Difference between revisions of "Wind Energy"

Abhinandanb (Talk | contribs) (→Market Share Analysis) |

Abhinandanb (Talk | contribs) (→Country-wise Market Distribution) |

||

| Line 128: | Line 128: | ||

To view the '''[[Country-wise Installed Wind Power Capacity]]''' (MW) 2002-2010 (Source: World Wind Energy Association), '''[http://dolcera.com/wiki/index.php?title=Country-wise_Installed_Wind_Power_Capacity click here]''' | To view the '''[[Country-wise Installed Wind Power Capacity]]''' (MW) 2002-2010 (Source: World Wind Energy Association), '''[http://dolcera.com/wiki/index.php?title=Country-wise_Installed_Wind_Power_Capacity click here]''' | ||

| + | |||

| + | ==Country Profiles== | ||

| + | ===China=== | ||

| + | According to the third National Wind Energy Resources | ||

| + | Census, China’s total exploitable capacity for both land-based | ||

| + | and offshore wind energy is around 700-1,200 GW. | ||

| + | Compared to the other leading global wind power markets, | ||

| + | China’s wind resources are closest to that of the United | ||

| + | States, and greatly exceed resources in India, Germany or | ||

| + | Spain. | ||

| + | |||

| + | <br>'''Market Developments in 2010''' | ||

| + | <br>Due to varied wind resources across China and differing | ||

| + | technical and economic conditions, wind power development | ||

| + | to date has been focused on a few regions and provinces, | ||

| + | including: Inner Mongolia, the Northwest, the Northeast, | ||

| + | Hebei Province, the Southeast coast and offshore islands. | ||

| + | <br>China’s wind market doubled every year between 2006 and | ||

| + | 2009 in terms of total installed capacity, and it has been the | ||

| + | largest annual market since 2009. In 2010, China overtook the United States as the country with the most installed wind | ||

| + | energy capacity by adding 16,500 MW* over the course of | ||

| + | the year, a 64% increase on 2009 in terms of cumulative | ||

| + | capacity, reaching 42.3 GW in total. | ||

| + | <br>According to Bloomberg New Energy Finance, the growth in | ||

| + | installed capacity was driven by a record level of investment | ||

| + | in wind power in China, which exceeded USD 20 billion in | ||

| + | 2009. In the third quarter of 2010, China’s investment in new | ||

| + | wind power projects accounted for half of the global total. | ||

| + | In addition, the Chinese government report “Development | ||

| + | Planning of New Energy Industry” calculated that the | ||

| + | cumulative installed capacity of China’s wind power will | ||

| + | reach 200 GW by 2020 and generate 440 TWh of electricity | ||

| + | annually, creating more than RMB 250 billion (EUR 28 bn / | ||

| + | USD 38 bn) in revenue. | ||

| + | |||

| + | <br>'''Chinese Wind Power Sector''' | ||

| + | <br>2010 was also an important year for Chinese wind turbine | ||

| + | manufacturers, as four companies, including Sinovel, | ||

| + | Goldwind, UnitedPower and Dongfang Electric, are part of | ||

| + | the world's top ten largest wind turbine manufacturers, and | ||

| + | are beginning to expand into overseas markets. | ||

| + | Driven by global development trends, Chinese firms, | ||

| + | including Sinovel, Goldwind, XEMC, Shanghai Electric Group | ||

| + | and Mingyang, have entered the competition to manufacture | ||

| + | wind turbines of 5 MW or more. | ||

| + | <br>China’s wind power generation market is mainly shared | ||

| + | among the ’Big Five’ power producers and several other | ||

| + | major state-owned enterprises. These firms account for more | ||

| + | than 80% of the total wind power market. The largest wind | ||

| + | power operators, Guodian (Longyuan Electric Group), Datang | ||

| + | and Huaneng expanded their capacity by 1-2 GW each during | ||

| + | the year, while Huadian, Guohua and China Guangdong | ||

| + | Nuclear Power are following close behind. Most of the local | ||

| + | state-owned non-energy enterprises, as well as foreignowned | ||

| + | and private enterprises have retreated from the | ||

| + | market. Access to finance is generally not a problem for wind | ||

| + | power projects. | ||

| + | |||

| + | <br>'''The Renewable Energy Law and the Chinese Feed In Tariff''' | ||

| + | <br>The breathtaking growth of the Chinese wind energy industry | ||

| + | has been driven primarily by national renewable energy | ||

| + | policies. The first Renewable Energy Law entered into force in | ||

| + | 2006, and gave huge momentum to the development of | ||

| + | renewable energy. In 2007, the first implementation rules for | ||

| + | the law emerged, giving further impetus to wind energy | ||

| + | development. In addition, the “Medium and Long-term | ||

| + | Development Plan for Renewable Energy in China” from 2007 | ||

| + | set out the government’s long term commitment and put | ||

| + | forward national renewable energy targets, policies and | ||

| + | measures for implementation, including a mandatory market | ||

| + | share of 1% of non-hydro renewable energy in the total | ||

| + | electricity mix by 2010 and 3% by 2020. | ||

| + | <br>In 2009, the Renewable Energy Law was amended to | ||

| + | introduce a requirement for grid operators to purchase a | ||

| + | certain fixed amount of renewable energy. The amendment | ||

| + | also requires grid companies to absorb the full amount of | ||

| + | renewable power produced, also giving them the option of | ||

| + | applying for subsidies from a new “Renewable Energy Fund” | ||

| + | to cover the extra cost related to integrating renewable | ||

| + | power if necessary. | ||

| + | <br>The breathtaking growth of the Chinese wind energy industry | ||

| + | has been driven primarily by national renewable energy | ||

| + | policies. The first Renewable Energy Law entered into force in | ||

| + | 2006, and gave huge momentum to the development of | ||

| + | renewable energy. In 2007, the first implementation rules for | ||

| + | the law emerged, giving further impetus to wind energy | ||

| + | development. In addition, the “Medium and Long-term | ||

| + | Development Plan for Renewable Energy in China” from 2007 | ||

| + | set out the government’s long term commitment and put | ||

| + | forward national renewable energy targets, policies and | ||

| + | measures for implementation, including a mandatory market | ||

| + | share of 1% of non-hydro renewable energy in the total | ||

| + | electricity mix by 2010 and 3% by 2020. | ||

| + | In 2009, the Renewable Energy Law was amended to | ||

| + | introduce a requirement for grid operators to purchase a | ||

| + | certain fixed amount of renewable energy. The amendment | ||

| + | also requires grid companies to absorb the full amount of | ||

| + | renewable power produced, also giving them the option of | ||

| + | applying for subsidies from a new “Renewable Energy Fund” | ||

| + | to cover the extra cost related to integrating renewable | ||

| + | power if necessary. | ||

| + | |||

| + | <br>'''Grid Connection Problem''' | ||

| + | <br>The rapid development of wind power in China has put | ||

| + | unprecedented strain on the country’s electricity grid | ||

| + | infrastructure. This has become the biggest problem for the | ||

| + | future development of wind power in the country, as some | ||

| + | projects have to wait for several months before being | ||

| + | connected to the national grid. | ||

| + | <br>There are reports that a large share of China’s wind power | ||

| + | capacity is not grid connected, but this is based on a | ||

| + | fundamental misunderstanding, which has its source in the | ||

| + | methodology used for calculating installed capacity. The | ||

| + | Chinese Federation of Power Generation, which provides | ||

| + | China’s energy statistics, only counts wind farms as operational from the moment that the last turbine of a | ||

