Difference between revisions of "Impact on Sales of a Drug going Off-Patent"

Sonal.pingle (Talk | contribs) |

|||

| Line 1: | Line 1: | ||

This study identifies all the variables affecting the sales of a drug after its patent expiry and establishes a relationship between them. This study covers US only. The need gap for the study is identified by referring to industry and academic literature, news articles and Dolcera<nowiki>’</nowiki>s client interaction. After making an exhaustive list of variables affecting the sales of the drug after its patent expiry, each variable is validated, keeping the scope of the study in mind. A model is then built by running OLS Regression, which establishes the relationship between all these variables. The model also explains the impact of each variable on the sales reduction of the drug going off-patent. It analyzes the significant variables in the model and its implications on the drug going off-patent. | This study identifies all the variables affecting the sales of a drug after its patent expiry and establishes a relationship between them. This study covers US only. The need gap for the study is identified by referring to industry and academic literature, news articles and Dolcera<nowiki>’</nowiki>s client interaction. After making an exhaustive list of variables affecting the sales of the drug after its patent expiry, each variable is validated, keeping the scope of the study in mind. A model is then built by running OLS Regression, which establishes the relationship between all these variables. The model also explains the impact of each variable on the sales reduction of the drug going off-patent. It analyzes the significant variables in the model and its implications on the drug going off-patent. | ||

| − | |||

The model built, using OLS Regression, is an outcome of real data points and can be applied to identify the effect of patent expiry on drugs going off-patent in the future. It will give the percentage reduction in sales for a drug after patent expiry on a yearly basis. | The model built, using OLS Regression, is an outcome of real data points and can be applied to identify the effect of patent expiry on drugs going off-patent in the future. It will give the percentage reduction in sales for a drug after patent expiry on a yearly basis. | ||

| − | |||

<br> | <br> | ||

<br> | <br> | ||

Revision as of 10:21, 5 January 2012

This study identifies all the variables affecting the sales of a drug after its patent expiry and establishes a relationship between them. This study covers US only. The need gap for the study is identified by referring to industry and academic literature, news articles and Dolcera’s client interaction. After making an exhaustive list of variables affecting the sales of the drug after its patent expiry, each variable is validated, keeping the scope of the study in mind. A model is then built by running OLS Regression, which establishes the relationship between all these variables. The model also explains the impact of each variable on the sales reduction of the drug going off-patent. It analyzes the significant variables in the model and its implications on the drug going off-patent.

The model built, using OLS Regression, is an outcome of real data points and can be applied to identify the effect of patent expiry on drugs going off-patent in the future. It will give the percentage reduction in sales for a drug after patent expiry on a yearly basis.

Contents

- 1 Introduction

- 2 Literature Review

- 3 Model Explanation

- 3.1 Methodology Used

- 3.2 Scope of the Study

- 3.3 Assumptions

- 3.4 Variables used in the Model

- 3.4.1 Number of competitors for the drug going off-patent (N)

- 3.4.2 Time from Patent Expiry (t)

- 3.4.3 Price Ratio (PR)

- 3.4.4 Brand Trust (BT)

- 3.4.5 Market Growth Rate (MG)

- 3.4.6 Drug Growth Rate (DG)

- 3.4.7 Government Regulations (GR)

- 3.4.8 Reimbursement Ratio (RR)

- 3.4.9 % Reduction in the sales of the drug that went off-patent (Si)

- 3.5 Regression Model

- 3.6 Interpretation of Model

- 4 Implications

- 5 Bibliography

- 6 Appendix

Introduction

Patent on a drug holds a lot of importance to the company manufacturing the drug. It means that the company holds exclusive rights to sell the drug (or formulation) throughout the world with no competition for more than 10 years. This encourages the company to market the drug, sell it at a higher price, and reap all the profits for more than a decade. The problem only arises when the drug, which has contributed to a large pie of profits, is going off-patent. This means that it will face a lot of competition from generic substitutes, which will have a huge impact on its sales.

