Difference between revisions of "Vestas Wind Systems A/S"

Abhinandanb (Talk | contribs) (→Key Insights) |

Abhinandanb (Talk | contribs) (→Key Insights) |

||

| Line 772: | Line 772: | ||

:* Since the passing of the American Recovery and Reinvestment Act, by May of 2009 '''$118 million''' has been announced to support the wind industry. Notably, in April of 2009, through the Department of Energy (DOE), $93 million was allocated to support further development of wind energy in the U.S. | :* Since the passing of the American Recovery and Reinvestment Act, by May of 2009 '''$118 million''' has been announced to support the wind industry. Notably, in April of 2009, through the Department of Energy (DOE), $93 million was allocated to support further development of wind energy in the U.S. | ||

<br> | <br> | ||

| + | |||

| + | *; Move production closer to where the action is | ||

| + | :* Vestas has expanded production facilities heavily in US (Portland and Colorado) and China as these markets are growing the fastest and it intends to supply all its markets from domestic factories to offer cost-effective product and save on transportation. | ||

| + | <br> | ||

| + | |||

| + | |||

| + | |||

*; Strategic Partnership to enter new market | *; Strategic Partnership to enter new market | ||

Revision as of 14:41, 10 May 2011

Contents

Company Overview

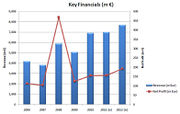

Vestas Wind Systems A/S engages in the development, manufacture, sale, and maintenance of wind technology that uses the energy of the wind to generate electricity. It offers wind turbines and wind power systems. The company also provides planning, installation, operation, and maintenance services. Vestas Wind Systems A/S has a strategic partnership with Marafeq to develop wind energy projects in Syria. It operates in Europe, the Americas, and the Asia Pacific. The company was founded in 1898 and is headquartered in Randers, Denmark. Revenues for the year 2010 rose 36%, to €6.9 billion, from nearly €5 billion in 2009, the company said. It expects revenues to hit €7 billion in 2011. Net profit rose 25% to about €156 million, up from about €125 million in 2009.

Vestas delivered 5,842 megawatts worth of wind turbines in 2010, compared to 4,764 megawatts delivered in 2009, the company said. The Global Wind Energy Council, based in Brussels, Belgium, said new wind turbine installations dropped to 35.8 gigawatts in 2010, from 38.6 gigawatts in 2009. Based on Vestas’ reported deliveries, the company’s world-wide marketshare rose to 16 percent in 2010, from 12 percent the previous year.

Key Facts

| Headquarter | Vestas Wind Systems A/S Alsvej 21 8940 Randers SV Denmark |

| Phone | (+45) 97 30 00 00 |

| Fax | (+45) 97 30 00 01 |

| vestas@vestas.com | |

| Website | http://www.vestas.com/ |

| Turnover (in million €) | 6,920 |

| Financial Year End | December |

| Number of employees | 23,252 |

Key Financials

Revenue Distribution

The following table gives the geopraphical break-up of revenue distribution for the year 2010:

| Geography | Revenue (m Eur) | % of Total Revenue |

| Europe & Africa | 4,162 | 60% |

| Americas | 1,626 | 23% |

| Asia Pacific | 1,132 | 16% |

| Total | 6,920 | 100% |

Business Overview

Vestas Wind Systems A/S engages in the development, manufacture, sale, and maintenance of wind technology that uses the energy of the wind to generate electricity. It offers wind turbines and wind power systems. The company also provides planning, installation, operation, and maintenance services. Vestas Wind Systems A/S has a strategic partnership with Marafeq to develop wind energy projects in Syria. It operates in Europe, the Americas, and the Asia Pacific. The company was founded in 1898 and is headquartered in Randers, Denmark. Its product range includes land and offshore wind turbines capable of generating between 850 kilowatts and 3 megawatts as well as supervisory control and data acquisition (SCADA) products, supplying a range of monitoring and control functions, allowing the wind power plants to be remotely supervised. The Company is operational internationally through a network of subsidiaries.

To date, Vestas has installed over 41,400 wind turbines in around 70 countries on five continents. Along with this vast experience, the company has predicted that by 2020 as much as 10 per cent of the world’s electricity consumption will be generated by wind energy.