| + | project has become grid-connected. However, in reality, most | ||

| + | of the installed wind turbines of a project are connected to | ||

| + | the grid and generating power much earlier. This explains the | ||

| + | much reported “gap” between installation and grid | ||

| + | connection which is often reported from China. In other | ||

| + | markets, it is common practice to include all turbines that are | ||

| + | grid connected, whether or not they constitute a completed | ||

| + | wind farm. | ||

| + | <br>Due to a lack of incentives, Chinese grid companies have | ||

| + | been reluctant to accept large amounts of wind power into | ||

| + | their systems. However, they have recently reached an | ||

| + | agreement to connect 80 GW of wind power by 2015 and | ||

| + | 150 GW by 2020. According to figures by the State Grid, at | ||

| + | the end of 2010, 40 billion RMB (EUR 4.5 bn / USD 6.1 bn) | ||

| + | had been invested to facilitate wind power integration into | ||

| + | the national power grid. | ||

| + | |||

| + | <br>'''Outlook 2011 & Beyond''' | ||

| + | <br>Despite its rapid and seemingly unhampered expansion, the | ||

| + | Chinese wind power sector continues to face significant | ||

| + | challenges, including issues surrounding grid access and | ||

| + | integration, reliability of turbines and a coherent strategy for | ||

| + | developing China’s offshore wind resource. These issues will | ||

| + | be prominent during discussions around the twelfth Five-Year | ||

| + | Plan, which will be passed in March 2011. According to the | ||

| + | draft plan, this is expected to reflect the Chinese | ||

| + | government’s continuous and reinforced commitment to | ||

| + | wind power development, with national wind energy targets | ||

| + | of 90 GW for 2015 and 200 GW for 2020. | ||

| + | |||

| + | |||

| + | ===India=== | ||

| + | India had a record year for new wind energy installations in | ||

| + | 2010, with 2,139 MW of new capacity added to reach a total | ||

| + | of 13,065 MW at the end of the year. Renewable energy is | ||

| + | now 10.9% of installed capacity, contributing about 4.13% to | ||

| + | the electricity generation mix, and wind power accounts for | ||

| + | 70% of this installed capacity. Currently the wind power | ||

| + | potential estimated by the Centre for Wind Energy | ||

| + | Technology (C-WET) is 49.1 GW, but the estimations of | ||

| + | various industry associations and the World Institute for | ||

| + | Sustainable Energy (WISE) and wind power producers are | ||

| + | more optimistic, citing a potential in the range of 65- | ||

| + | 100 GW. | ||

| + | <br>Historically, actual power generation capacity additions in | ||

| + | the conventional power sector in India been fallen | ||

| + | significantly short of government targets. For the renewable | ||

| + | energy sector, the opposite has been true, and it has shown a | ||

| + | tendency towards exceeding the targets set in the five-year | ||

| + | plans. This is largely due to the booming wind power sector. | ||

| + | Given that renewable energy was about 2% of the energy | ||

| + | mix in 1995, this growth is a significant achievement even in | ||

| + | comparison with most developed countries. This was mainly | ||

| + | spurred by a range of regulatory and policy support measures | ||

| + | for renewable energy development that were introduced | ||

| + | through legislation and market based instruments over the | ||

| + | past decade. | ||

| + | <br>The states with highest wind power concentration are Tamil | ||

| + | Nadu, Maharashtra, Gujarat, Rajasthan, Karnataka, Madhya | ||

| + | Pradesh and Andhra Pradesh. | ||

| + | |||

| + | <br>'''Main market developments in 2010''' | ||

| + | <br>Today the Indian market is emerging as one of the major | ||

| + | manufacturing hubs for wind turbines in Asia. Currently, | ||

| + | seventeen manufacturers have an annual production capacity | ||

| + | of 7,500 MW. According to the WISE, the annual wind turbine | ||

| + | manufacturing capacity in India is likely to exceed | ||

| + | 17,000 MW by 2013. | ||

| + | <br>The Indian market is expanding with the leading wind | ||

| + | companies like Suzlon, Vestas, Enercon, RRB Energy and GE | ||

| + | now being joined by new entrants like Gamesa, Siemens, and | ||

| + | WinWinD, all vying for a greater market share. Suzlon, however, | ||

| + | is still the market leader with a market share of over 50%. | ||

| + | <br>The Indian wind industry has not been significantly affected | ||

| + | by the financial and economic crises. Even in the face of a | ||

| + | global slowdown, the Indian annual wind power market has | ||

| + | grown by almost 68%. However, it needs to be pointed out | ||

| + | that the strong growth in 2010 might have been stimulated | ||

| + | by developers taking advantage of the accelerated | ||

| + | depreciation before this option is phased out. | ||

| + | |||

| + | <br>'''Policy support for wind power in India''' | ||

| + | <br>Since the 2003 Electricity Act, the wind sector has registered | ||

| + | a compound annual growth rate of about 29.5%. The central | ||

| + | government policies have provided policy support for both | ||

| + | foreign and local investment in renewable energy | ||

| + | technologies. The key financial incentives for spurring wind | ||

| + | power development have been the possibility to claim | ||

| + | accelerated depreciation of up to 80% of the project cost | ||

| + | within the first year of operation and the income tax holiday | ||

| + | on all earnings generated from the project for ten | ||

| + | consecutive assessment years. | ||

| + | <br>In December 2009 the Ministry for New and Renewable | ||

| + | Energy (MNRE) approved a Generation Based Incentive (GBI) | ||

| + | scheme for wind power projects, which stipulated that an | ||

| + | incentive tariff of Rs 0.50/kWh (EUR 0.8 cents/USD 1.1 cents) | ||

| + | would be given to eligible projects for a (maximum) period of | ||

| + | ten years. This scheme is currently valid for wind farms | ||

| + | installed before 31 March 2012. However, the GBI and the | ||

| + | accelerated depreciation are mutually exclusive and a | ||

| + | developer can only claim concessions under one of them for the same project. Although the projected financial outlay for | ||

| + | this scheme under the 11th Plan Period (2007-2012) is | ||

| + | Rs 3.8 billion (EUR 61 million/USD 84 million), the uptake of | ||

| + | the GBI has been slow due to the fact that at the current rate | ||

| + | it is still less financially attractive than accelerated | ||

| + | depreciation. | ||

| + | <br>Currently 18 of the 25 State Electricity Regulatory | ||

| + | Commissions (SERCs) have issued feed-in tariffs for wind | ||

| + | power. Around 17 SERCs have also specified state-wide | ||

| + | Renewable Purchase Obligations (RPOs). Both of these | ||

| + | measures have helped to create long-term policy certainty | ||

| + | and investor confidence, which have had a positive impact on | ||

| + | the wind energy capacity additions in those states. | ||

| + | |||

| + | <br>'''Support framework for wind energy''' | ||

| + | <br>There has been a noticeable shift in Indian politics since the | ||

| + | adoption of the Electricity Act in 2003 towards supporting | ||

| + | research, development and innovation in the country’s | ||

| + | renewable energy sector. In 2010, the Indian government | ||

| + | clearly recognised the role that renewable energy can play in | ||

| + | reducing dependence on fossil fuels and combating climate | ||

| + | change, and introduced a tax (“cess”) of Rs.50 (~USD1.0) on | ||

| + | every metric ton of coal produced or imported into India. This | ||

| + | money will be used to contribute to a new Clean Energy Fund. | ||

| + | In addition, the MNRE announced its intention to establish a | ||

| + | Green Bank by leveraging the Rs 25 billion (EUR 400 million / | ||

| + | USD 500 million) expected to be raised through the national | ||

| + | Clean Energy Fund annually. The new entity would likely work | ||

| + | in tandem with the Indian Renewable Energy Development | ||

| + | Agency (IREDA), a government-owned non-banking financial | ||

| + | company. | ||

| + | <br>In keeping with the recommendations of the National Action | ||

| + | Plan on Climate Change (NAPCC) the MNRE and the Central | ||

| + | Electricity Regulatory Commission (CERC) have evolved a | ||

| + | framework for implementation of the Renewable Energy | ||

| + | Certificate (REC) Mechanism for India.1 This is likely to give | ||

| + | renewable energy development a further push in the coming | ||

| + | years, as it will enable those states that do not meet their | ||

| + | RPOs through renewable energy installations to fill the gap | ||

| + | through purchasing RECs. | ||

| + | |||

| + | <br>'''Obstacles for wind energy development''' | ||

| + | <br>With the introduction of the Direct Tax Code2, the | ||

| + | government aims to modernize existing income tax laws. | ||

| + | Starting from the fiscal year 2011-12, accelerated | ||

| + | depreciation, the key instrument for boosting wind power | ||

| + | development in India, may no longer be available. | ||

| + | Another limitation to wind power growth in India is | ||

| + | inadequate grid infrastructure, especially in those states with | ||

| + | significant wind potential, which are already struggling to | ||

| + | integrate the large amounts of wind electricity produced. As | ||

| + | a result, the distribution utilities are hesitant to accept more | ||

| + | wind power. This makes it imperative for CERC and SERCs to | ||

| + | take immediate steps toward improved power evacuation | ||

| + | system planning and providing better interface between | ||

| + | regional grids. The announcement of India’s Smart Grid Task | ||

| + | Force by the Ministry of Power is a welcome first step in this | ||

| + | direction. | ||

==Market Share Analysis== | ==Market Share Analysis== | ||

Revision as of 05:25, 10 May 2011

This report presents a brief introduction to wind energy and technologies available for horizontal wind turbines. A detailed taxonomy for horizontal axis wind turbines is presented covering parts of the turbine, control systems, applications among others. A detailed landscape analysis of patent and non-patent literature is done with a focus on Doubly-fed Induction Generators (DFIG) used in the horizontal axis wind turbines for efficient power generation. The product information of major players in the market is also captured for Doubly-fed Induction Generators. The final section of the report covers the existing and future market predictions for wind energy-based power generation.

Error code: 134

Contents

[hide]Introduction

- We have been using wind power at least since 5000 BC to propel sailboats and sailing ships, and architects have used wind-driven natural ventilation in buildings since similarly ancient times. The use of wind to provide mechanical power came later.

- Harnessing renewable alternative energy is the ideal way to tackle the energy crisis, with due consideration given to environmental pollution, that looms large over the world.

- Renewable energy is also called "clean energy" or "green power" because it doesn’t pollute the air or the water. Wind energy is one such renewable energy source that harnesses natural wind power.

Read More?

Click on Wind Energy Background to read more about wind energy.

In order to overcome the problems associated with fixed speed wind turbine system and to maximize the wind energy capture, many new wind farms are employing variable speed wind energy conversion systems (WECS) with doubly-fed induction generator (DFIG). It is the most popular and widely used scheme for the wind generators due to its advantages.

For variable-speed systems with limited variable-speed range, e.g. ±30% of synchronous speed, the doubly-fed induction generator(DFIG) can be an interesting solution. This is mainly due to the fact that the power electronic converter only has to handle a fraction (20-30%) of the total power as the converters are connected to the rotor and not to the stator. Therefore, the losses in the power electronic converter can be reduced, compared to a system where the converter has to handle the total power. The overall structure of wind power generation through DFIG as shown in the figure below.