In the recent years, a lot of major drugs, which have gone off-patent, have suffered a huge blow to their sales after their patent expiry. Taking the case of Zocor as an example, Merck & Co lost 68.7% of the sales to generic substitutes just a year after its patent expiry in 2006. Its market fell from $2.803 Bn in 2006 to $0.877 Bn in 2007. Similarly, Rocephin lost its patent in 2005 and Roche lost 55% of its sales to generic substitutes in 2006.

Many blockbuster drugs are lined up with patent expiry in the coming years. Lipitor, a blockbuster drug by Pfizer, went off-patent recently in 2011. It contributed to $10.8 billion in sales in 2010, which accounts for 15.8% of total revenue earned by Pfizer in 2010. Plavix, a blockbuster drug by Bristol-Myers Squibb will be going off-patent in 2012. It has contributed to the sales value of $6.666 Bn to Bristol-Myers Squibb in 2010. Humira, which is a blockbuster drug for Breast Cancer, has contributed to the sales value of $6.548 Bn to Abbott Laboratories in 2010. It is going off-patent in 2016.

Need Gap

In the past, many companies have used marketing techniques, tie-ups with pharmacies and insurance companies to keep up to their sales, even after the patent expiry of the drug. But identifying all the variables and their relationship with sales value is of prime importance before any strategic decision is made.

- There is a need to identify the various factors affecting the sales of the drug going off patent

- Establish relationship between all the variables and the impact of each variable on the sales of a drug going off-patent

Literature Review

Many academic and industrial research papers were referred to, in order to come up with an exhaustive list of variables for study and values for various variables under study. The list of all the references is listed in the bibliography, towards the end of this report.

The following table gives a snapshot of the 2 main references of this study. It lists down all the variables used in the research paper, the limitations of the paper and how this study has overcome those limitations.

| Name of the Research Paper | Research Conducted by | Year of Study | Objective of the Research Paper | Variables considered for the study | Limitations of the paper | How the limitation has been overcome in this paper |

| Competition in Off-Patent Drug Markets: Issues, Regulation and Evidence | London School of Economics and Political Science | Jul-07 | This paper develops a model to explain the overall determinants of generic prices post patent expiry, the determinants of generic diffusion, and the relationship between originator branded and generic prices | 1. Generic Market Share 2. Originator Price 3. Number of pharmacies per 1000 inhabitants 4. Time Trend 5. Dummy for reference price |

1. R2 value of the paper is very less 2. The paper considers absolute value of prices which biases the regression output |

1. The R2 value of this study is very good (The model in this paper explains 71% of the data) 2. This paper considers price/reimbursement in ratio scale |

| Pricing and Reimbursement in U.S. Pharmaceutical Markets | Harvard Kennedy School | Sep-10 | The paper presents a theoretical framework for the pricing of branded pharmaceuticals, without and then in the presence of prescription drug insurance, noting factors affecting the relative impacts of drug insurance on prices and on utilization. | 1. Copayment and Coinsurance 2. Retail and Mail Order Insurance |

No analysis on the regulations and reimbursements in US. It only lists down all the regulations and reimbursements in US. | This study uses this paper as a reference for retail, mail order coinsurance and copayment calculations for each drug. |

This paper uses the above 2 papers as main reference and builds on their theories, to come up with an exhaustive list of variables explaining the reduction in sales of a drug after its patent expiry.

Model Explanation

The following section explains the methodology for model building, the variables used in the model and their relationship with the reduction in sales of the drug after its patent expiry.

Methodology Used

- The methodology used for data collection is secondary research.

- An exhaustive list of variables was identified after reading academic and industrial literature.

- The model was then developed with theoretical basis.

- After identifying all the variables affecting the sales of a drug after its patent expiry, data points for each variable were collected.

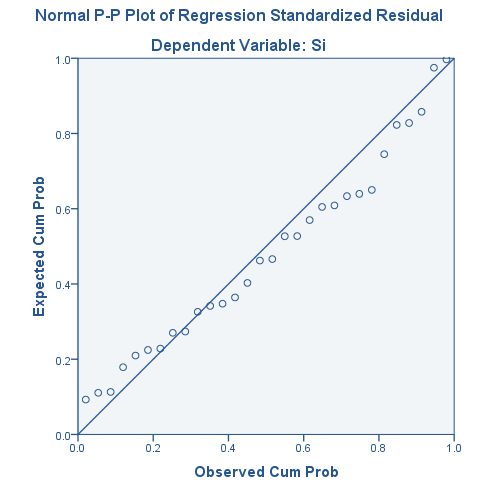

- OLS Regression was then run on SPSS software to obtain a deterministic first order linear model explaining the relationship between Reduction in sales of the drug going off-patent and other variables.

