,000 people worldwide, 80 percent of which work outside of Germany. Henkel is one of the most internationally aligned German companies |

| Business Segments | * Laundry & Home Care: The laundry products comprise heavy-duty detergents and special detergents. In fiscal 2010, the Laundry & Home Care business sector contributed 29 % of total company sales * Cosmetics / Toiletries: Schwarzkopf & Henkel stands for brand-name products in the fields of hair colorants, hair styling hair care and form, toiletries, skin care and oral hygiene. Schwarzkopf Professional is one of the world’s leading suppliers of hair salon products. In fiscal 2009, the segment contributed 22 % of total company sales * Adhesive Technologies: Henkel is the world market leader in adhesives, sealants and surface treatments for consumers, craftsmen and industrial applications. Henkel offers a multitude of applications to satisfy the needs of different target groups – consumers as well as craftsmen and industrial businesses. In fiscal 2009, the business sector contributed 48 % of total company sales |

| Geographic Presence | * With presence in 125 countries on five continents, Henkel engages in the majority of its business within Europe and North America |

| Brands | * Persil washing powder, Spee washing powder, Vernel/Silan fabric softener, Somat/Glist dishwasher tablets, Pril washing-up liquid, Schwarzkopf hair care, Schauma shampoo, Fa shower gel and deodorant, Diadermine skin and body care, Dial shower and hand soap, Loctite adhesives, etc. |

| Revenue | * €15,092 million (2010) |

| Profit | * €1,862 million (2010) |

| Recent Developments | * Mar 2011: Henkel was recognized with the European Diversity Leadership Honour Award in the Multicultural Working Environment category, the jury was particularly impressed by the company’s commitment and transparency in the diversity domain * Feb 2011: Henkel unveiled new company logo and slogan ’Henkel – Excellence is our Passion’. * Jan 2011: Henkel conferred "Best Supply Performance 2010" award to Firmenich and Symrise for their outstanding operational supply performance * Aug 2010: CMO at Henkel Müller, responsible for the global retail business of the company’s hair cosmetics, skin and oral care segments, was awarded the accolade of "Chief Marketing Officer of the Year", in recognition of outstanding and innovative marketing achievements that have made a major contribution to corporate success |

Procter & Gamble Co.

| Parameters | Details |

| Overview | * The Procter & Gamble Company was founded in 1837 and is headquartered in Cincinnati, Ohio. * P&G world’s largest multinational consumer goods company, Procter & Gamble Co. (P&G, NYSE: PG) is the 4th largest corporation in the world by market capitalization and is Fortune’s 6th Most Admired Company. * P&G touches the lives of 4 billion consumers daily with trusted brands |

| Business Segments | * Beauty and Grooming: GBU offers female beauty products, including cosmetics, deodorants, female blades and razors, personal cleansing and skin care products, hair care products, and fragrances under the Head & Shoulders, Olay, Pantene, and Wella brands. It also provides electric hair removal devices, home appliances, male blades and razors, and male personal care products, such as deodorants, face and shave products, hair care, and personal cleansing products under the Braun, Fusion, Gillette, and Mach3 brands * Health and Well-Being: GBU provides feminine care, oral care, and personal health care products under Always, Crest, and Oral-B brands; and snacks and pet food under the Lams and Pringles brands * Household Care: GBU offers air care products, batteries, dish care products, and fabric care and surface care products under the Ace, Ariel, Dawn, Downy, Duracell, Gain, and Tide brands. It also offers baby care and family care products, under the Bounty, Charmin, and Pampers brands * Retail & Brands: P&G sells its products through retail operations, including mass merchandisers, grocery stores, membership club stores, drug stores, department stores, salons, and high-frequency stores |

| Geographic Presence | * P&G products are available in North America, Latin America, Europe, the Middle East, Africa, Asia, Australia and New Zealand |

| Brands | * Tide, Olay, Pantene, Herbal Essences, Gillette, Always, Pampers, Crest, Braun, Pringles, Duracell, Secret, Old Spice, Hugo Boss, etc. |

| Revenue | * US$ 78.938 billion (2010) |

| Profit | * - |

| Recent Developments | * P&G signed a binding offer with the Sara Lee Corporation to acquire Ambi Pur for €320 million. Procter & Gamble acquired the high end shaving chain called the Art of Shaving in line with its objective to expand in high end male grooming category * Procter & Gamble has sold of its hair care brands to reduce its exposure to slow-growing businesses * P&G also decided to dispose off its pharma unit, but it seems it finding it difficult to find a buyer due to the credit crunch. Procter & Gamble organized its beauty and grooming business unit around "Him and Her" to better connect with the male consumer section which has not received the same level attention as female consumers |

SWOT of Colgate

LinkedIn Data Mining

Growth of Employees in Sales & Marketing and R&D

Insights for Unilever

Lateral Movement of Employees working in Unilever

Key Insights

- Unilever's Growth in terms of Sales and Marketing is more than the Industry average, this justifies its high sales and Market Leadership position across various categories

- Unilever attracts talent from rival firms such as Kraft, Sara Lee, etc. However, after working in Unilever people generally go in for Consulting Organizations like Accenture, this shows the expertise they gain in the organization specifically in Supply Chain and Logistics

Insights for Colgate

Lateral Movement of Employees working in Colgate

Key Insights

- Colgate spends quite less on R&D and hence prefers Acquisitions as preferred mode of expansion