Product & Services

Vestas offers a complete portfolio of products and services to its customers which includes:

- Wind Project Planning - plan for a reliable, successful project, delivered on time and on budget

- Procurement - offering a broad product portfolio to offer the ideal turbines for all sites and conditions

- Construction - co-ordinating with the customer to supply, install and balance the wind power plant according to the specific profile of the project

- Operation and Service - work in partnership with the client to control and maintain the wind power plant to the highest possible standards

- Power Plant Optimization - Vestas uses predictive and preventive service and maintenance techniques, to reduce down time and optimise yield for the installed Vestas turbines

Product Portfolio

Vestas has an extensive portfolio of turbines which are each suited to specific conditions and requirements. Vestas wind turbines are checked and tested at their own test centres, after which the results are verified and certified by independent organisations.

Click on the product name to view the details:

Services Portfolio

Vestas provides Active Output Management service programme, or AOM for short, to ensure the highest possible output at all times. A number of different AOM packages available based on the needs of the specific project, are listed below:

- AOM 1000: For customers seeking maximum flexibility. With no base fee, a number of Vestas services are offered on a pay-as-you-go basis.

- AOM 2000: A low-cost way to reduce the risk of downtime. Turbine performance is sustained through regular maintenance, with the option of additional maintenance items.

- AOM 3000: For customers willing to share the risk factor. A complete field service package including parts (apart from main components) and labor is accessible to customers with more risk tolerance. Turbine reliability is maximised through expert scheduled and unscheduled maintenance.

- AOM 4000: A complete package to maximise uptime and performance. A complete package including everything necessary (main components and material) to maximise uptime and performance. The service contract covers periods up to 10 years, suitable for customers who want the traditional time-based availability guarantee – of up to 97%. These high expectations are formalised through liquidated damages and bonus clauses in the contract.

- AOM 5000: A complete package to ensure minimised lost production. A complete package including everything necessary to maximise output but with further aligned incentives. An energy based availability guarantee is offered that aligns service and maintenance execution with low wind periods. The service contract covers periods up to 10 years, and energy based guarantees up to 97% (subject to site evaluation). These high expectations are formalised through liquidated damages and bonus clauses in the contract.

Geographic Presence

Vestas has delivered 5,842 MW in 66 countries of the world across different continents:

- Europe and Africa - 3,111 MW

- Americas - 1,482 MW

- Asia-Pacific - 1,249 MW

The following table provides the detailed presence of Vestas in various countries:

| Country/Region | Number | MW | Country/Region | Number | MW | Country/Region | Number | MW | ||

| Argentina | 19 | 11,8 | Germany | 5,879 | 7,405.13 | Norway | 27 | 15,88 | ||

| Aruba | 10 | 30 | Greece | 698 | 944.32 | Peru | 1 | 0,25 | ||

| Australia | 554 | 1060,75 | Hungary | 49 | 105.45 | Philippines | 20 | 33 | ||

| Austria | 224 | 386,56 | India | 4,231 | 2,434.59 | Poland | 204 | 422,625 | ||

| Azerbaijan | 2 | 1,7 | Iran | 37 | 16,38 | Portugal | 347 | 628,9 | ||

| Belgium | 120 | 274,67 | Israel | 3 | 0,455 | Republic of Ireland | 546 | 555,90 | ||

| Brazil | 125 | 204,43 | Italy | 2,235 | 2,485.35 | Romania | 98 | 271,66 | ||

| Bulgaria | 110 | 292,2 | Jamaica | 33 | 38.93 | Russia | 3 | 1,1 | ||

| Canada | 1,021 | 1683,10 | Japan | 379 | 509,98 | Slovakia | 4 | 2,64 | ||

| Cape Verde | 9 | 2,55 | Jordan | 5 | 1,125 | South Africa | 3 | 4.21 | ||

| Caribbean Islands | 2 | 0,2 | Kenya | 6 | 5,1 | South Korea | 104 | 166,485 | ||

| Chile | 64 | 116,68 | Latvia | 1 | 0,85 | Spain | 2,696 | 3,587.86 | ||

| China | 2,615 | 2,964,05 | Lithuania | 6 | 18 | Sri Lanka | 5 | 3 | ||

| Costa Rica | 71 | 50,55 | Luxemburg | 13 | 9,4 | Sweden | 1,012 | 1,117.63 | ||

| Croatia | 21 | 47,95 | Malaysia | 1 | 0,15 | Switzerland | 17 | 24,56 | ||

| Cuba | 4 | 3,8 | Mauritius | 1 | 0,1 | Taiwan | 50 | 86,1 | ||

| Cyprus | 41 | 82 | Mexico | 56 | 103.13 | Thailand | 1 | 0,15 | ||

| Czech Republic | 44 | 64,47 | Morocco | 84 | 50,4 | Turkey | 139 | 375.91 | ||

| Denmark | 4,934 | 2,564.56 | Netherlands | 1,280 | 1,506.35 | USA | 11,026 | 8,116.31 | ||