- The scatter plot was seen to see whether the linear model is a good fit for the data collected and to identify outliers. No outliers were found in the data.

- Variables with high correlation were identified and some variables were eliminated to eliminate correlation to obtain the final model.

- The model was found to have an impressive goodness of fit (i.e. R2 value)

Method Used: OLS Regression

Scope of the Study

The scope of the study is limited to United States. Hence, all the data points taken as input to the model are values for United States only.

Assumptions

- No generic substitute is discontinued after its launch

- All generic substitutes are launched in the market, as soon as they get FDA approval

- In case of generic entry by same company, it was considered as a competitor drug

- No out of stock conditions

- All the drugs have equal access to the market (Similar Distribution)

Variables used in the Model

The variables used in this model, to calculate the percentage reduction in sales of a drug going off-patent, takes into account all the major variables affecting the sales of a drug in the pharmaceuticals. These variables have been considered after referring to academic and industrial research. Most of the variables under study are in the ratio scale so as to eliminate the bias created by absolute values on the output of the model.

The following variables have been used in the model to explain the reduction in sales of a drug going off-patent:

- Number of competitors for the drug going off-patent (N)

- Time from Patent Expiry (t)

- Price Ratio (PR)

- Brand Trust (BT)

- Market Growth Rate (MG)

- Drug Growth Rate (DG)

- Government Regulations (GR)

- Reimbursement Ratio (RR)

- % Reduction in the sales of the drug that went off-patent (Si)

Number of competitors for the drug going off-patent (N)

The variable N represents the number of competitors for the drug going off-patent. The value of N=1 when there is no competition in the market. The value of N goes on increasing as the number of players increase yearly, in the market. The assumption taken while developing the model is that no generic is discontinued after its launch. Hence, the value of N is always incremental or constant. It does not decrease for any drug in the sample considered for study.

- N = Number of competitors for the drug going off-patent

Time from Patent Expiry (t)

Time from Patent Expiry (t) is the difference between the present year under study and the year of patent expiry plus one.

- t = Present Year – Patent Expiry Year + 1

’t’ is defined such that its value never approaches zero

Price Ratio (PR)

Price Ratio (PR) is the ratio of the price of the drug going off-patent to the price of a generic substitute for the same drug. The variable Price has been included in the model in terms of ratio so as to eliminate skewed results due to the absolute difference in the drug prices.

- PR = Price of the Drug going off-patent / Price of the generic substitute

Note: Both prices (originator drug and generic substitute) are considered only after patent expiry

Brand Trust (BT)

Brand Trust (BT) is one the very important factors that will influence the decision of the Physician/Pharmacist/Consumer. Since, the drug going off-patent has been in the market for more than 10 years, it must have built trust among the Physicians/Pharmacists/Consumers. The parent company must have marketed the drug throughout its tenure before the patent expiry and must have built a trusted brand. Even if generic substitutes are price competitive, consumers may have loyalty to originator brand. Hence, Brand Trust is one of the most important factors for the sale of the drug even after its patent expiry.

To quantify brand trust in the model, it has been equated to the Brand popularity on the internet. Google Keywords tool has been used to calculate Brand trust. Since the scope of the study is limited to United States, the number of keyword searches has been limited to United States of America. To nullify the effect of very high values of Brand keyword searches, it has been divided by 1000 and included in the model.

