Difference between revisions of "OLED Mobile Phones Market Research and Analysis Report"

Manikandan (Talk | contribs) (→Bass Diffusion Analysis) |

Manikandan (Talk | contribs) (→Contact Dolcera) |

||

| Line 620: | Line 620: | ||

|} | |} | ||

| + | ==<span style="color:#C41E3A">Like this report?</span>== | ||

| + | <p align="center"> '''This is only a sample report with brief analysis''' <br> | ||

| + | '''Dolcera can provide a comprehensive report customized to your needs'''</p> | ||

| + | {|border="2" cellspacing="0" cellpadding="4" align="center" " | ||

| + | |style="background:lightgrey" align = "center" colspan = "3"|'''[mailto:info@dolcera.com <span style="color:#0047AB">Buy the customized report from Dolcera</span>]''' | ||

| + | |- | ||

| + | | align = "center"| [http://www.dolcera.com/website_prod/services/ip-patent-analytics-services Patent Analytics Services] | ||

| + | |align = "center"| [http://www.dolcera.com/website_prod/services/business-research-services Market Research Services] | ||

| + | |align = "center"| [http://www.dolcera.com/website_prod/tools/patent-dashboard Purchase Patent Dashboard] | ||

| + | |- | ||

| + | |align = "center"| [http://www.dolcera.com/website_prod/services/ip-patent-analytics-services/patent-search/patent-landscapes Patent Landscape Services] | ||

| + | |align = "center"| [http://www.dolcera.com/website_prod/research-processes Dolcera Processes] | ||

| + | |align = "center"| [http://www.dolcera.com/website_prod/industries Industry Focus] | ||

| + | |- | ||

| + | |align = "center"| [http://www.dolcera.com/website_prod/services/ip-patent-analytics-services/patent-search/patent-landscapes Patent Search Services] | ||

| + | |align = "center"| [http://www.dolcera.com/website_prod/services/ip-patent-analytics-services/alerts-and-updates Patent Alerting Services] | ||

| + | |align = "center"| [http://www.dolcera.com/website_prod/tools Dolcera Tools] | ||

| + | |- | ||

| + | |} | ||

| + | <br> | ||

==Contact Dolcera== | ==Contact Dolcera== | ||

Revision as of 22:44, 5 August 2009

Executive Summary

- The OLED(Organic Light-Emitting Diode) technology is rapidly evolving, and these improvements are changing the dynamics display screens in mobile phones, TVs, camera, etc. The report provides a technological overview of OLEDS and includes comparisons with the rival technology of LCDs.

- This report analyses the market for OLED display mobile phones in terms of products, applications, market size and structure, competitive environment and technology, and determines its future prospects.

- The statistical tools of cluster analysis and regression are used to determine the segments of smart-phones likely to adopt OLED displays

- Bass Diffusion Model for adoption of new technologies is applied to forecast sales of OLED display based mobile phones. This forecast is arrived at by modeling the sales on the historical sales data of certain proxy products. This data is graphically presented in the report.

- The study reveals that by 2012 cumulative sale of OLED based mobile phone is expected to reach 183 million units and details the trend of these sales over the years

Objective

- To estimate the market for OLED mobile phones.

- To forecast the adoption rate of OLED mobile phones.

Methodology

A three stage analysis was conducted:

1. Technology Overview

A brief understanding of the technology behind the OLED displays forms the introduction to this report.

2. Cluster Analysis

Cluster Analysis was used to determine a class of mobile handsets that is most likely to use OLED displays. Cluster analysis is a technique used to assign objects to groups (called clusters), such that objects from the same cluster are more similar to each other than objects from different clusters. To determine the cluster, certain attributes of a handset like input mode, display size, camera resolution, etc. were considered.

3. Bass Diffusion Model

The Bass Diffusion Model was used to forecast the adoption of the OLED display mobile phones by consumers. The Bass Diffusion model is a quantitative tool that describes the process of how new products get adopted as an interaction between users and potential users. In this analysis, the model was employed to forecast the sales of a new product by utilizing historical sales data of analogous products from the same product category as well as from a diverse product category. The market penetration for mobiles with OLED displays is arrived at with result for both the proxies.