Market Research

The History of Wind Energy

- 3200 BC: Early Egyptians use wind to sail boats on the Nile River

- 0 : The Chinese fly kites during battle to signal their troops

- 700s : People living in Sri Lanka use wind to smelt (separate) metal from rock ore. They would dig large crescent-shaped furnaces near the top of steep mountainsides. In summer, monsoon winds blow up the mountain slopes and into a furnace to create a mini-tornado. Charcoal fires inside the furnace could reach 1200°C (2200°F). Archaeologists believe the furnaces enabled Sri Lankans to make iron and steel for weapons and farming tools.

- 950 AD: The first windmills are developed in Persia (present-day Iran). The windmills look like modern day revolving doors, enclosed on two sides to increase the tunnel effect. These windmills grind corn and pump water.

- 1200s : Europeans begin to build windmills to grind grain. They also built the first post mills out of wood. The Mongolian armies of Genghis Khan capture Persian windmill builders and take them to China to build irrigation windmills. Persian-style windmills are built in the Middle East. In Egypt, windmills grind sugar cane.

- 1300s : The Dutch invent the smock mill. The smock mill consists of a wooden tower with six or eight sides. The roof on top rotates to keep the sails in the wind.

- .

- .

- .

- 1892 : Danish inventor Poul LaCour invents a Dutch-style windmill with large wooden sails that generates electricity. He discovers that fast-turning rotors with few blades generate more electricity than slow-turning rotors with many blades. By 1908, Denmark has 72 windmills providing low-cost electricity to farms and villages.

- .

- .

- .

- .

- 2000s : North Hoyle, the largest offshore wind farm in the United Kingdom, is built. The Energy Policy Act of 2005 strengthens incentives for wind and other renewable energy sources.

Source: Wind Energy

To know more about the History of Wind Energy, click here

Global Wind Energy Market

Market Overview

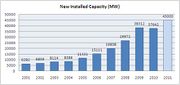

- In the year 2010, the wind capacity reached worldwide 196’630 Megawatt, after 159’050 MW in 2009, 120’903 MW in 2008, and 93’930 MW in 2007.

- Wind power showed a growth rate of 23.6 %, the lowest growth since 2004 and the second lowest growth of the past decade.

- For the first time in more than two decades, the market for new wind turbines was smaller than in the previous year and reached an overall size of 37’642 MW, after 38'312 MW in 2009.

- All wind turbines installed by the end of 2010 worldwide can generate 430 Tera watt hours per annum, more than the total electricity demand of the United Kingdom, the sixth largest economy of the world, and equaling 2.5 % of the global electricity consumption.

- In the year 2010, altogether 83 countries, one more than in 2009, used wind energy for electricity generation. 52 countries increased their total installed capacity, after 49 in the previous year.

- The turnover of the wind sector worldwide reached 40 billion Euros (55 billion US$) in 2010, after 50 billion Euros (70 billion US$) in the year 2009. The decrease is due to lower prices for wind turbines and a shift towards China.

- China became number one in total installed capacity and the center of the international wind industry, and added 18’928 Megawatt within one year, accounting for more than 50 % of the world market for new wind turbines.

- The wind sector in 2010 employed 670’000 persons worldwide.

- Nuclear disaster in Japan and oil spill in Gulf of Mexico will have long-term impact on the prospects of wind energy. Governments need to urgently reinforce their wind energy policies.

- WWEA sees a global capacity of 600’000 Megawatt as possible by the year 2015 and more than 1’500’000 Megawatt by the year 2020.

Source: World Wind Energy Report, 2010

Global Market Forecast

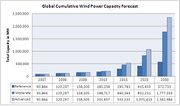

- Global Wind Energy Outlook 2010, provides forecast under three different scenarios - Reference, Moderate and Advanced.

- The Global Cumulative Wind Power Capacity is estimated to reach 572,733 MW by the year 2030, under the Reference Scenario

- The Global Cumulative Wind Power Capacity is estimated to reach 1,777,550 MW by the year 2030, under the Moderate Scenario

- The Global Cumulative Wind Power Capacity is estimated to reach 2,341,984 MW by the year 2030, under the Advanced Scenario

- The following chart shows the Global Cumulative Wind Power Capacity Forecast,under the different scenarios:

Source: Global Wind Energy Outlook 2010

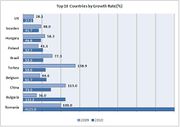

Market Growth Rates

- The growth rate is the relation between the new installed wind power capacity and the installed capacity of the previous year.

- With 23.6 %, the year 2010 showed the second lowest growth rate of the last decade.

- Before 2010, the annual growth rate had continued to increase since the year 2004, peaking in 2009 at 31.7%, the highest rate since 2001.

- The highest growth rates of the year 2010 by country can be found in Romania, which increased its capacity by 40 times.

- The second country with a growth rate of more than 100 % was Bulgaria (112%).

- In the year 2009, four major wind markets had more than doubled their wind capacity: China, Mexico, Turkey, and Morocco.

- Next to China, strong growth could be found mainly in Eastern European and South Eastern European countries: Romania, Bulgaria, Turkey, Lithuania, Poland, Hungary, Croatia and Cyprus, and Belgium.

- Africa (with the exception of Egypt and Morocco) and Latin America (with the exception of Brazil), are again lagging behind the rest of the world in the commercial use of wind power.

- The Top 10 countries by Growth Rate are shown in the figure listed below (only markets bigger than 200 MW have been considered):

Geographical Market Distribution

- China became number one in total installed capacity and the center of the international wind industry, and added 18'928 Megawatt within one year, accounting for more than 50 % of the world market for new wind turbines.

- Major decrease in new installations can be observed in North America and the USA lost its number one position in total capacity to China.

- Many Western European countries are showing stagnation, whereas there is strong growth in a number of Eastern European countries.

- Germany keeps its number one position in Europe with 27'215 Megawatt, followed by Spain with 20'676 Megawatt.

- The highest shares of wind power can be found in three European countries: Denmark (21.0%), Portugal (18.0 %) and Spain (16.0%).

- Asia accounted for the largest share of new installations (54.6%), followed by Europe (27.0%) and North America (16.7 %).

- Latin America (1.2%) and Africa (0.4%) still played only a marginal role in new installations.

- Africa: North Africa represents still lion share of installed capacity, wind energy plays hardly a role yet in Sub-Sahara Africa.

- Nuclear disaster in Japan and oil spill in Gulf of Mexico will have long-term impact on the prospects of wind energy. Governments need to urgently reinforce their wind energy policies.

Source: World Wind Energy Report, 2010

The regional breakdowns for the period 2009-2030 has been provided for the following three scenarios:

Note: To know more about the Forecast Scenarios, click here

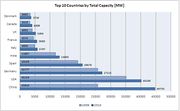

Country-wise Market Distribution

- In 2010, the Chinese wind market represented more than half of the world market for new wind turbines adding 18.9 GW, which equals a market share of 50.3%.

- A sharp decrease in new capacity happened in the USA whose share in new wind turbines fell down to 14.9% (5.6 GW), after 25.9% or 9.9 GW in

the year 2009.

- Nine further countries could be seen as major markets, with turbine sales in a range between 0.5 and 1.5 GW: Germany, Spain, India, United

Kingdom, France, Italy, Canada, Sweden and the Eastern European newcomer Romania.

- Further, 12 markets for new turbines had a medium size between 100 and 500 MW: Turkey, Poland, Portugal, Belgium, Brazil, Denmark, Japan, Bulgaria, Greece, Egypt, Ireland, and Mexico.

- By end of 2010, 20 countries had installations of more than 1 000 MW, compared with 17 countries by end of 2009 and 11 countries byend of 2005.

- Worldwide, 39 countries had wind farms with a capacity of 100 Megawatt or more installed, compared with 35 countries one year ago, and 24 countries five years ago.

- The top five countries (USA, China, Germany, Spain and India) represented 74.2% of the worldwide wind capacity, significantly more than 72.9 % in the year.

- The USA and China together represented 43.2% of the global wind capacity (up from 38.4 % in 2009).

- The newcomer on the list of countries using wind power commercially is a Mediterranean country, Cyprus, which for the first time installed a larger grid-connected wind farm, with 82 MW.

Source: World Wind Energy Report, 2010

The top 10 countries by Total Installed Capacity for the year 2010, is illustrated in the chart below:

To view the Top 10 countries by different other parameters for the year 2010, click on the links below:

To view the Country-wise Installed Wind Power Capacity (MW) 2002-2010 (Source: World Wind Energy Association), click here

Country Profiles

China

According to the third National Wind Energy Resources Census, China’s total exploitable capacity for both land-based and offshore wind energy is around 700-1,200 GW. Compared to the other leading global wind power markets, China’s wind resources are closest to that of the United States, and greatly exceed resources in India, Germany or Spain.

Market Developments in 2010

Due to varied wind resources across China and differing

technical and economic conditions, wind power development

to date has been focused on a few regions and provinces,

including: Inner Mongolia, the Northwest, the Northeast,

Hebei Province, the Southeast coast and offshore islands.