- However, the striking feature here is the shrinking employee growth rate in Colgate in Sales and Marketing as compared to its competitors

Insights for P&G

Lateral Movement of Employees working in P&G

Key Insights

- P&G's personnel growth in Sales and Marketing as well as R&D is quite less

- An interesting trend is the movement of employees from P&G into Hewlett Packard which is a core Technology Firm, this shows strong Technology Adoption Culture being followed in P&G

Insights for Beiersdorf

Lateral Movement of Employees working in Beiersdorf

Key Insights

- Beiersdorf has been steadily reducing Personnel growth in its R&D department, hinting at heightening M&A Activity

Insights for Henkel

Lateral Movement of Employees working in Henkel

Key Insights

- Henkel has an increased spend in Research and Development Activities which shows that strategies are directed towards product innovations

- The attrition rate is low, that shows that Henkel is trying its best to retain its employees and job satisfaction is high

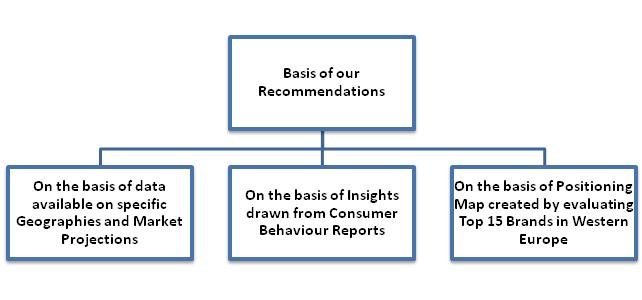

Recommendations

Key Geographies for Deodorant Market

Western Europe

- Germany – It has the highest spend per capita in the world for deodorants. With a stable growth rate in the next 4 years, Germany remains an important place to have a presence. As Sanex already is there in Germany, with Uilever’s Sales and Marketing experience can take this brand even further ahead.

- UK – Next best country after Germany for spend per capita. Usage is very high and is a part of daily habit. This market is exploited by many big and small players but still keeps the scope of new entrants with new product innovations. As people are very aware and used to deodorant as a category, continues new ranges and product innovation is where lies the key.

Eastern Europe

In Eastern Europe Colgate has its presence with Mennen and Palmolive deodorants. But with no new product innovation in last few years and very less spent on marketing, these brands were ignored to an extent by Colgate. As per a report published on Colgate acquiring Sanex, one major reason behind this acquisition was to get R&D capabilities in Deodorant market which Colgate lacked initially.

- Poland – Part of eastern market, which is growing at very high rate in the context of deodorants, Poland has the highest spend per capita, and an increasing projected value growth in deodorant markets.

- Russia – Russia, because of the population is expected to have a high volume for deodorant sales, though it has low spend per capita, but the projected growth trend is stable and promising.

- Hungary – Expected to grow in next two years but may get stagnant after that because of very low spend per capita on deodorants

Consumer Insights

- Women still remain the driving point behind men using personal care items, thus the positioning should always be around attraction and sex appeal

- One of the biggest turn off among women is men with dangling white residue from their underarms. No product in Europe till date is tackling this problem, and it can be treated as a new product innovation to invest into

- In Russia, preserving feminity is of key importance, hence becomes the weak point to sell personal care products to Russian women

- Secondary research on consumer behavior insights will be backed by Primary Research in key European markets

Brand Positioning

- The key challenge for Colgate is that the parent company Colgate Palmolive is considered as a brand and not as a parent company with umbrella brands.

- Nine out of ten people consider Colgate as an Oral care brand and not as a personal care brand.

- As Oral care market is almost saturated and with Colgate having plans in exploring more categories, it becomes even more challenging.

- Branding its individual brands separately is the biggest challenge Colgate is facing, the marketing attempts should be more focused to strengthening the Individual brands, being distributed by Colgate Palmolive, like in the case of P&G, Unilever and Reckitt.

- Colgate is known for its continues innovations, and now after acquiring Sanex R&D Capablties, Colgate can explore newer markets and also can strengthen its existing brand – Mennen and Palmolive.

Tough Sanex brand positioning is also related to its premiumness, Sanex does not provide the emotional value to the customer. The positioning need to work upon and category may need to be chosen. As In deodorant brands multiple variants are possible, marketing tricks can be used to brand them separately in different markets as per needs

- As per the positioning map there are two major emotional spaces, where there is good scope of growth and can be used to create a stronger positioning for that segment

1) Sporty Appeal – Adidas being only player working in the category, and as per the consumer behavior report, Sports deodorants acted as a trigger in the deodorant sales, Sanex can have a variant in this category to cater the segment

2) Masculine Emotional Space – Old Spice acts as an old premium brand in this category for last many years. Sanex (as it being a non premium brand) can launch a variant in this category as a mass brand, and can target those who aspire for masculine appe

References

- Euromonitor

- Mintel

- Top 100 Cosmetic Manufacturers

- Global Deodorant Industry insights in 2007

- European Deodorant Market Insight

- Outlook of Russian Deodorant Market

- Consumer Behave Insights from Russia

- Consumer Behavior Insights from UK

- Consumer Behavior Insights from Romania

- Consumer Behavior Insights from France

- Consumer Insights derived from a study conducted by Unilever

- Consumer Behavior Insights from a study conducted by Body Shop

- European Commission - Press release Mergers: Commission approves acquisition of Sanex by Colgate