- BT = Drug Brand keyword monthly searches in United States / 1000

Note:

- Brand in this equation refers to the Drug going off-patent only

- The absolute value of Brand Trust has been taken so that the effect of the Brand Popularity can be seen on the Sales of the drug after the patent expiry

Market Growth Rate (MG)

The growth rate of the medical problem, which the drug going off-patent caters to, has been considered as the Market Growth rate in the model. For example, one of the drugs under study is Pfizer’s Norvasc that went off-patent in 2007, is an Anti-Hypertension Drug. Hence, the compounded annual growth rate (CAGR) of Anti-Hypertension Drugs, which is 3%, has been taken as the market growth rate for the drug. The absolute value of growth rate has been given as input in the model.

- MG = CAGR of the Market (Market of the Medical Problem that the drug caters to)

Drug Growth Rate (DG)

The drug growth rate (DG) is calculated as the compounded annual growth rate (CAGR) of the sales value in US, for the last 5 years before the patent expiry of the drug. For example, Pfizer’s drug Norvasc went off-patent in 2007. Hence, the CAGR of sales of Norvasc in US during the period 2002-2006 was considered as the Drug growth rate for Norvasc (calculated as 7.08%).

- DG = CAGR of the Drug Sales in US in the last 5 years before patent expiry

Government Regulations (GR)

Rising government spending on healthcare

Generic substitutes are always price competitive because they enter the market only after the patent expiry of the originator brand and hence do not incur any research and development costs. The expenditure on pharmaceuticals as a proportion of healthcare spending has been significantly high in many OECD countries. The following table shows the spending on healthcare and pharmaceuticals in key OECD countries:

| Health and pharmaceutical spending in key OECD countries, 1995 – 2009 | ||||||||

| Country | Total healthcare expenditure as % of GDP | Total pharmaceuticals expenditure and other non-durables as a % of total health expenditure | ||||||

| 1995 | 2000 | 2005 | 2009 | 1995 | 2000 | 2005 | 2009 | |

| USA | 13.7 | 13.7 | 15.7 | 17.4 | 8.4 | 11.3 | 12.1 | 12.0 |

| UK | 6.8 | 7.0 | 8.2 | 9.8 | 15.3 | 14.2 | 12.8 | 11.4 |

| Germany | 10.1 | 10.3 | 10.7 | 11.6 | 12.8 | 13.6 | 15.0 | 14.9 |

| France | 10.4 | 10.1 | 11.1 | 11.8 | 15.0 | 16.5 | 16.7 | 16.1 |

| Italy | 7.3 | 8.1 | 8.9 | 9.5 | 20.7 | 22.0 | 20.2 | 18.2 |

| Spain | 7.4 | 7.2 | 8.3 | 9.5 | 19.2 | 21.3 | 20.4 | 18.9 |

| Canada | 9.0 | 8.8 | 9.8 | 11.4 | 13.9 | 15.9 | 17.2 | 17.0 |

Government policies encouraging use of generics

To decrease their expenditure on healthcare and pharmaceuticals, government policies encouraging the use of generics have risen in the past decade. Countries in Europe and North America have implemented aggressive generic policies, aiming to contain the cost of prescription. In Spain, Italy and France, for instance, regulations on reference pricing for generics and generic substitutes have been implemented. In other countries, like UK, generic prescription has been made compulsory. In Europe and North America, to encourage the generic manufacturers, policies like the Bolar Policy have been implemented. Bolar provision is a practice where generic manufacturers are allowed to complete their regulatory processes prior to the patent expiry of the originator molecule. In some countries, the speed of making generics is rewarded by providing a market exclusivity period. Physicians and Pharmacies are incentivized to prescribe generics. The following table gives a snapshot of the Pharmaceutical Policies for generics in some of the OECD countries.

| Generic pharmaceutical policies in 7 OECD countries, 2000 - 2006 | |||||||

| Measure | UK | Germany | France | Italy | Spain | USA | Canada |

| Supply-side | |||||||

| Bolar Type regulation | Y | Y | Y | Y | Y | Y | Y |

| Price Cap | Y | Y | Y | Y | |||

| Reference Pricing | Y | Y | Y | Y | Y | ||

| Proxy Demand-side | |||||||

| Promoting Generic Prescribing | Y | Y | Y | Y | Y | ||

| Compulsory Generic Prescribing | Y | ||||||

| Prescribing Monitoring & Audit | Y | Y | Y | Y | Y | Y | Y |

| Generic Substitution | Y | Y | Y | Y | Y | Y | |

| Flat or Regressive Margin | Y | Y | Y | Y | |||

| Discounting allowed officially | Y | Y | Y | Y | |||

| Clawback | Y | ||||||

| Demand Side | |||||||

| Differential co-pays | Y | ||||||

Government regulations as a variable in the model

The government regulations for a particular country under study is a constant since the regulations on healthcare and pharmaceuticals sector remains constant for all the drugs in a particular country. Since the scope of the study is limited to US only, the variable ’government regulations’ has been considered to be a constant in the model.