| Egypt | 124 | 79,075 | New Caledonia | 20 | 4,5 | United Arabian Emirates | 1 | 0,85 | ||

| Finland | 38 | 18,45 | New Zealand | 219 | 309,96 | United Kingdom | 1,137 | 1,674.95 | ||

| France | 586 | 1,104.95 | North Korea | 2 | 0,18 | Uruguay | 15 | 30 |

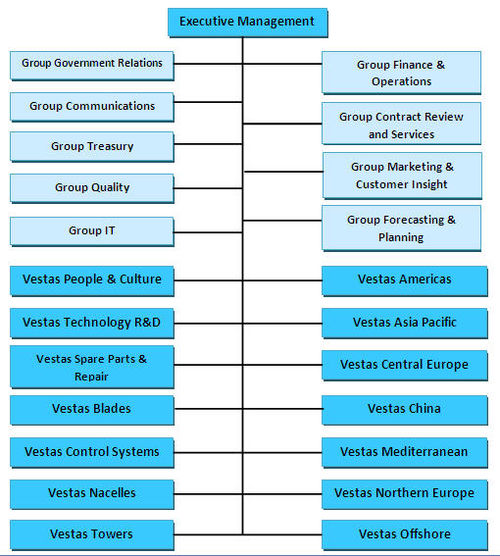

Organizational Structure

- Vestas has 14 business units, all reporting directly to the Executive Management.

- The presidents of the individual business units are responsible for the general day-to-day management of their respective areas of responsibility.

- Each unit has a Board of directors that holds meetings at least four times a year. Vestas’ Executive Management is a member of the business units’ Boards, thus ensuring close dialogue with the individual units.

- The Government coordinates production and sales – and prioritises development efforts so that the Group can implement the strategy defined by the Board of Directors in collaboration with the Executive Management. The Vestas Government holds weekly government meetings.

A schematic representation of the company structure is given below:

To view the details of an individual business unit, please click on the business unit name:

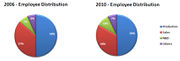

Employee Distribution

- Vestas recruit employees under the “People before megawatt” principle, because the costs of well-educated excess capacity are lower than the costs of remedying faults due to a rushed staff inflow caused by strong MW growth.

- The 23,252 employees have an average seniority of 3 years and 11 months.

- Key priority areas identified are training and, in particular, retention of new and existing employees as around 22% of the employees are having less than one year's seniority.

- Due to enhanced efficiency, improved turbine performance and economies of scale, going forward, Vestas expects its headcount to rise at a lower rate than its business volume.

- A prerequisite for sustaining progress is for Vestas to become a more international business with a much higher number of non-Danish employees in management positions. Furthermore, Vestas aims to have more women executives.

- In addition, Vestas also aims to have many nationalities at all locations in order to create a truly global business, which also has extensive local insight and understanding.

The following table provides the employee distribution of Vestas across geographies:

| Region/Department | Production | Sales | R&D | Others | Total |

| Europe & Africa | 7,579 | 4,509 | 1,515 | 1,522 | 15,125 |

| Americas | 1,479 | 1,278 | 189 | 0 | 2,946 |

| Asia-Pacific | 2,475 | 2,004 | 573 | 129 | 5,181 |

| Total | 11,533 | 7,791 | 2,277 | 1,651 | 23,252 |

A comparative graph of emplyee distribution by function for 2006 and 2010 is given below:

Mergers & Acquisitions

| Acquisitions | Stakes | Divestitures |

|

|

|

Sources: Analyst Reports

Order Book

The following table provides the Order Book summary for Vestas from 2007 to 2010:

| Particulars | 2010 | 2009 | 2008 | 2007 |

| Order Value (bnEUR) | 8.6 | 3.2 | 6.4 | 5.5 |

| Order intake (MW) | 8,673 | 3,072 | 6,019 | 5,613 |

| Produced and shipped (MW) | 4,057 | 6,131 | 6,160 | 4,974 |

| Deliveries (MW) | 5,842 | 4,764 | 5,580 | 4,502 |

Sources: Analyst Reports, Factiva News Articles

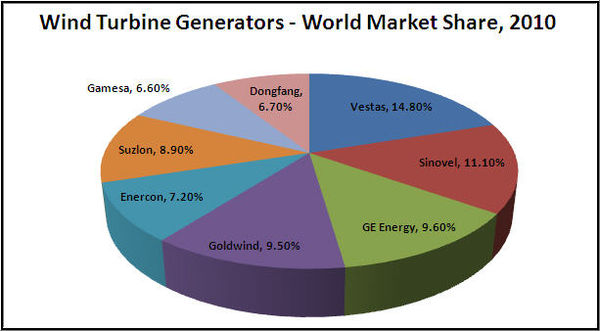

Market Overview

- Market Share of Vestas Wind Systems for 3 years from different sources

| Source | 2010 | 2009 | 2008 |

| BTM Consult | 14.8% | 12.5% | 19% |

| Make Consulting | 12% | 14.5% | 19% |

Reasons for decrease in market share:

- Emerging competitors in the wind energy space.