China’s wind market doubled every year between 2006 and

2009 in terms of total installed capacity, and it has been the

largest annual market since 2009. In 2010, China overtook the United States as the country with the most installed wind

energy capacity by adding 16,500 MW* over the course of

the year, a 64% increase on 2009 in terms of cumulative

capacity, reaching 42.3 GW in total.

According to Bloomberg New Energy Finance, the growth in

installed capacity was driven by a record level of investment

in wind power in China, which exceeded USD 20 billion in

2009. In the third quarter of 2010, China’s investment in new

wind power projects accounted for half of the global total.

In addition, the Chinese government report “Development

Planning of New Energy Industry” calculated that the

cumulative installed capacity of China’s wind power will

reach 200 GW by 2020 and generate 440 TWh of electricity

annually, creating more than RMB 250 billion (EUR 28 bn /

USD 38 bn) in revenue.

Chinese Wind Power Sector

2010 was also an important year for Chinese wind turbine

manufacturers, as four companies, including Sinovel,

Goldwind, UnitedPower and Dongfang Electric, are part of

the world's top ten largest wind turbine manufacturers, and

are beginning to expand into overseas markets.

Driven by global development trends, Chinese firms,

including Sinovel, Goldwind, XEMC, Shanghai Electric Group

and Mingyang, have entered the competition to manufacture

wind turbines of 5 MW or more.

China’s wind power generation market is mainly shared

among the ’Big Five’ power producers and several other

major state-owned enterprises. These firms account for more

than 80% of the total wind power market. The largest wind

power operators, Guodian (Longyuan Electric Group), Datang

and Huaneng expanded their capacity by 1-2 GW each during

the year, while Huadian, Guohua and China Guangdong

Nuclear Power are following close behind. Most of the local

state-owned non-energy enterprises, as well as foreignowned

and private enterprises have retreated from the

market. Access to finance is generally not a problem for wind

power projects.

The Renewable Energy Law and the Chinese Feed In Tariff

The breathtaking growth of the Chinese wind energy industry

has been driven primarily by national renewable energy

policies. The first Renewable Energy Law entered into force in

2006, and gave huge momentum to the development of

renewable energy. In 2007, the first implementation rules for

the law emerged, giving further impetus to wind energy

development. In addition, the “Medium and Long-term

Development Plan for Renewable Energy in China” from 2007

set out the government’s long term commitment and put

forward national renewable energy targets, policies and

measures for implementation, including a mandatory market

share of 1% of non-hydro renewable energy in the total

electricity mix by 2010 and 3% by 2020.

In 2009, the Renewable Energy Law was amended to

introduce a requirement for grid operators to purchase a

certain fixed amount of renewable energy. The amendment

also requires grid companies to absorb the full amount of

renewable power produced, also giving them the option of

applying for subsidies from a new “Renewable Energy Fund”

to cover the extra cost related to integrating renewable

power if necessary.

The breathtaking growth of the Chinese wind energy industry

has been driven primarily by national renewable energy

policies. The first Renewable Energy Law entered into force in

2006, and gave huge momentum to the development of

renewable energy. In 2007, the first implementation rules for

the law emerged, giving further impetus to wind energy

development. In addition, the “Medium and Long-term

Development Plan for Renewable Energy in China” from 2007

set out the government’s long term commitment and put

forward national renewable energy targets, policies and

measures for implementation, including a mandatory market

share of 1% of non-hydro renewable energy in the total

electricity mix by 2010 and 3% by 2020.

In 2009, the Renewable Energy Law was amended to

introduce a requirement for grid operators to purchase a

certain fixed amount of renewable energy. The amendment

also requires grid companies to absorb the full amount of

renewable power produced, also giving them the option of

applying for subsidies from a new “Renewable Energy Fund”

to cover the extra cost related to integrating renewable

power if necessary.

Grid Connection Problem

The rapid development of wind power in China has put

unprecedented strain on the country’s electricity grid

infrastructure. This has become the biggest problem for the

future development of wind power in the country, as some

projects have to wait for several months before being

connected to the national grid.

There are reports that a large share of China’s wind power

capacity is not grid connected, but this is based on a

fundamental misunderstanding, which has its source in the

methodology used for calculating installed capacity. The

Chinese Federation of Power Generation, which provides

China’s energy statistics, only counts wind farms as operational from the moment that the last turbine of a

project has become grid-connected. However, in reality, most

of the installed wind turbines of a project are connected to

the grid and generating power much earlier. This explains the

much reported “gap” between installation and grid

connection which is often reported from China. In other

markets, it is common practice to include all turbines that are

grid connected, whether or not they constitute a completed

wind farm.

Due to a lack of incentives, Chinese grid companies have

been reluctant to accept large amounts of wind power into

their systems. However, they have recently reached an

agreement to connect 80 GW of wind power by 2015 and

150 GW by 2020. According to figures by the State Grid, at

the end of 2010, 40 billion RMB (EUR 4.5 bn / USD 6.1 bn)

had been invested to facilitate wind power integration into

the national power grid.

Outlook 2011 & Beyond

Despite its rapid and seemingly unhampered expansion, the

Chinese wind power sector continues to face significant

challenges, including issues surrounding grid access and

integration, reliability of turbines and a coherent strategy for

developing China’s offshore wind resource. These issues will

be prominent during discussions around the twelfth Five-Year

Plan, which will be passed in March 2011. According to the

draft plan, this is expected to reflect the Chinese

government’s continuous and reinforced commitment to

wind power development, with national wind energy targets

of 90 GW for 2015 and 200 GW for 2020.

India

India had a record year for new wind energy installations in

2010, with 2,139 MW of new capacity added to reach a total

of 13,065 MW at the end of the year. Renewable energy is

now 10.9% of installed capacity, contributing about 4.13% to

the electricity generation mix, and wind power accounts for

70% of this installed capacity. Currently the wind power

potential estimated by the Centre for Wind Energy

Technology (C-WET) is 49.1 GW, but the estimations of

various industry associations and the World Institute for

Sustainable Energy (WISE) and wind power producers are

more optimistic, citing a potential in the range of 65-

100 GW.

Historically, actual power generation capacity additions in

the conventional power sector in India been fallen

significantly short of government targets. For the renewable

energy sector, the opposite has been true, and it has shown a

tendency towards exceeding the targets set in the five-year

plans. This is largely due to the booming wind power sector.

Given that renewable energy was about 2% of the energy

mix in 1995, this growth is a significant achievement even in

comparison with most developed countries. This was mainly

spurred by a range of regulatory and policy support measures

for renewable energy development that were introduced

through legislation and market based instruments over the

past decade.

The states with highest wind power concentration are Tamil

Nadu, Maharashtra, Gujarat, Rajasthan, Karnataka, Madhya

Pradesh and Andhra Pradesh.

Main market developments in 2010

Today the Indian market is emerging as one of the major

manufacturing hubs for wind turbines in Asia. Currently,

seventeen manufacturers have an annual production capacity

of 7,500 MW. According to the WISE, the annual wind turbine

manufacturing capacity in India is likely to exceed

17,000 MW by 2013.

The Indian market is expanding with the leading wind

companies like Suzlon, Vestas, Enercon, RRB Energy and GE

now being joined by new entrants like Gamesa, Siemens, and

WinWinD, all vying for a greater market share. Suzlon, however,

is still the market leader with a market share of over 50%.

The Indian wind industry has not been significantly affected

by the financial and economic crises. Even in the face of a

global slowdown, the Indian annual wind power market has

grown by almost 68%. However, it needs to be pointed out

that the strong growth in 2010 might have been stimulated

by developers taking advantage of the accelerated

depreciation before this option is phased out.

Policy support for wind power in India

Since the 2003 Electricity Act, the wind sector has registered

a compound annual growth rate of about 29.5%. The central

government policies have provided policy support for both

foreign and local investment in renewable energy

technologies. The key financial incentives for spurring wind

power development have been the possibility to claim

accelerated depreciation of up to 80% of the project cost

within the first year of operation and the income tax holiday

on all earnings generated from the project for ten

consecutive assessment years.

In December 2009 the Ministry for New and Renewable

Energy (MNRE) approved a Generation Based Incentive (GBI)

scheme for wind power projects, which stipulated that an

incentive tariff of Rs 0.50/kWh (EUR 0.8 cents/USD 1.1 cents)

would be given to eligible projects for a (maximum) period of

ten years. This scheme is currently valid for wind farms

installed before 31 March 2012. However, the GBI and the

accelerated depreciation are mutually exclusive and a

developer can only claim concessions under one of them for the same project. Although the projected financial outlay for

this scheme under the 11th Plan Period (2007-2012) is

Rs 3.8 billion (EUR 61 million/USD 84 million), the uptake of

the GBI has been slow due to the fact that at the current rate

it is still less financially attractive than accelerated

depreciation.

Currently 18 of the 25 State Electricity Regulatory

Commissions (SERCs) have issued feed-in tariffs for wind

power. Around 17 SERCs have also specified state-wide

Renewable Purchase Obligations (RPOs). Both of these

measures have helped to create long-term policy certainty

and investor confidence, which have had a positive impact on

the wind energy capacity additions in those states.