OLED Technology - An Overview

OLED (Organic Light Emitting Diodes) is a flat display technology, made by placing a series of organic thin films between two conductors. On applying an electric current, a bright light is emitted. OLEDs use organic semiconductor material instead of inorganic semiconductor material used in conventional Light Emitting Diodes (LEDs). Through a process called electrophosphorescence, OLEDs emit light in the presence of an electric current. Like any other diode, OLEDs permit electric current to pass only in one direction. Unlike diodes made from inorganic semiconductors, OLEDs are very flexible because they are only 100 to 500 nanometers thick - the human hair is 200 times thicker than it. As a result, OLED screens are very flexible and can be made in very large sheets. OLEDs use lesser energy than LEDs as well.

The easiest way to understand OLEDs is to compare them to LCDs. LCDs are made by placing a color filter over a white backlight source – filtering out the colors that are not wanted for each pixel. If you want to display blue, you'll have to filter out green and red. OLEDs, on the other hand, are emissive, which means that you simply need to display the colors you need for each pixel, which is made from three color (RGB) OLED “pixels.”

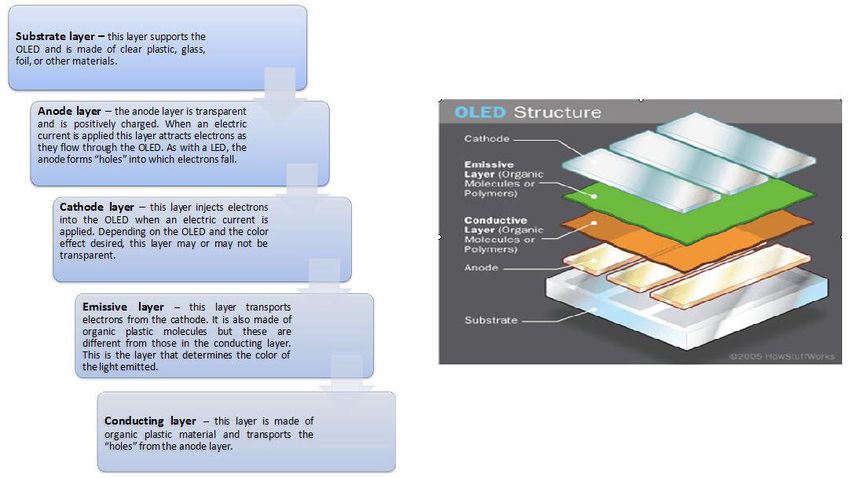

OLED Construction

An OLED can be made of a single layer of organic material but multiple layers increase efficiency and effectiveness. A typical OLED is comprised of five layers of material:

Types of OLED construction

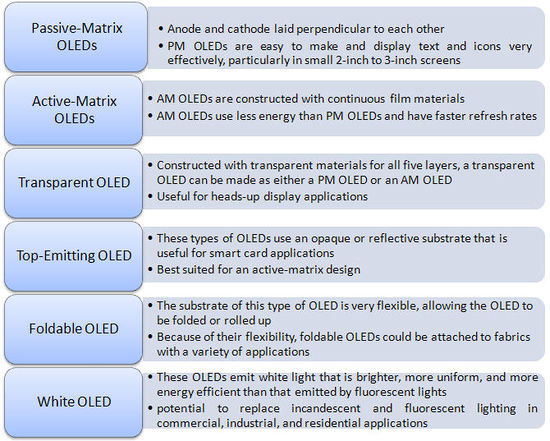

OLEDs can be constructed in a variety of ways to serve a variety of functions. While each type of construction uses the layers described previously, the manner in which each layer is built alters the way the OLED functions. The five most common types of OLEDs are as follows:

Applications of OLED

The ten most prominent applications for OLEDs over the next eighteen months would be:

| Television: | Cell phone: | Video Camera: | |

| MP3: | Near Eye: | Games: | |

| Media Players: | Digital Still Camera: | Car Audio: |

Key Players

The key players in the OLED screen mobile phone category are:

Like this report?