- Stiff competition for Vestas in China – Sinovel (21,9%), Goldwind (17,7%), and Dongfang (16,4%) - which are all of Chinese origin. China‘s main three suppliers hold about 60% stake in the home market.

- GE is providing a stiff competition in the american market.

- The German market, being one of the core countries in Vestas strategy, is showing signs of saturation.

Source: BTM Consult, Make Consulting, Analyst Reports

Track record by Turbine Type

| Turbine Type | Installed in 2010 | Accumulated Installed | ||

| Number | MW | Number | MW | |

| V52-850 kW | 340 | 289 | 3,764 | 3,199 |

| V60-850 kW | 15 | 13 | 15 | 13 |

| V80-1.8 MW | 0 | 0 | 1,016 | 1,829 |

| V80-2.0 MW | 267 | 534 | 2,981 | 5,962 |

| V82-1.5 MW | 0 | 0 | 213 | 320 |

| V82-1.65 MW | 273 | 450 | 2,883 | 4,757 |

| V90-1.8 MW | 269 | 484 | 572 | 1,029 |

| V90-2.0 MW | 763 | 1,527 | 3,286 | 6,544 |

| V90-3.0 MW | 834 | 2,502 | 2,170 | 6,510 |

| V100-1.8 MW | 20 | 36 | 20 | 36 |

| V112-3.0 MW | 2 | 6 | 2 | 6 |

| Other | 1 | 1 | 26,511 | 13,909 |

| Total | 2,784 | 5,842 | 43,433 | 44,114 |

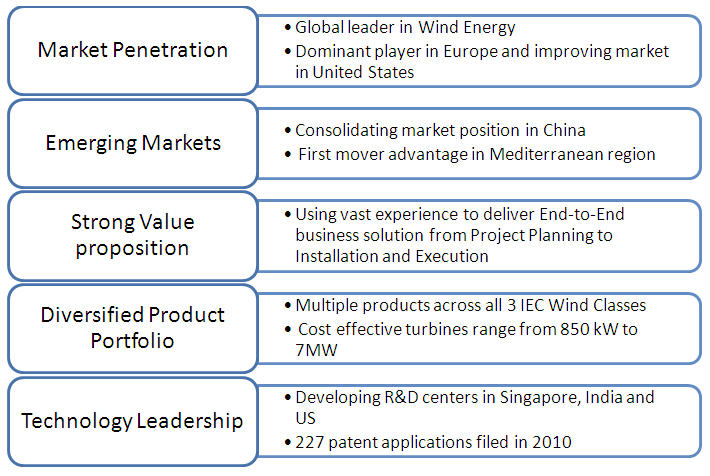

Strategic Position

Sources: BTM Consulting, Analyst Reports

SWOT Analysis

| Strengths | Weaknesses |

|

|

| Opportunities | Threats |

|

|

Recent Developments

| S.No | Date | Details | Source |

| 1 | 6th May’11 | Danish wind-turbine maker Vestas Wind Systems A/S said today it won an order for 34 units of its V90-3.0 MW wind turbine for a project in California owned by Canadian Brookfield Renewable Power Inc and US Coram California Development Management LLC. Vestas will be responsible for the delivery and commissioning of the turbines and will provide service and maintenance for two years. It will as well provide a VestasOnline Business SCADA system.The wind turbines are due for delivery in the second half of 2011. Commissioning is scheduled to happen by late 2011. | ProQuest |

| 2 | 4th May’11 | Vestas has been handed a 250MW supply agreement by the Guibang Shengtai Investment (GSI). GSI has also signed the deal is for 24 V80 2MW turbines for a project in Huitengxile, in the Inner Mongolia Autonomous Region. This is the second 100MW+ deal Vestas has signed in China this week. Yesterday, it announced an unnamed customer had ordered 100MW (50 V90 2MW machines) for Shandong Province, China. | Windpower Monthly |