- GR = constant (for US)

Reimbursement Ratio (RR)

Tiers in the Drug Insurance Plans

Reimbursement policies on the amount to be reimbursed on drug purchase have evolved in the United States for the last two decades. Drug benefit cost sharing provisions charge different amounts to different drugs, depending on which ’tier’ the drug belongs to. The initial drug insurance plans consisted of two tiers, but now-a-days these plans have four tiers. In such an arrangement, the generics usually fall under tier I, where the customer gets a relatively small amount reimbursed. Depending on the manufacturer’s negotiations, the insurer has more preferred brands in the Tier II. The customer gets a larger co-payment if the drug he purchases falls in Tier II. For brands where the manufacturer was unable to negotiate a favorable price, fall in Tier III. Customers get a higher incentive but also have to pay more from their pocket if they purchase these non-preferred brands falling in the third tier. Finally, very costly drugs, such as the oncology and rheumatoid arthritis biologics that can cost thousands of dollars per month are placed in Tier IV.

Coinsurance and Copayments

A Copayment is a fixed-dollar amount that a customer pays each time he buys a drug whereas coinsurance is a percent of the cost incurred in purchasing a drug. The customer is responsible for paying the coinsurance amount, whereas the rest of the amount is reimbursed by the insurance policy. The coinsurance and copayment amounts for a drug differ for mail order and retail order.

The following tables indicated the average amount reimbursed, in case of retail order and mail order payments:

| Retail Order | |||||||||

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | |

| Average Copayments Retail Order | |||||||||

| Tier I | $7.68 | $8.33 | $8.66 | $9.14 | $9.53 | $9.53 | $8.99 | $9.53 | $9.96 |

| Tier II | $16.06 | $17.57 | $19.26 | $20.71 | $21.61 | $21.61 | $23.08 | $24.62 | $25.19 |

| Tier III | $30.51 | $33.23 | $35.15 | $37.45 | $39.06 | $39.06 | $39.63 | $41.13 | $42.95 |

| Tier IV | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | $62.11 |

| Average Coinsurance Retail Order | |||||||||

| Tier I | 18% | 19% | 20% | 18% | 19% | 19% | 18% | 20% | 20% |

| Tier II | 23% | 23% | 26% | 25% | 27% | 26% | 26% | 26% | 27% |

| Tier III | 33% | 37% | 40% | 34% | 38% | 38% | 38% | 42% | 40% |

| Tier IV | 0 | 0 | 0 | 30% | 43% | 42% | 27% | 29% | 28% |

| Mail Order | |||||||||

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | |

| Average Copayments Retail Order | |||||||||

| Tier I | $12.60 | $14.61 | $16.63 | $17.18 | $17.95 | $17.95 | $17.58 | $19.23 | $20.23 |

| Tier II | $26.01 | $31.21 | $37.33 | $39.90 | $41.65 | $41.65 | $47.86 | $51.47 | $51.70 |

| Tier III | $55.23 | $60.61 | $67.55 | $74.85 | $77.05 | $77.05 | $80.80 | $85.77 | $99.04 |

| Tier IV | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | $117.79 |

| Average Coinsurance Retail Order | |||||||||

| Tier I | 18% | 18% | 21% | 18% | 19% | 19% | 19% | 19% | 19% |

| Tier II | 23% | 23% | 25% | 25% | 27% | 26% | 25% | 25% | 28% |

| Tier III | 33% | 41% | 43% | 34% | 38% | 38% | 38% | 40% | 43% |

| Tier IV | 0 | 0 | 0 | 30% | 43% | 42% | 27% | 26% | 29% |

Segmentation of Drug insurance market

There are very clear trends over time in customers buying various insurance policies. Coinsurance accounts for 18.3% of the total drug insurance market whereas copayment accounts for 81.7% of the market. Also, 81.2% of the total purchases are made in the retail stores whereas only 18.8% of the drugs are ordered by mail in the United States.