Support framework for wind energy

There has been a noticeable shift in Indian politics since the

adoption of the Electricity Act in 2003 towards supporting

research, development and innovation in the country’s

renewable energy sector. In 2010, the Indian government

clearly recognised the role that renewable energy can play in

reducing dependence on fossil fuels and combating climate

change, and introduced a tax (“cess”) of Rs.50 (~USD1.0) on

every metric ton of coal produced or imported into India. This

money will be used to contribute to a new Clean Energy Fund.

In addition, the MNRE announced its intention to establish a

Green Bank by leveraging the Rs 25 billion (EUR 400 million /

USD 500 million) expected to be raised through the national

Clean Energy Fund annually. The new entity would likely work

in tandem with the Indian Renewable Energy Development

Agency (IREDA), a government-owned non-banking financial

company.

In keeping with the recommendations of the National Action

Plan on Climate Change (NAPCC) the MNRE and the Central

Electricity Regulatory Commission (CERC) have evolved a

framework for implementation of the Renewable Energy

Certificate (REC) Mechanism for India.1 This is likely to give

renewable energy development a further push in the coming

years, as it will enable those states that do not meet their

RPOs through renewable energy installations to fill the gap

through purchasing RECs.

Obstacles for wind energy development

With the introduction of the Direct Tax Code2, the

government aims to modernize existing income tax laws.

Starting from the fiscal year 2011-12, accelerated

depreciation, the key instrument for boosting wind power

development in India, may no longer be available.

Another limitation to wind power growth in India is

inadequate grid infrastructure, especially in those states with

significant wind potential, which are already struggling to

integrate the large amounts of wind electricity produced. As

a result, the distribution utilities are hesitant to accept more

wind power. This makes it imperative for CERC and SERCs to

take immediate steps toward improved power evacuation

system planning and providing better interface between

regional grids. The announcement of India’s Smart Grid Task

Force by the Ministry of Power is a welcome first step in this

direction.

- Vestas leads the Global Market in the 2010 with a 12% market share according to Make Consulting, while BTM Consulting reports it to have a 14.8% market share.

- According to Make Consulting, the global market share of Vestas has decreased from 19% in 2008, to 14.5% in 2009, to 12% in 2010.

- According to BTM Consulting, the global market share of Vestas has changed from 19% in 2008, to 12% in 2009, to 14.8% in 2010.

- According to Make Consulting, the global market share of GE Energy has decreased from 18% in 2008, to 12.5% in 2009, to 10% in 2010.

- The market share of world no. 2 Sinovel, has been constantly increasing, from 5% in 2008 , to 9.3% in 2009, to 11% in 2010

- The top 5 companies have been occupying more than half of the Global Market Share from 2008 to 2010

Source: Make Consulting, BTM Global Consulting

The chart given below illustrates the Global Market Share Comparison of Major Wind Energy Companies for the period 2008-2010, as provided by two different agencies, Make Consulting and BTM Consulting:

Company Profiles

Products of Top Companies

| S. No. | Company | Product | Specifications |

| 1 | Vestas | V80 | Rated Power: 2.0 MW, Frequency: 50 Hz/60 Hz, Number of Poles: 4-pole, Operating Temperature: -30°C to 40° |

| 2 | Vestas | V90 | Rated Power: 1.8/2.0 MW, Frequency : 50 Hz/60 Hz, Number of Poles : 4-pole(50 Hz)/6-pole(60 Hz), Operating Temperature: -30°C to 40° |

| 3 | Vestas | V90 Offshore | Rated Power: 3.0 MW, Frequency: 50 Hz/60 Hz, Number of Poles: 4-pole, Operating Temperature: -30°C to 40° |

| 4 | North Heavy Company | 2 MW DFIG | Rated Power: 2.0 MW, Rated Voltage: 690V, Rated Current: 1670A, Frequency: 50Hz, Number of Poles : 4-pole, Rotor Rated Voltage: 1840V, Rotor Rated Current 670A, Rated Speed: 1660rpm; Power Speed Range: 520-1950 rpm, Insulation Class: H, Protection Class: IP54, Motor Temperature Rise =<95K |

| 5 | Gamesa | G90 | Rated Voltage: 690 V, Frequency: 50 Hz, Number of Poles: 4, Rotational Speed: 900:1,900 rpm (rated 1,680 rpm) (50Hz); Rated Stator Current: 1,500 A @ 690 V, Protection Class: IP 54, Power Factor(standard): 0.98 CAP - 0.96 IND at partial loads and 1 at nominal power, Power Factor(Optional): 0.95 CAP - 0.95 IND throughout the power range |

| 6 | Nordex | N80 | Rated Power: 2.5 MW, Rated Voltage: 690V, Frequency: 50/60Hz, Cooling Systems: liquid/air |

| 7 | Nordex | N90 | Rated Power: 2.5 MW, Rated Voltage: 690V, Frequency: 50/60Hz, Cooling Systems: liquid/air |

| 8 | Nordex | N100 | Rated Power: 2.4 MW, Rated Voltage: 690V, Frequency: 50/60Hz, Cooling Systems: liquid/air |

| 9 | Nordex | N117 | Rated Power: 2.5 MW, Rated Voltage: 690V, Frequency: 50/60Hz, Cooling Systems: liquid/air |

| 10 | Converteam | DFIG | NA |

| 11 | Xian Geoho Energy Technology | 1.5MW DFIG | Rated Power: 1550KW, Rated Voltage: 690V, Rated Speed: 1755 r/min, Speed Range: 975~1970 r/min, Number of Poles: 4-pole, Stator Rated Voltage: 690V±10%, Stator Rated Current: 1115A; Rotor Rated Voltage: 320V, Rotor Rated Current: 430A, Winding Connection: Y / Y, Power Factor: 0.95(Lead) ~ 0.95Lag, Protection Class: IP54, Insulation Class: H, Work Mode: S1, Installation ModeI: M B3, Cooling Mode: Air cooling, Weight: 6950kg |

| 12 | Tecowestinghouse | TW450XX (0.5-1 KW) | Rated Power: 0.5 -1 KW, Rated Voltage: 460/ 575/ 690 V, Frequency: 50/ 60 Hz, Number of Poles: 4/6, Ambient Temp.(°C): -40 to 50, Speed Range (% of Synch. Speed): 68% to 134%, Power Factor (Leading): -0.90 to +0.90 , Insulation Class: H/F, Efficiency: >= 96% |

| 13 | Tecowestinghouse | TW500XX (1-2 KW) | Rated Power: 1-2 kW, Rated Voltage: 460/ 575/ 690 V, Frequency: 50/ 60 Hz, Number of Poles: 4/6, Ambient Temp.(°C): -40 to 50; Speed Range (% of Synch. Speed): 68 to 134%, Power Factor(Leading): -0.90 to +0.90, Insulation Class: H/F, Efficiency: >= 96% |

| 14 | Tecowestinghouse | TW560XX (2-3 KW) | Rated Power: 2-3kW, Rated Voltage: 460/ 575/ 690 V, Frequency: 50/ 60 Hz, Number of Poles: 4/6, Ambient Temp(°C): -40 to 50, Speed Range(% of Synch. Speed): 68 to 134%, Power Factor(Leading): -0.90 to +0.90, Insulation Class: H/F, Efficiency: >= 96%. |

| 15 | Acciona | AW1500 | Rated Power: 1.5MW, Rated Voltage: 690 V, Frequency: 50 Hz, Number of Poles: 4, Rotational Speed: 900:1,900 rpm(rated 1,680 rpm) (50Hz), Rated Stator Current: 1,500 A @ 690 V, Protection Class: IP54, Power Factor(standard): 0.98 CAP - 0.96 IND at partial loads and 1 at nominal power, Power factor(optional): 0.95 CAP - 0.95 IND throughout the power range |

| 16 | Acciona | AW3000 | Rated Power: 3.0MW, Rated Voltage: 690 V, Frequency: 50 Hz, Number of Poles: 4, Rotational Speed: 900:1,900 rpm(rated 1,680 rpm) (50Hz), Rated Stator Current: 1,500 A @ 690 V, Protection Class: IP54, Power Factor(standard): 0.98 CAP - 0.96 IND at partial loads and 1 at nominal power, Power Factor (optional): 0.95 CAP - 0.95 IND throughout the power range |

| 17 | General Electric | GE 1.5/2.5MW | Rated Power: 1.5/2.5 MW, Frequency(Hz): 50/60 |

IP Search & Analysis

Doubly-fed Induction Generator: Search Strategy

The present study on the IP activity in the area of horizontal axis wind turbines with focus on Doubly-fed Induction Generator (DFIG) is based on a search conducted on Thomson Innovation.