This is only a sample report with brief analysis

Dolcera can provide a comprehensive report customized to your needs

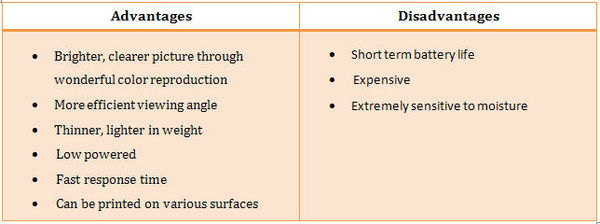

Advantages and Disadvantages of OLEDs

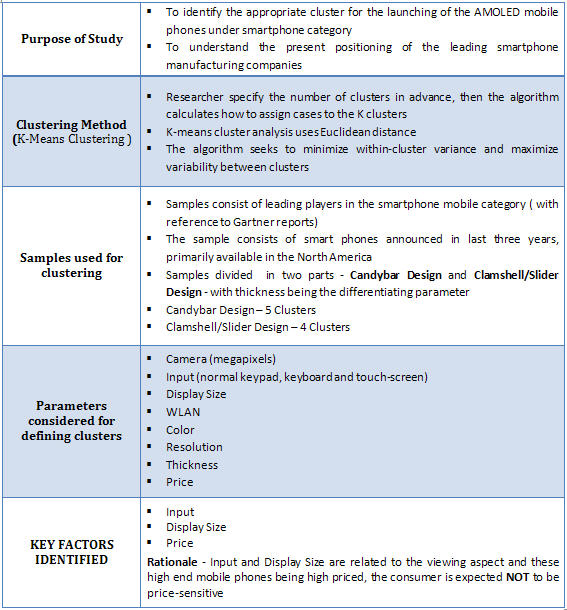

Cluster Analysis for TFT Display Mobile Phones

The table here summarizes the objective, methodology, procedure and result of the cluster analysis

Selection of model

Using the analysis, one cluster of smart-phones likely to move to OLED technology was identified for each of the two categories. For the next stage of the research - that of forecasting sales - would need the historical sales data of one particular model. For this purpose, Apple iPhone from the 2nd cluster of candy-bar phones was selected because of constraint of availability of sales data for other models like Blackberry, Nokia N96, HTC Dreamers etc.

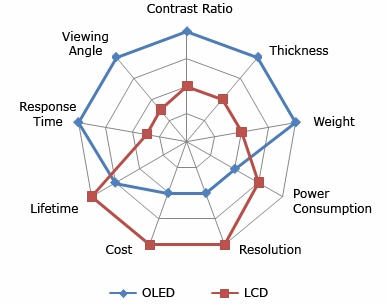

A Comparison of LCD and OLED technologies

The two technologies can be compared on various attributes.

The radar graph here shows the comparison between OLED and TFT LCD.

The graph depicts the following things:

- OLEDs are thinner than LCDs.

- OLEDs are lighter in weight.

- OLEDs consume more power than LCDs: Power Consumption is a measure of the amount of power required by a display to produce a certain level of brightness. In theory, OLEDs have an inherent advantage in that they only consume power when they emit light. For example, a black OLED pixel consumes no power. An LCD backlight consumes constant power regardless of the image being displayed. However, LCDs still hold a slight advantage over the OLEDs currently in production. Future generations of OLED displays will be far more efficient than their LCD counterparts.

- OLEDs cost more: The Cost of an AM-LCD is currently about half that of a comparable AM-OLED display. This is again due to the maturity of the LCD manufacturing processes and facilities. The components comprising a typical LCD display are actually more expensive than those in an OLED display. However, OLED manufacturing facilities suffer from low yields, currently at 60%-70%. The higher cost and low output of OLED panels due to faulty yield closes off large portions of the potential market to panel makers. Also contributing to the cost is simply the inability of manufacturers to deliver enough units to satisfy large orders.

- OLEDs have a shorter lifespan as compared to LCDs.

- OLEDs have a faster response time. They have a response time of .01ms while LCDs have a response time about 8-12ms.

- OLEDs have a superior viewing angle of 180 degree while LCDs have a lower viewing angle.

Cluster Analysis

Methodology

Sample Definition: The sample space consists of moblie phones by leading players in the smart-phone mobile category. These models were identified from Gartner reports. The models of smart-phones launched in the last three years in North America were considered.

Sample Space:After defining the sample, the various key attributes of smart-phones like camera, display, etc. were defined. The data for these attributes for all the models was collected from the company websites as well as the following websites:

- www.phonearena.com

- www.phonegg.com

- www.mobile.am

The pricing information was obtained from

- www.fonearena.com

- www.india-cellular.com

- www.naaptaol.com

- www.mobilestore.com

- www.indiatimes.com.