All the above segmentation factors have been taken into consideration while building the model of % reduction in sales of a drug going off-patent.

Therefore, the reimbursement ratio is calculated as the ratio of reimbursement amount on the drug going off-patent to the reimbursement amount on its generic substitute.

- RR = Reimbursement on Originator Drug / Reimbursement on Generic Substitute

% Reduction in the sales of the drug that went off-patent (Si)

% Reduction in sales is defined as the reduction in sales after the patent expiry of the drug with the sales value of that drug a year before its patent expiry, as the reference. Hence to calculate Si for each year, the reference year is the sales value of the drug a year before its patent expiry. All the sales value considered for computation is for US only.

- Si = (Present Year Sales Value – Sales Value of the Year before Patent Expiry) * 100 / (Sales Value of the Year before Patent Expiry)

Regression Model

Data pertaining to all the above variables was collected and was subjected to OLS regression in SPSS 20. Following model was obtained at the end of regression process

- Si = -11.08t - 1.304N - 1.235MG + 0.242BT – 5.739RR - 22.35

Si = % Reduction in the sales of the drug that went off-patent

N = Number of competitors for the drug going off-patent

t = Time from Patent Expiry

BT = Brand Trust

MG = Market Growth Rate

RR = Reimbursement Ratio

Goodness-of-Fit

R2 values and standard error of estimate are shown in table below

| Model Summary | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | 0.84 | 0.71 | 0.65 | 18.86 |

R2 value of 0.71 implies that this model explains about 71% variation seen in the reduction of sales of drug seen after patent expiry.

Coefficients and significance of individual variables

Following table shows the individual coefficients and significance levels are shown in table below

| Variable | Beta | Std. Error | t-value | Significance | Lower Bound | Upper Bound |

| (Constant) | -22.35 | 17.32 | -1.29 | 0.21 | -58.10 | 13.40 |

| t | -11.08 | 2.57 | -4.32 | 0.00 | -16.38 | -5.78 |

| N | -1.30 | 0.85 | -1.53 | 0.14 | -3.06 | 0.46 |

| MG | -1.24 | 1.18 | -1.04 | 0.31 | -3.68 | 1.21 |

| BT | 0.24 | 0.09 | 2.86 | 0.01 | 0.07 | 0.42 |

| RR | -5.74 | 4.33 | -1.33 | 0.20 | -14.68 | 3.20 |

As seen from table most significant variable is Time from expiry followed by Brand Trust, Number of Generic Substitutes, Reimbursement Ratio and Market Growth in decreasing order of significance.

Interpretation of Model

| Variable | Beta | Interpretation |

| Time from Expiry | -11.081 | A year from patent expiry will reduce sales by 11% |

| N | -1.304 | Every additional generic competitor will reduce sales by 1.3% |

| Market Growth | -1.235 | If Market had positive growth rate, higher chances of reduction in sales, Almost 1.235% per cent of growth rate |

| Brand Trust | 0.242 | Higher brand trust helps sales of branded drug |

| Reimbursement Ratio | -5.739 | Higher reimbursement ratio implies higher payment for branded drug which reduces sales by 5.73% per unit rise in ratio |

Implications

Model takes time from expiry, Number of generic substitutes, CAGR of market, brand trust and reimbursement ratio as inputs to predict reduction in sales. Reimbursement ratio and brand trust are the two parameters that can be controlled by branded drug company.

- Branded drugs companies need to build brand value for their product before it expires. Building brand trust thus has spillover effects post-patent expiry which works in favor of the drug.

- Company can have insurance strategy planned which should reduce reimbursement ratio for that particular product.

Further Research

- This model can further be modified by including variables like discounts given to the Pharmacies.