Control Patents

| S. No. | Patent/Publication No. | Publication Date (mm/dd/yyyy) |

Assignee/Applicant | Title |

| 1 | US6278211 | 08/02/01 | Sweo Edwin | Brush-less doubly-fed induction machines employing dual cage rotors |

| 2 | US6954004 | 10/11/05 | Spellman High Voltage Electron | Doubly fed induction machine |

| 3 | US7411309 | 08/12/08 | Xantrex Technology | Control system for doubly fed induction generator |

| 4 | US7485980 | 02/03/09 | Hitachi | Power converter for doubly-fed power generator system |

| 5 | US7800243 | 09/21/10 | Vestas Wind Systems | Variable speed wind turbine with doubly-fed induction generator compensated for varying rotor speed |

| 6 | US7830127 | 11/09/10 | Wind to Power System | Doubly-controlled asynchronous generator |

Patent Classes

| S. No. | Class No. | Class Type | Definition |

| 1 | F03D9/00 | IPC | Machines or engines for liquids; wind, spring, or weight motors; producing mechanical power or a reactive propulsive thrust, not otherwise provided for / Wind motors / Adaptations of wind motors for special use; Combination of wind motors with apparatus driven thereby (aspects predominantly concerning driven apparatus) |

| 2 | F03D9/00C | ECLA | Machines or engines for liquids; wind, spring, or weight motors; producing mechanical power or a reactive propulsive thrust, not otherwise provided for / Wind motors / Adaptations of wind motors for special use; Combination of wind motors with apparatus driven thereby (aspects predominantly concerning driven apparatus) / The apparatus being an electrical generator |

| 3 | H02J3/38 | IPC | Generation, conversion, or distribution of electric power / Circuit arrangements or systems for supplying or distributing electric power; systems for storing electric energy / Circuit arrangements for ac mains or ac distribution networks / Arrangements for parallely feeding a single network by two or more generators, converters or transformers |

| 4 | H02K17/42

|

IPC | Generation, conversion, or distribution of electric power / Dynamo-electric machines / Asynchronous induction motors; Asynchronous induction generators / Asynchronous induction generators |

| 5 | H02P9/00 | IPC | Generation, conversion, or distribution of electric power / Control or regulation of electric motors, generators, or dynamo-electric converters; controlling transformers, reactors or choke coils / Arrangements for controlling electric generators for the purpose of obtaining a desired output |

| 6 | 290/044 | USPC | Prime-mover dynamo plants / electric control / Fluid-current motors / Wind |

| 7 | 290/055 | USPC | Prime-mover dynamo plants / Fluid-current motors / Wind |

| 8 | 318/727 | USPC | Electricity: motive power systems / Induction motor systems |

| 9 | 322/047 | USPC | Electricity: single generator systems / Generator control / Induction generator |

Concept Table

| S. No. | Concept 1 | Concept 2 | Concept 3 |

| Doubly Fed | Induction | Generator | |

| 1 | doubly fed | induction | generator |

| 2 | double output | asynchronous | machines |

| 3 | dual fed | systems | |

| 4 | dual feed | ||

| 5 | dual output |

Thomson Innovation Search

Database: Thomson Innovation

Patent coverage: US EP WO JP DE GB FR CN KR DWPI

Time line: 01/01/1836 to 07/03/2011

| S. No. | Concept | Scope | Search String | No. of Hits |

| 1 | Doubly-fed Induction Generator: Keywords(broad) | Claims, Title, and Abstract | (((((doubl*3 OR dual*3 OR two) ADJ3 (power*2 OR output*4 OR control*4 OR fed OR feed*3)) NEAR5 (induction OR asynchronous)) NEAR5 (generat*3 OR machine*1 OR dynamo*1)) OR dfig or doig) | 873 |

| 2 | Doubly-fed Induction Generator: Keywords(broad) | Full Spec. | (((((doubl*3 OR dual*3 OR two) ADJ3 (power*2 OR output*1 OR control*4 OR fed OR feed*3)) NEAR5 (generat*3 OR machine*1 OR dynamo*1))) OR dfig or doig) | - |

| 3 | Induction Machine: Classes | US, IPC, and ECLA Classes | ((318/727 OR 322/047) OR (H02K001742)) | - |

| 4 | Generators: Classes | US, IPC, and ECLA Classes | ((290/044 OR 290/055) OR (F03D000900C OR H02J000338 OR F03D0009* OR H02P0009*)) | - |

| 5 | Combined Query | - | 2 AND 3 | 109 |

| 6 | Combined Query | - | 2 AND 4 | 768 |

| 7 | French Keywords | Claims, Title, and Abstract | ((((doubl*3 OR dual*3 OR two OR deux) NEAR4 (nourris OR feed*3 OR puissance OR sortie*1 OR contrôle*1)) NEAR4 (induction OR asynchron*1) NEAR4 (générateur*1 OR generator*1 OR machine*1 OR dynamo*1)) OR dfig or doig) | 262 |

| 8 | German Keywords | Claims, Title, and Abstract | (((((doppel*1 OR dual OR two OR zwei) ADJ3 (ausgang OR ausgänge OR kontroll* OR control*4 OR gesteuert OR macht OR feed*1 OR gefüttert OR gespeiste*1)) OR (doppeltgefüttert OR doppeltgespeiste*1)) NEAR4 (((induktion OR asynchronen) NEAR4 (generator*2 OR maschine*1 OR dynamo*1)) OR (induktion?maschinen OR induktion?generatoren OR asynchronmaschine OR asynchrongenerator))) OR dfig) | 306 |

| 9 | Doubly-fed Induction Generator: Keywords(narrow) | Full Spec. | (((((((doubl*3 OR dual*3) ADJ3 (power*2 OR output*4 OR control*4 OR fed OR feed*3))) NEAR5 (generat*3 OR machine*1 OR dynamo*1))) SAME wind) OR (dfig SAME wind)) | 1375 |

| 10 | Top Assignees | - | (vestas* OR (gen* ADJ2 electric*) OR ge OR hitachi OR woodward OR repower OR areva OR gamesa OR ingeteam OR nordex OR siemens OR (abb ADJ2 research) OR (american ADJ2 superconductor*) OR (korea ADJ2 electro*) OR (univ* NEAR3 navarra) OR (wind OR technolog*) OR (wind ADJ2 to ADJ2 power)) | - |

| 11 | Combined Query | - | 2 AND 10 | 690 |

| 12 | Top Inventors | - | ((Andersen NEAR2 Brian) OR (Engelhardt NEAR2 Stephan) OR (Ichinose NEAR2 Masaya) OR (Jorgensen NEAR2 Allan NEAR2 Holm) OR ((Scholte ADJ2 Wassink) NEAR2 Hartmut) OR (OOHARA NEAR2 Shinya) OR (Rivas NEAR2 Gregorio) OR (Erdman NEAR2 William) OR (Feddersen NEAR2 Lorenz) OR (Fortmann NEAR2 Jens) OR (Garcia NEAR2 Jorge NEAR2 Martinez) OR (Gertmar NEAR2 Lars) OR (KROGH NEAR2 Lars) OR (LETAS NEAR2 Heinz NEAR2 Hermann) OR (Lopez NEAR2 Taberna NEAR2 Jesus) OR (Nielsen NEAR2 John) OR (STOEV NEAR2 Alexander) OR (W?ng NEAR2 Haiqing) OR (Yuan NEAR2 Xiaoming)) | - |

| 13 | Combined Query | - | ((3 OR 4) AND 10) | 899 |

| 14 | Final Query | - | 1 OR 5 OR 6 OR 7 OR 8 OR 9 OR 11 OR 13 | 2466(1060 INPADOC Families) |

Taxonomy

- Use the mouse(click and drag/scroll up or down/click on nodes) to explore nodes in the detailed taxonomy

- Click on the red arrow adjacent to the node name to view the content for that particular node in the dashboard

Sample Analysis

A sample of 139 patents from the search is analyzed based on the taxonomy.

Provided a link below for sample spread sheet analysis for doubly-fed induction generators.

Patent Analysis

| S. No | Patent/Publication No. | Publication Date (mm/dd/yyyy) |

Assignee/Applicant | Title | Dolcera Analysis | |

| Problem | Solution | |||||

| 1 | US20100117605 | 05/13/10 | Woodward | Method of and apparatus for operating a double-fed asynchronous machine in the event of transient mains voltage changes | The short-circuit-like currents in the case of transient mains voltage changes lead to a corresponding air gap torque which loads the drive train and transmission lines can damages or reduces the drive train and power system equipments. | The method presents that the stator connecting with the network and the rotor with a converter. The converter is formed to set a reference value of electrical amplitude in the rotor, by which a reference value of the electrical amplitude is set in the rotor after attaining a transient mains voltage change, such that the rotor flux approaches the stator flux. |

| 2 | US20100045040 | 02/25/10 | Vestas Wind Systems | Variable speed wind turbine with doubly-fed induction generator compensated for varying rotor speed | The DFIG system has poor damping of oscillations within the flux dynamics due to cross coupling between active and reactive currents, which makes the system potentially unstable under certain circumstances and complicates the work of the rotor current controller. These oscillations can damage the drive train mechanisms. | A compensation block is arranged, which feeds a compensation control output to the rotor of the generator. The computation unit computes the control output during operation of the turbine to compensate partly for dependencies on a rotor angular speed of locations of poles of a generator transfer function, so that the transfer function is made independent of variations in the speed during operation of the turbine which eliminates the oscillations and increases the efficiency of the wind turbine. |

| 3 | US20090267572 | 10/29/09 | Woodward | Current limitation for a double-fed asynchronous machine | Abnormal currents can damage the windings in the doubly- fed induction generator. Controlling these currents with the subordinate current controllers cannot be an efficient way to extract the maximum amount of active power. | The method involves delivering or receiving of a maximum permissible reference value of an active power during an operation of a double-fed asynchronous machine, where predetermined active power and reactive power reference values are limited to a calculated maximum permissible active and reactive power reference values, and hence ensures reliable regulated effect and reactive power without affecting the power adjustment, the rotor is electrically connected to a pulse-controlled inverter by slip rings with a static frequency changer, and thus a tension with variable amplitude and frequency is imposed in the rotor. |

| 4 | US20090008944 | 01/08/09 | Universidad Publica De Navarra | Method and system of control of the converter of an electricity generation facility connected to an electricity network in the presence of voltage sags in said network | Double-fed asynchronous generators are very sensitive to the faults that may arise in the electricity network, such as voltage sags. During the sag conditions the current which appears in said converter may reach very high values, and may even destroy it. | During the event of a voltage sag occurring, the converter imposes a new set point current which is the result of adding to the previous set point current a new term, called demagnetizing current, It is proportional to a value of free flow of a generator stator. A difference between a value of a magnetic flow in the stator of the generator and a value of a stator flow associated to a direct component of a stator voltage is estimated. A value of a preset calculated difference is multiplied by a factor for producing the demagnetizing current. |

| 5 | US7355295 | 04/08/08 | Ingeteam Energy | Variable speed wind turbine having an exciter machine and a power converter not connected to the grid | a) The active switching of the semiconductors of the grid side converter injects undesirable high frequency harmonics to the grid. b) The use of power electronic converters (4) connected to the grid (9) causes harmonic distortion of the network voltage. |