After aggregating the data we used the k-clustering method to identify the different clusters for the samples. This technique aims to partition n observations into k clusters in which each observation belongs to the cluster with the nearest mean. Hence clusters of phones with similar attributes is achieved.

Samples were segregated into two broad categories - candy-bar phones and clamshell or sliding phones - with thickness being the differentiating parameter. This was done in order to mitigate any error due to the design of the phone(i.e. candybar,clamshell,slider), since the thicknes of the mobile could be a cause for erroneous results.

Results

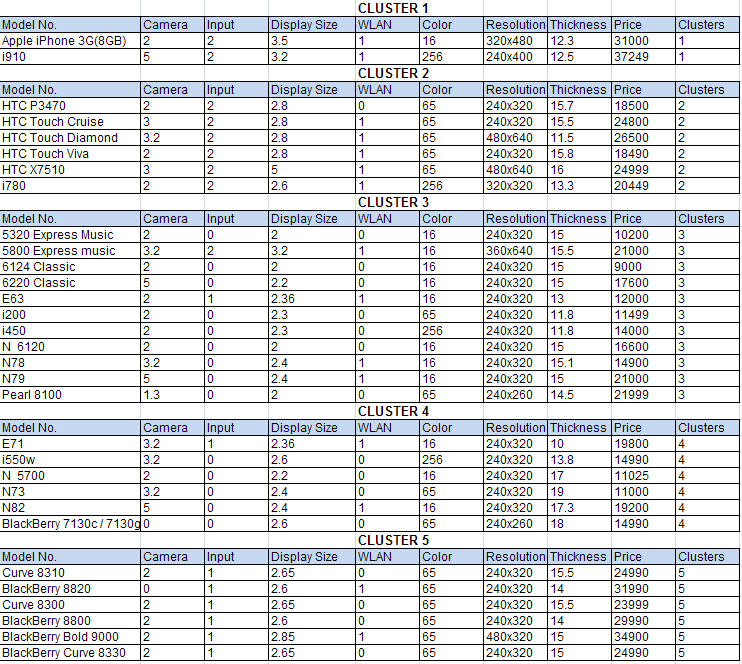

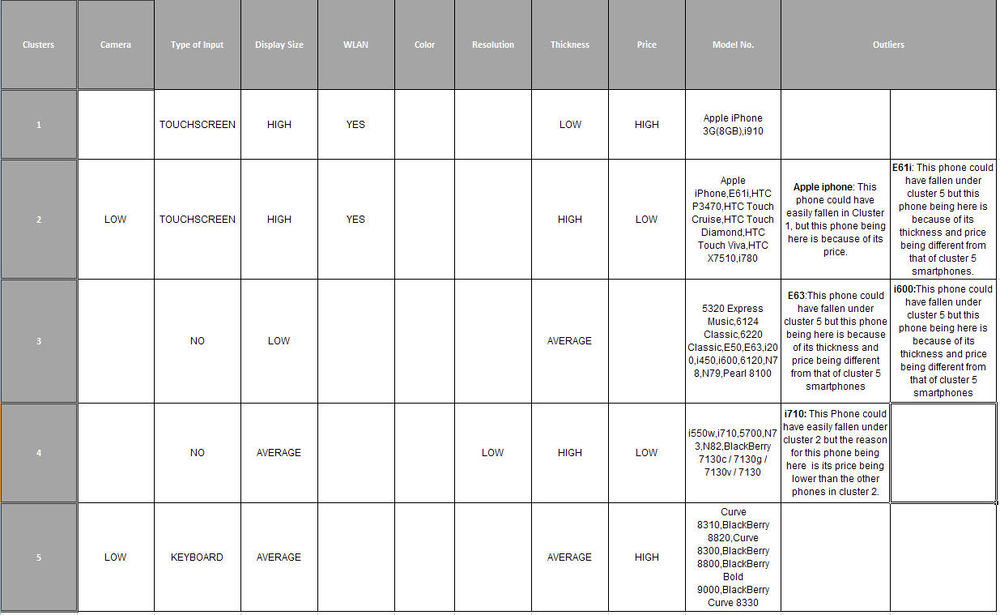

The sheet below shows the clusters formed for the candy-bar phones.