- The impact of regulations can be included if this model is extrapolated to the global market (or more than one geography)

Bibliography

Anis A. (1994). Substitution laws, insurance coverage, and generic drug use. Medical Care,32(3):240-256.

Aronson T, Bergman M, Rudholm N. (2001). The Impact of Generic Drug on Brand Name Market Shares: Evidence from Micro Data. Review of Industrial Organization, 19: 425-435.

Berndt E., N. J. (2010). Pricing and Reimbursement in U.S. Pharmaceutical Markets. Cambridge: National Bureau of Economic Research.

Berndt ER. (2002). Pharmaceuticals in US Health Care: Determinants of Quantity and Prices. Journal of Economic Perspectives, 16 (4): 45-66.

Caves RE, Whinston ME, Hurwitz MA. (1991). Patent expiration, entry, and competition in the US pharmaceutical industry: an exploratory analysis. Brookings Papers on Economic Activity:

Kanavos P., C.-F. J. (2007). Competition in Off-Patent Drug Markets: Issues, Regulation and Evidence. London: London School of Economics and Political Science.

Microeconomics, pp.1-66, Washington: Brookings Institute.Frank R.G, and Salkever D.S. (1997). Generic entry and the pricing of pharmaceuticals. Journal of Economics and Management Strategy, 6(1), 75-90.

Suh D-C, Schondelmeyer S, Manning W, Hadsall R, Nyman J. (1999). Price Trends Before and After Patent Expiration in the Pharmaceutical Industry. Journal of Research in Pharmaceutical Economics, 9(2): 17 – 32.

Appendix

Regression output

Model Summary

| Model Summary | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | .842a | .709 | .648 | 18.86230 |

| a. Predictors: (Constant), RR, MG, t, BT, N | ||||

Scree Plot

ANOVA Output

| ANOVA | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 20764.591 | 5 | 4152.918 | 11.673 | .000b |

| Residual | 8538.870 | 24 | 355.786 | |||

| Total | 29303.461 | 29 | ||||

| a. Dependent Variable: Si | ||||||

| b. Predictors: (Constant), RR, MG, t, BT, N | ||||||

Variable Coefficients and Significance

| Coefficients | ||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | 95.0% Confidence Interval for B | |||

| B | Std. Error | Beta | Lower Bound | Upper Bound | ||||

| 1 | (Constant) | -22.352 | 17.322 | -1.290 | .209 | -58.103 | 13.399 | |

| t | -11.081 | 2.567 | -.527 | -4.317 | .000 | -16.379 | -5.784 | |

| N | -1.304 | .853 | -.240 | -1.529 | .139 | -3.063 | .456 | |

| MG | -1.235 | 1.183 | -.132 | -1.044 | .307 | -3.677 | 1.207 | |

| BT | .242 | .085 | .338 | 2.855 | .009 | .067 | .418 | |

| RR | -5.739 | 4.331 | -.193 | -1.325 | .198 | -14.677 | 3.200 | |

| a. Dependent Variable: Si | ||||||||

Coefficient Correlations

| Coefficient Correlations | |||||||

| Model | RR | MG | t | BT | N | ||

| 1 | Correlations | RR | 1.000 | .162 | .215 | -.250 | -.607 |

| MG | .162 | 1.000 | -.116 | .170 | -.373 | ||

| t | .215 | -.116 | 1.000 | .066 | -.321 | ||

| BT | -.250 | .170 | .066 | 1.000 | .012 | ||

| N | -.607 | -.373 | -.321 | .012 | 1.000 | ||

| Covariances | RR | 18.757 | .829 | 2.393 | -.092 | -2.240 | |

| MG | .829 | 1.400 | -.352 | .017 | -.377 | ||

| t | 2.393 | -.352 | 6.589 | .014 | -.703 | ||

| BT | -.092 | .017 | .014 | .007 | .001 | ||

| N | -2.240 | -.377 | -.703 | .001 | .727 | ||

| a. Dependent Variable: Si | |||||||

Data used for the model

List of drugs used in the model

- Biaxin

- Coreg IR/Kredex

- Effexor

- Lamisil

- Lotrel

- Norvasc

- Zithromax