Providing the way that power is only delivered to the grid through the stator of the doubly fed induction generator, avoiding undesired harmonic distortion. Grid Flux Orientation (GFO) is used to accurately control the power injected to the grid. An advantage of this control system is that it does not depend on machine parameters, which may vary significantly, and theoretical machine models, avoiding the use of additional adjusting loops and achieving a better power quality fed into the utility grid. |

| 6 | US20080203978 | 08/28/08 | Semikron | Frequency converter for a double-fed asynchronous generator with variable power output and method for its operation | Optislip circuit with a resistor is used when speed is above synchronous speed, results in heating the resistor and thus the generator leads to limitation of operation in super synchronous range which results in tower fluctuations. | Providing a back-to-back converter which contains the inverter circuit has direct current (DC) inputs, DC outputs, and a rotor-rectifier connected to a rotor of a dual feed asynchronous generator. A mains inverter is connected to a power grid, and an intermediate circuit connects one of the DC inputs with the DC outputs. The intermediate circuit has a semiconductor switch between the DC outputs, an intermediate circuit condenser between the DC inputs, and a diode provided between the semiconductor switch and the condenser. Thus the system is allowed for any speed of wind and reduces the tower fluctuations. |

| 7 | US20070210651 | 09/13/07 | Hitachi | Power converter for doubly-fed power generator system | During the ground faults, excess currents is induced in the secondary windings and flows into power converter connected to secondary side and may damage the power converter. Conventional methods of increasing the capacity of the power converter increases system cost, degrade the system and takes time to activate the system to supply power again. | The generator provided with a excitation power converter connected to secondary windings of a doubly-fed generator via impedance e.g. reactor, and a diode rectifier connected in parallel to the second windings of the doubly-fed generator via another impedance. A direct current link of the rectifier is connected in parallel to a DC link of the converter. A controller outputs an on-command to a power semiconductor switching element of the converter if a value of current flowing in the power semiconductor switching element is a predetermined value or larger. |

| 8 | US20070132248 | 06/14/07 | General Electric | System and method of operating double fed induction generators | Wind turbines with double fed induction generators are sensitive to grid faults. Conventional methods are not effective to reduce the shaft stress during grid faults and slow response and using dynamic voltage restorer (DVR) is cost expensive. | The protection system has a controlled impedance device. Impedance device has bidirectional semiconductors such triac, assembly of thyristors or anti-parallel thyristors. Each of the controlled impedance devices is coupled between a respective phase of a stator winding of a double fed induction generator and a respective phase of a grid side converter. The protection system also includes a controller configured for coupling and decoupling impedance in one or more of the controlled impedance devices in response to changes in utility grid voltage and a utility grid current. High impedance is offered to the grid during network faults to isolate the dual fed wind turbine generator. |

| 9 | US20060192390 | 08/31/06 | Gamesa Innovation | Control and protection of a doubly-fed induction generator system | A short-circuit in the grid causes the generator to feed high stator-currents into the short-circuit and the rotor-currents increase very rapidly which cause damage to the power-electronic components of the converter connecting the rotor windings with the rotor-inverter. | The converter is provided with a clamping unit which is triggered from a non-operation state to an operation state, during detection of over-current in the rotor windings. The clamping unit comprises passive voltage-dependent resistor element for providing a clamping voltage over the rotor windings when the clamping unit is triggered. |

| 10 | US20050189896 | 09/01/05 | ABB Research | Method for controlling doubly-fed machine | Controlling the double fed machines on the basis of inverter control to implement the targets set for the machine, this model is extremely complicated and includes numerous parameters that are often to be determined. | A method is provided to use a standard scalar-controlled frequency converter for machine control. A frequency reference for the inverter with a control circuit, and reactive power reference are set for the machine. A rotor current compensation reference is set based on reactive power reference and reactive power. A scalar-controlled inverter is controlled for producing voltage for the rotor of the machine, based on the set frequency reference and rotor current compensation reference. |

Click here to view the detailed analysis sheet for doubly-fed induction generators patent analysis.

Article Analysis

| S No. | Title | Publication Date (mm/dd/yyyy) |

Journal/Conference | Dolcera Summary |

| 1 | Study on the Control of DFIG and its Responses to Grid Disturbances | 01/01/06 | Power Engineering Society General Meeting, 2006. IEEE | Presented dynamic model of the DFIG, including mechanical model, generator model, and PWM voltage source converters. Vector control strategies adapted for both the RSC and GSC to control speed and reactive power independently. Control designing methods, such as pole-placement method and the internal model control are used. MATLAB/Simulink is used for simulation. |

| 2 | Application of Matrix Converter for Variable Speed Wind Turbine Driving an Doubly Fed Induction Generator | 05/23/06 | Power Electronics, Electrical Drives, Automation and Motion, 2006. SPEEDAM 2006. | A matrix converter is replaced with back to back converter in a variable speed wind turbine using doubly fed induction generator. Stable operation is achieved by stator flux oriented control technique and the system operated in both sub and super synchronous modes, achieved good results. |

| 3 | Optimal Power Control Strategy of Maximizing Wind Energy Tracking and Conversion for VSCF Doubly Fed Induction Generator System | 08/14/06 | Power Electronics and Motion Control Conference, 2006. IPEMC 2006. CES/IEEE 5th International | Proposed a new optimal control strategy of maximum wind power extraction strategies and testified by simulation. The control algorithm also used to minimize the losses in the generator. The dual passage excitation control strategy is applied to decouple the active and reactive powers. With this control system, the simulation results show the good robustness and high generator efficiency is achieved. |

| 4 | A Torque Tracking Control algorithm for Doubly–fed Induction Generator | 01/01/08 | Journal of Electrical Engineering | Proposed a torque tracking control algorithm for Doubly fed induction generator using PI controllers. It is achieved by controlling the rotor currents and using a stator voltage vector reference frame. |

| 5 | Fault Ride Through Capability Improvement Of Wind Farms Using Doubly Fed Induction Generator | 09/04/08 | Universities Power Engineering Conference, 2008. UPEC 2008. 43rd International | An active diode bridge crowbar switch presented to improve fault ride through capability of DIFG. Showed different parameters related to crowbar such a crowbar resistance, power loss, temperature and time delay for deactivation during fault. |

Click here to view the detailed analysis sheet for doubly-fed induction generators article analysis.

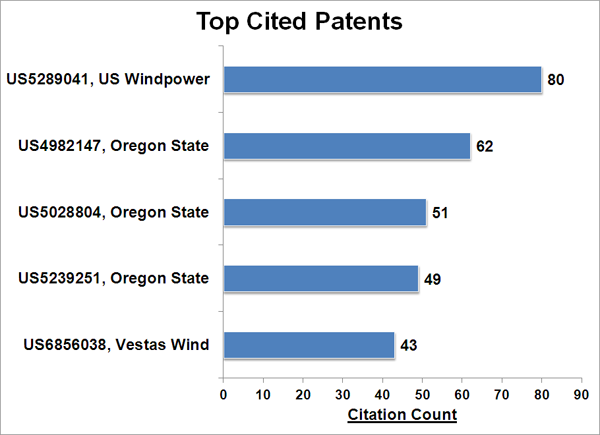

Top Cited Patents

| S. No. | Patent/Publication No. | Publication Date (mm/dd/yyyy) |

Assignee/Applicant | Title | Citation Count |

| 1 | US5289041 | 02/22/94 | US Windpower | Speed control system for a variable speed wind turbine | 80 |

| 2 | US4982147 | 01/01/91 | Oregon State | Power factor motor control system | 62 |

| 3 | US5028804 | 07/02/91 | Oregon State | Brushless doubly-fed generator control system | 51 |

| 4 | US5239251 | 08/24/93 | Oregon State | Brushless doubly-fed motor control system | 49 |

| 5 | US6856038 | 02/15/05 | Vestas Wind Systems | Variable speed wind turbine having a matrix converter | 43 |

| 6 | WO1999029034 | 06/10/99 | Asea Brown | A method and a system for speed control of a rotating electrical machine with flux composed of two quantities | 36 |

| 7 | WO1999019963 | 04/22/99 | Asea Brown | Rotating electric machine | 36 |

| 8 | US7015595 | 03/21/06 | Vestas Wind Systems | Variable speed wind turbine having a passive grid side rectifier with scalar power control and dependent pitch control | 34 |

| 9 | US4763058 | 08/09/88 | Siemens | Method and apparatus for determining the flux angle of rotating field machine or for position-oriented operation of the machine | 32 |

| 10 | US7095131 | 08/22/06 | General Electric | Variable speed wind turbine generator | 25 |

Top Cited Articles

White Space Analysis

- White-space analysis provides the technology growth and gaps in the technology where further R&D can be done to gain competitive edge and to carry out incremental innovation.