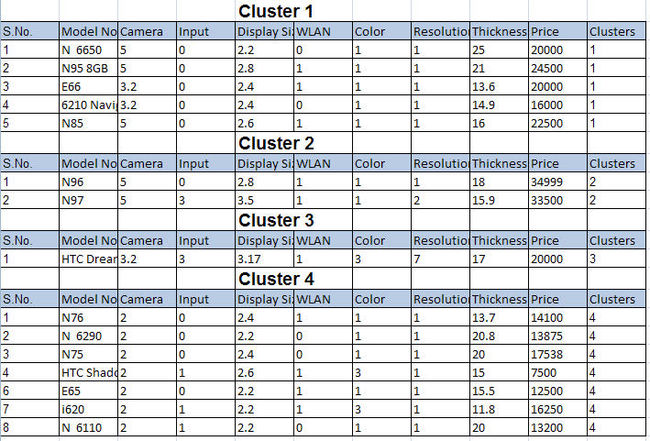

The sheet below shows the cluster formed for the clamshell/sliding phones.

Definition of Attributes:

- Camera : resolution in Megapixels

- Input method: two types of input methods - touchscreen and keyboard

- Display size: diagonal length of the displeay screen

- Resolution: display resolutions

- Color: display color

- Thickness: total thickness of the phone

Conclusion

The matrices presented here show the common attributes for each cluster identified above and list the smart-phone models for each. The outliers are the models which could have fallen into some other cluster barring a particular attribute. This has been explained in the notes.

Candy-bar Phones

Clamshell/Sliding Phones

Selection of model

Using the analysis, one cluster of smart-phones likely to move to OLED technology was identified for each of the two categories. For the next stage of the research - that of forecasting sales of AMOLED display phones - would need the historical sales data of one particular model. For this purpose, Apple iPhone from the 2nd cluster of candy-bar phones was selected because of constraint of availabilty of sales data for other models like Blackberry, Nokia N96, HTC Dreamers etc.

Prices for AMOLED screens

Market data was collected for the prices of OLED screens by various manufacturers

| Company Name | Model Number | Size | Resolution | Colors | Price/unit(in USD) | ||

| 0-99 | 100-999 | 1000 ++ | |||||

| Chung Yuan Technology Co., Ltd | 2.2" | 220x176 | 20.00 | 16.5 | |||

| Digiprotek Markcom India P Ltd.(Densitron) | C0201QILK-C | 2 | 176xRGBx220 | 262K | 25.69 | 24.92 | 20.67 |

| C0240QGLA-T | 2.4 | 240xRGBx320 | 262K | 35.97 | 34.9 | 27.83 | |

| P0340WQLC-T | 3.45 | 480xRGBx272 | 16M | 85.65 | 83.1 | 47.72 | |

| P0430WQLC-T | 4.3 | 480xRGBx272 | 16M | 119.90 | 116.32 | 85.84 | |

| GLYN GmbH & Co. KG(CMEL) | C0201QILKC | 2 | 176x220 | 262K | 25.00 | 15 | |

| C0240QGLAT | 2.4 | 240xRGBx320 | 262K | 30.00 | 20 | ||

| C0283QGLDT | 2.83 | 240xRGBx320 | 262K | 38 | 26 | ||

| P0340WQLCT | 3.4 | 480xRGBx272 | 16M | 60.00 | 35 | ||

| P0430WQLCT | 4.3 | 480xRGBx272 | 16M | 90 | 63 | ||

| A4G Technologies(OSD) | OSD020AMQCIF | 2 | 176x220 | 262K | 22.50 | 20.98 | 19.10 |

| OSD024AMQV | 2.4 | 240x320 | 262K | 30.20 | 28.57 | 25.40 | |

| OSD0283AMQV | 2.83 | 240x320 | 262K | 38.30 | 36.16 | 33.63 | |

| OSD0340WQLC | 3.4 | 480x272 | 16M | 69.50 | 67.25 | 42.48 | |

| OSD0430WQLC-T | 4.3 | 480x272 | 16M | 109.00 | 87.00 | 72.00 | |

| Blaze Technology | BDO-0240QGLA-T | 2.4 | 240xRGBx320 | 262K | 20.8 | ||

| BDO-0283QGLD-T | 2.83 | 240xRGBx320 | 262K | 26.85 | |||

| BDO-0340WQLA-T | 3.4 | 480x272 | 16M | 39.5 | |||

| BDO-0430WQLA-T | 4.3 | 480x272 | 16M | 90.6 | |||

Like this report?