| 3 | 19th April’11 | Vestas, the world’s largest wind turbine manufacturer, has recently won a large contract from China Datang Corporation Renewable Power, said Vestas China Tuesday in Beijing. The contract includes an order for 25 two-megawatt wind turbines, which will be installed near the city of Hulunbuir in North China’s Inner Mongolia autonomous region. The turbines are scheduled to be delivered in the second quarter of 2011. | Factiva |

| 4 | 11th April’11 | Hull and Immingham (UK) are already the country’s busiest ports by freight volumes. Land at the docks could now become the hub for Britain’s wind revolution with Siemens, Vestas and Gamesa — giants of the global turbine manufacturing industry — all talking about locating factories there. | Factiva |

| 5 | 31st March’11 | Vestas said it was Britain’s commitment to the so-called Round 3 developments of huge offshore wind farms to create up to 32,000 megawatts of capacity — or up to a third of the nation’s potential power output — that had prompted it to develop the new V164 turbine. However, the company refused to commit itself to building a manufacturing plant in the UK to construct the turbines. Vestas sailed into controversy in 2009 when it closed Britain’s only wind turbine manufacturing plant — producing smaller onshore turbine on the Isle of Wight with the loss of 425 jobs. | Times |

Key Insights

- Amendment in Chinese Renewable Energy Law results in tremendous Growth opprtunities for Vestas

- In 2010, the Chinese government revised the Wind-Power Sector targets to 150 GW by 2020 and also abolished the 70% local content requirement; while continuing their policy for R&D support, Reduced Tax Rates and Tax Rebate on import of components. New requirements for manufacturers to be eligible for tax breaks, land use and government loans are suited for large turbine manufacturers.

- 972 MW order intake in 2010 - Vestas’ order intake in China has quadrupled to a new record in 2010. It also had a record-high Chinese exposure in 2010 (19% of volume)

- In 2010, Vestas announced $50 million investment over 5-years period to develop its R&D facility in China.

- Vestas has also formed strategic relationships with leading Chinese players like Longyuan, Datang and Huaneng

- Vestas favors US over emerging markets in Asia (excluding China)

- Vestas favors the Americas, especially the U.S., in its growth strategy given the growing legislative support for renewable energy sources in the area. Though only 6% of the U.S. has strong wind resources, these resources could supply 150% of the current U.S. energy consumption - but only if they were fully developed with turbines.

- Since the passing of the American Recovery and Reinvestment Act, by May of 2009 $118 million has been announced to support the wind industry. Notably, in April of 2009, through the Department of Energy (DOE), $93 million was allocated to support further development of wind energy in the U.S.

- Move production closer to where the action is

- Vestas has expanded production facilities heavily in US (Portland and Colorado) and China as these markets are growing the fastest and it intends to supply all its markets from domestic factories to offer cost-effective product and save on transportation.

- Strategic Partnership to enter new market

- Al Kharafi Cham for Utilities Development Co. (MARAFEQ), Cham Holding’s arm for the development of power generation, water and wastewater treatment projects; and VESTAS Wind Systems Co. signed early May a strategic partnership to develop first wind energy in Syria including the submittal of a joint pre-qualification to the Public Establishment for Electricity Generation and Transmission (PEEGT) for the development of the first wind energy project in Syria. This project includes the construction and operation of a wind farm with a generation capacity of 50-100 MW at two sites; Al Sukhna and Al Hijana.

Key Executives

Vestas has 14 business units, all reporting directly to the Executive Management. The presidents of the individual business units are responsible for the general day-to-day management of their respective areas of responsibility.

| Name | Designation |

| Ditlev Engel | President and CEO, Vestas Wind Systems A/S |

| Henrik Nørremark | Executive Vice President and CFO, Vestas Wind Systems A/S |

| Anders Søe-Jensen | President, Vestas Offshore, Denmark |

| Bjarne Ravn Sørensen | President, Vestas Control Systems, Denmark |

| Finn Strøm Madsen | President, Vestas Technology R&D, Denmark |

| Hans Jørn Rieks | President, Vestas Central Europe, Germany |

| Jens Tommerup | President, Vestas China, China |

| Juan Araluce | President, Vestas Mediterranean, Spain |

| Klaus Steen Mortensen | President, Vestas Northern Europe, Sweden |

| Knud Bjarne Hansen | President, Vestas Towers, Denmark |

| Martha Wyrsch | President, Vestas Americas, USA |

| Ole Borup Jakobsen | President, Vestas Blades, Denmark |

| Phil Jones | President, Vestas Spare Parts & Repair, Denmark |

| Roald Steen Jakobsen | President, Vestas People & Culture, Denmark |

| Sean Sutton | President, Vestas Asia Pacific, Singapore |

| Søren Husted | President, Vestas Nacelles, Denmark |