- Dolcera provides White Space Analysis in different dimensions. Based on Product, Market, Method of Use, Capabilities or Application or Business Area and defines the exact categories within the dimension.

- Below table shows a sample representation of white space analysis for controlling DFIG parameters with converters, based on the sample analysis.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

US20070052394A1 | US20100148508A1

US20100133816A1 EP2166226A1 US20070132248A1 US20070052394A1 US20100096853A1 |

US20100114388A1 | US20090008938A1 | WO2010079234A1 | US20090206606A1 | US20100156192A1 | US20100002475A1 | US20070052244A1 | US20070177314A1 | EP2166226A1 | ||

| |

US20030151259A1 | US20030151259A1 | US20030151259A1 | ||||||||||

| |

US20100142237A1 | US20100096853A1

US20100148508A1 US20100133816A1 US20070132248A1 US20070052394A1 |

US20100114388A1 | US20090008938A1 | WO2010079234A1 | US20080129050A1 | US20070182383A1 | US20100002475A1 | US20080157533A1 | US20090273185A1 | US20090121483A1 | ||

| |

US20020079706A1 | US20070216164A1 | US20090265040A1 | US20070216164A1 |

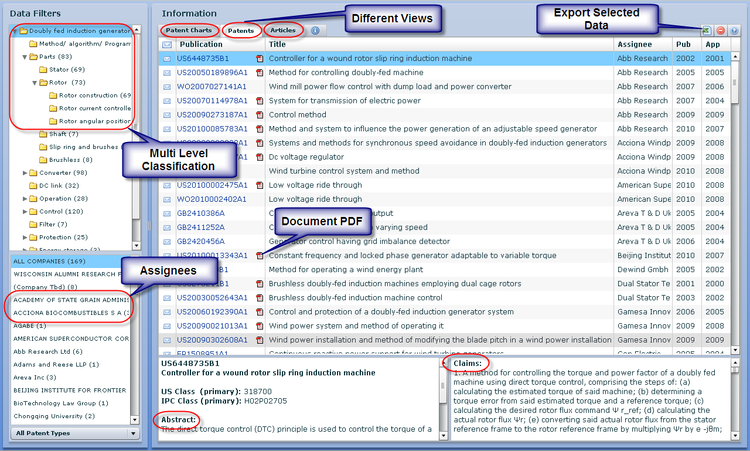

Dolcera Dashboard

Dashboard Link

| Doubly Fed Induction Generator - Dashboard |

- Flash Player is essential to view the Dolcera dashboard

Key Findings

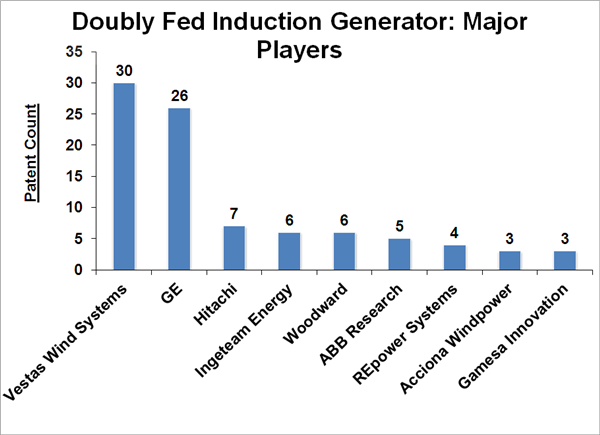

Major Players

- Vestas Wind Energy Systems and General Electric are the major players in wind energy generation technology.

Key Patents

- The key patents in the field are held by US Windpower, Oregon State and Vestas Wind Energy Systems.

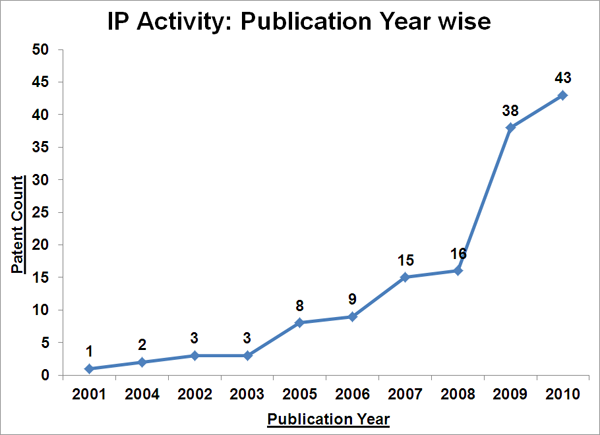

IP Activity

- Patenting activity has seen a very high growth rate in the last two years.

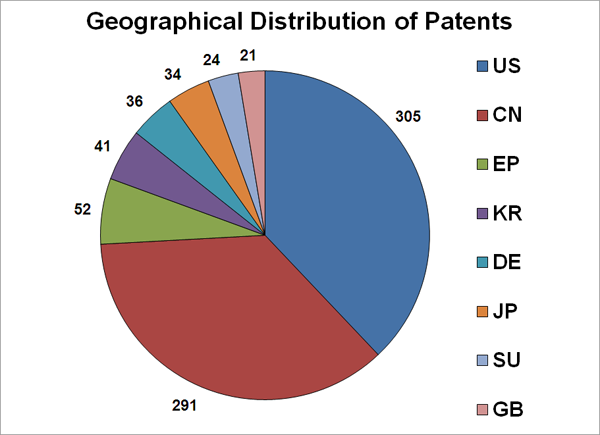

Geographical Activity

- USA, China, Germany, Spain, and India are very active in wind energy research.

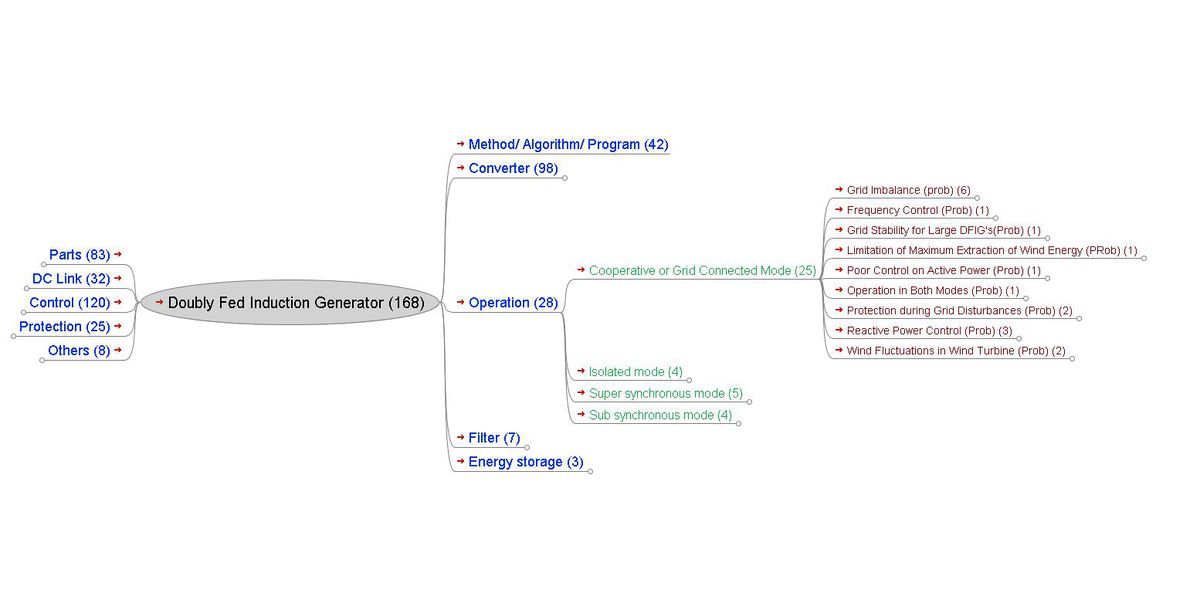

Research Trend

- Around 86% patents are on controlling the doubly-fed induction generation(DFIG) which indicates high research activity going on in rating and controlling of the DFIG systems.

Issues in the Technology

- 86% of the patent on DFIG operation are focusing on grid connected mode of operation, suggesting continuous operation of the DFIG system during weak and storm winds, grid voltage sags, and grid faults are major issues in the current scenario.

Emerging Player

- Woodward is a new and fast developing player in the field of DFIG technology. The company filed 10 patent applications in the field in year 2010, while it has no prior IP activity.

Like this report?

This is only a sample report with brief analysis

Dolcera can provide a comprehensive report customized to your needs

References

Contact Dolcera

| Samir Raiyani |

|---|

| Email: info@dolcera.com |

| Phone: +1-650-269-7952 |