This is only a sample report with brief analysis

Dolcera can provide a comprehensive report customized to your needs

Bass Diffusion Analysis

One of the most important functions during the launch of a new product is to forecast the demand for that product, as it guides many other critical decisions faced by the company. Companies can schedule their production activities once they have an idea about the demand in the coming months or years. At a high level, Bass Diffusion Model is used to determine the shape of the curve representing the cumulative adoption of the new product. Bass describes the individuals who decide to adopt an innovation independently of the actions of others as innovators. Those who respond to the influences of the social system and obtain information about a new product from those who have already adopted the product are termed as imitators.

Proxies for analysis

The use of the model has been made by using the historical sales data of proxy products to forecast sales for OLED display mobile phones with an assumption that OLED display mobile phones would mimic the diffusion patterns of the proxies. Hence it was important to select the proxies carefully. We used the following for this forecast:

- iPhone - since this was the latest revolution in mobile phone devices and consumers would show a similar adoption behavior for a new mobile phone technology even though it comes at a price premium

- LCD/Plasma TVs & Monitors - consumers spent more money to purchase screens with superior quality by significantly increasing their budget

- LCD and Plasma TVs and LCD monitors were treated as a single analogous product(by ascribing different weights to these) for the forecast

Forecasting OLED display phone sales using Analogous Products

The following products from different product categories were considered:

- LCD TV

- Plasma Display TV

- LCD Monitor

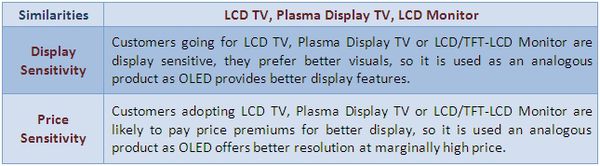

They were considered to be befitting analogies because of the following similarities:

Weighted average for the analogous products:

Weights for modeling co-efficients for the analogous products such as LCD TV, Plasma Display TV and LCD monitor had been assigned.

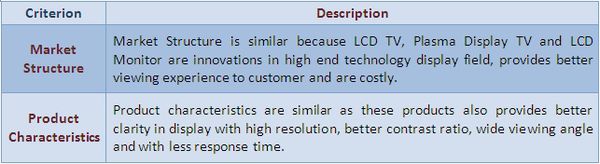

To judge the similarity of analogous products to OLED, we examined two criteria.

- a. Market Structure

- b. Product Characteristics

- a. Market Structure

The S-Graph for the cumulative projected sale of OLED display mobiles modeled on analogous products

- In 2009 and 2010 OLED Mobile Phone market would grow slowly driven by innovators

- From 2011 to 2015, market will grow rapidly due to the early adopters

- In 2016 and 2017, market will growth will dwindle as late adopters take to the phones

- 2018 onwards growth will peter, as the laggards pick up the last few models and the market will saturate

- From 2016 the technology will near obsolescence and a new technology would replace it

Comparison of Adoption rate of Innovators with those of Imitators

The model helps to determine sales to innovators and imitators for each year:

This graph shows that a small number of innovators will kick-start the sales. OLED display mobile Phones will get off to a slow start in first 2 years. Once a critical mass is reached by the end of the second year, strong imitative effects will take over as the innovators decrease.

Detailed Analysis

The detailed modeling with a description of parameters and mathematical equations can be viewed here:

Bass Diffusion Analysis for OLED display phones

OLED Mobile Phone Projections Based on I-Phone

The S-Graph for the cumulative projected sale of OLED display mobiles modeled on analogous products

- From Q1,'09 to Q3,'09, the OLED display mobile phone market would grow slowly, driven by innovators

- From Q4,'09 to Q4,'10 market will grow rapidly due to the early adopters

- From Q1,'11 and Q3,'11 market growth will dwindle as late adopters take to the phones

- Q4,'11 onwards growth will peter, as the laggards pick up the last few models and the market will saturate

- From Q4, the technology will near obsolescence and a new technology would substitute it

Comparison of Adoption rate of Innovators with those of Imitators

The model helps to determine sales to innovators and imitators for each year:

This graph shows that a small number of innovators will kick-start the sales. OLED display mobile Phones will get off to a slow start in first three quarters. Once a critical mass is reached by the end of the Q3, strong imitative effects will take over as the innovators decrease.

Detailed Analysis

The detailed modeling with a description of parameters and mathematical equations can be viewed here:

Bass Diffusion Analysis for OLED display phones

Comparing projections

Since disparate product categories had been used for the two forecasts, the two were compared to cross validate the results <<excel sheet with calculations>>

- Looking at the forecast for OLED display mobile phones based on analogous products and on iPhone, both are seen to be convergent

- This validates the forecast

Key Market Drivers and Constraints for OLED adoption

Market Drivers

- Mobile Internet - According to Nielsen Mobile, mobile internet in the US has reached 40 million active users and is growing rapidly. Consumer video constitutes majority of this traffic.(Marketingchart.com)

- Multimedia Applications – Increase in online video viewing will act as a major growth driver. Bigger screens coupled with greater visual clarity are expected to be preferred by this segment.

- Technological Innovations – Recent technologies like 3G and 4G emphasize more on data and video content.

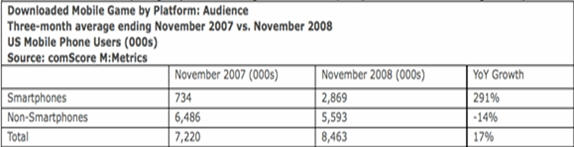

- Online Gaming – Online gaming content is skyrocketing, which is evident from the fact that since November '07 to '08, this industry has witnessed YoY growth of 291% driven by the high end phone category, mainly the iPhone and Blackberry ( iPhone owners accounted for 14% of mobile game downloaders in November '08 )

- Online Gaming – Online gaming content is skyrocketing, which is evident from the fact that since November '07 to '08, this industry has witnessed YoY growth of 291% driven by the high end phone category, mainly the iPhone and Blackberry ( iPhone owners accounted for 14% of mobile game downloaders in November '08 )

Major inferences:

- 1. Consumers' emphasis on viewing is fast becoming a major factor for today's mobile industry.

- 2. Use of OLEDs will enable mobile manufacturers to provide all these features more effectively owing to its wide viewing angle, faster response time and higher contrast ratio.

Market Constraints

- Cost of OLED – Although the performance benefits of OLEDs surpass LCDs, the decreasing cost of LCDs and enhancement in LCD technology is the key factor constraining the industry. LCD manufacturers will continue to improve their products and search for ways to reduce overhead costs.

- Sunlight Readability – OLED’s emit light. Bright sunlight would interfere and wash out the image.

Sneak Preview of some models using OLED technology

| 1. Apple iPhone - It’s nothing official at the moment, but word on the street is that Apple might have chosen a series of OLED displays for its next round of handsets. Such a move would certainly be in the best interests of battery life, as the iPhone isn’t noted for its battery capabilities. Considering the amount of new features that were announced in the iPhone 3.0 firmware update, it would be fairly practical to have a capacitive OLED display in the future. | |

| 2. Nokia - Nokia 6600 Slide Mobile Phone is a 3G device with large OLED display and 3.2 megapixel camera. It has curved edges and with a weight of 110g is a bit heavy to hold. The 2.2” screen supports 16 million colors and comes with QVGA resolution. The dimensions of the phone are 90 x 45 x 14mm. | |

| 3. Samsung - Samsung A877 features include a 3.2-inch WQVGA AMOLED touchscreen, a 3 megapixel camera, GPS, HSDPA and Bluetooth. And as well at it supports AT&T’s 3G service. | |

| 4. Sony - Sony Ericsson Z555 features a 1.9-inch LCD display, an OLED 128×36 external display, a 1.3 Megapixel camera with 4x digital zoom. | |

| 5. LG - One of the first handsets to get the new AM OLED, is already advanced LG SH150 DMB TV phone. | |

| 6. Motorola - The MOTO U9 is a Quad-band phone with a 2-inch QVGA LCD display, a 1.45-inch secondary OLED display, integrated music player, Bluetooth, 25MB internal memory and a microSD card slot. |

Like this report?

This is only a sample report with brief analysis

Dolcera can provide a comprehensive report customized to your needs

Contact Dolcera

| Samir Raiyani |

|---|

| Email: info@dolcera.com |

| Phone: +1-650-269-7952 |